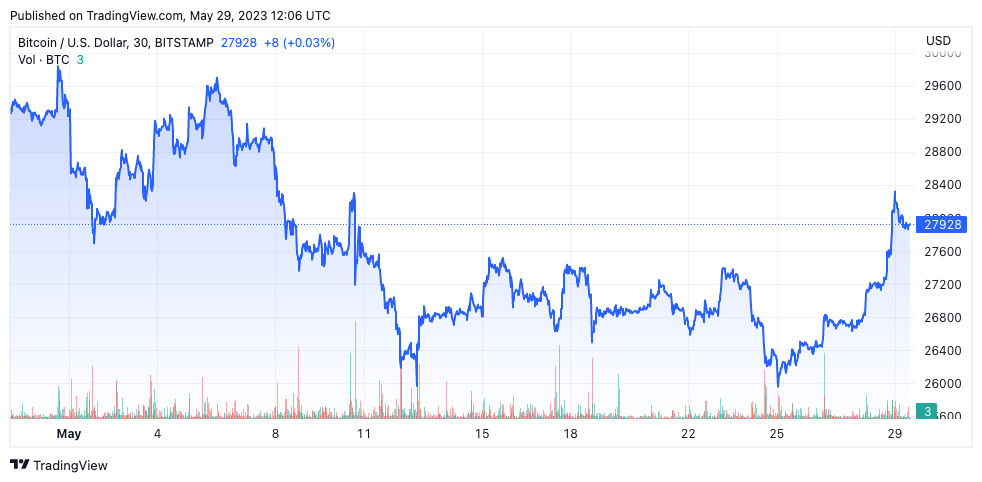

After spending most of Could comparatively flat, Bitcoin skilled a quick surge within the early hours of Monday, Could 29, briefly above the $28,000 resistance stage. Shopping for strain eased over the weekend and bitcoin stabilized at $28,800.

