- Cryptocurrency markets traded constantly decrease for many of final week.

- Annual profit-taking is the primary motive for the decline as monetary establishments shut out positions for the yr, however the Fed's hawkish stance at its Dec. 18 coverage assembly additionally performed a job.

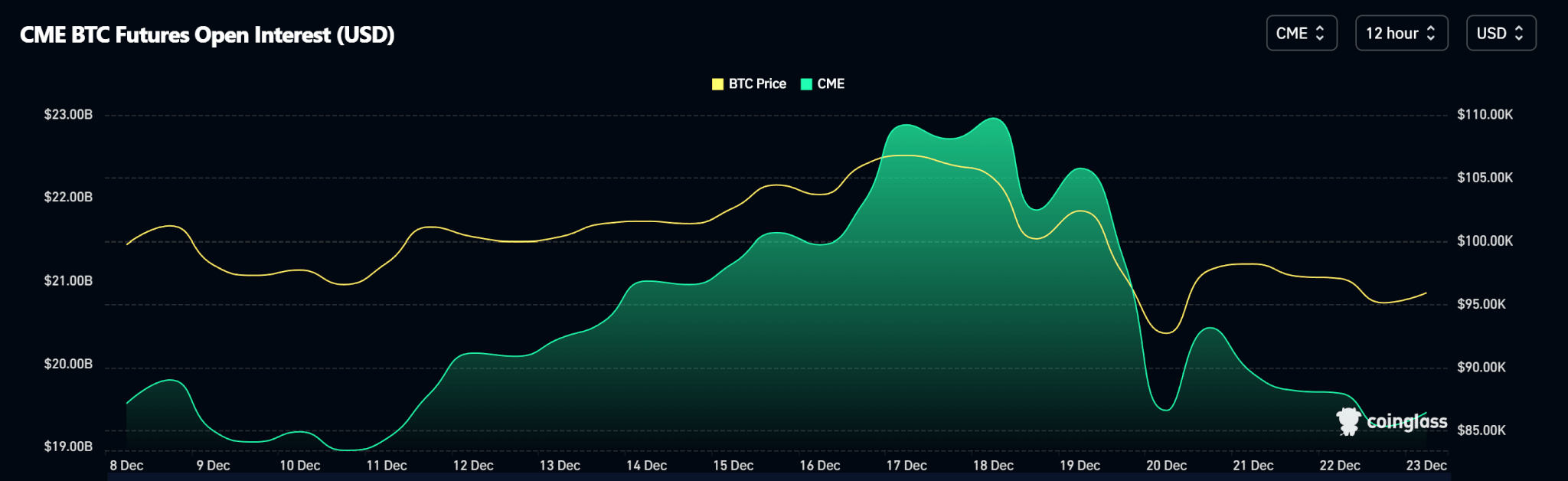

