- Bitcoin dips beneath $90,000 as ETF outflows and liquidations weigh in the marketplace.

- Greater than $400 million in cryptocurrency positions are liquidated in a single day, most of them lengthy positions.

- Ethereum, XRP, Solana, and BNB widened their month-to-month losses amid weak institutional demand.

Friday’s slide in cryptocurrencies continued into Saturday, as rising U.S. Treasury yields, institutional outflows and additional liquidations despatched the market deeper into decline.

Main property resembling Bitcoin, Ethereum, XRP, Solana, and BNB widened their losses for the primary time in a month as danger sentiment weakened throughout digital property. The broader crypto market cap has fallen by greater than $80 billion in a matter of hours, totaling a 2.7% drop over the previous day. In response, crypto market sentiment has fallen into concern territory.

ETF flows present vital decline

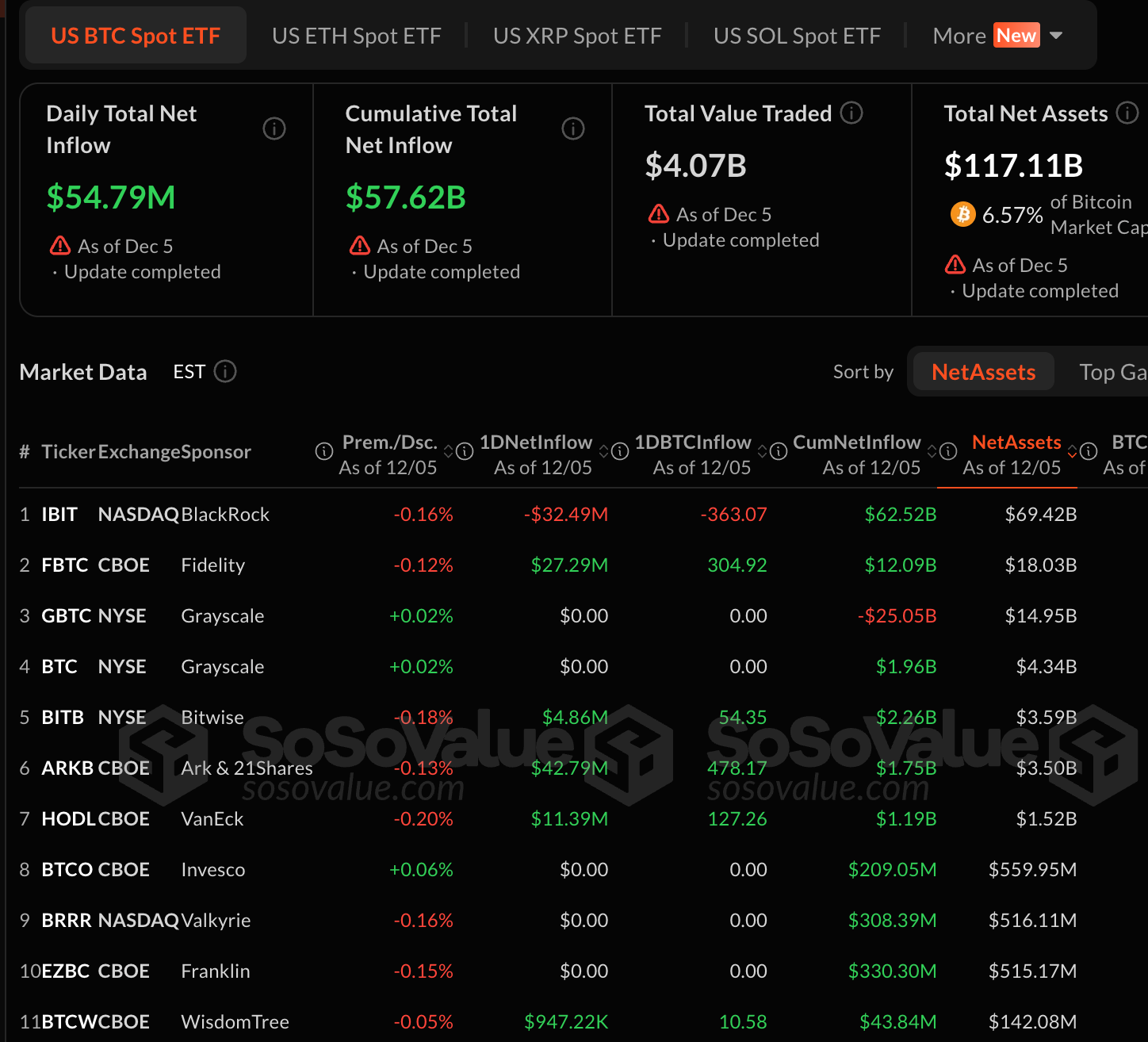

SoSoValue’s ETF movement knowledge captures two days of dramatic swings that helped outline the temper of the market. On Thursday, December 4th, Spot Bitcoin ETF outflows totaled roughly $194.64 million, the biggest single-day outflow since November twentieth.

This withdrawal considerably elevated promoting strain and coincided with Bitcoin’s sharp intraday decline.

Associated: Financial institution of America permits 15,000 advisors to supply Bitcoin. CIO units “1-4% allocation” normal

Flows turned barely optimistic on Friday, Dec. 5, with each day web inflows of $54.79 million. Nonetheless, the restoration was slower than the day past’s rebound and was not sufficient to reverse the promoting momentum.

Cumulative inflows stay vital at $57.62 billion, bringing the entire web property of your complete Bitcoin Spot ETF to almost $117.11 billion. Nonetheless, the influx curve successfully flattened in December, indicating that institutional confidence is waning.

Ethereum and Solana affirm leaks

Equally, Ethereum ETFs noticed outflows of over $50 million earlier within the week, whereas Solana merchandise recorded $32 million in redemptions. The pullback throughout main ETFs added vital promoting strain to an already fragile market construction.

In the meantime, as of Friday’s shut, the Solana ETF welcomed $15 million in new investments, and the Ethereum ETF recorded a further $75 million in gross sales.

