- Thaler disputes the argument that too many corporations are copying Bitcoin’s monetary mannequin.

- He argues that Bitcoin isn’t a threat, however fairly its weak enterprise mannequin is.

- Saylor stated holding Bitcoin can offset losses higher than inventory buybacks or bonds.

What began as a routine query shortly was a heated trade.

In a latest interview, Michael Saylor pushed again towards skepticism concerning the rising variety of corporations adopting Bitcoin as a monetary asset. The interviewer requested if the market is changing into crowded with corporations that simply challenge shares and bonds to purchase Bitcoin with out constructing an precise enterprise.

Sailor did not have that.

“Why can we particularly choose solely Bitcoin consumers?”

The interviewer acknowledged that Technique (previously MicroStrategy) holds greater than 650,000 Bitcoins and is in a novel place, however argued that most of the smaller, financial-focused corporations are struggling and buying and selling at deep reductions, harming shareholders.

Thaler turned the argument on its head.

He likened proudly owning Bitcoin to a household or private funding. Not everybody owns the identical quantity, and that is OK, he stated. In his view, there may be little level in criticizing an organization for merely shopping for Bitcoin when hundreds of thousands of different corporations do not personal any Bitcoin in any respect.

“Why criticize the businesses that purchased Bitcoin and ignore the a whole lot of hundreds of thousands of corporations that did not? Why not deal with criticizing the loss-making corporations that do not personal Bitcoin?” he argued.

The center of Thaler’s argument

Thaler made a transparent distinction. The actual drawback isn’t Bitcoin. That is dangerous enterprise.

He stated corporations which can be incurring losses are weak, no matter whether or not they personal Bitcoin or not. But when an ailing firm has Bitcoin on its steadiness sheet, the asset might assist offset working losses over the long run.

To elucidate, Thaler gave a easy instance.

- Firms lose $10 million a yr in enterprise operations.

- owns $100 million in Bitcoin

- A 30% rise in Bitcoin would equate to a revenue of $30 million

In that case, Bitcoin doesn’t pose an elevated threat, he stated. That is what retains the corporate going.

Inventory buyback vs Bitcoin

Saylor additionally criticized options comparable to inventory buybacks and Treasury payments for corporations which can be already shedding cash.

He stated shopping for again shares of unprofitable corporations would solely speed up failure. In the event you park your money in low-yield authorities bonds, your losses could also be delayed barely, however the final result stays the identical.

In Thaler’s view, Bitcoin is the one possibility that has the potential to outweigh the losses over time.

As buying and selling intensifies, Saylor additionally accused critics within the crypto business of concentrating on Bitcoin adopters whereas giving conventional corporations a free go.

He argued that some traders are extra snug attacking Bitcoin finance corporations than questioning why so many corporations that burn money with out Bitcoin are nonetheless elevating cash.

The story of Saylor and Bitcoin

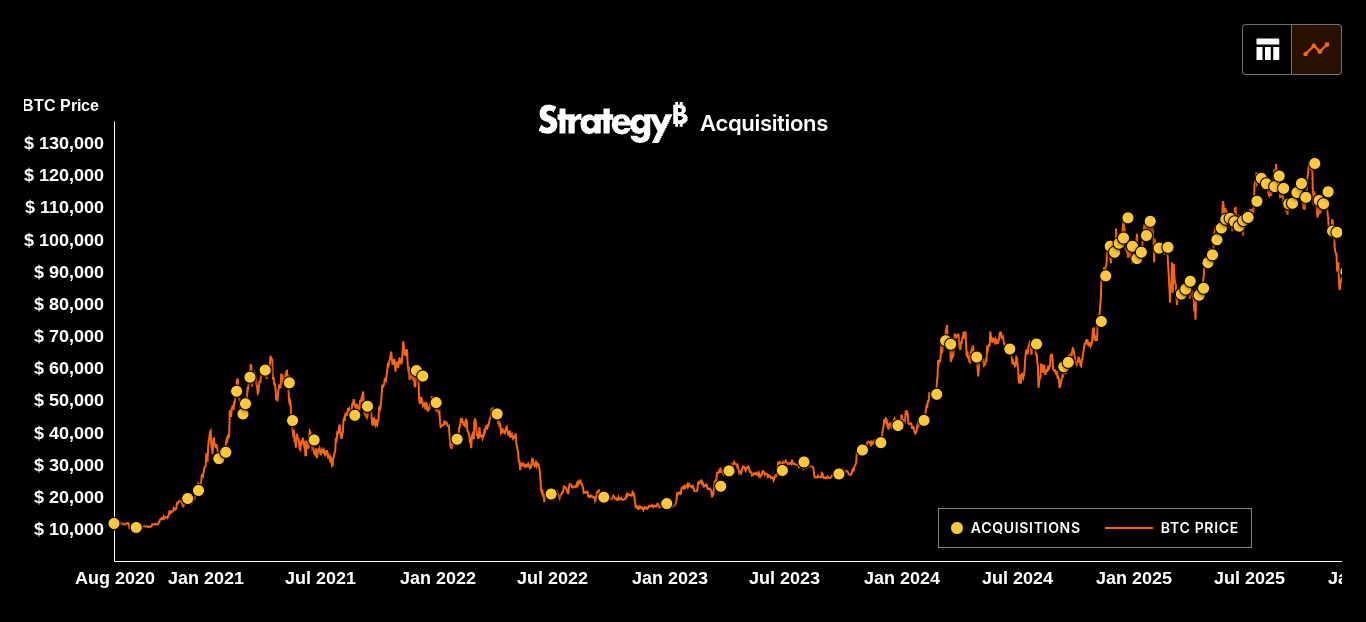

Saylor started constructing his Bitcoin place in August 2020, when MicroStrategy invested $250 million and bought over 21,000 BTC. The corporate continued to purchase within the second half of the yr utilizing funds raised by convertible bonds, and by December, its holdings exceeded 70,000 BTC.

Over the subsequent few years, the corporate continued to make regular income by inventory gross sales and different financing. By March 2025, the corporate’s Bitcoin holdings exceeded 500,000 BTC. Below Saylor’s management, the now renamed Technique Inc. continued to make aggressive purchases from late 2025 to early 2026, rising its whole holdings to nicely over 680,000 BTC.

Associated: Bitcoin quantum testnet with NIST-approved quantum-proof safety launches

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.