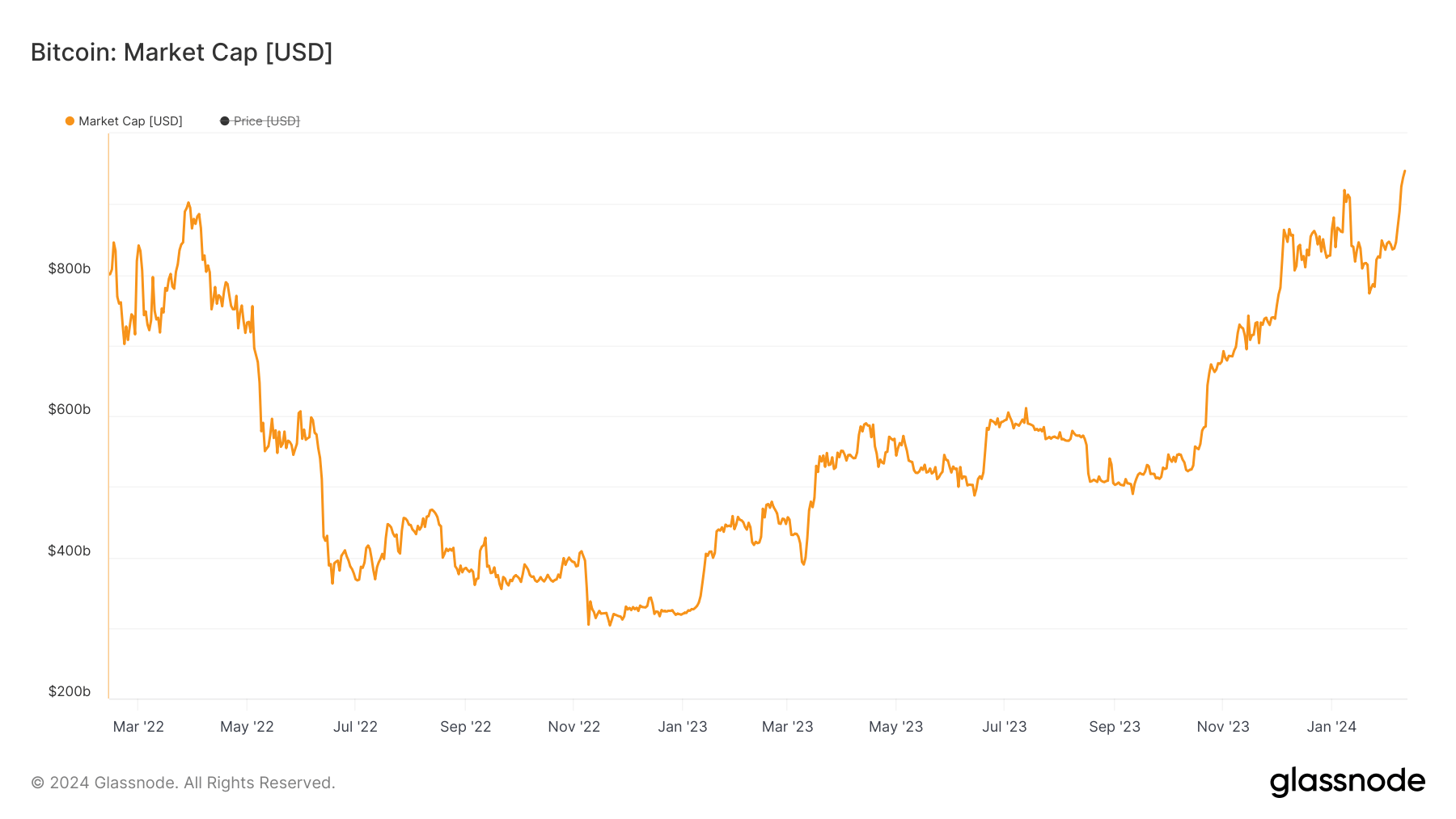

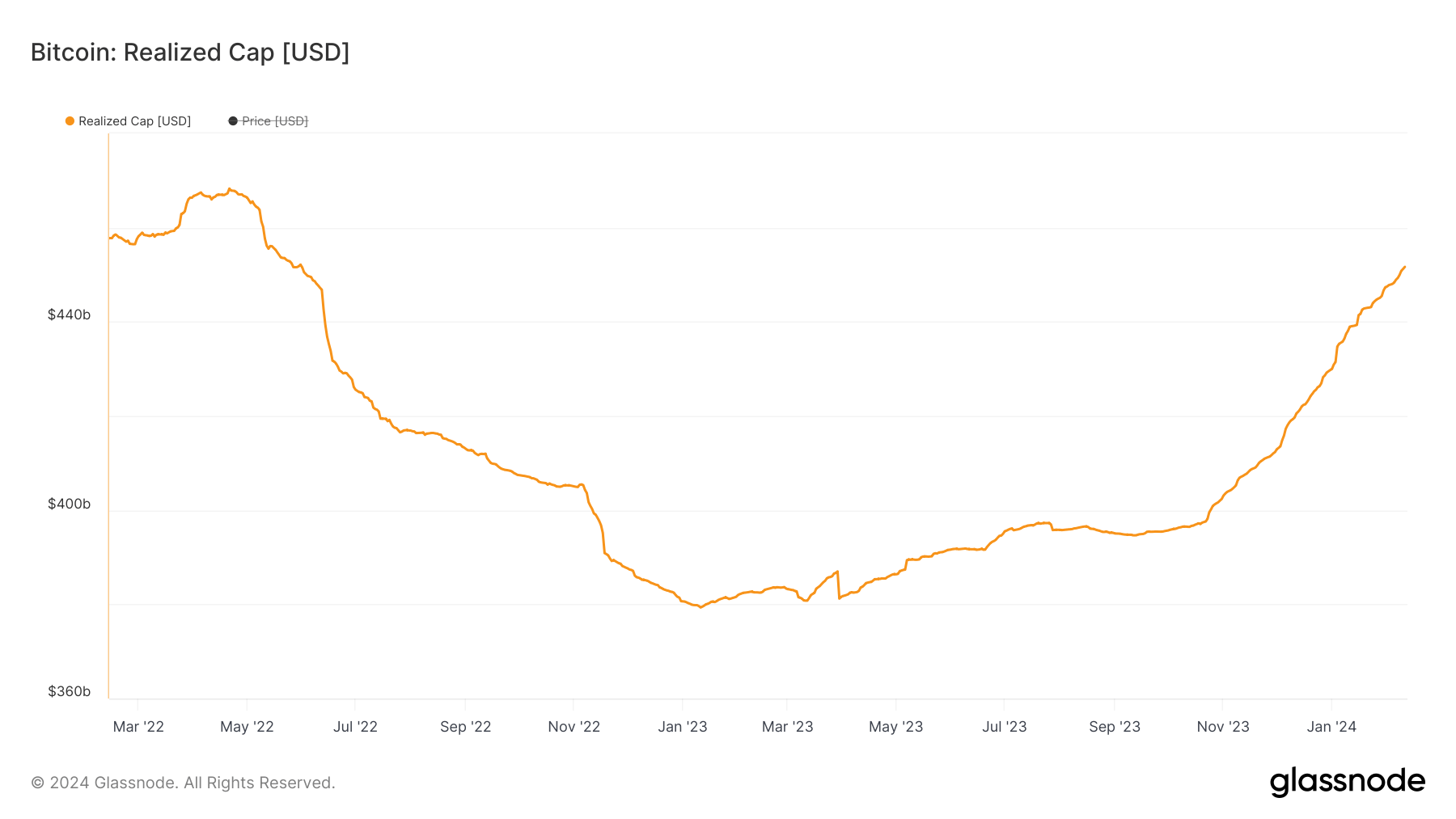

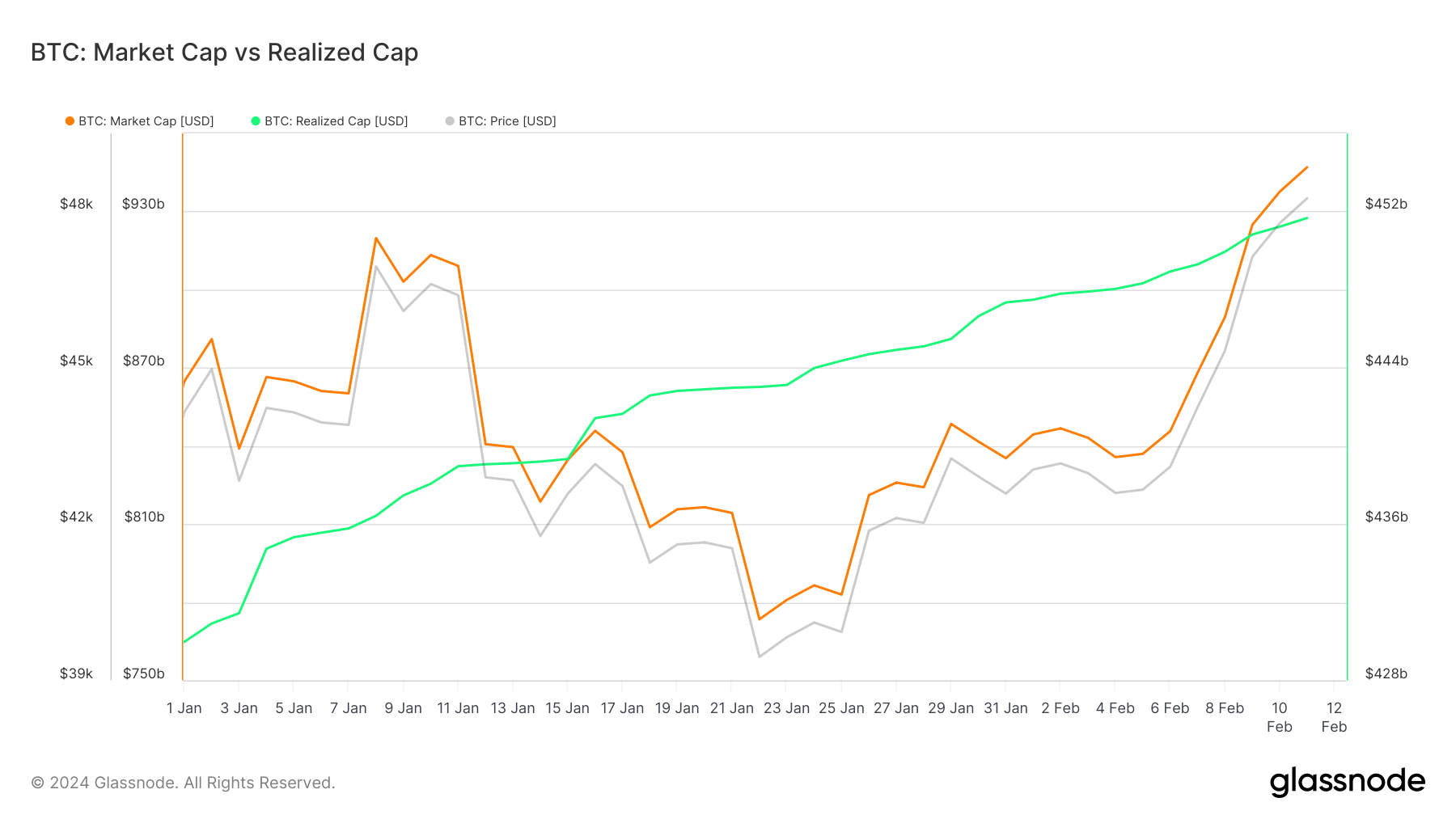

The value of Bitcoin has seen a big rise in February, leaping from $43,049 firstly of the month to $49,900 on February twelfth on the time of writing. Breaking above $49,000 can be an vital milestone for BTC as it might point out a attainable break by way of the $50,000 resistance and method all-time highs. Bitcoin's market cap elevated dramatically by greater than $102.5 billion in February as costs soared. Over the identical interval, Bitcoin's realized cap skilled a extra modest enhance, rising by simply over $4 billion from $447.48 billion to $451.66 billion.

Understanding the distinction and development of those two metrics is vital for market evaluation. Whereas each could seem too broad to supply perception into refined market actions, their variations and long-term developments are sometimes among the best indicators of market well being. Masu. That is very true for realization caps, an typically neglected metric that gives beneficial details about the general value foundation of the market.

