- Whale strikes $3.33 million of $WLD to Binance and faces a lack of $50,000.

- WLD's worth fell by 10.4%, and its market capitalization additionally fell by 9.77%.

- Technical indicators counsel that the bearish pattern in WLD continues.

In a monetary operation, the crypto whale transferred $624,479 WLD tokens value roughly $3.33 million to the Binance change to mitigate additional losses. Nevertheless, this motion resulted in an estimated financial lack of $50,000.

As Lookonchain reported in a publish on X (previously Twitter), the monetary exercise started with whales buying tokens, with whole spending reaching roughly $3.38 million final month.

Lookonchain identified that:

He saved 624,479 $WLD($338M) from #Binance final month at a median worth of $5.42 and deposited it to #Binance 4 hours in the past.

Throughout this accumulation part, tokens have been bought at a median worth of $5.42. Subsequent deposits to Binance have been supposed to restrict losses because of altering market situations.

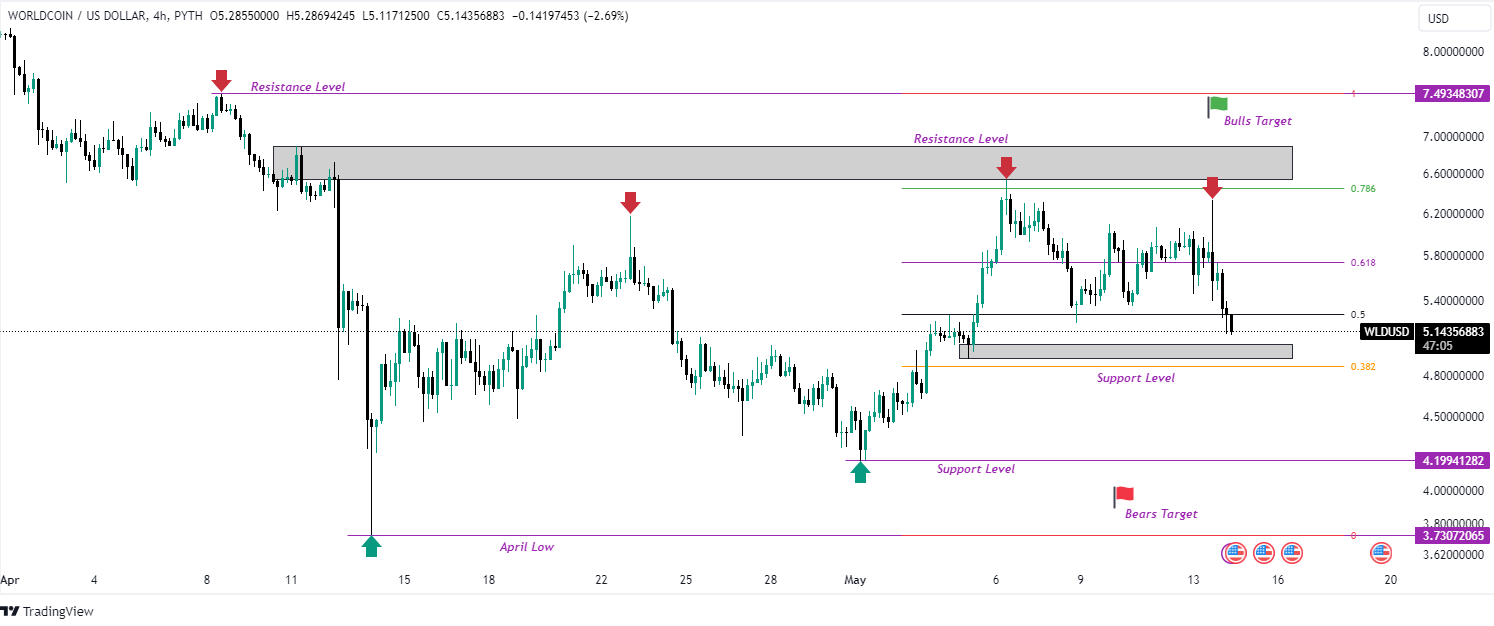

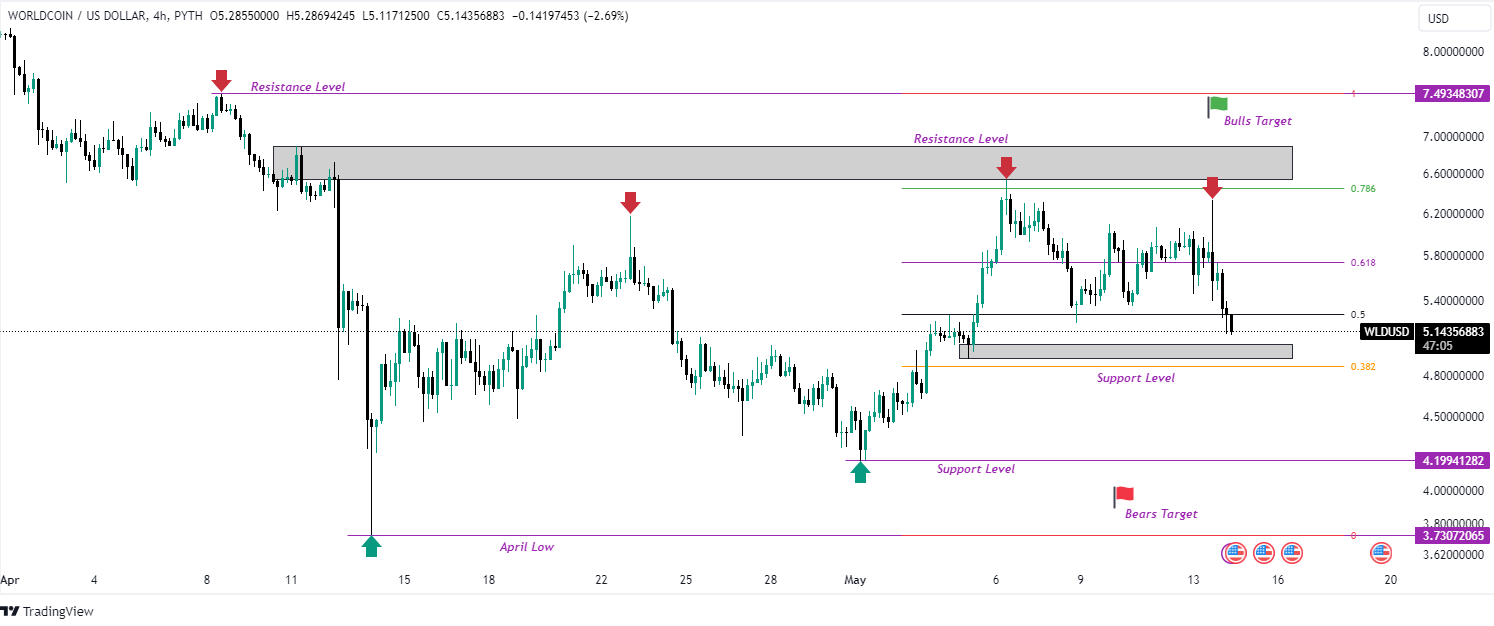

WLD coin worth fluctuation

Regardless of rising 5% on the month-to-month chart, WorldCoin’s WLD token, which is related to Sam Altman’s iris-scanning venture, fell a hefty 15.72% for the week. On the time of writing, the token worth is $5.158, down 10.4% from yesterday, persevering with its bearish pattern.

World Coin's market capitalization additionally decreased by 9.77%, settling at roughly $1.09 billion. This decline modified WLD's rating, making it the 72nd cryptocurrency by market capitalization.

Such fluctuations are crucial as they have an effect on the visibility of the token and investor confidence. In distinction to the decline in market cap and worth, the buying and selling quantity of the WLD token tells a unique story.

