- Over $250 million has been withdrawn from Voyager Digital after a one-year hiatus.

- The steadiness of cryptocurrency brokers is now right down to $176.38 million.

- Voyager at the moment has a clear asset ratio of 96.15%, which incorporates numerous tokens resembling BTC, ETH, USDC, and SHIB.

Crypto dealer Voyager Digital has witnessed a large outflow, with withdrawals resuming after a year-long hiatus. Collectors are transferring rapidly to gather the cash, leading to a large outflow of over $250 million.

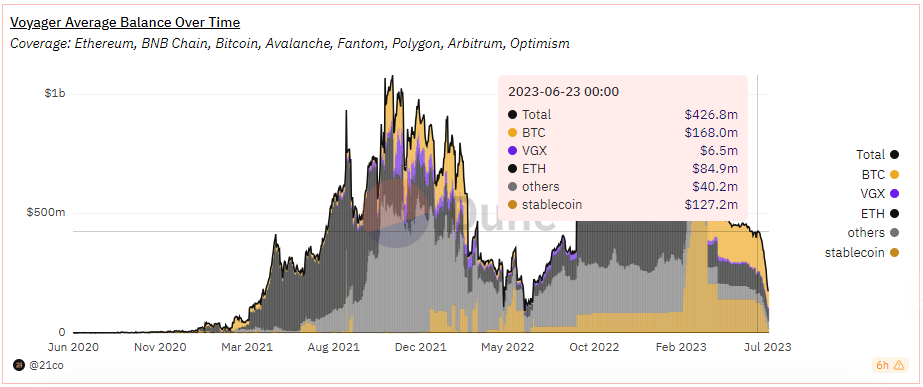

Cryptocurrency finance firm Voyager Digital, which has been in monetary bother after submitting for Chapter 11 chapter and suspending investor withdrawals, not too long ago resumed withdrawal providers on June 23. The platform steadiness, which stood at $426.8 million when withdrawals resumed, has now dropped to $176.38 million. Specifically, there have been many transactions over $1 million.

Information from Dune Analytics reveals that over $250 million value of crypto belongings have been withdrawn from Voyager. Presently, the platform holds roughly $176 million value of crypto belongings, with a clear asset ratio of 96.15%. This determine consists of BTC at $69 million, ETH at $50.99 million, USDC at $18.56 million, SHIB at $15.7 million, and a number of other different tokens.

In early Could, U.S. chapter decide Michael Wiles accredited Voyager’s proposed liquidation plan. This allowed the corporate to return roughly $1.33 billion of crypto belongings to its prospects, marking the tip of its Chapter 11 restructuring efforts.

On this chapter plan, prospects are anticipated to gather 35.72% of their deposits. After distributing these preliminary funds, Voyager will proceed to hunt further belongings to pay additional collectors.

In a Could 8 Voyager announcement, “topic to decision of the FTX/Alameda Precedence Claims Dispute, the success of further claims introduced towards third events by the Voyager Plan Directors and by the Voyager Property as a creditor. It depends upon whether or not restoration is feasible.” Purchasers could obtain further recoveries sooner or later as a result of liquidation of Three Arrows Capital. ”

Voyager Digital has confronted a bumpy street since submitting for chapter safety in July 2022, citing market volatility. Notably, his two makes an attempt to promote belongings to Binance US and FTX failed, leaving the platform to grapple with monetary challenges.

Comments are closed.