Web3 protocol losses as a result of hacks and exploits fell 58% to $313.5 million within the second quarter from $745 million stolen in the identical interval final 12 months, in keeping with a CertiK report. crypto slate.

“The decline in monetary losses as a result of cybersecurity breaches means that the Web3 trade’s technical defenses and safety protocols have gotten simpler,” mentioned CertiK. crypto slate in an announcement. “Cryptocurrency exchanges, blockchain networks and particular person builders could also be adopting extra strong safety measures and investing in areas resembling risk detection, vulnerability administration and incident response.”

In comparison with the primary quarter of this 12 months, whole losses are down barely from a recorded $330 million.

There have been 212 incidents in Q2 2023, leading to a median lack of $1.5 million

CertiK reported 212 safety incidents within the second quarter, leading to a median lack of $1.5 million.

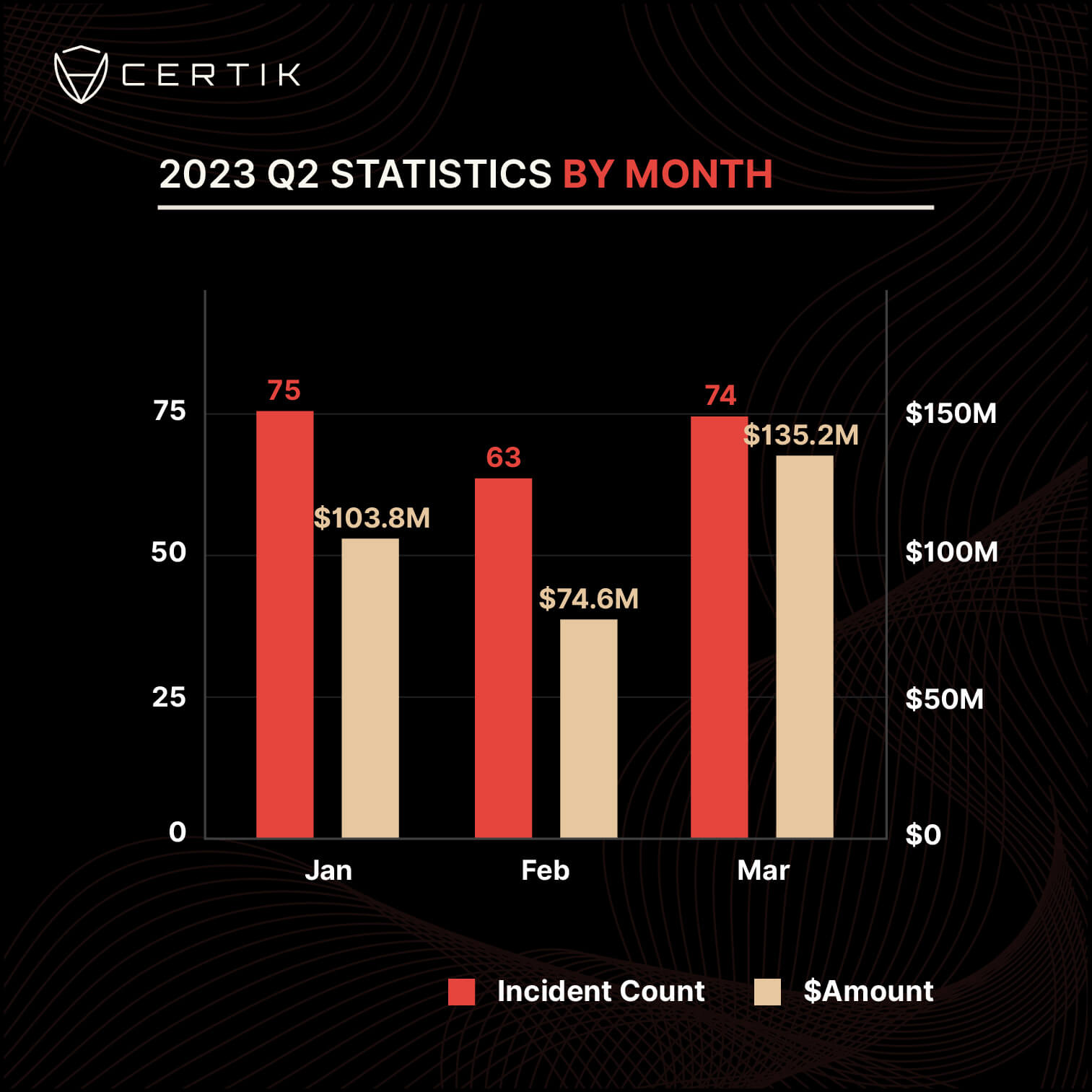

April and June have been significantly busy for the villains, in keeping with the report, with greater than 70 incidents recorded in each months, leading to greater than $100 million in losses every.

