- Bitcoin soared above $96,000 as inflation statistics eased, triggering short-term liquidations and boosting the general crypto market.

- Altcoins led the rally as danger urge for food recovered, with Sprint up 48% and crypto market cap exceeding $3.25 trillion.

- Expectations for rate of interest cuts, regulatory developments and company purchases of Bitcoin boosted confidence regardless of combined world markets.

Cryptocurrency markets rose on Wednesday, with Bitcoin hitting a two-month excessive above $96,000. The rise was pushed by easing US inflation statistics, regulatory developments and adjustments in world danger sentiment. Altcoins outperformed as merchants coated quick positions and returned to riskier property.

Bitcoin rises as shorts come beneath stress

Bitcoin rose practically 5% on the day, briefly hitting $96,400, its highest since November, earlier than buying and selling round $94,700. Analysts at the moment say Bitcoin wants to interrupt above the $92,000 to $94,000 vary to proceed rising. If that fails, the value might transfer sideways or fall in the direction of $88,000.

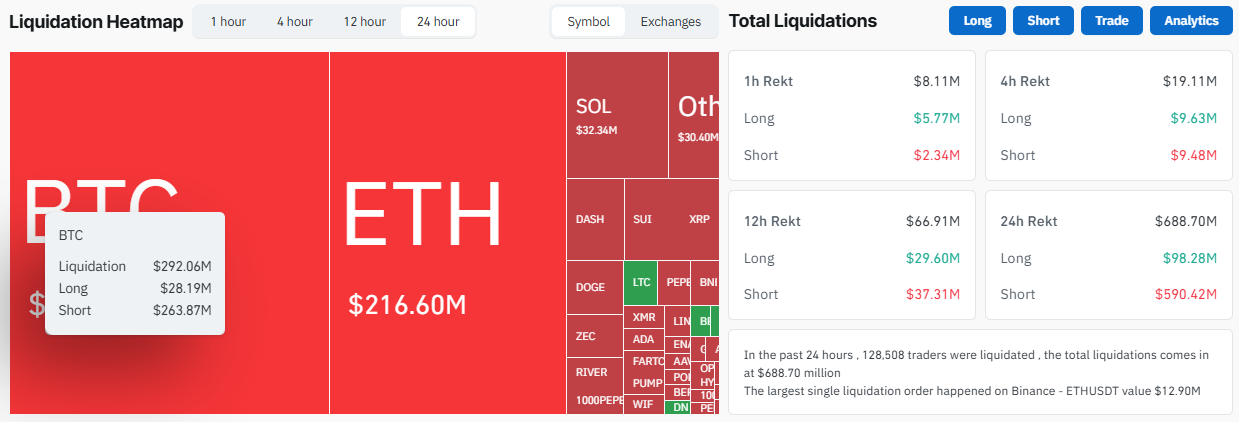

Notably, Bitcoin’s rally has resulted in additional than $688 million in liquidations previously 24 hours, together with $292 million in Bitcoin, most of it from merchants who guess on the value falling.

Altcoins lead positive aspects as danger urge for food improves

Apparently, many altcoins have soared rather more sharply than Bitcoin through the rally, indicating an elevated danger urge for food throughout the market. Sprint particularly rose 48% in 24 hours, reaching its highest stage since 2021.

Different tokens comparable to Optimism, Web Laptop, Pudgy Penguins, Pepe, and XRP additionally posted vital positive aspects.

On the time of writing, Ethereum is buying and selling at $3,321 after gaining 6.1% over the previous day. XRP rose 3.9% to $2.2, whereas Solana edged as much as $144.

Whereas most altcoins are in constructive territory, Bitcoin’s share of the general cryptocurrency market has declined barely. The full market capitalization of cryptocurrencies has elevated by greater than 3.2% previously 24 hours to greater than $3.25 trillion.

Inflation knowledge and rate of interest lower expectations assist cryptocurrencies

Financial indicators additionally supported the rise. US inflation stabilized at 2.7% in December, however core inflation slowed to 2.6%. Current employment statistics additionally confirmed that employment is cooling down.

These developments elevate expectations that the Federal Reserve might lower rates of interest later this yr, which generally will increase demand for danger property comparable to cryptocurrencies.

Market sentiment additionally improved. The Crypto Worry and Greed Index has moved from excessive worry in December to impartial ranges this week, suggesting rising confidence with out extreme hypothesis.

Regulation and company buying increase confidence

Regulatory developments within the US additionally boosted sentiment. Lawmakers launched the textual content of the CLARITY Act forward of the rise within the Senate. The invoice goals to make clear the roles of the Securities and Trade Fee and the Commodity Futures Buying and selling Fee in overseeing digital forex markets.

Company accumulation additional supported costs. Michael Saylor’s firm Technique stated it purchased 13,627 Bitcoins price roughly $1.25 billion to $1.3 billion at a median worth of practically $91,500. The full quantity held is at the moment 687,410 BTC. Merchants usually view main acquisitions as stabilizing elements throughout unstable instances.

In the meantime, Akshat Siddhant, lead quantitative analyst at Mudrex, stated escalating tensions within the Center East are driving buyers in the direction of various property comparable to cryptocurrencies. He added that on-chain knowledge exhibits that short-term holders are reclaiming earnings, indicating that promoting stress is easing.

World markets are exhibiting combined alerts

Conventional markets have been giving combined alerts. Within the US, monetary shares led the decline, with the Dow Jones Industrial Common dropping 0.80%, the S&P 500 dropping 0.19%, and the Nasdaq dropping 0.10%.

In Asia, markets opened larger. Shanghai rose 0.89%, Shenzhen rose 1.54%, China A50 rose 0.56% and Hong Kong’s Dangle Seng rose 0.35%. Japan’s Nikkei Inventory Common rose 0.9%, and the yen continued to weaken.

Commodities strengthened. Gold rose to a brand new excessive as buyers sought protection property whereas oil costs rose amid rising geopolitical tensions within the Center East. Analysts stated the developments mirrored warning in world markets regardless of advances in crypto property.

Associated: Iranian forex crashes to ‘zero’: why is it necessary for Bitcoin

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.