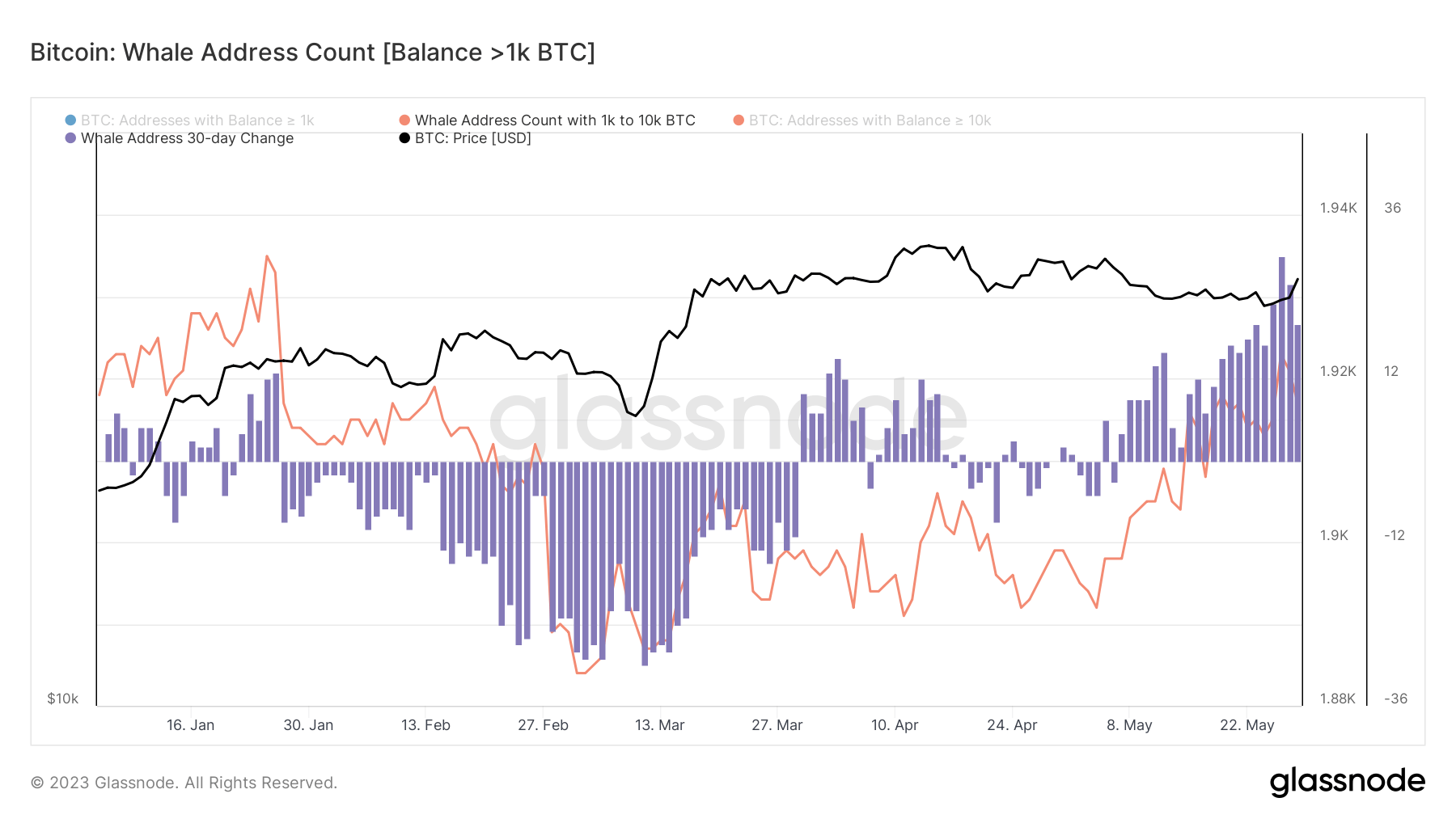

Bitcoin’s weekend volatility left many of the market unshaken, with whales and long-term holders including to their accumulations. Thought of by many to be one of many key drivers of market sentiment, the 2 teams, which have centered on accumulating all through Could, have taken benefit of Bitcoin’s weekend volatility to spice up their holdings. Elevated.

The variety of whale addresses categorised as addresses over 1,000 BTC elevated in late Could and peaked over the weekend.

