- UNI stabilized round $8.18, above the 9EMA and 61.8% Fibonacci help zone.

- Futures open curiosity jumped to $770 million, indicating renewed dealer exercise and confidence.

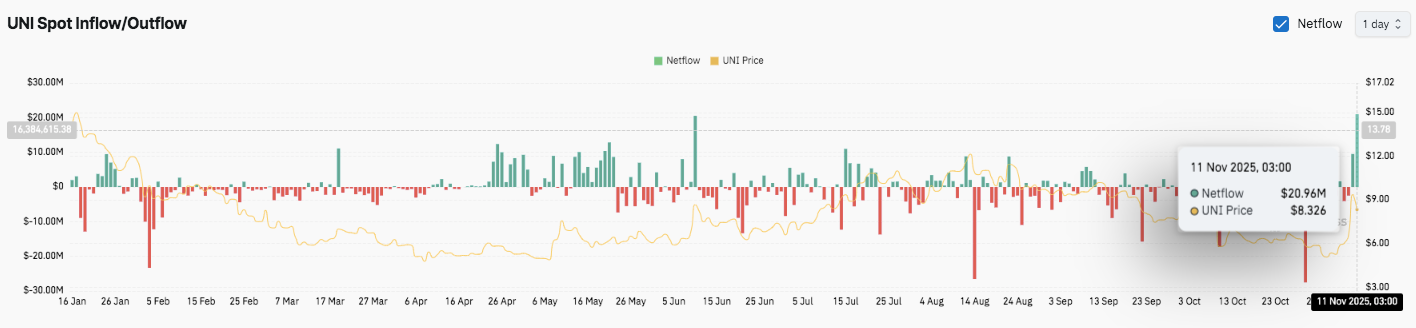

- Web inflows of $20.96 million and unified supply increase UNI’s bullish medium-term outlook.

Uniswap (UNI) is displaying renewed power heading into mid-November, with worth developments and market information suggesting the token might lengthen its restoration in the direction of the $10 stage. UNI stays bullish regardless of a brief interval of consolidation after rising sharply from $4.78 earlier this quarter. Current momentum in derivatives and spot inflows has additional fueled optimism amongst merchants and seems poised for a possible breakout.

Worth is above main help

Uniswap’s current bull run to $9.03 was met with gentle profit-taking. The token is at present holding regular close to $8.18, slightly below the short-term 9EMA stage close to $7.90. This space is a crucial dynamic help that coincides with the 61.8% Fibonacci retracement zone.

If consumers defend this space, UNI might resume its upward trajectory in the direction of the $9.50 to $10.00 vary. If the worth stays above $10, it is going to be the primary full restoration for the reason that mid-year correction.

Beneath $7.90, extra help ranges seem round $6.90 and $5.00. A break under $6.90 might weaken the bullish construction and widen losses in the direction of the earlier accumulation zone. Nevertheless, the present retracement seems to be wholesome given the robust growth of the Bollinger Bands reflecting elevated volatility and new dealer participation.

Derivatives market exhibits renewed curiosity

The derivatives panorama additionally exhibits elevated exercise. Uniswap futures open curiosity soared to $770.41 million on Nov. 11, signaling a resurgence in dealer engagement after months of subdued buying and selling.

This improve in open quantity is in line with UNI’s restoration, indicating a resurgence in speculative and hedging exercise. Rising positions sometimes point out confidence in continued worth motion, both by way of directional betting or danger administration methods.

In consequence, elevated by-product buying and selling volumes add liquidity and depth to the market, making worth actions extra sustainable. The rally additionally means that merchants expect short-term volatility as UNI checks the resistance zone once more.

Inflows reflecting stronger institutional investor demand

On-chain information helps technical outlook. Uniswap recorded web inflows of $20.96 million on November 11, its highest day since mid-year. This optimistic capital motion displays new accumulation by traders, reversing the outflows of the months from June to October.

Continued inflows above $10 million might help a broader structural restoration for DeFi tokens. Furthermore, expectations for future governance enhancements and a stronger DeFi sector might proceed to gas shopping for momentum, conserving UNI’s medium-term outlook bullish.

Governance proposals spur market optimism

Including to the momentum, Uniswap Labs and Uniswap Basis launched the “UNIfication” proposal. The plan, led by founder Hayden Adams and the Basis’s government group, outlines a change in protocol charges and the activation of a brand new token burn mechanism. The transfer goals to cut back UNI’s circulating provide whereas enhancing long-term sustainability.

Technical outlook for Uniswap costs

Key ranges stay nicely outlined heading into mid-November. Upside ranges embrace instant resistance at $9.03, adopted by $9.50 and the psychological mark of $10.00. If confirmed above $9.03, momentum might speed up in the direction of $10.50 and even $11.20, indicating a full restoration to the pre-correction vary.

On the draw back, the primary help is situated close to $7.90, coinciding with the 9-day EMA and the 61.8% Fibonacci stage. A deeper correction might widen to $6.90, the place the 50% Fibonacci retracement offers structural help, and additional to $5.00 if promoting strain will increase. The 200-day EMA round $6.80 stays an necessary medium-term stage to guard to keep up a bullish bias.

The technical construction exhibits Uniswap holding agency inside a minor retracement part after breaking out from $4.78. The Bollinger Bands are vast, reflecting elevated volatility and indicating that worth compression could quickly resolve right into a wave of recent path.

Associated: “Legendary” Uniswap (UNI) Whale Returns After 3 Years, Earns Practically $4 Million in UNI Tokens

Can Uniswap keep its momentum?

Uniswap’s near-term path will rely upon whether or not the bulls can defend the $7.90-$8.00 zone whereas sustaining influx energy above $10 million. If this stage holds, UNI might resume its upward trajectory with targets of $9.50 and $10.00. Nevertheless, a break under $6.90 might weaken the construction and trigger the token to right in the direction of $5.50.

For now, Uniswap stays necessary. New capital inflows, elevated open curiosity, and governance developments recommend improved sentiment. Continued buildup above key helps confirms that UNI’s subsequent rally is underway and will set the stage for an extension of the bullish part into the ultimate quarter of 2025.

Associated: UNI falls 26% regardless of bullish sample, Uniswap annual buying and selling quantity tops $1 trillion

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.