Bitcoin's brief interval beneath $40,000 induced an enormous ripple available in the market, so we count on a surge in retail buying and selling exercise as soon as Bitcoin recovers to $42,000. Quick-term holders make up the vast majority of so-called “particular person” merchants, so a spike in Bitcoin's worth normally leads to a noticeable spike in exercise amongst that group.

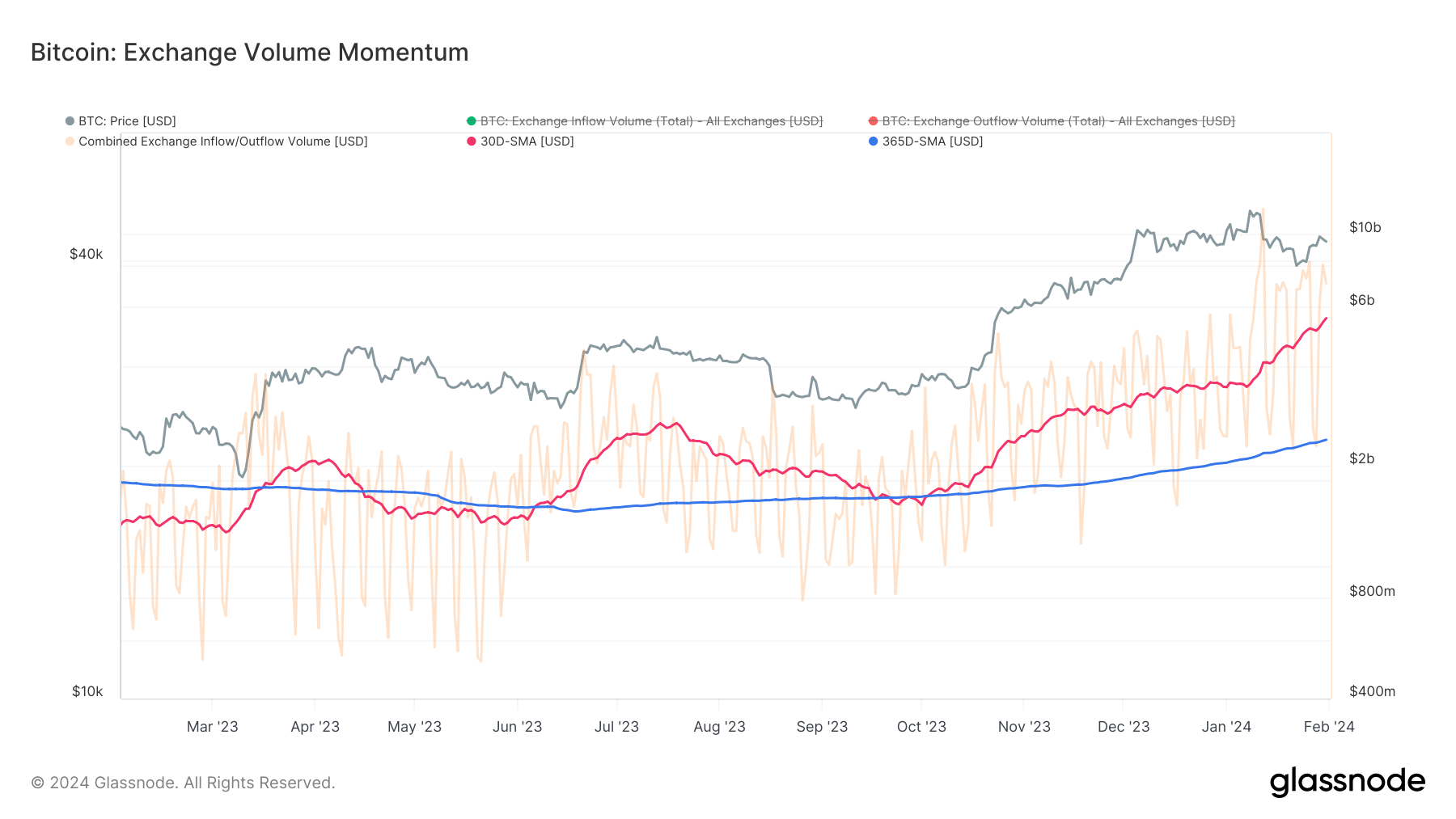

In accordance with knowledge from Glassnode, international alternate inflows and withdrawals exceeded $8 billion on January thirtieth. Whereas that is decrease than the 31-month excessive of $11.86 billion hit on January 12, it’s nonetheless fairly excessive for this a part of the market. cycle.

The 30-day easy shifting common (SMA) of buying and selling quantity reached $5.65 billion on January thirtieth. It is a stage beforehand seen in the course of the 2021 bull market, when Bitcoin costs hovered between $60,000 and $64,000.

Digging deeper into on-chain knowledge will can help you higher perceive the place your quantity is coming from.