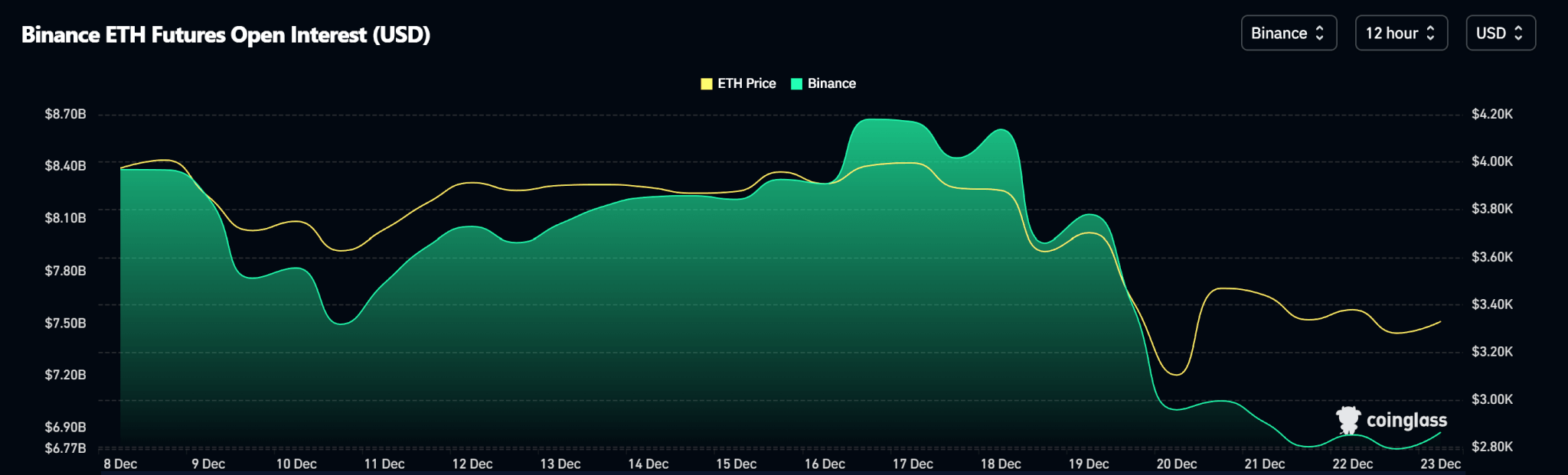

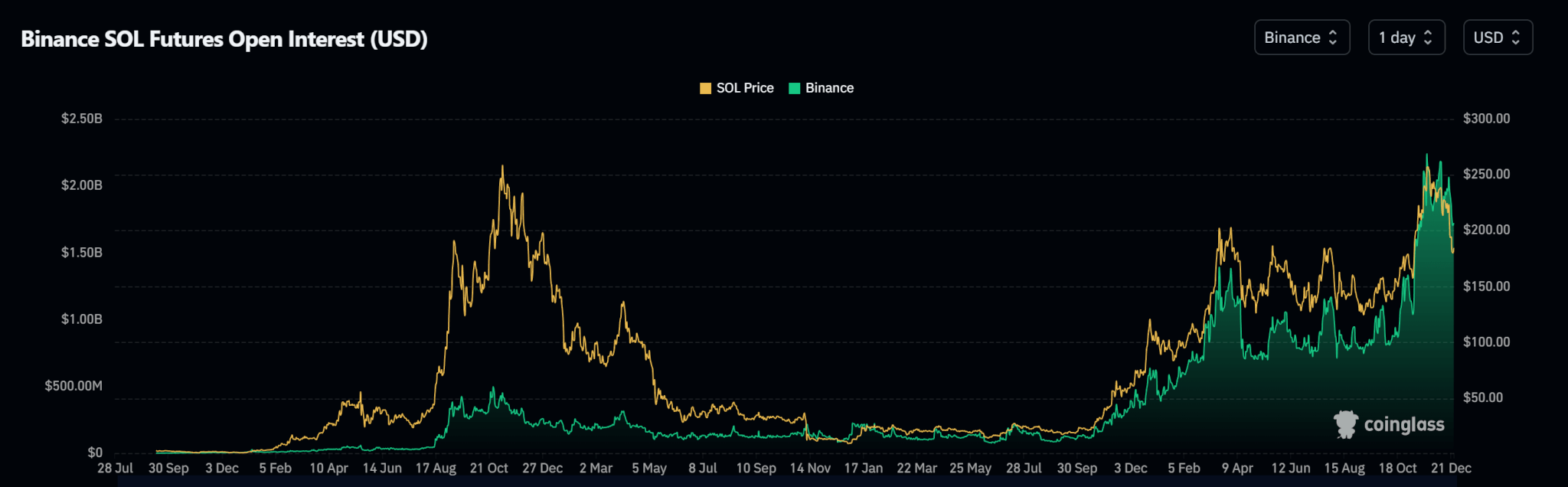

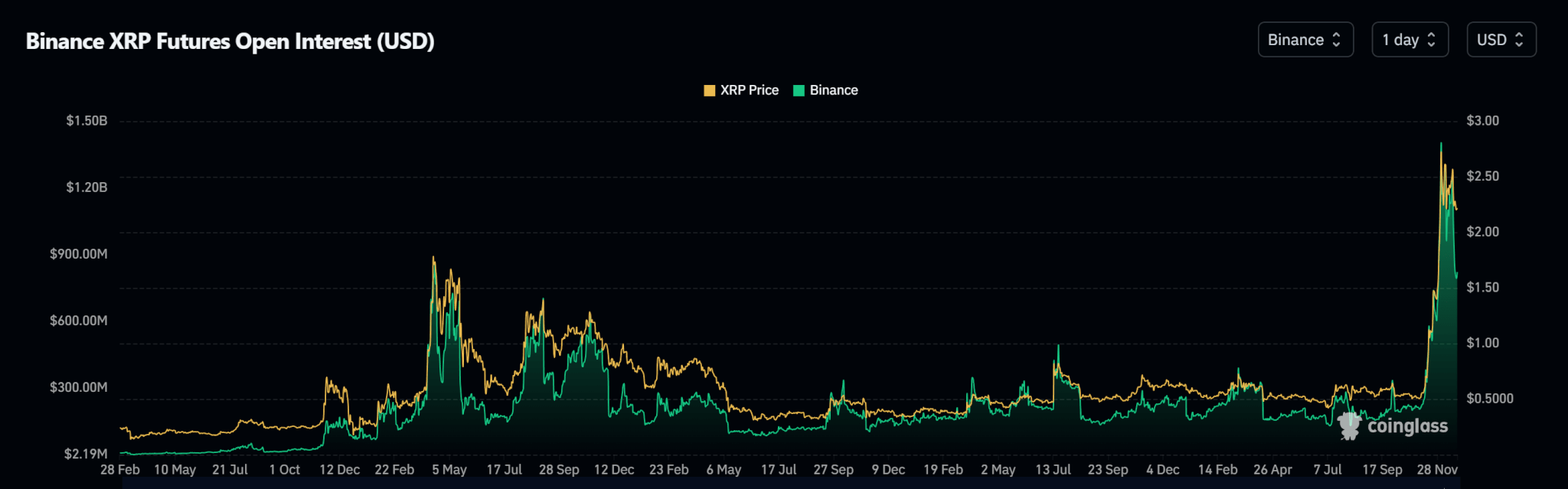

- Open curiosity in main cryptocurrencies confirmed weekly declines.

