Glassnode's Hodler Internet Place Change Indicator supplies detailed perception into the conduct of long-term Bitcoin buyers. This metric is calculated by monitoring inflows and outflows from wallets labeled as holders, i.e., wallets which were “held for all times” for a really very long time.

This metric is essential in understanding market sentiment, particularly the boldness degree of buyers who’re recognized to carry Bitcoin for the long run no matter market volatility.

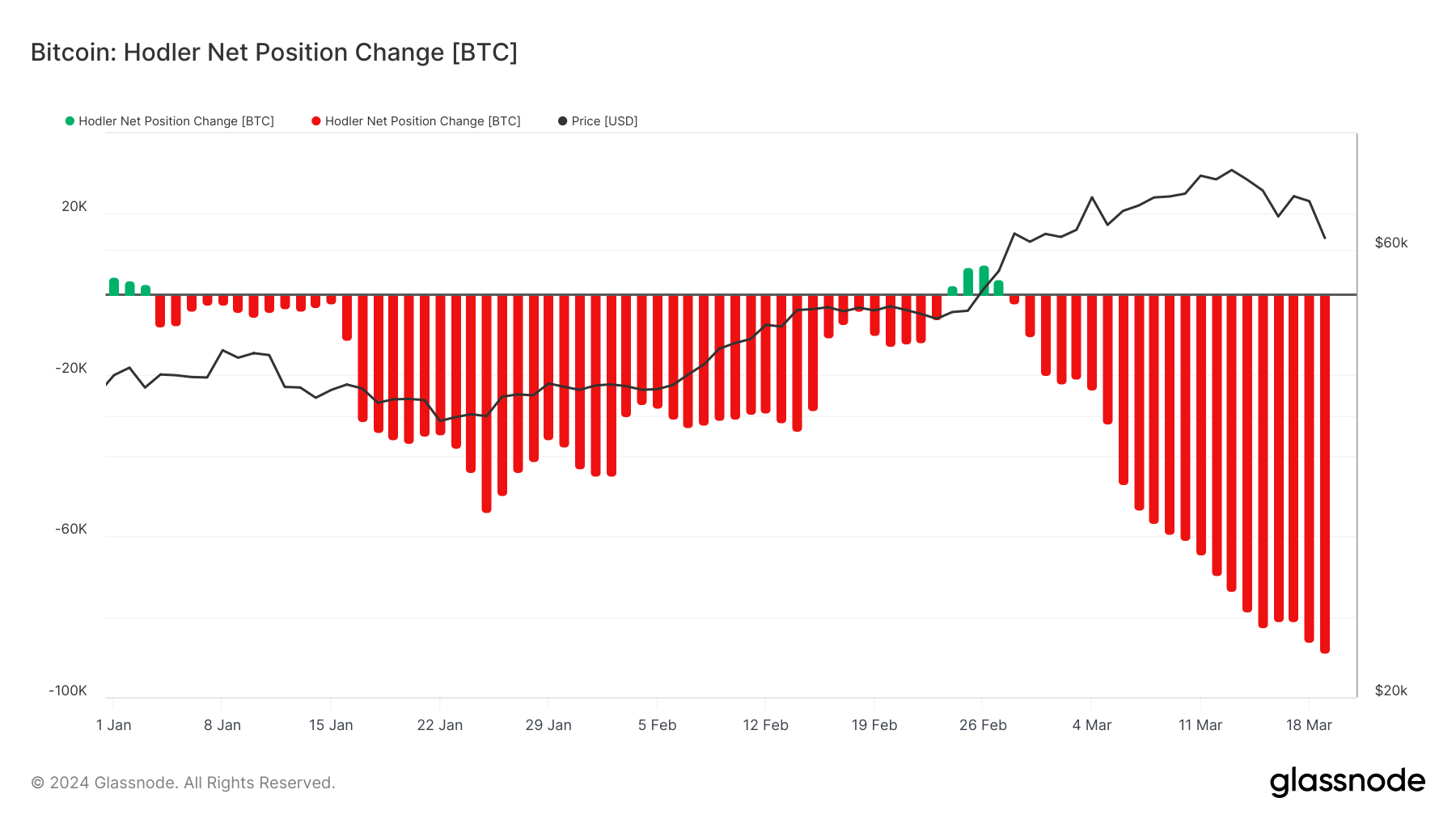

On March nineteenth, the 30-day Hodler internet place change reached -88,860 BTC, marking the most important damaging change in three years.

This downward pattern has been ongoing since January 4 and was damaged by simply 4 days of optimistic change on the finish of February. This vital decline in Hodler balances got here after a pointy correction within the value of Bitcoin, which went from a peak of $73,000 on March thirteenth to only underneath $61,000 by March twentieth. It fell.

Such giant damaging modifications in Hodler balances sometimes point out a change in long-term investor conduct, and within the quick time period could point out a decline in confidence in Bitcoin's value stability. there’s. The timing and magnitude of those modifications could point out a big shift in sentiment amongst these buyers, who’re usually recognized for his or her resilience throughout market fluctuations.

Nevertheless, deciphering market situations by means of a single indicator, corresponding to change in Hodler internet place, could be deceptive if different indicators usually are not taken under consideration.

Earlier currencyjournals evaluation discovered that regardless of short-term value fluctuations and elevated promoting stress on centralized exchanges, the basic pattern of accumulation throughout the market stays unaffected.

This may be seen within the discrepancy between market capitalization and realization cap, indicating {that a} lower in market worth doesn’t forestall the buildup of Bitcoin, and that the belief cap represents a rise within the realized worth of all cash shifting on the community. I’m.

Regardless of the decline in long-term holders' balances since December 2023, this continued accumulation suggests different elements are at play. Declining over-the-counter (OTC) desk balances and vital outflows from Grayscale ETFs might contribute to this pattern.

OTC desks serve giant merchants and establishments, facilitating giant trades with minimal market influence. A decline in OTC balances could point out that institutional buyers are shifting their holdings onto exchanges, maybe in anticipation of gross sales or to satisfy liquidity wants. This doesn’t essentially point out widespread promoting amongst particular person long-term holders, however moderately contributes to a change within the internet place of damaging holding holders.

Moreover, outflows from GBTC, Grayscale, the first institutional entity for Bitcoin publicity previous to the launch of the Spot Bitcoin ETF, could have had a big influence on Hodler's internet place. These strikes might be attributable to buyers reallocating to ETFs with extra aggressive charges or liquidating positions in response to market situations.

This information demonstrates the significance of contemplating a number of sources and on-chain metrics for a complete understanding of the market. Institutional measures can have a big influence on market indicators and usually are not essentially per the sentiment and conduct of the broader investor neighborhood.

The put up What’s pushing down Bitcoin hodler balances? The put up appeared first on currencyjournals.