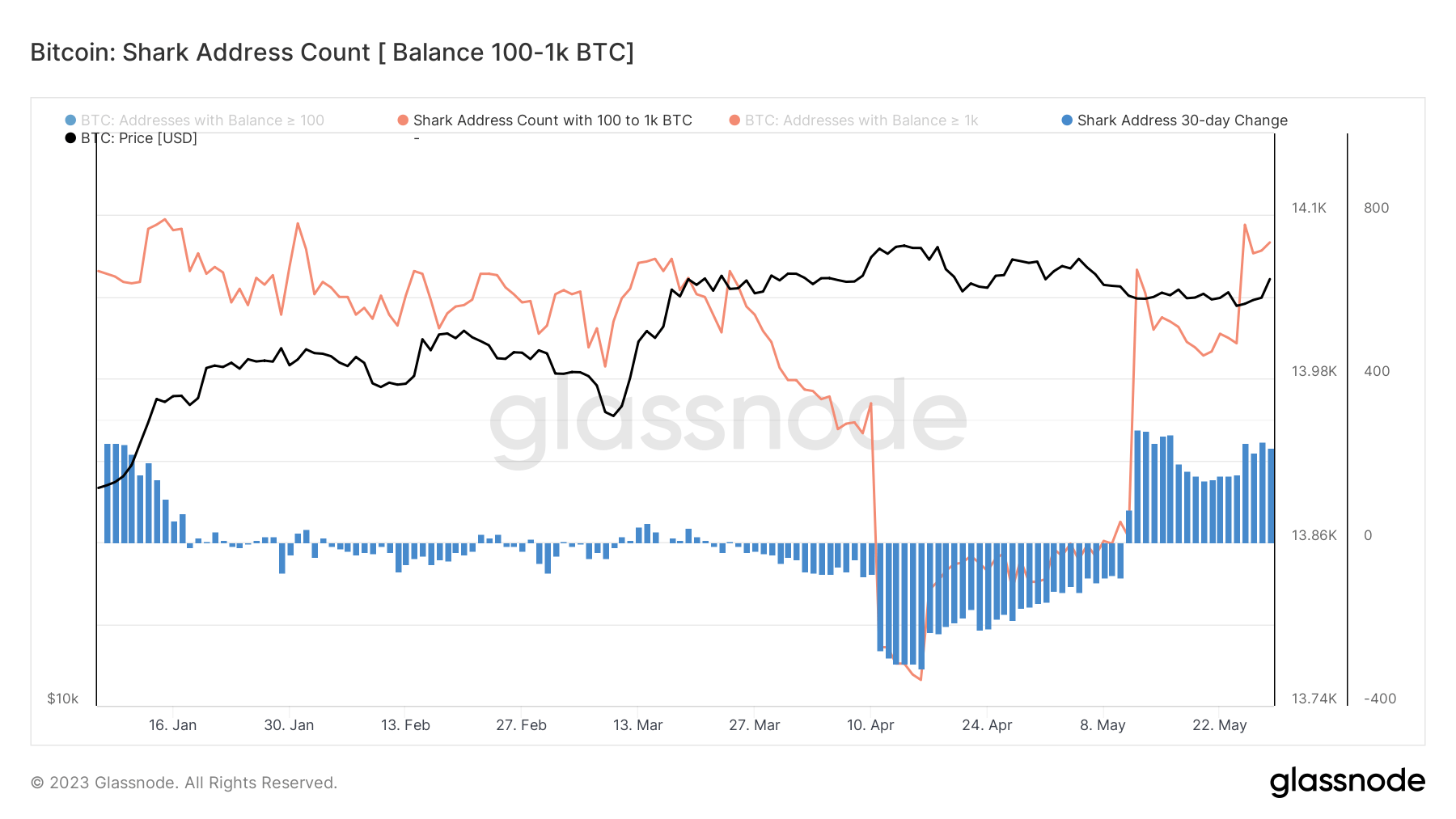

An identical development has emerged amongst shark addresses holding between 100 BTC and 1,000 BTC, with a transparent enhance within the Glassnode information.

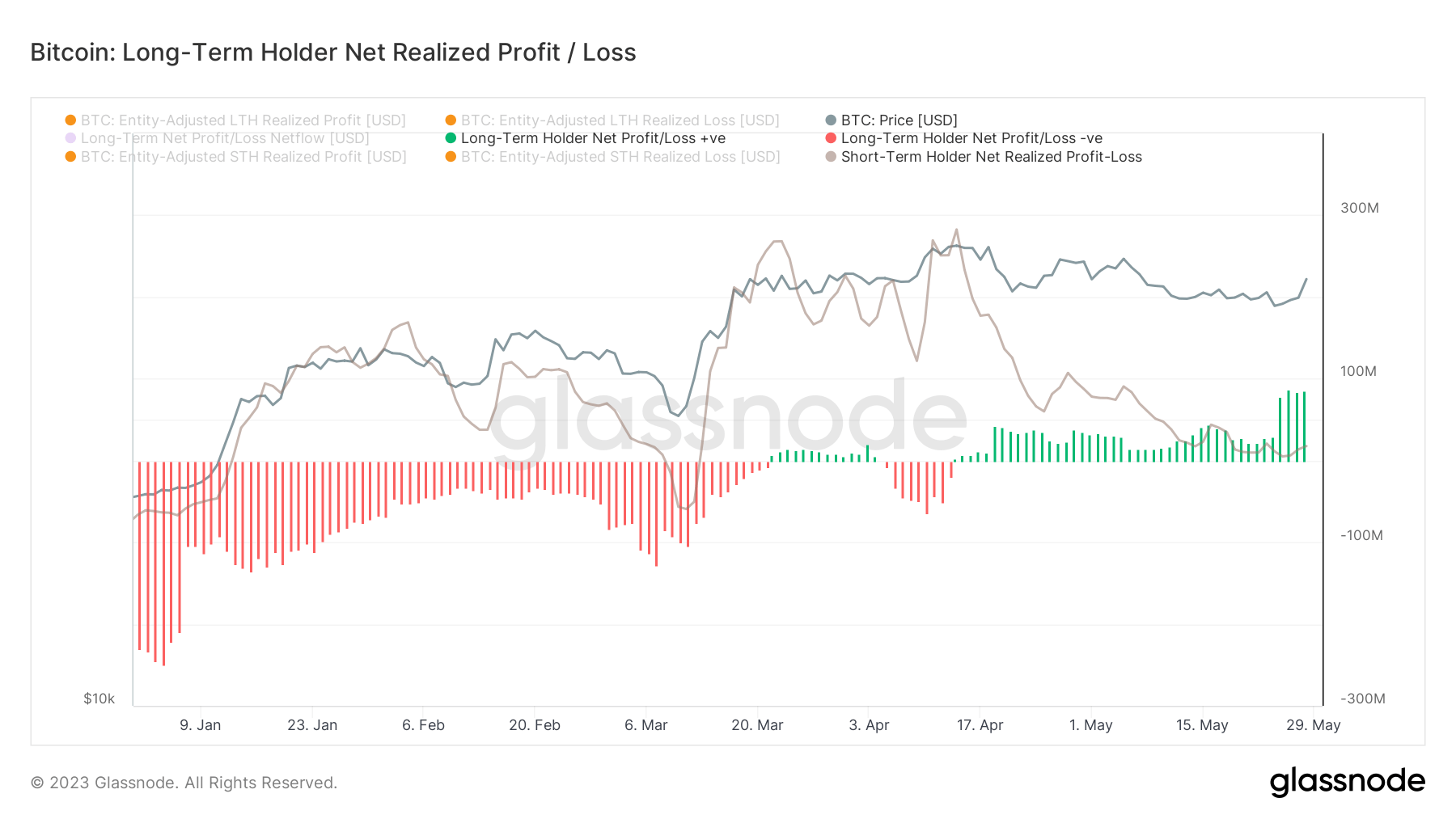

As well as, long-term holders have discovered their Internet Realized PnL (NPL) to surge considerably. This means that these relentless buyers spent the coin in extra of its value of acquisition all through Could.