Bitcoin

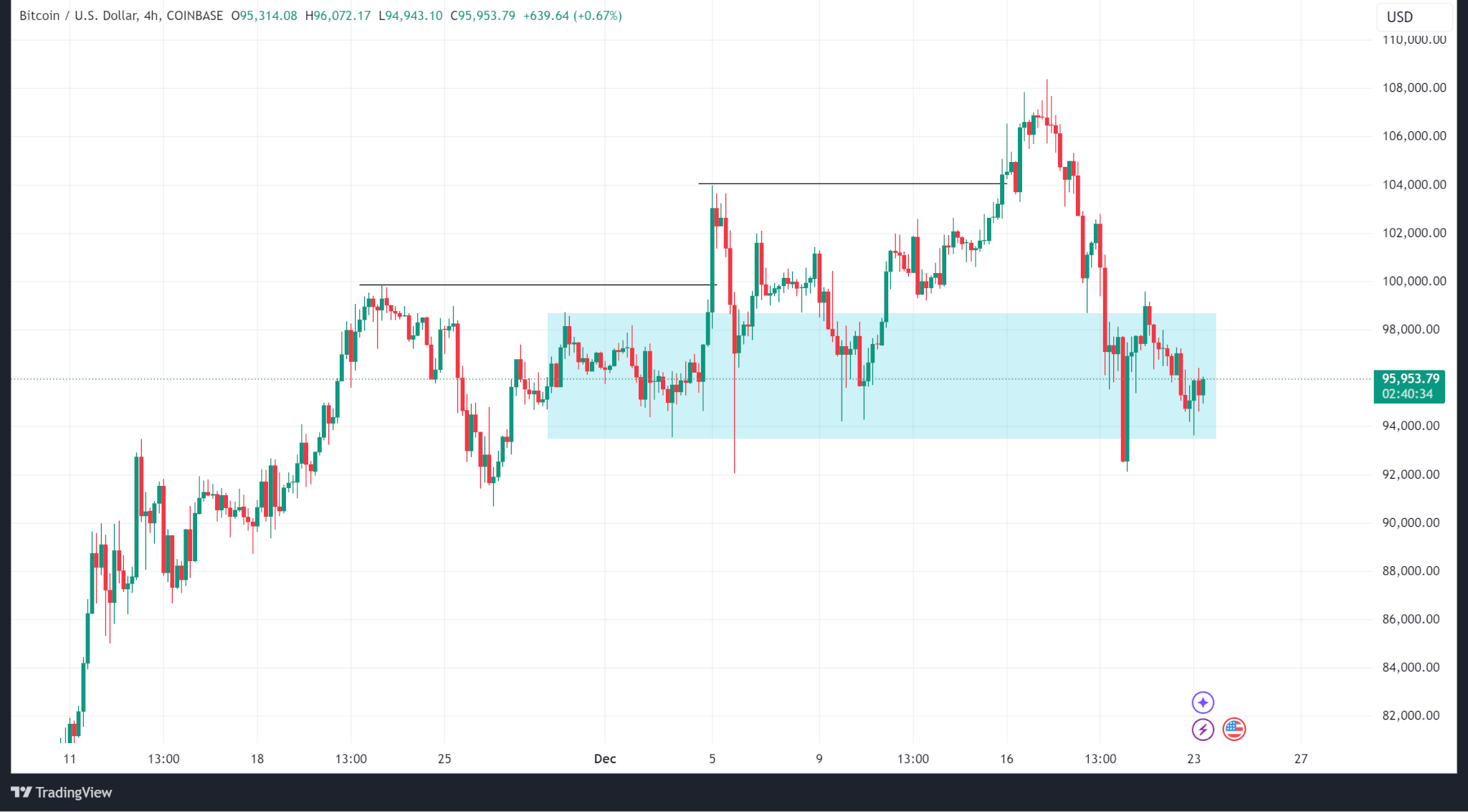

Bitcoin worth fell from a weekly excessive of $108,372 on December seventeenth to a low of $92,555, ending the week at round $97,700. Nonetheless, regardless of the 9.7% drop, the Bitcoin worth has not modified its character in a downward route.

Open curiosity information reveals a lower in open curiosity on CME, which correlates with a decline in worth.

The Fed supported a 25 bps price minimize in its December 18 coverage determination. Nonetheless, the decline worsened after Federal Reserve Chairman Jerome Powell expressed hawkish sentiment concerning subsequent yr's deliberate cuts.

In the meantime, in keeping with influx information for the Bitcoin Spot ETF, outflows on December nineteenth and twentieth totaled $948.9 million. From December sixteenth to December twentieth, internet inflows have been $447 million.

On the time of publication, Bitcoin is buying and selling at $95,700.

