- Bitcoin and main altcoins fell as traders lowered their publicity to dangerous belongings.

- World macro considerations, together with stress within the AI sector and central financial institution coverage, weighed in the marketplace.

- Losses throughout cryptocurrencies widened resulting from decrease leverage, ETF outflows, and liquidations.

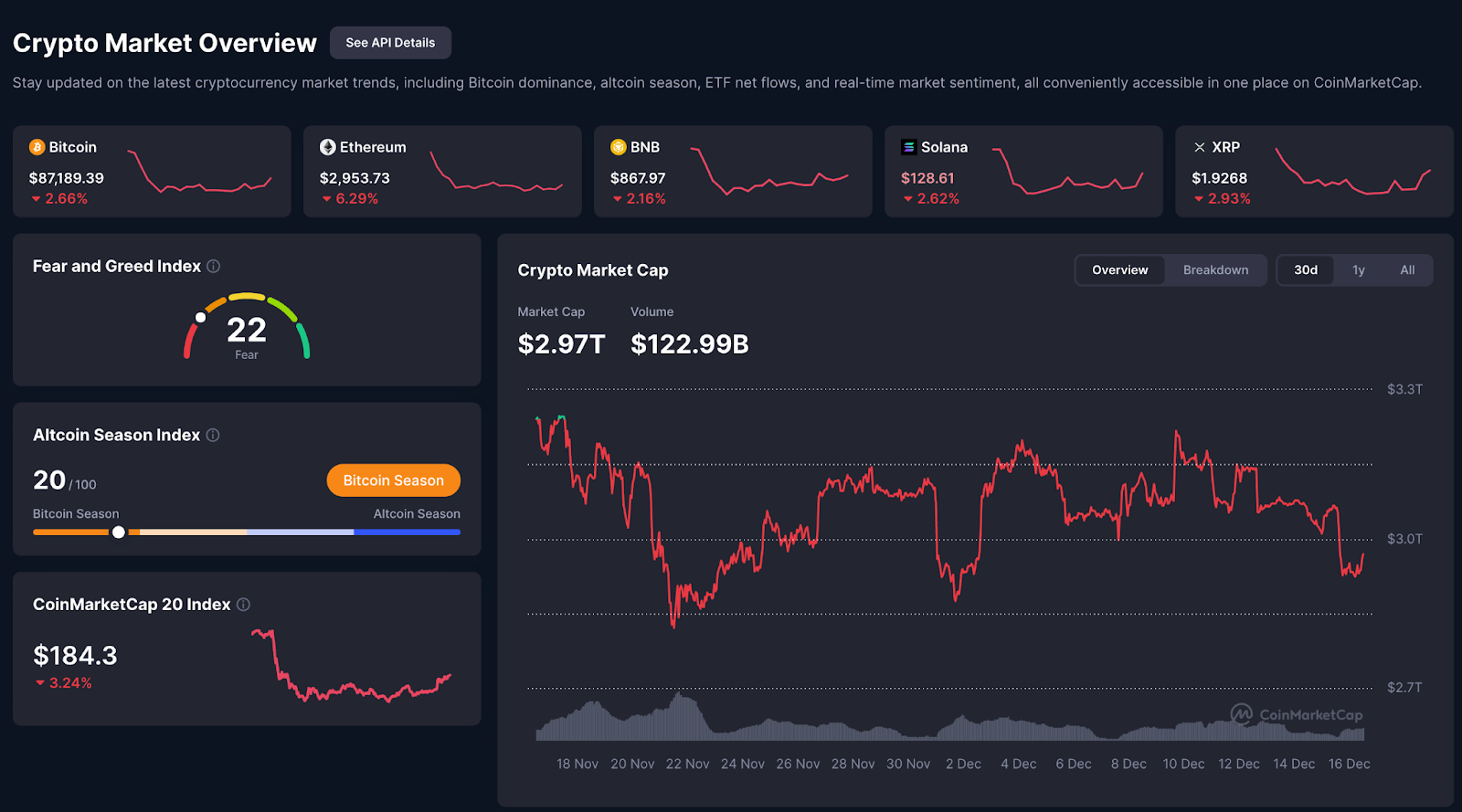

Cryptocurrency costs proceed to fall in the present day as traders retreat from dangerous belongings amid world market uncertainty. Bitcoin and main altcoins fell as macroeconomic dangers, central financial institution coverage considerations, and declining leverage weighed on costs.

