- Vitalik Buterin revealed that 36.5% of the Ethereum Basis's 2023 funds has been allotted to the brand new basis.

- Buterin's annual wage is ready at S$182,000 (roughly $134,000), bringing higher transparency to Ethereum's monetary operations.

- The Ethereum market is exhibiting combined alerts with the value dropping by 4.94% and choices buying and selling quantity rising by 62.47%.

Ethereum (ETH) co-founder Vitalik Buterin has shared new data concerning the Ethereum Basis's expenditures in addition to his personal wage for 2023. Buterin, who is understood for influencing the markets along with his posts, supplied an in depth breakdown of the inspiration's spending.

In a publish on his X account, Buterin outlined the principle spending classes. The biggest portion, 36.5%, will go to “new foundations,” together with organizations such because the Nomic Basis, DRC, L2Beat, and 0xPARC. Along with this, investments will go in direction of tier 1 analysis and improvement, making up 24.9% of the funds, whereas 12.7% will go to group improvement.

Buterin additionally revealed his annual wage, which he places at S$182,000, or roughly the equal of $134,000 USD. The disclosure provides a glimpse into the monetary operations of the Ethereum Basis.

The cryptocurrency market has reacted to Buterin's publish, with Ethereum presently buying and selling at $2,589.24 with a 24-hour buying and selling quantity of $14.09 billion. The value has fallen 4.94% prior to now 24 hours, bringing Ethereum's market cap to $311.48 billion. Ethereum's circulating provide is 120.3 million ETH cash.

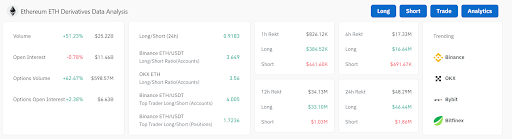

Ethereum derivatives buying and selling knowledge additionally exhibits a surge in exercise. Open curiosity declined barely, however buying and selling quantity elevated by 51.23% to $25.22 billion. Choices buying and selling noticed a major improve in quantity of 62.47%. Moreover, the lengthy/quick ratio displays a typically bullish sentiment, particularly on Binance and OKX, the place lengthy positions dominate.

Nonetheless, the general 24-hour lengthy/quick ratio stood at 0.9183, indicating a slight favorability in direction of quick positions throughout the market. High merchants on Binance are exhibiting a powerful lengthy bias, suggesting they continue to be assured in Ethereum’s potential regardless of the current worth pullback.

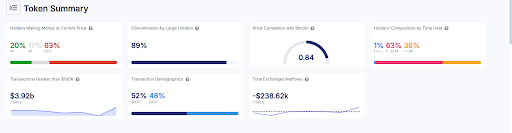

Moreover, Ethereum's present market state of affairs exhibits combined alerts. ETH is buying and selling at $2,588.92, down 2.16% prior to now 24 hours, with a market cap of $326.69 billion. At present, solely 20% of holders are making a revenue, whereas 63% are in losses. Giant holders management 89% of the availability, indicating excessive centralization. Moreover, ETH exhibits a powerful correlation (0.84) with Bitcoin worth fluctuations.

Regardless of the short-term bearish pattern, the info signifies continued curiosity and potential for Ethereum within the broader market. Destructive change internet flows of $238.62K over the previous week might recommend accumulation. These indicators subsequently recommend that Ethereum will stay a significant participant within the cryptocurrency market and that its future prospects are intently tied to broader market circumstances.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent any form of monetary recommendation or counsel. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.