Ethereum

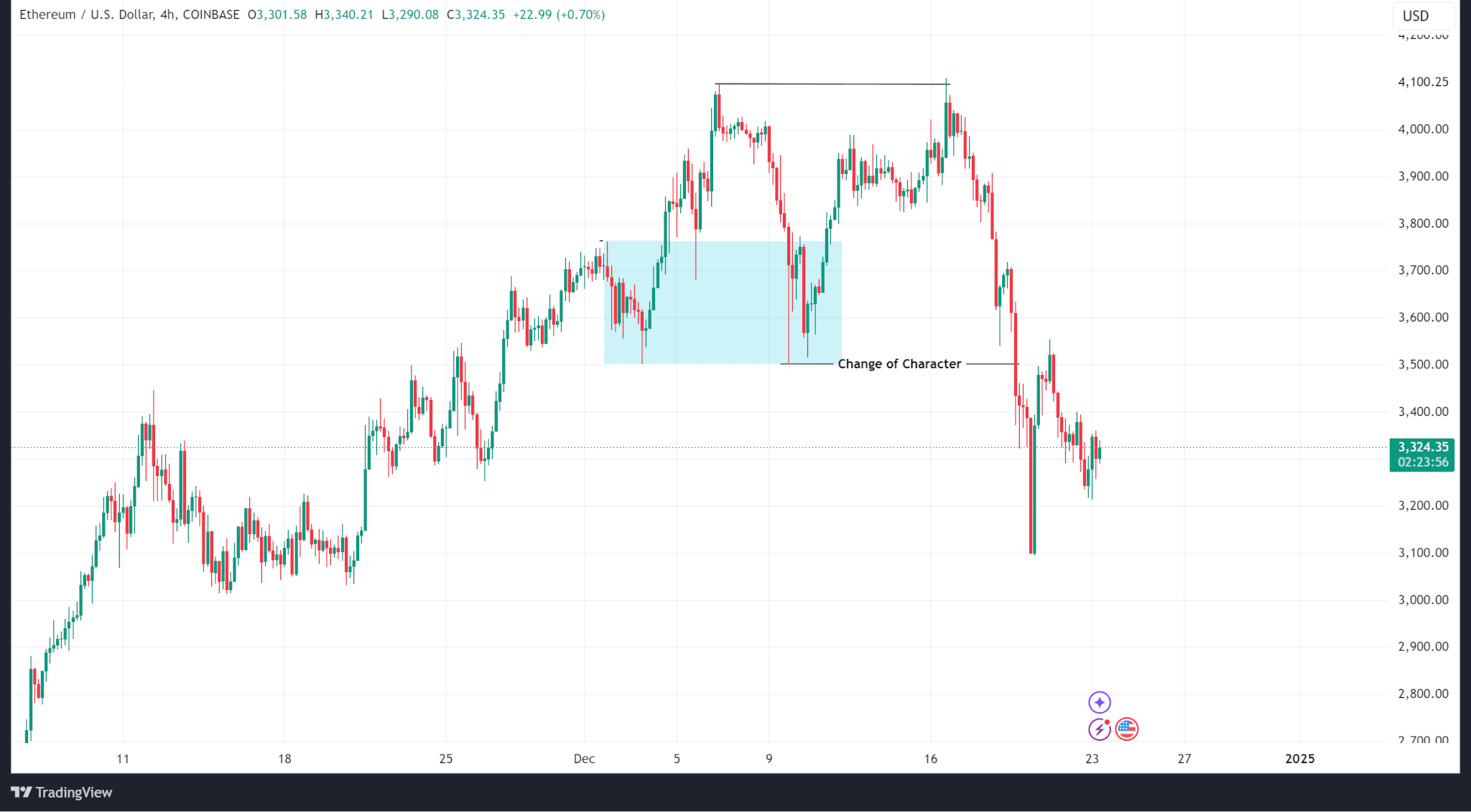

In contrast to Bitcoin, which maintained its bullish construction, Ethereum worth modified character and began trending downward within the second half of the yr after testing (however failing to interrupt) the native excessive of $4,096.50.

Ethereum fell from a weekly excessive of $4,108.82 to a weekly low of $3,098.40, in the end ending the week at $3,470.44 (down 15.51%).

Ethereum Spot ETF inflows present an analogous sample to Bitcoin, with outflows seen over the past two days of the week.

Then again, Ethereum's open curiosity has proven a pointy decline in correlation with the worth.

Ethereum is buying and selling at $3,330.78 on the time of publication.

