Because the political scenario in america heats up, monetary analyst Michael A. Gade not too long ago stated that the rising nationwide debt of over $35 trillion is a higher menace to democracy than political management. Gade emphasised that the speed of debt progress is outpacing each tax revenues and the inflation price, making a precarious fiscal atmosphere.

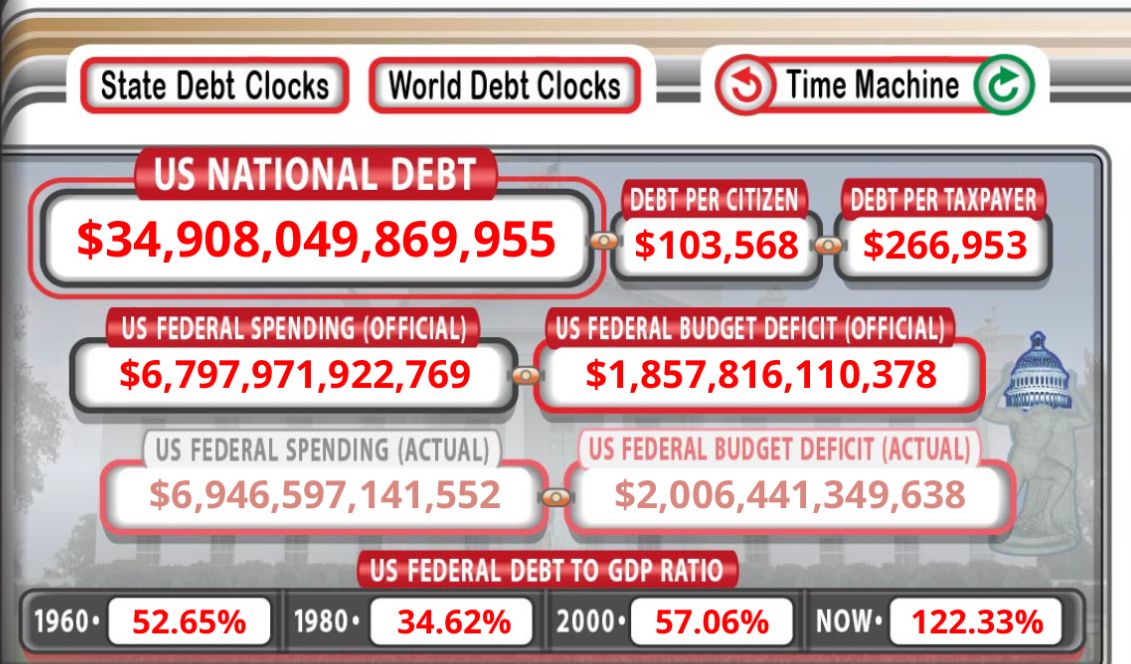

The U.S. federal debt-to-GDP ratio has risen from 52.65% in 1960 to 122.33% as we speak, additional illustrating the unsustainable nature of the nation's fiscal coverage. As debt continues to develop unchecked, the potential for a extreme recession turns into extra pronounced.

The US nationwide debt now stands at $34.9 trillion. The debt per capita has risen to $103,568, and the debt per taxpayer to $266,953. The US federal funds deficit can be massive, with the official determine at $1.8 trillion and the precise deficit at over $2 trillion.

In response to Gade's feedback, Eric Voorhees, founding father of ShapeShift and a distinguished determine within the cryptocurrency world, emphasised the gravity of the scenario. Voorhees argues that rising debt is an inevitable financial menace, whatever the presidential administration. He predicts that the relentless rise within the nationwide debt will ultimately result in a catastrophic collapse of the bond market, leading to widespread monetary collapse.

Voorhees additionally means that this trajectory can’t be mitigated within the present political local weather represented by leaders like Trump and Biden. Beneath any believable situation, the debt is projected to develop by greater than $1 trillion per yr, indicating a dire fiscal outlook. This unsustainable debt progress, Voorhees argues, is a higher menace to democracy than anyone politician.

The influence of such an financial collapse could be important. Voorhees envisions a situation wherein society may emerge from this turmoil with dignity and religion and turn out to be extra affluent. However this may be a big departure from the twentieth century idea of nice energy states. He argues that Bitcoin and related decentralized belongings are important to this transformation. By way of its inherent financial recreation principle, Bitcoin may stop the debasement of currencies that gasoline the expansion of nice energy states.

The belief that Bitcoin is a extra everlasting asset than fiat currencies, which has but to be totally realized, may play a pivotal position on this shift. Voorhees believes that when Bitcoin is acknowledged as a extra steady retailer of worth over generations, it may restrict the flexibility of huge nations to inflate their currencies, thereby curbing their enlargement.

If Republicans win in November, Trump and Vance are unlikely to considerably scale back the debt, however they may present an atmosphere wherein cryptocurrencies can thrive, Voorhees stated. Doing so would assist ingrain cryptocurrencies' roots deeper into the cultural and financial atmosphere, doubtlessly giving them the resilience to resist anticipated monetary turmoil.

“The very best factor Trump and Vance can do throughout their administration, since they can not and won’t materially alleviate the debt scenario, is to create 4 years of tolerant area wherein cryptocurrencies can thrive with out persecution.”

Voorhees' views replicate a broader sentiment inside the crypto group that sees decentralized digital belongings as a possible safeguard in opposition to the financial instability of huge nationwide debt. Whether or not the crypto business can provide a substitute for the standard fiat foreign money system could possibly be essential in weathering future monetary challenges.