Then again, Could had the bottom variety of exploits with 63 exploits and misplaced $74.6 million.

Improve in departure fraud

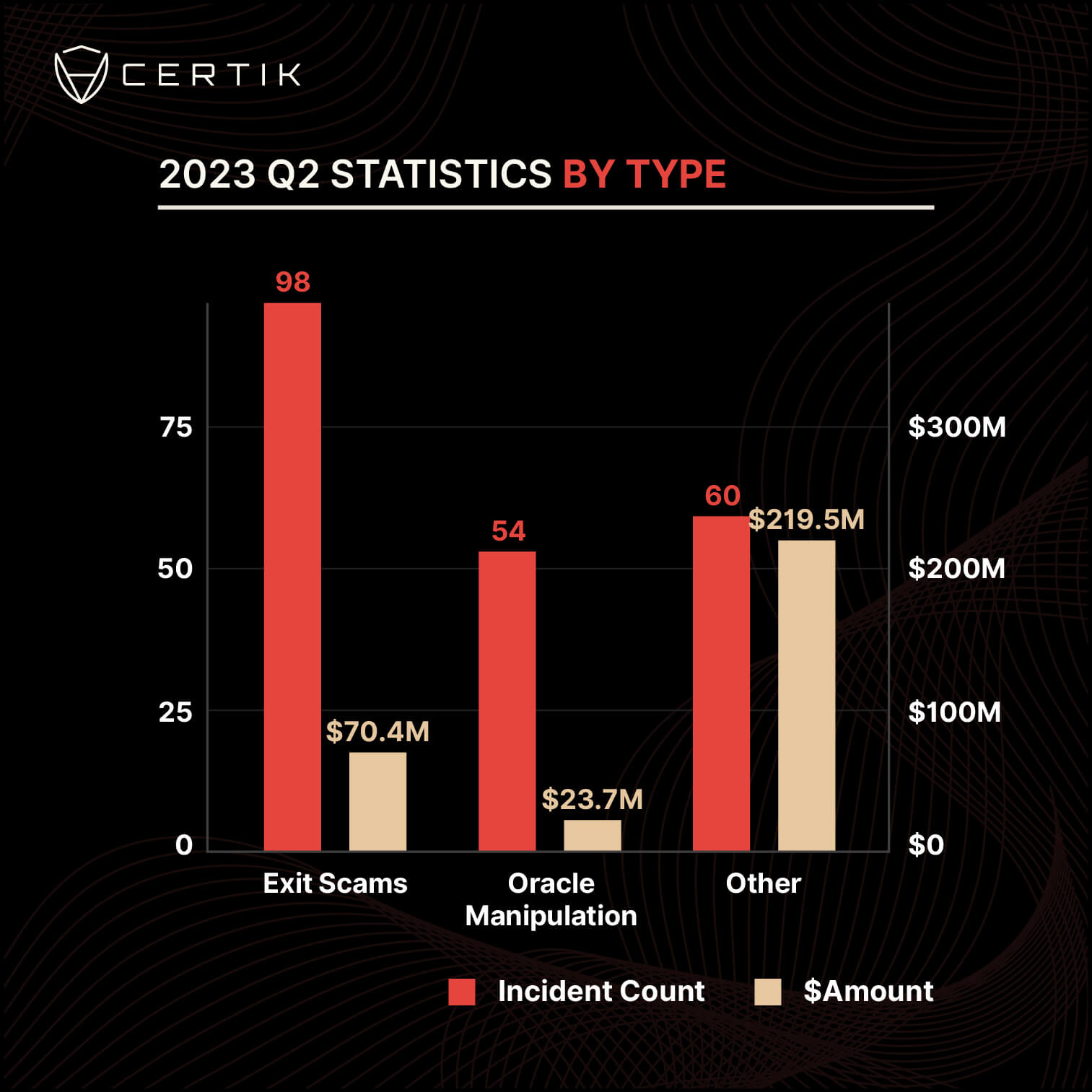

CertiK studies that many of the safety incidents in Q2 have been exit scams often called lag pulls. A lag pull is a rip-off by which a crew unexpectedly abandons a undertaking after accepting investor funds, promoting all of its liquidity.

In the course of the interval, the villains fraudulently executed 98 initiatives and stole $70.35 million. That is greater than double his $31 million misplaced to the identical rip-off within the first quarter.

Main exit scams this quarter included Morgan DF Fintoch, which stole over $30 million, and Ordinals Finance and Chibi Finance, which stole about $1 million every.

In the meantime, flash mortgage/oracle operations accounted for 54 circumstances, with $23.7 million stolen. Safety breaches tagged as “different” resulted in $219.5 million in losses.

