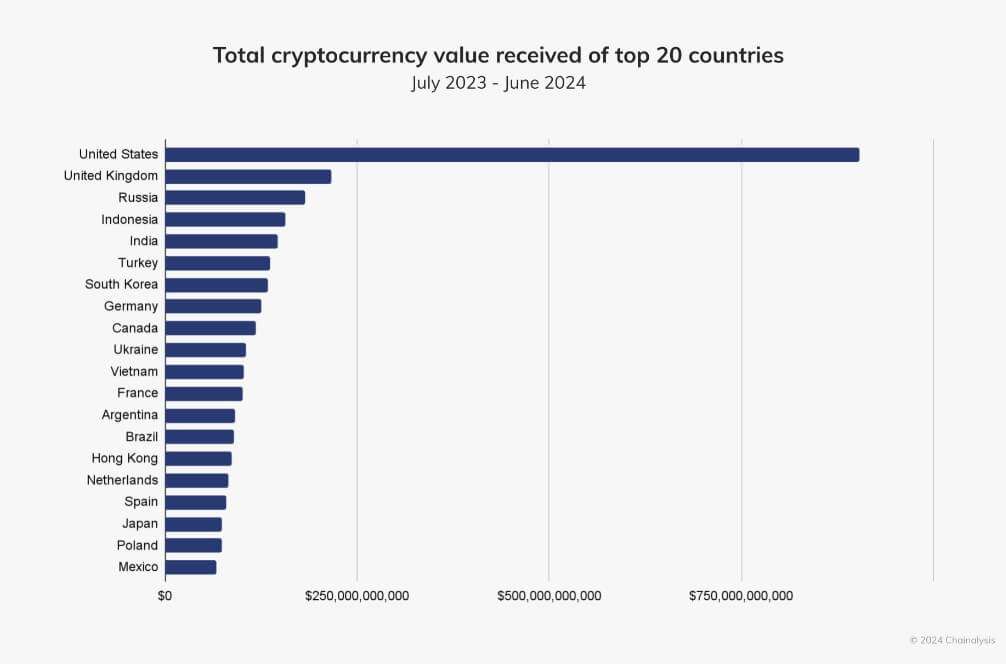

Based on a Chainalysis report on October 17, North America has as soon as once more claimed the highest spot because the world's most vital cryptocurrency market as a result of elevated institutional investor exercise in the US.

From July 2023 to June 2024, $1.3 trillion of on-chain worth will probably be created in North America, representing 22.5% of the worldwide whole. Chainalysis believes this benefit is because of elevated institutional investor exercise, significantly within the US, the place massive transactions of over $1 million account for 70% of crypto remittances within the area. .

Whereas the US leads the North American cryptocurrency business, Canada follows, with on-chain worth of $119 billion over the identical interval.

US benefit

The US stays a dominant participant within the North American cryptocurrency market, thanks largely to vital institutional funding round spot Bitcoin and Ethereum exchange-traded funds (ETFs).

However this management isn’t with out its challenges. Chainalysis notes that the U.S. market is extra risky than international markets.

The report states:

“In current quarters, the US has proven sensitivity to each bull and bear markets. When crypto costs rise, the US market exhibits larger progress than the worldwide market, and vice versa when the crypto market falls. applies.”

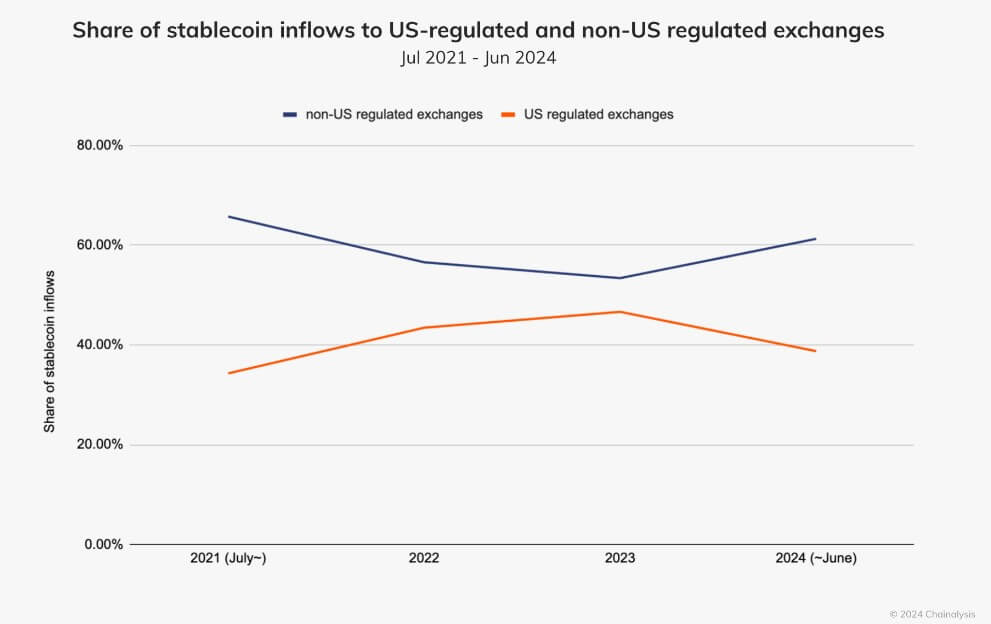

Though cryptocurrencies are gaining popularity in the US, the quantity of stablecoins held on exchanges is quickly lowering. The share of stablecoin buying and selling on US-regulated exchanges has fallen from round 50% in 2023 to lower than 40% in 2024.

Chainalysis reported that this decline could also be associated to regulatory uncertainty surrounding these digital belongings in the US. Circle, the issuer of the USDC stablecoin, famous that regulatory uncertainty within the US has led stablecoin initiatives to hunt extra favorable environments in Europe and the UAE.

Stablecoin utilization is rising exterior the US

In distinction, stablecoin buying and selling is quickly rising exterior the US, accounting for greater than 60% of buying and selling in non-US markets by 2024.

This pattern is especially sturdy in creating markets, the place stablecoins permit customers to entry US {dollars} with out counting on conventional banking programs. Circle confirmed this transformation, reporting that as of late 2022, 45% of US greenback payments in circulation will probably be held abroad.

The elevated use of stablecoins exterior the US displays a broader pattern. International markets are more and more viewing USD-backed stablecoins as each a retailer of worth and a extra inexpensive technique of transaction.

Tether CEO Paolo Ardoino additionally emphasised the significance of USDT in offering stability amid financial uncertainty in inflation-hit international locations like Argentina.

talked about on this article

(Tag translation) Bitcoin