The decline comes within the wake of a world inventory market decline, tightening monetary circumstances, and a wave of compelled liquidations throughout crypto markets.

Broad market decline hits cryptocurrencies

Bitcoin is buying and selling at $86,297 after falling 4.1% over the previous day, widening its month-to-month losses to greater than 10%. Main altcoins corresponding to Ethereum, XRP, and Dogecoin fell greater than 6% in 24 hours.

Because of this, the market capitalization of cryptocurrencies fell by greater than 4.1% to $3.26 trillion, though the market had recovered barely on the time of writing.

Associated: The variety of Bitcoin holders by main firms is 6 million. Why is BTC nonetheless beneath $100,000?

Leveraged merchants speed up the decline

Futures open curiosity throughout the crypto market has fallen to about $129 billion, from an October excessive of greater than $250 billion, based on the information. This decline signifies a decline in danger urge for food and fewer speculative buying and selling.

Liquidations surged as costs fell. Almost 200,000 merchants misplaced cash in 24 hours, totaling round $650 million in losses. Bitcoin and Ethereum have been hit the toughest as compelled sell-offs brought on their costs to fall quickly.

Accumulation of macro stress

Notably, world markets fell as traders grew to become extra cautious. U.S. shares fell, significantly within the tech sector, and the weak spot spilled over into cryptocurrencies, which regularly observe riskier belongings throughout instances of market stress.

AI firms have additionally added to the strain, with a number of main firms lately shedding important worth. There are rising considerations that heavy spending on AI will gradual.

Investor Holger Zashapitz mentioned he was involved after Oracle reported elevated debt and adverse free money move regardless of elevated gross sales. Oracle’s debt assure prices soared to their highest degree since 2009, highlighting considerations in regards to the AI business’s monetary dangers and heightening market nervousness.

Buyers have develop into cautious resulting from uncertainty surrounding U.S. financial information. Markets are awaiting the most recent employment information and inflation reviews, that are anticipated to point out slower development and better inflation.

This comes after the Federal Reserve minimize rates of interest by 0.25% and mentioned any future strikes would rely on new information. Because of this, merchants retreated, decreasing short-term demand for cryptocurrencies.

Financial institution of Japan resolution will increase world strain

The Financial institution of Japan can be attracting consideration. The financial institution is anticipated to lift rates of interest by 0.25% this week, the very best in many years. Up to now, Bitcoin has fallen after such value will increase, dropping 27% in March 2024, 30% in July 2024, and 31% in January 2025.

Rising rates of interest in Japan have typically ended carry trades that relied on low-cost yen borrowing, prompting traders to promote riskier belongings corresponding to cryptocurrencies.

Chinese language mining laws and ETF outflows add strain

Additional promoting strain additionally got here from China, the place authorities have reportedly tightened laws on Bitcoin mining. The transfer took important mining capability offline, decreasing world mining energy and forcing some miners to promote their holdings to cowl working prices.

On the similar time, Bitcoin exchange-traded funds recorded important outflows totaling over $350 million in at some point. Main funds reported web withdrawals, suggesting near-term warning amongst institutional traders.

What comes subsequent after Bitcoin?

Regardless of the decline, some institutional traders proceed to purchase. Technique revealed further Bitcoin purchases, underscoring its continued long-term curiosity.

Associated: Copper-to-gold ratio hits 15-year low: Will Bitcoin’s enterprise cycle be reset?

From a technical perspective, Bitcoin stays near a key help degree round $85,000. Analysts say the market’s subsequent transfer will doubtless rely on upcoming financial information, central financial institution choices and whether or not promoting strain continues to ease.

Analysts say that if Bitcoin can preserve help round $85,000, it may get better towards the $90,000 degree. Nonetheless, a sustained transfer beneath $84,000 may open the door to a deeper pullback in the direction of $80,000.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.