Buying and selling exercise has elevated considerably, rising 72.77% previously 24 hours, with buying and selling quantity reaching $648.76 million. This spike means that curiosity in buying and selling the WLD token stays excessive regardless of the downward pattern in worth, and will point out speculative buying and selling or buyers shopping for the dip. is excessive.

WLD bear energy strengthens

WLD token is approaching a key help stage at $5.04 on 4-hourly chart. A continuation of the prevailing bearish sentiment may result in a breakout of this help stage, resulting in additional worth decline in direction of the following help stage at $4.19.

If this decrease stage can also be damaged, the WLD token may intention to succeed in the bulls’ aim by difficult the lows seen in April. Conversely, if the $5.04 help stage proves sturdy, WLD token may expertise worth appreciation.

This uptrend may problem the resistance stage close to the 78.6% Fibonacci retracement. A breakout of this resistance stage may push WLD worth in direction of the bulls’ goal stage of $7.49.

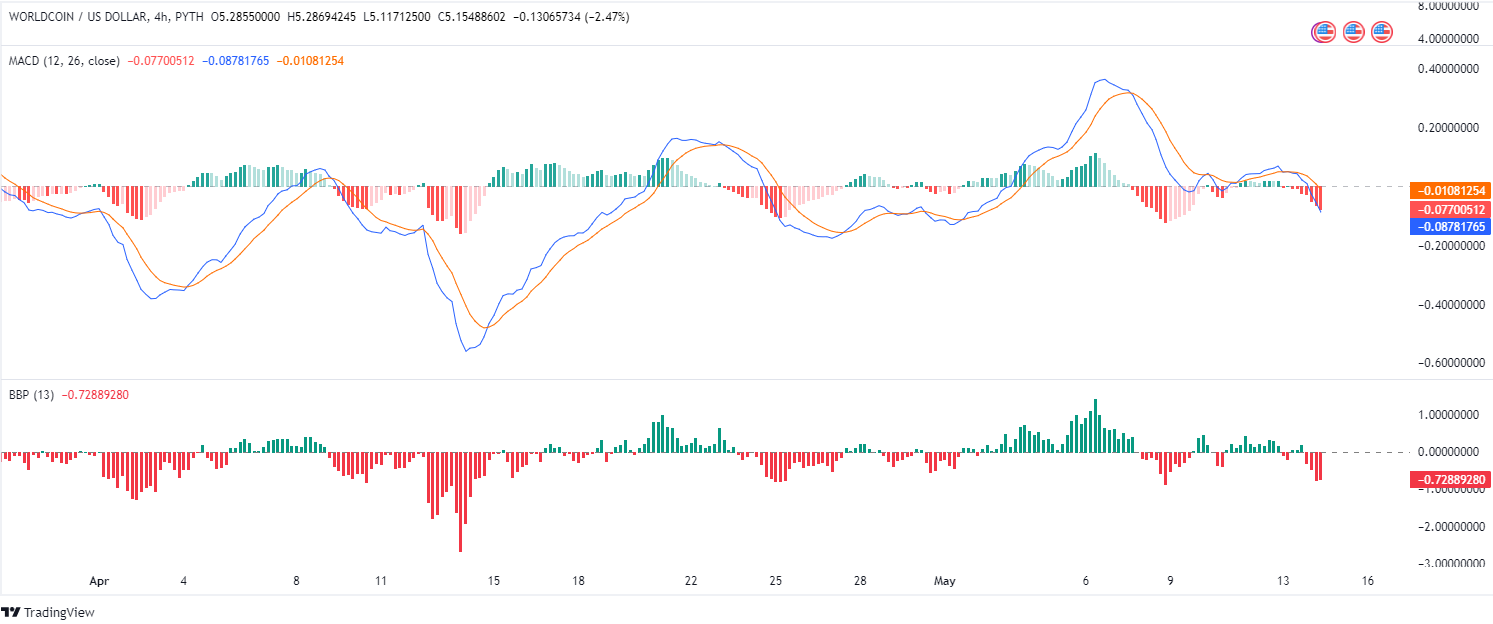

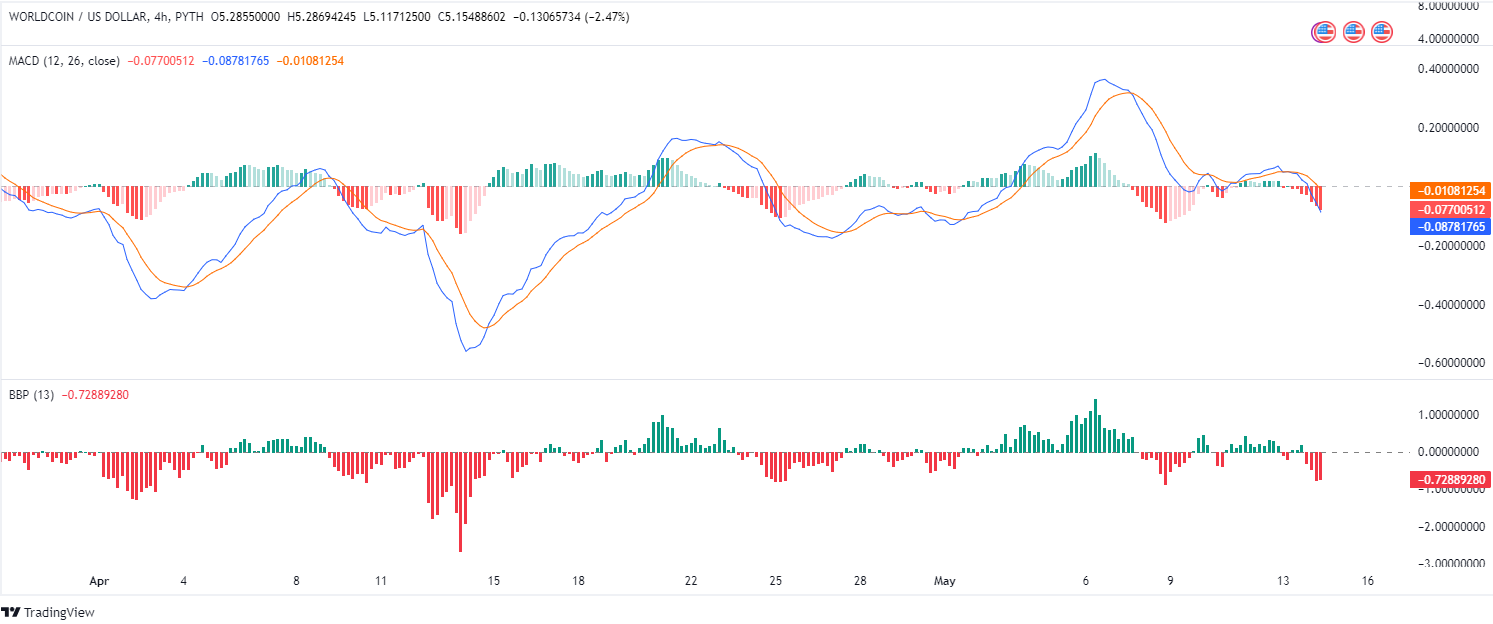

From a technical evaluation perspective, the MACD indicator emphasizes bearish sentiment and signifies a pointy downward trajectory. The MACD is 0.0108 under each the zero line and the sign line, indicating that the bearish momentum within the WLD market is more likely to proceed within the quick time period.

That is additional supported by the MACD histogram, with the pink bar under the zero line increasing, reinforcing the energy of the present bearish temper. In parallel, the Bull Bear Energy Indicator additionally contributes to this evaluation, indicating a widening bar under the zero line.

Collectively, these indicators point out that the downtrend within the WLD token market is gaining momentum, indicating that this motion is more likely to proceed for a while.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.