- US merchants are exhibiting sturdy promoting strain as Coinbase premium continues to fall sharply.

- Adjustments in insurance coverage premiums spotlight the numerous regional variations between the U.S. and world markets.

- The continued unfavorable numbers coincide with Bitcoin’s multi-week decline and market stress.

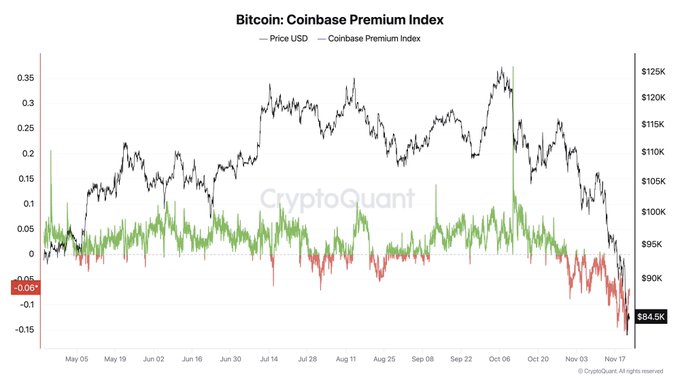

Bitcoin’s near-term market outlook is going through new strain as knowledge exhibits a pointy decline within the Coinbase Premium Index, a broadly watched indicator of U.S. investor habits. The index fell to its weakest stage this 12 months, reflecting the lengthy interval through which Bitcoin constantly traded beneath the worldwide spot worth on Coinbase.

In line with chart knowledge cited by Ki Younger Ju, the Coinbase Premium Index has remained in unfavorable territory all through November, coinciding with Bitcoin’s decline in direction of the $84,500 stage. The indicator has not too long ago been hovering round -0.06, indicating one of many reductions recorded in latest months.

Traditionally, a unfavorable premium signifies that US spot patrons are promoting extra aggressively than members in different areas, and the present studying coincides with Bitcoin’s fourth straight weekly crimson candlestick.

Associated: BTC Could 2025 Outlook: Coinbase Premium Hole Drops to -5.07, Resistance Forward

This chart additionally exhibits that in intervals of secure costs, the index usually approaches impartial ranges. Nevertheless, every huge decline over the previous 12 months has resulted in a crimson spike, marking the second when Coinbase’s worth fell beneath the worldwide common.

Supply: X

market correction

The info exhibits how the scenario has modified since mid-year. In June, July and early October, the index rose above 0.25 as US demand pushed Bitcoin above $120,000. These optimistic indicators have since disappeared, changed by sustained low cost ranges consistent with the present correction.

The premium hole additionally reached almost -$90 at one level, revealing a transparent divide between U.S. merchants and members in Europe and Asia-Pacific, the place premiums remained flat or solely barely optimistic.

Spot market stress

The disconnect between U.S. capital flows and abroad exercise is inserting additional pressure on Bitcoin’s market construction. US time buying and selling remained unfavorable by way of many of the month, contributing to continued downward strain.

Analysts say a protracted unfavorable premium is commonly interpreted as a warning signal amongst U.S. merchants. Nevertheless, the most recent measurements correspond to documented gross sales exercise throughout key periods.

Associated: Coinbase Premium reveals key insights as Bitcoin reaches $100,000

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.