Solana

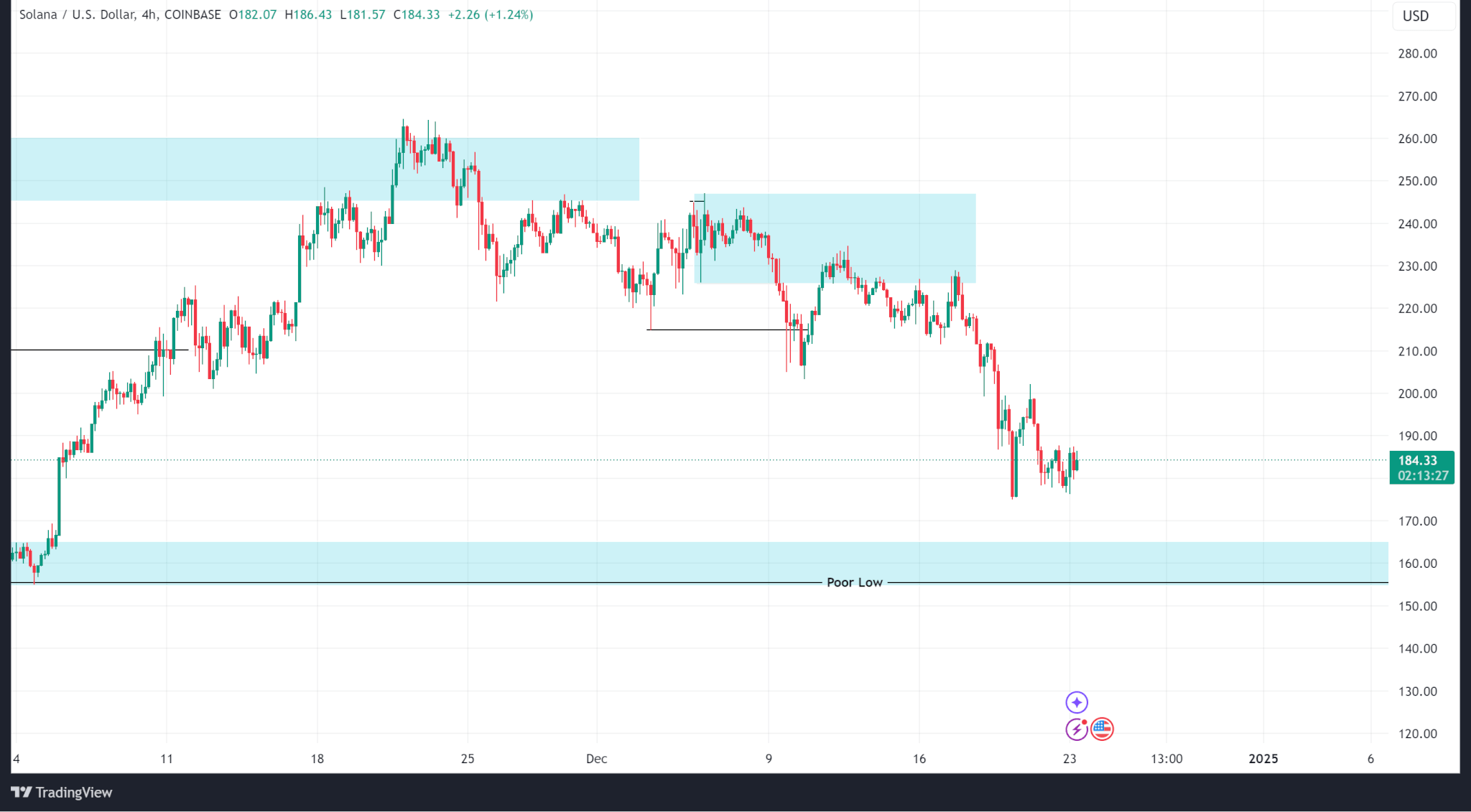

Solana's worth motion continued the decline that started two weeks in the past after failing to interrupt above its all-time excessive of $260.02.

Final week's worth motion noticed the inventory commerce in an inside provide zone round $227.71, promoting to a weekly low of $175.12 and eventually closing at $194.44 (down 15.07%).

As open curiosity continues to say no, the demand zone round $160 (talked about final week) stays the primary logical help zone.