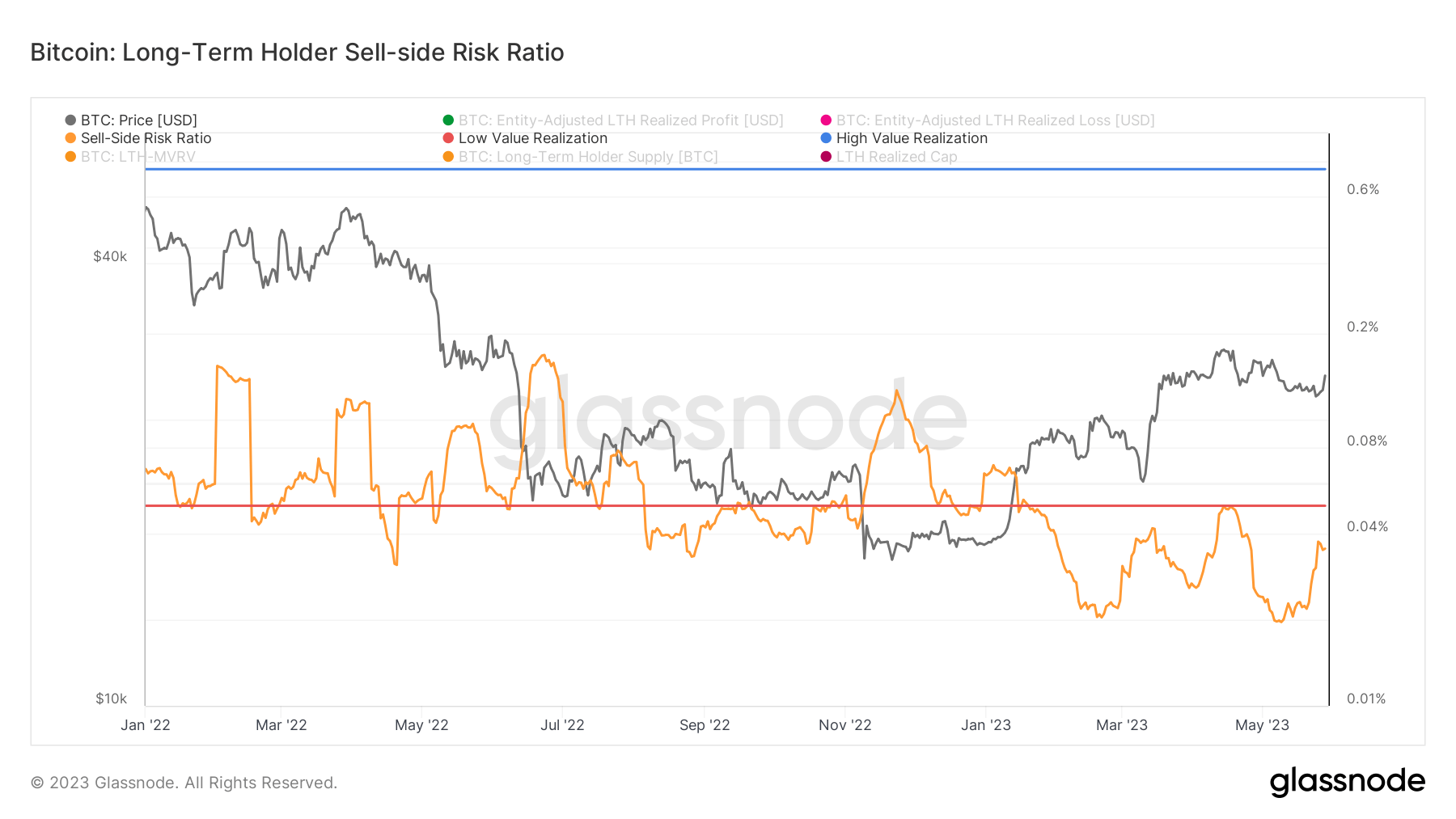

crypto slate Our evaluation exhibits that the cash collected by these teams are unlikely to flow into on exchanges anytime quickly. The marked decline and continued downward development in long-term sell-side danger ratios signifies that collected bitcoin is being held for long-term development potential.

Aggressive accumulation by whales and long-term holders might stabilize the market regardless of the blended value dynamics seen this week. Different cohorts corresponding to shrimp and short-term holders have additionally continued to build up, however the higher market affect of whales and long-term holders means their accumulation patterns pave the best way for a stronger base for future development. This means that there’s a chance of opening up the

The article first appeared on currencyjournals after long-term holders of whales collected extra and bitcoin reached $28,000.

Comments are closed.