In 2023, the blockchain safety panorama noticed a $50 billion lower in crypto asset losses, strengthening safety protocols and a transition to maturity of the DeFi ecosystem.

The dimensions of financial harm brought on by hacking and fraud decreased considerably final 12 months, in keeping with a year-end report from cryptocurrency safety agency Hakken. His whole losses amounted to $1.9 billion, in stark distinction to the staggering numbers recorded beforehand. The discount in losses represents vital progress within the business's efforts to strengthen safety measures and extra successfully handle vulnerabilities.

Throughout the business, the BNB chain suffered probably the most assaults with 214 assaults, adopted by Ethereum in second place with 178 assaults. Notably, a lot of the BNB Chain and Ethereum hacks have been labeled as “rug pulls” with 148 and 97 respectively.

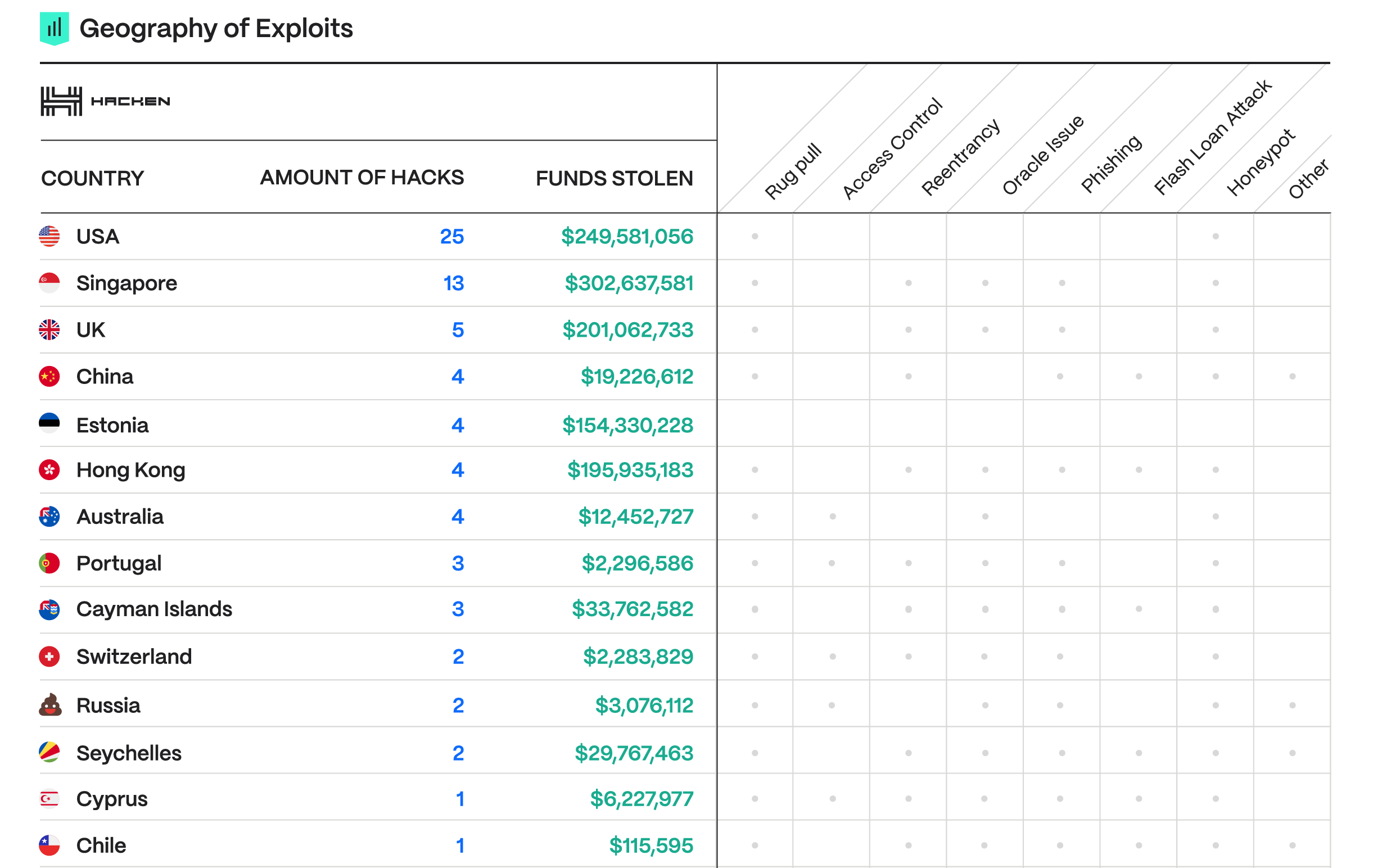

The report additionally highlights the geographic distribution of blockchain exploits, with vital hotspots rising in areas with excessive fintech exercise. This geographic evaluation offers helpful perception into the worldwide nature of blockchain vulnerabilities and the necessity for a coordinated worldwide response to deal with these challenges.

The US had probably the most circumstances with 15, adopted by Singapore (13) and the UK (5) in second and third place. In fourth place, China has one of many lowest quantities stolen per hack, with a mean of $5 million per hack, in comparison with the US with $10 million, Singapore with $23 million, and the UK with $40 million. Evaluate.