Solana is priced at $184.82 on the time of publication.

ripple

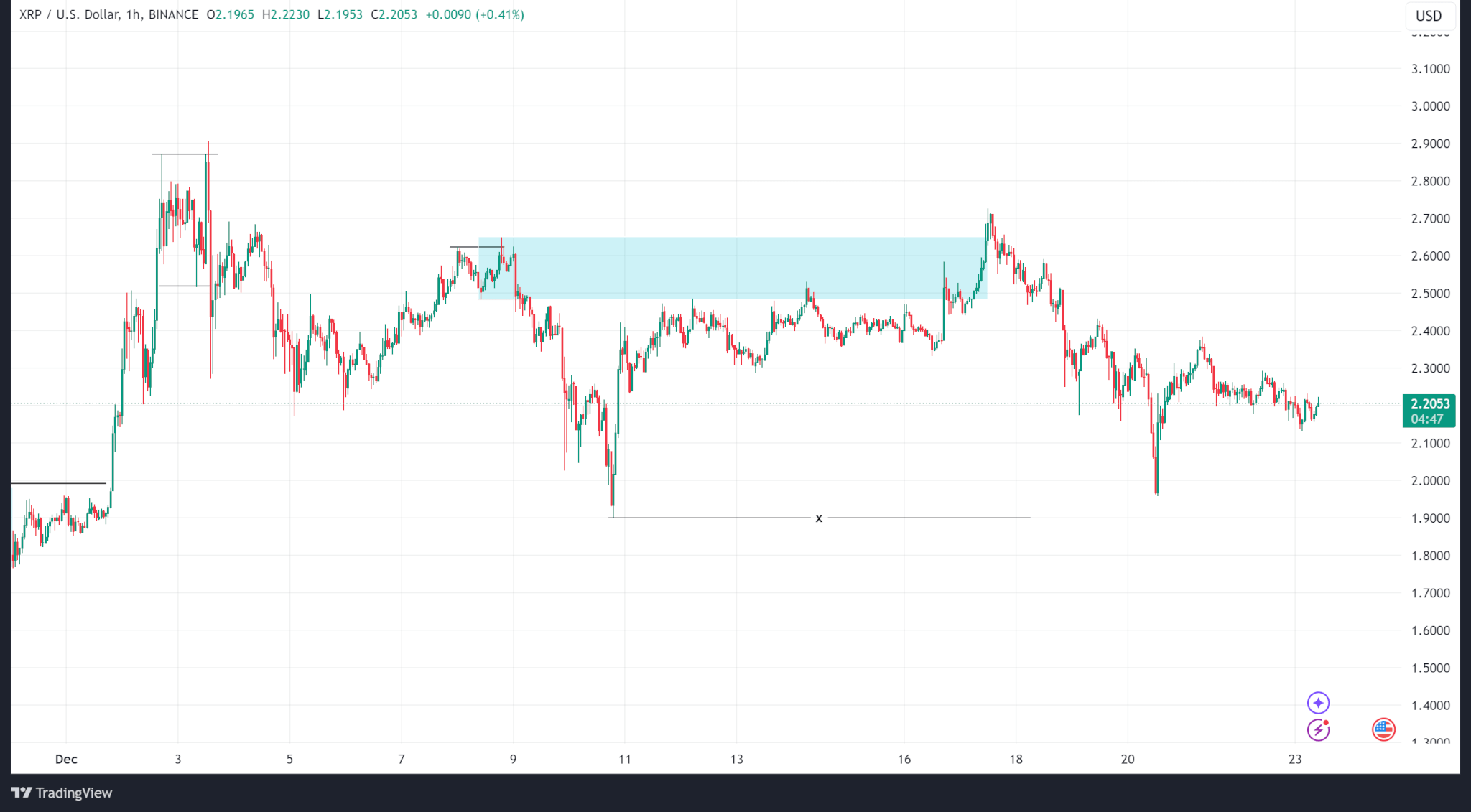

Since hitting a brand new all-time excessive two weeks in the past, Ripple’s worth actions have primarily ranged between $1.89 and $2.90. Nonetheless, inside this vary, the worth has recorded decrease lows.

Ripple worth traded within the inside provide zone and rose above it on December seventeenth, however fell to a weekly low of $1.95 and in the end closed at $2.27 (down 16.42%).

Ripple’s open curiosity information reveals that open curiosity has been lowering since December third.

Ripple is buying and selling at $2.21 on the time of publication.

(Tag translation) Evaluation