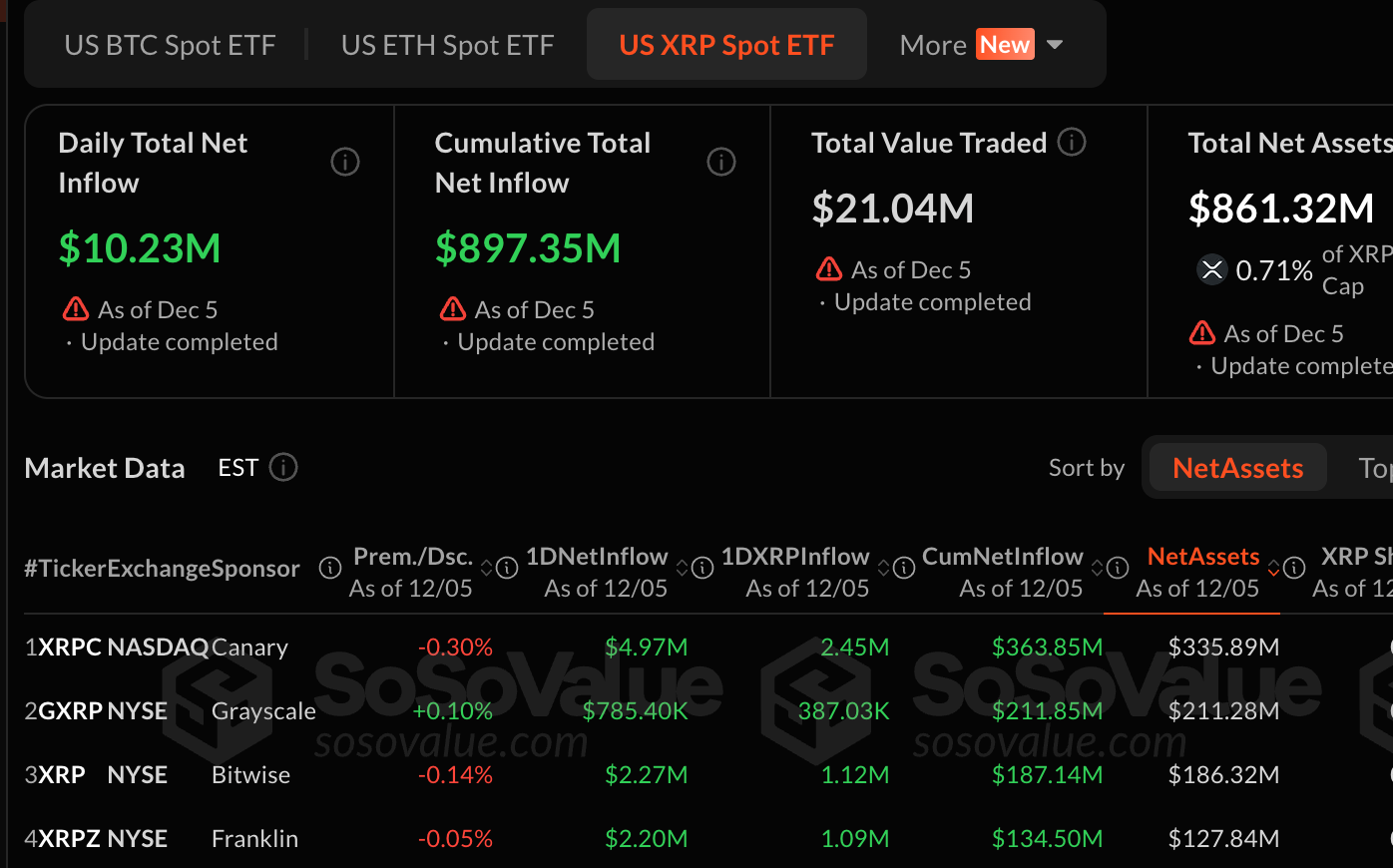

XRP goes in opposition to the pattern

Apparently, the XRP ETF is bucking the outflow pattern seen in different crypto ETFs. These merchandise proceed to draw new investments each enterprise day since their launch. On Friday, $10.3 million value of latest capital flowed in from Canary Capital, Bitwise, Grayscale, and Franklin. Whole inflows now stand at $897 million.

Nonetheless, this continued funding has not benefited the worth of XRP. The coin is buying and selling within the purple at $2.04 and is vulnerable to shedding the $2 assist stage.

Liquidation accelerates decline

In the meantime, the continuing financial downturn deepened as leverage unraveled. In keeping with CoinGlass, greater than $411 million in crypto positions had been liquidated previously day, affecting 132,442 merchants.

Many of the liquidations got here from lengthy positions that had been compelled to shut after Bitcoin misplaced assist close to $90,000. HyperLiquid recorded a single liquidation value $8.5 million, highlighting the focus of danger within the perpetual futures market.

Bitcoin falls beneath main ranges

As of this writing, Bitcoin is buying and selling at $89,732.53, down 2.6% previously 24 hours and down 13% previously month. The asset failed to interrupt out of the $92,000-$94,000 vary and hit a five-day low round $88,000.

