- ICP worth restoration above key Fibonacci ranges indicators new bullish momentum

- Improve in open curiosity highlights speculative exercise and rising dealer confidence

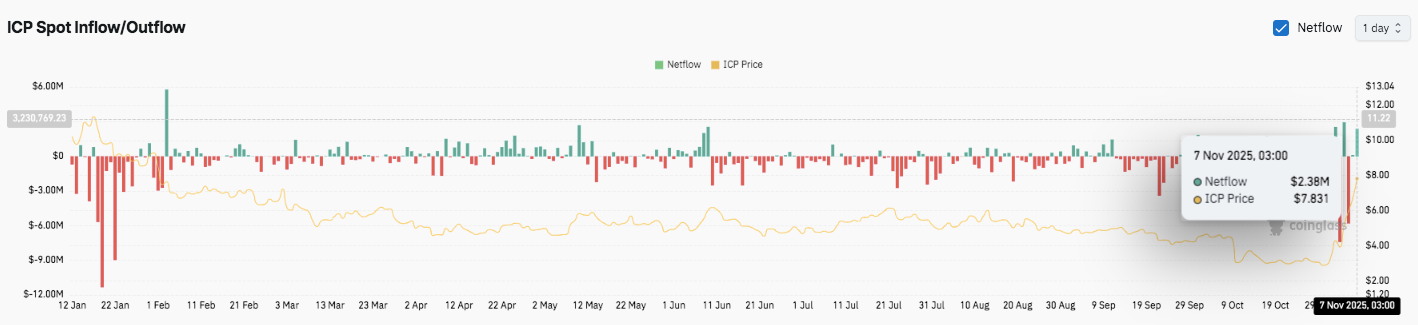

- Growing spot inflows point out a resurgence of accumulation and robust investor demand

Web Laptop (ICP) has emerged as one of many best-performing cryptocurrencies this week after recording a formidable worth restoration. The token traded at $8.29 on November seventh, with a day by day buying and selling quantity of over $1.4 billion. Up to now seven days, ICP has surged over 184%, rising its market cap to $4.42 billion.

Sturdy rebound above key Fibonacci ranges

After recovering the Fibonacci 0.5 retracement at $5.00, ICP’s bullish momentum accelerated, sparking renewed investor curiosity. The coin has since examined the 0.786-1.0 Fibonacci vary between $7.75 and $8.10, which is more likely to see some short-term revenue taking. This surge has reversed months of decline, with the four-hour chart displaying constant highs and lows.

Moreover, the exponential shifting averages (20, 50, 100, 200) are aligned in good bullish order for the primary time since mid-2023. The Supertrend indicator turned optimistic at $5.38, indicating a technical shift in direction of sustained upward momentum. Subsequently, if the coin closes above $7.75, the worth might purpose in direction of the $8.50 to $9.00 space.

Nevertheless, speedy assist lies between $5.93 and $4.84, representing the earlier breakout zone. A breakdown under $5.90 might point out weak spot and will result in a retest of deeper assist close to $4.20 and $3.07, which coincides with the 200-EMA close to $3.98.

Improve in open curiosity and market members

Open curiosity in ICP futures surged to $206.85 million, reflecting certainly one of its highest ranges since 2023. This rise displays elevated speculative exercise as merchants take positions to purpose for additional upside. The resurgence of derivatives buying and selling indicators rising confidence within the short-term energy of ICP.

Moreover, the restoration in open curiosity is accompanied by widespread optimism available in the market, with members re-entering the market after months of subdued sentiment. The sustained progress in leveraged positions suggests renewed confidence that ICP’s bullish momentum might proceed within the coming weeks.

Spot move signifies new accumulation

Current on-chain knowledge exhibits that inflows are bettering, with internet inflows of $2.38 million recorded on November seventh. These inflows observe regular outflows over the primary few months of the 12 months. This sample suggests a transition to accumulation as buyers reposition close to the oversold zone.

Importantly, the constant surge in inflows since October confirms a return to market confidence and rising demand. If the shopping for strain continues, ICP might prolong its upward trajectory in direction of the subsequent resistance cluster between $8.50 and $9.00, reinforcing the bullish outlook.

Web Laptop (ICP) Expertise Outlook: Key Ranges Strong, Bullseye at $9

- High stage: $7.75, $8.10, and $8.50 stay speedy resistance zones and will see some short-term revenue taking. A affirmation above $8.10 might pave the best way for $9.00 and $9.50, indicating continued bullish momentum.

- Cheaper price stage: $6.20 acts as the primary main assist, adopted by $5.93 and $4.84, each of which coincide with earlier breakout zones. Deeper assist is seen at $4.20 and $3.07, coinciding with the 200-EMA space that anchors the broader bullish construction.

- Higher restrict of resistance: The $8.10 to $8.50 vary acts as a medium-term barrier for a reversal in direction of a sustained upward continuation. If we will preserve energy above this stage, the subsequent leg in direction of $9.50 and above might be validated.

Can ICP preserve its momentum?

The worth outlook for Web computer systems stays optimistic so long as patrons keep on with the $6.00 to $6.20 vary. The coin has damaged its long-term downtrend and is now buying and selling firmly above all main shifting averages. Continued capital inflows and elevated open curiosity counsel that speculative confidence is bettering.

If ICP sustains above $6.00, it might acquire momentum in direction of $8.50-$9.00 within the close to time period. Nevertheless, failure to maintain assist at $5.90 might set off a retest of $4.84, the place sturdy shopping for curiosity beforehand surfaced. For now, ICP is buying and selling inside a pivotal zone the place sustained quantity and structural affirmation will decide whether or not the rally extends in direction of the $9.50 goal or consolidates earlier than shifting increased.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.