Malicious Gamers Goal BNB Chain Venture

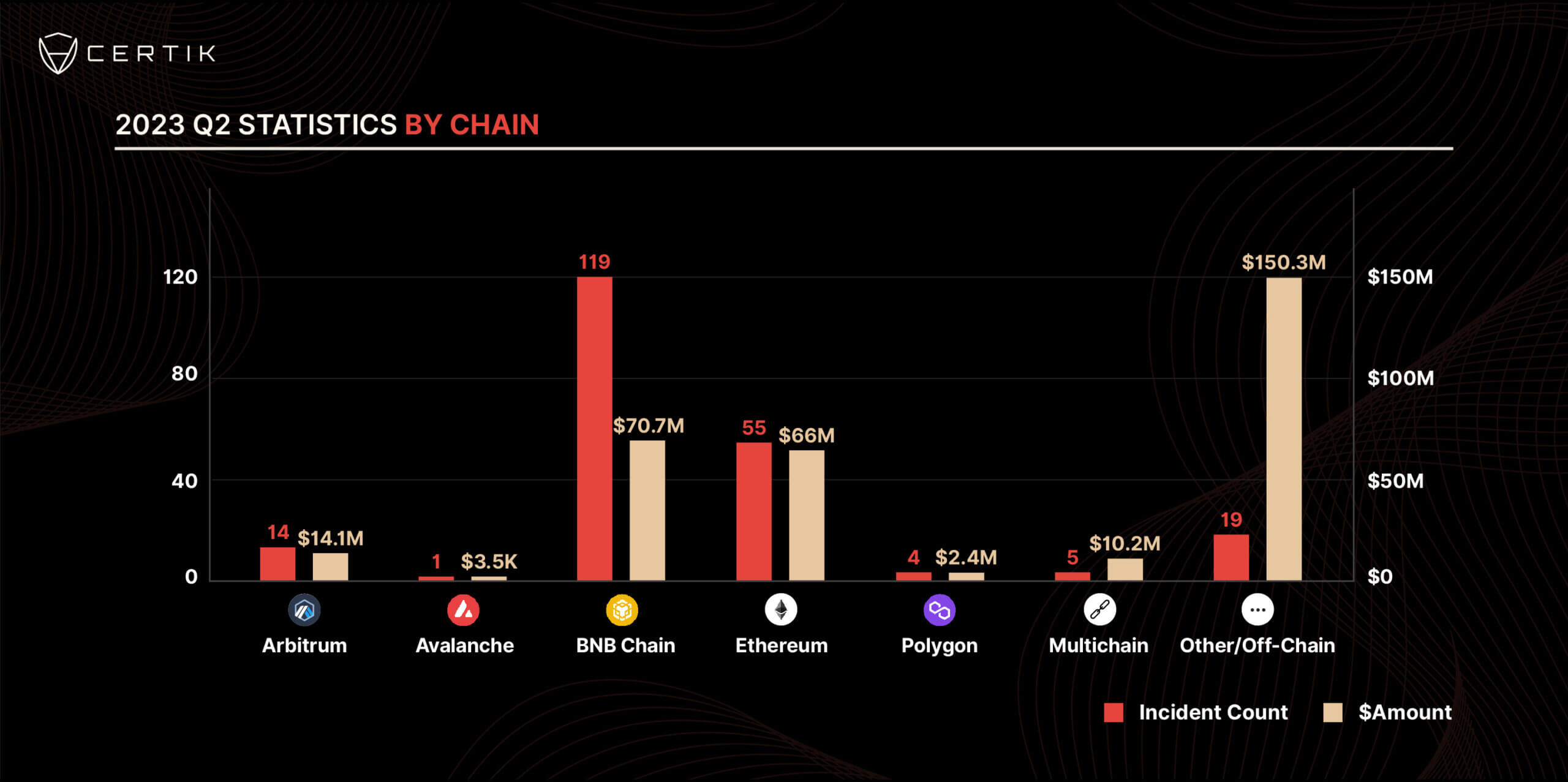

Throughout blockchain networks, the CertiK report notes that crypto initiatives on BNB chains have gotten more and more engaging targets for exploitation. The blockchain safety agency mentioned 119 safety incidents associated to its community brought on $70.7 million in harm.

By comparability, Ethereum (ETH) recorded 55 safety breaches, leading to a lack of $66 million. 14 exploits on Arbitrum price him $14.1M, and his 5 exploits on multichain price him $10.2M. Avalanche (AVAX) and Polygon (MATIC) recorded 5 accidents leading to a lack of $2.4 million.

Nevertheless, 19 incidents stole $150.3 million from different chain and off-chain occasions. His $100 million Atomic Pockets exploit accounted for many of this loss, and can also be probably the most vital private exploit of the quarter.

(Tag Translation) Ethereum

Comments are closed.