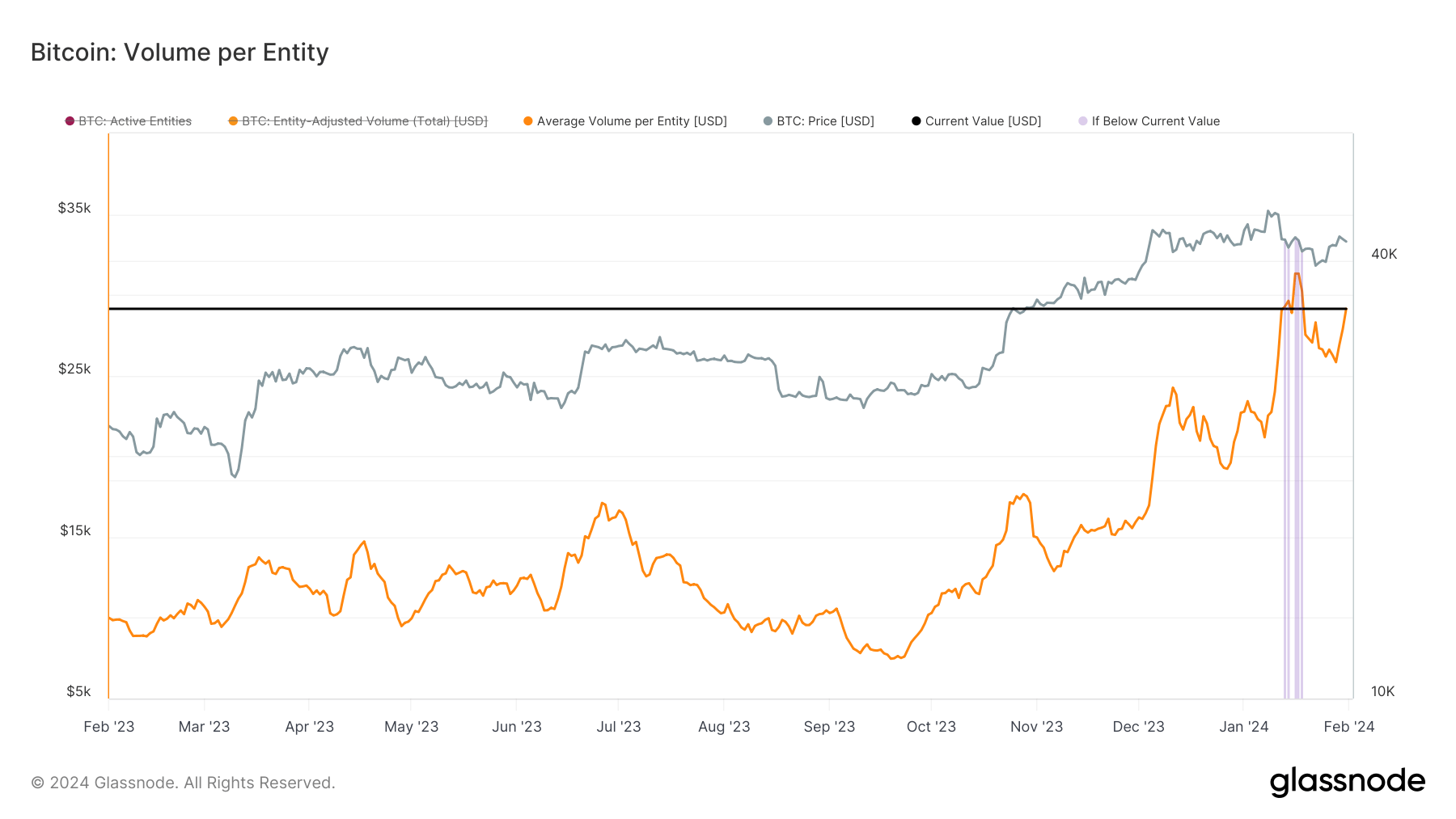

Glassnode knowledge confirmed that the variety of giant corporations available in the market is growing. That knowledge tracks the quantity of Bitcoin transactions coordinated by an entity and divides it by the variety of energetic entities on the Bitcoin community to get the typical quantity per energetic entity.

Because of the reducing variety of energetic entities available in the market, the typical quantity per entity has skyrocketed considerably since September 2023, reaching $31,318 on January sixteenth. As of January thirty first, the typical quantity per entity was $29,136.

Exercise amongst whales with addresses over 1,000 BTC has additionally skyrocketed this 12 months, with the quantity of transfers to exchanges considerably exceeding final 12 months's common quantity. Whale deposits to the alternate peaked at 79,228 BTC on January 12, the day after ETF buying and selling started within the US. On January 31, Whale deposited 43,556 BTC to the alternate.

Elevated buying and selling quantity and inflows for Spot Bitcoin ETFs within the US will definitely gas this common quantity improve, because the ETF contract creation and redemption mechanism depends on giant transactions from APs. I'm placing it on.

This factors to a rising presence of enormous companies within the sector, with establishments and whales taking the lead.

The publish Whales and establishments take the lead in Bitcoin buying and selling quantity surge appeared first on currencyjournals.