- Curve DAO’s CRV token funding price has dropped to a brand new annual low.

- Over the past 24 hours, CRV token has fallen 10%.

- USDT worth fell 0.25% because of Curve ecosystem imbalance.

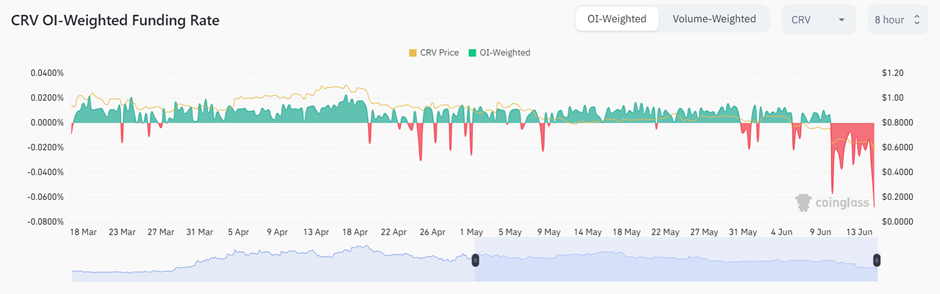

In response to a latest evaluation, the funding price of the Curve DAO token CRV has dropped to -0.0733% within the final 8 hours, the bottom stage for the yr. Over the previous 24 hours, the token has fallen greater than 10%.

An imbalance within the Curve ecosystem has led to an enormous change of USDT into DAI and USDC, leading to a 0.25% low cost to the value of USDT. On the time of writing, USDT is buying and selling down 0.26% to $0.998 and CRV is buying and selling down 12.17% to $0.5683.

Famend Chinese language journalist Colin Wu shared a sequence of threads on Twitter by his official Wu Blockchain web page, providing perception into doable causes for the yearly low CRV.

Just a few days earlier, Curve Finance founder Michael Egoroff reportedly deposited $24 million price of CRV tokens, representing 34% of the full provide. The large deposit into decentralized protocol Aave was an try and mitigate the liquidation danger of a $65 million stablecoin mortgage. In response to Crypto Detective, Lookonchain, Egorov has deposited 291 million CRV and borrowed $65 million USDT and USDC.

Wu argued right now that CRV’s declining funding price could possibly be attributed to Curb founder Mikwill’s betting.

The principle purpose for that is believed to be bets on liquidation by quick sellers of positions held by Curve founder michwill (0x7a…5428). This deal with holds his 430 million CRV tokens (roughly 50% of the circulating provide) as collateral for the lending protocol.

The reporter included michwill’s pockets deal with, highlighting that it holds over 400 million CRV tokens price a complete of $2,342,134.

Comments are closed.