- Bibit Hacks have elevated concern of centralized change safety vulnerabilities

- US President Donald Trump’s commerce tariffs are rising market uncertainty

- Trump’s encryption could have began out as an important factor, however they may show devastating

In line with the COO of Unity Pockets, three issues have contributed to decrease crypto costs.

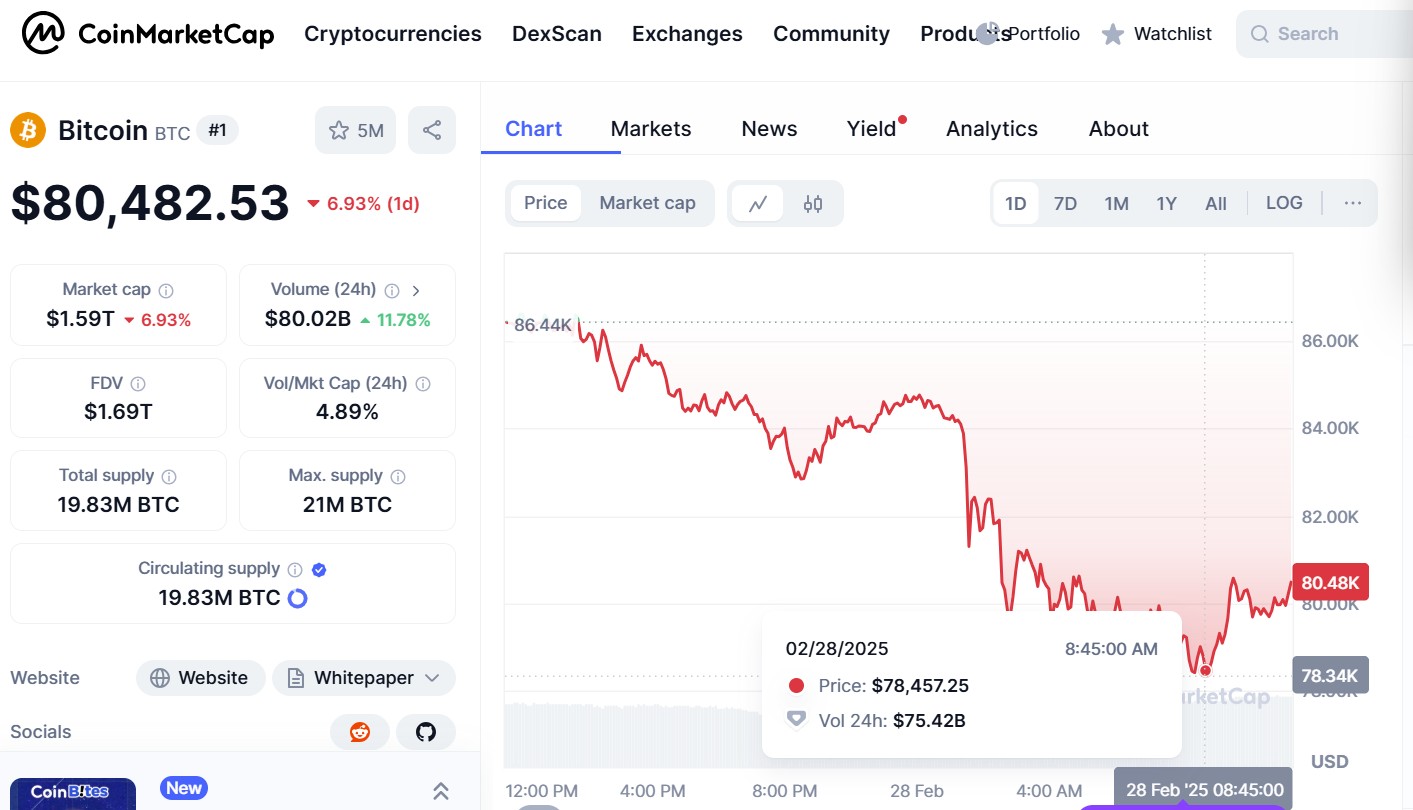

This fell sharply from Bitcoin’s all-time excessive, reaching $109,000 in January forward of President Donald Trump’s inauguration.

Optimism sparked a bubble within the post-election crypto market after the election, and “the real-life inauguration is now in place,” he advised Coin Journal.

In Toredano’s view, the Purchase-bit hack on the Crypto Trade (which resulted within the $1.5 billion theft close to Ethereum) is among the components affecting crypto costs.

It undermined buyers’ belief, which led to a withdrawal of panic and a complete market-wide promoting. Bybit CEO Ben Zhou responded shortly to the hack, however the state of affairs “has elevated the concern of centralized change safety vulnerabilities.

Dom Haz, co-founder of Bob, a hybrid layer-2 (“Bitcoin construct”), mentioned theft on Bybit was a “stricken reminder of the elemental business points,” including:

“We have been hypnotized by value surges, memocoin frenzy and media spectacles. We overlook that crypto is a brand new monetary system. Bybit has given us a $1.5 billion reminder that we’re not approaching that actuality.”

Trump’s tariffs

The continued market sale follows Trump’s commerce tariff announcement earlier this week.

Throughout his election marketing campaign, the US president made a crypto-making promise and mentioned the US would develop into the “crypto capital of the earth.”

Since coming into the White Home, he has appointed a person custody to restructure governmental companies, particularly Paul Akins, as the following chair of the U.S. Securities and Trade Fee (SEC).

Mark Ueda is at the moment chairman of the SEC.

Trump has additionally signed an govt order to determine a cryptographic working group to supply readability on laws. Additionally it is anticipated that the working group will examine the opportunity of nationwide crypto stockpiles.

However regardless of these steps, Trump’s commerce struggle may quickly conflict with the EU, the world’s largest commerce bloc, with 25% tariffs, rising market uncertainty.

In line with Toledano, Trump’s tariffs are “harming the worldwide economic system,” and far of the crypto area feels upset by the US president.

“The guarantees are huge and actuality can show to be catastrophic,” he added. “I believe Trump understands that the monetary business is interconnected and is changing into an increasing number of converged.”

The best financial threat

The third contributor affecting market costs alongside Toredano is the query of total US governance.

A Chatham Home article means that the most important financial threat from Trump’s presidency is the lack of belief in US governance. Trump’s insurance policies could appear gentle within the brief time period, however I learn that steps that undermine the US and its worldwide allies may have lasting results.

“We hardly ever get frightened of the peaks and troughs that codes current, however after we mix the volatility of conventional shares with what is occurring, I believe there is a supply of concern proper now,” Toredano mentioned.

(tagstotranslate) Market