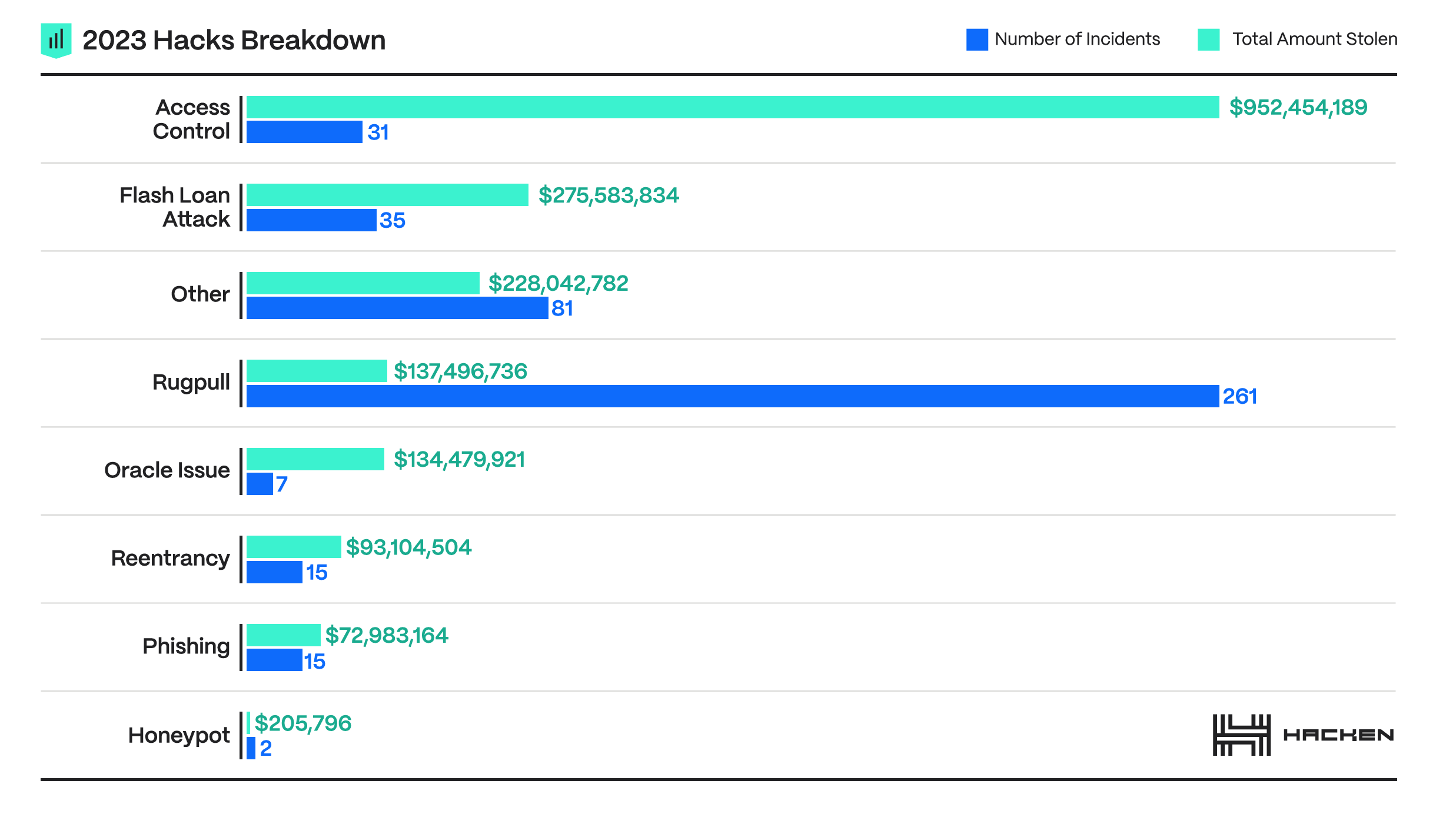

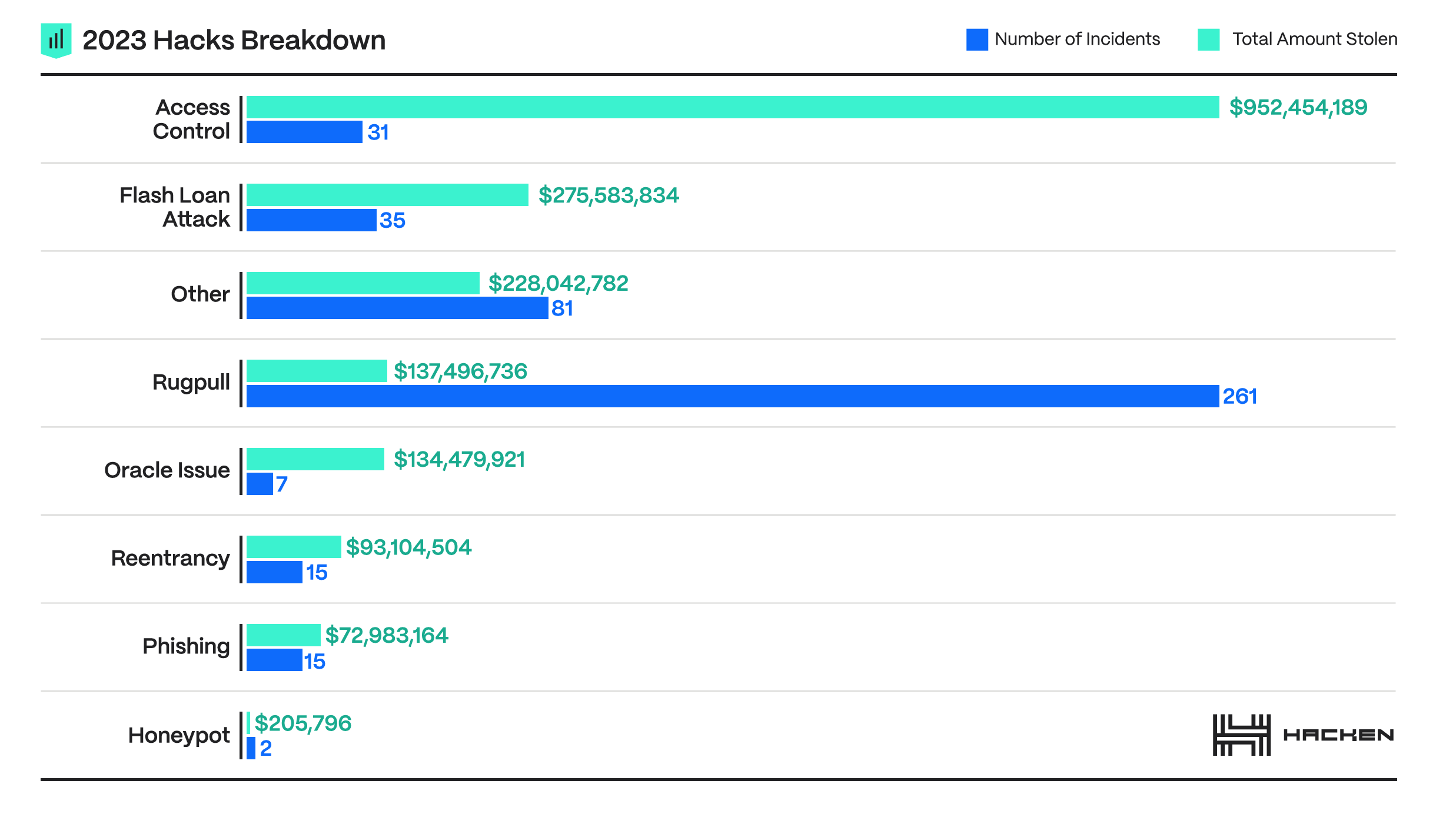

Declining year-over-year losses don’t imply the menace state of affairs is reducing. Quite the opposite, the variety of assaults elevated by 14% in comparison with the earlier 12 months, highlighting an evolving and increasing assault floor. The number of these assaults, from superior entry management violations to flash mortgage assaults, exhibits that attackers are frequently refining their methods to use the complicated net of DeFi and blockchain know-how. I’m.

Essentially the most vital thefts this 12 months concerned multi-chain bridges, with $231 million leaked, demonstrating simply how excessive the stakes are in making certain the protection of cross-chain operations. Regardless of the excessive profile of some assaults, the business was capable of get well a good portion of the belongings stolen by exploited protocols within the first 12 months, roughly 20% or $400 million . This restoration was made doable by fast response groups, the goodwill of sure hackers, and elevated regulation enforcement efforts.