Market capitalization is calculated by multiplying Bitcoin's present market worth by the whole variety of cash in circulation. Though it is a very crude metric, it’s extensively used as a result of it’s one of the simplest ways to signify the scale of a specific asset or market. Market capitalization is extremely delicate to cost fluctuations and sometimes fluctuates considerably over quick durations of time to replicate quick market sentiment and speculative exercise. Because the market worth of Bitcoin rises, the market capitalization can increase rapidly and aggressively, displaying the present valuation of all Bitcoins on the newest market worth of BTC.

Realization caps, then again, present a extra nuanced perspective on Bitcoin's worth. Not like market cap, which solely considers Bitcoin's most up-to-date market worth, realization cap takes under consideration the historical past of every coin to know its contribution to the whole worth of the Bitcoin community. This methodology seems to be on the worth at which every Bitcoin was really moved. By specializing in these buying and selling costs, Realized Cap supplies a snapshot of the market that takes under consideration the precise worth individuals paid for his BTC, relatively than the present market worth, which may be affected by short-term buying and selling. Serve the shot.

The belief cap will increase when Bitcoin trades at the next worth than it was final moved. It’s because newer and better transaction costs are actually taken under consideration, rising the general “value foundation”, or the whole quantity spent on buying Bitcoin. Then again, if Bitcoin is barely being moved at a worth decrease than the final traded worth, the belief cap decreases.

This “complete value metric” is a crucial idea as a result of it supplies perception into the precise investments poured into Bitcoin. It supplies a extra steady and fewer risky metric than market capitalization, which may fluctuate extensively relying on worth fluctuations. Subsequently, the realized cap may be thought of a extra grounded measure of Bitcoin's financial footprint and displays a agency dedication to the community of long-term traders.

The distinction seen in February was that market capitalization elevated considerably, whereas realized caps elevated extra slowly, indicating a interval of serious worth will increase. This discrepancy is because of the truth that market capitalization, relatively than realization limits, immediately displays present worth actions.

The soar in market capitalization is indicative of the general sentiment and liquidity of the market. Bullish sentiment may encourage additional purchases, pushing up each worth and market cap. Nonetheless, if this shopping for exercise is concentrated in younger provide relatively than long-term cash, the realized cap won’t instantly replicate this enthusiasm.

The rise within the realized cap suggests {that a} vital quantity of Bitcoin was traded at the next worth than the historic common beforehand acquired. The continual enhance within the realized cap since September 2023 signifies that the market has been steadily absorbing promoting stress, with each new and current traders It signifies that you’re keen to purchase for extra.

This basis displays underlying investor confidence and valuation metrics which are much less prone to be eroded by short-term market volatility, so it may function a springboard for future worth appreciation. there’s.

The publish Why did Bitcoin's market cap soar by over $102 billion, but its most realization solely elevated by $4 billion?The publish appeared first on currencyjournals.

Comments are closed.