- Inside an eight-year interval, Bitcoin generated returns greater than seven instances that of gold and eight instances greater than shares.

- DCA (Greenback Price Averaging) is an efficient choice for newcomers and specialists alike, however it isn’t with out its drawbacks.

- That is the popular funding technique for almost all of crypto traders, with 59% utilizing it as their main strategy.

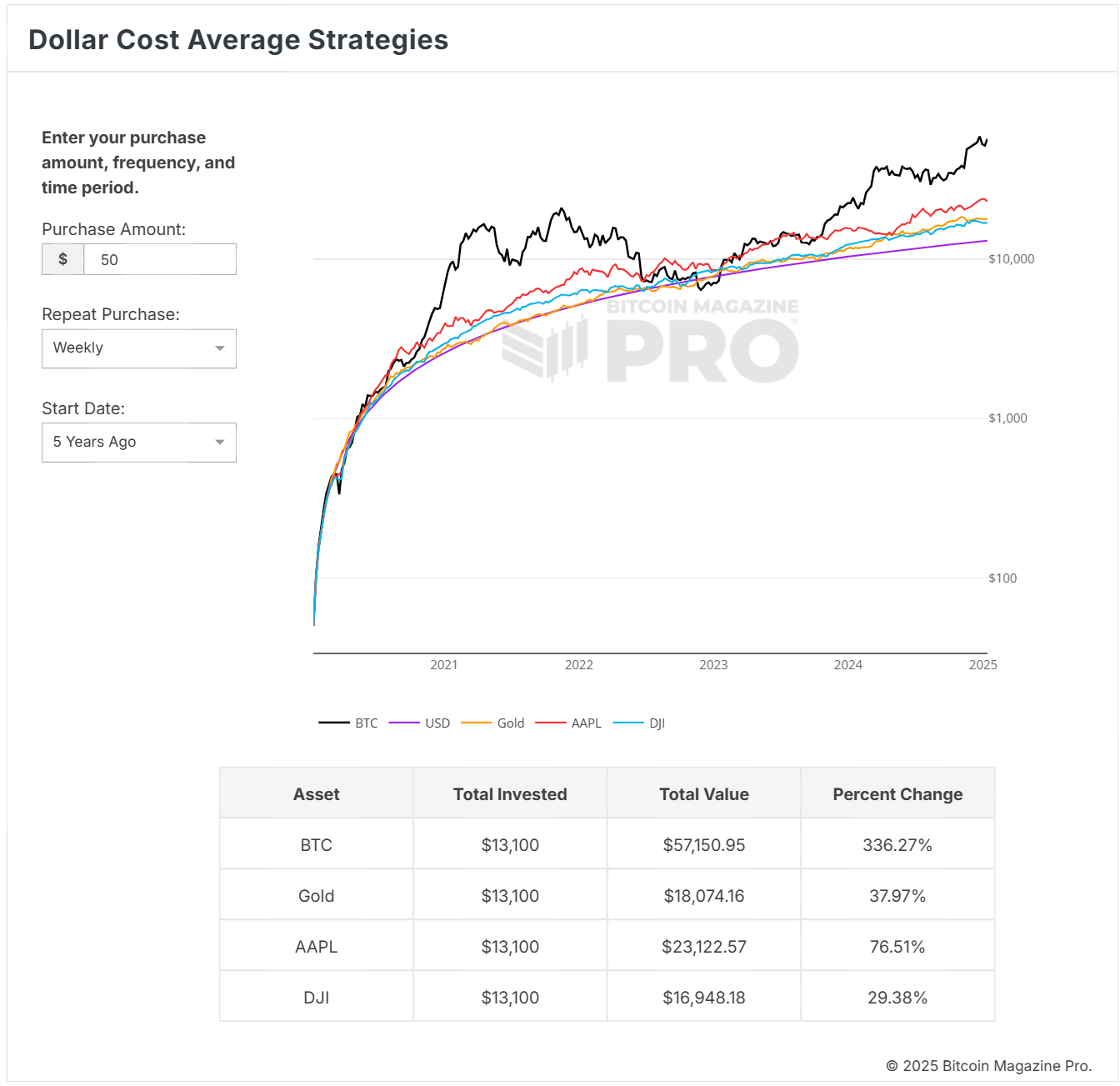

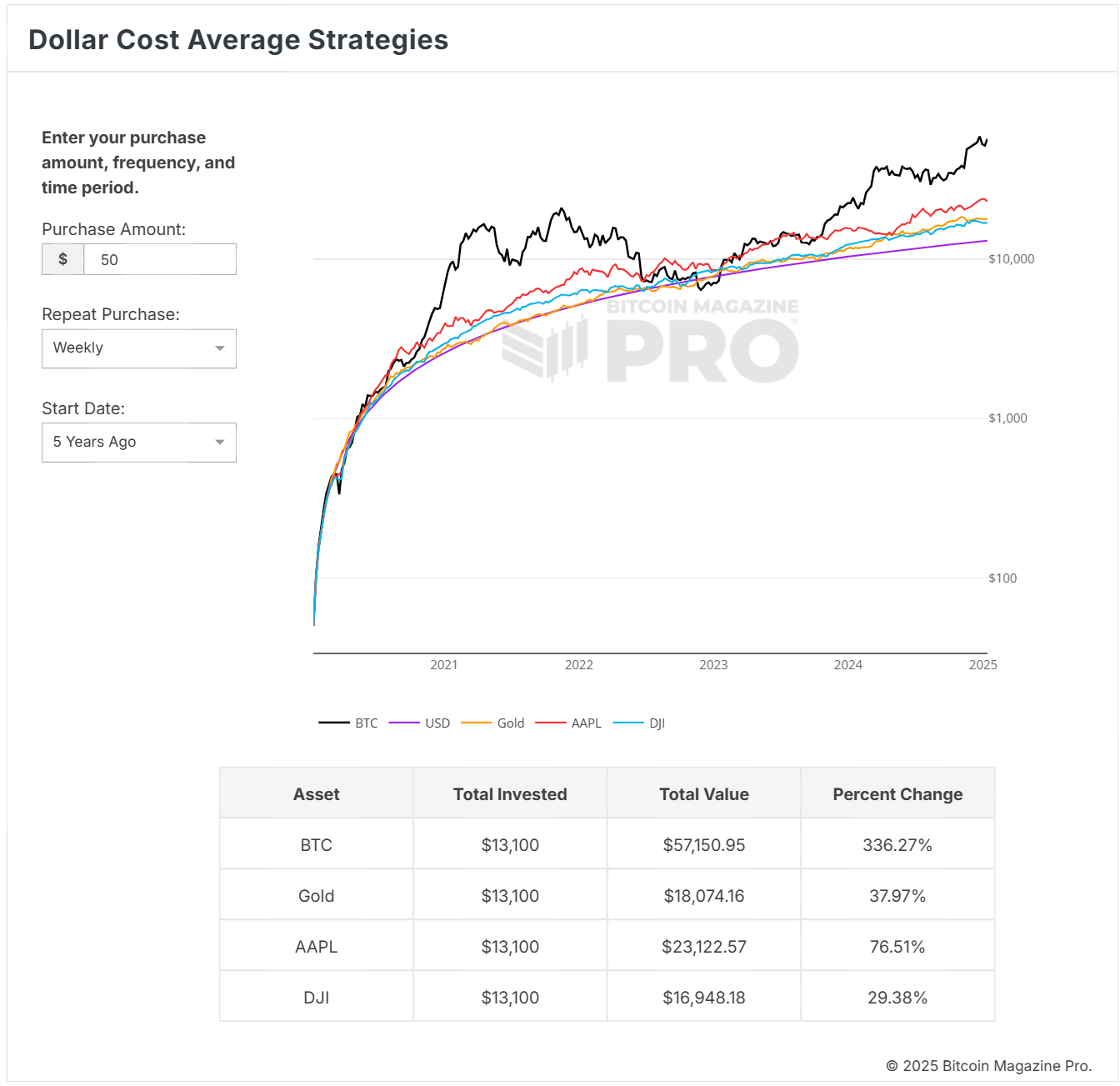

Bitcoin's value has been hovering round $93,000, and there's no scarcity of discuss its persistently rising worth. So what would occur if you happen to jumped on this in 2017 and took $25 each week for DCA (constantly investing a predetermined quantity in a particular asset, whatever the present market value)?

Spoiler alert: You’ll now have some huge cash. Furthermore, over these eight years, Bitcoin's ROI will exceed that of gold and shares.

Let's break it down. Beginning in 2017, if you happen to DCA $25 every week, now you can make investments about $10,450. Subsequently, your funding will return roughly $16,946.00 in gold and roughly $15,358.23 in shares.

Nevertheless, for Bitcoin, it's a whopping $133,689.39. That is 8x the return on shares and 7x in comparison with gold. Whereas this can be a “what if” state of affairs, it does illustrate Bitcoin's vital progress through the years and the potential of dollar-cost averaging.

If you wish to see for your self and check out totally different time intervals and funding ranges, take a look at this chart right here.

What’s DCA good for?

The primary use of DCA is to scale back market volatility, because it lets you clean out the results of market fluctuations by investing a hard and fast quantity at common intervals.

It is usually beginner-friendly as investing is simplified and accessible to these with out in depth market data or expertise. Moreover, with DCA, you don't should consistently monitor the market or fear about whether or not the market is doing effectively or not.

As such, it has change into a preferred technique, with a survey final yr displaying {that a} vital 59% of crypto traders prioritized dollar-cost averaging as their main funding technique.

Nevertheless, please word that DCA doesn’t present any ensures of any type and chances are you’ll miss out on increased returns if the market persistently rises throughout your funding interval. Subsequently, it will not be appropriate for everybody.

That being stated, if you happen to resolve to experiment with DCA with cryptocurrencies, begin by selecting the cryptocurrency you need to spend money on. Subsequent, set up your funding funds and frequency of contributions. Moreover, make sure you completely consider your monetary state of affairs and do any obligatory analysis.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.