Ethereum was buying and selling at $3,039.30, down 4.0% on the day and 10% for the month. Equally, XRP is buying and selling at $2.05, down 1.8% previously day and 12% previously month.

Different main altcoins are additionally falling. Solana was buying and selling at $133.15, down 4.1% for the day and 16.5% for the month. In the meantime, BNB was buying and selling at $884.12, down 2.2% in 24 hours and seven% for the month. A number of different altcoins additionally recorded even bigger intraday losses, together with APT, HYPE, PUMP, PEPE, WLD, and AVAX.

Macro pressures improve as a consequence of bond market actions

U.S. Treasury yields added to the stress. The ten-year Treasury yield rose 4% on Friday, its highest stage since Nov. 14 and its largest weekly improve since June.

The transfer comes regardless of the most recent PCE report displaying inflation rising consistent with expectations and rising requires a price lower on the Federal Reserve’s assembly in December. Nonetheless, rising headline PCE statistics and rising fiscal issues recommend that long-term borrowing prices might stay excessive till 2026.

Associated: Kevin O’Leary declares altcoins are useless, solely Bitcoin and Ethereum will survive

Market individuals at the moment are maintaining a tally of upcoming central financial institution conferences and tendencies in ETF flows, utilizing indicators to find out whether or not cryptocurrencies will stabilize within the coming weeks or face additional declines.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.