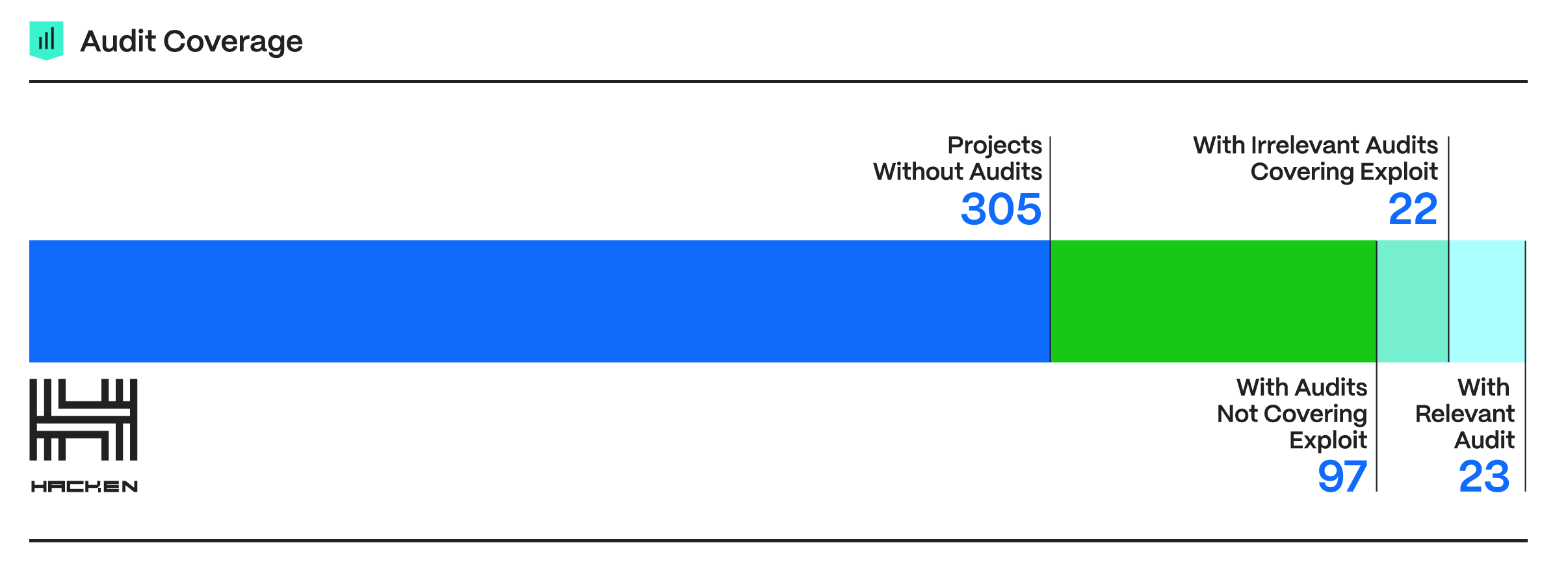

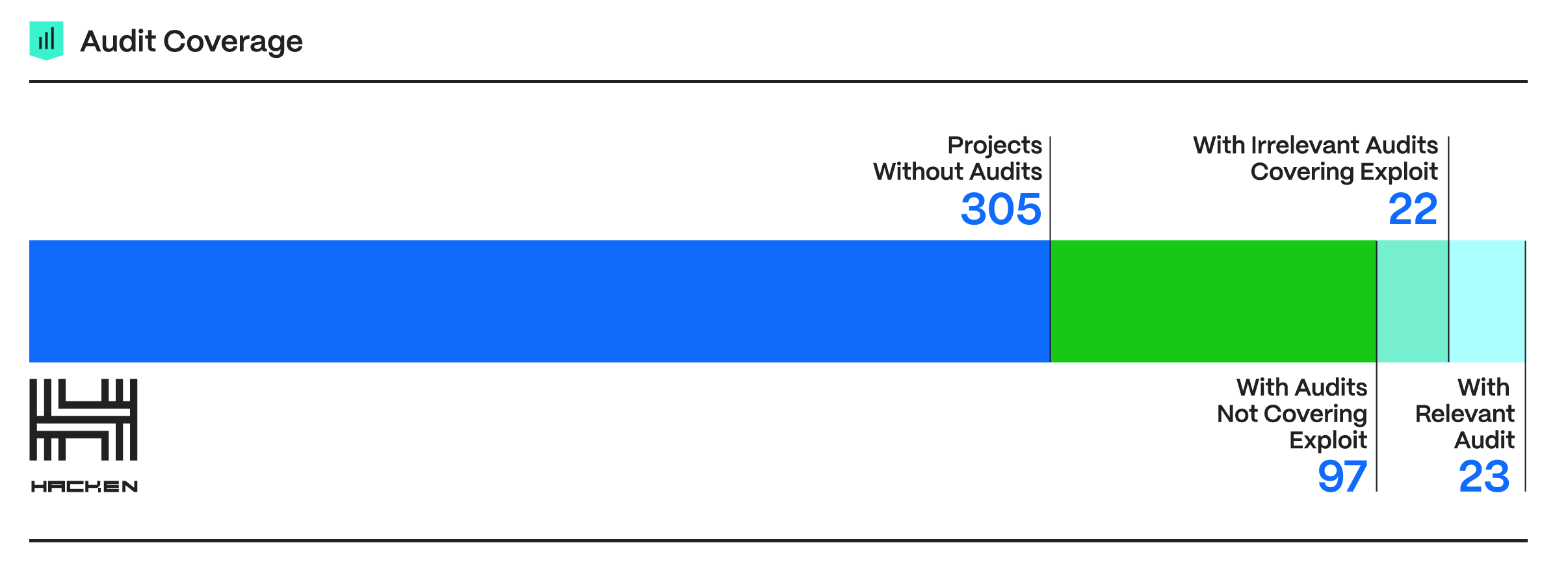

Hacken's report additional emphasizes the vital significance of complete audit protection and the position of bug bounty applications to determine and mitigate vulnerabilities earlier than they are often exploited. Regardless of these safety measures, knowledge reveals that many tasks are nonetheless poorly protected, both as a result of auditing doesn’t exist or the audits carried out are unrelated to the deployed code. I did. This safety preparedness hole highlights the necessity for a extra proactive and thorough method to safety audits, making certain they’re complete and related to deployed blockchain code. .

Moreover, Hacken emphasizes the effectiveness of real-time monitoring instruments and the event of safe pockets know-how as a key element of a sturdy safety framework. These instruments play a vital position within the early detection and mitigation of potential threats, strengthening the general safety posture of blockchain platforms and defending customers' belongings.

Looking forward to 2024, this report offers predictions and proposals to deal with future safety challenges. Amongst them: Because the business continues to innovate and broaden, vulnerabilities are anticipated to extend, particularly with the adoption of recent Layer 1 and Layer 2 options. The report requires continued emphasis on entry management and prevention of flash mortgage assaults, the significance of fostering a constructive safety tradition, and the necessity for collaboration throughout the business to strengthen collective protection mechanisms.

Though progress has been made in mitigating the financial affect of assaults, it’s clear that combating crypto-related crime stays an ongoing problem to take care of the continued progress and stability of the DeFi sector.

(Tag translation) Ethereum