CoinShares reported $1.18 billion in inflows into digital asset ETFs world wide final week, which was anticipated regardless of the massive sum of money flowing into these new spot Bitcoin ETFs. The optimistic influence on Bitcoin worth has not materialized. This raises questions in regards to the underlying mechanics of those ETFs and their influence on Bitcoin's worth.

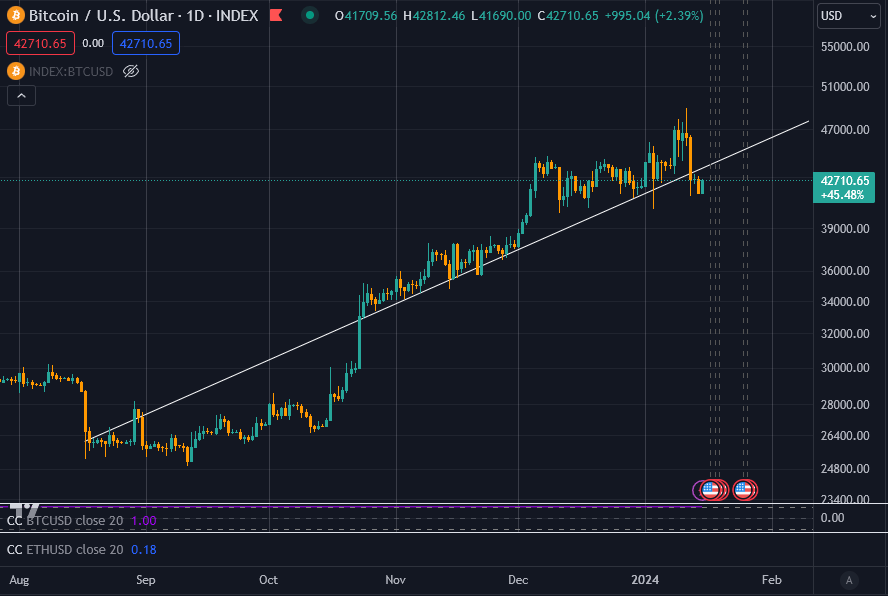

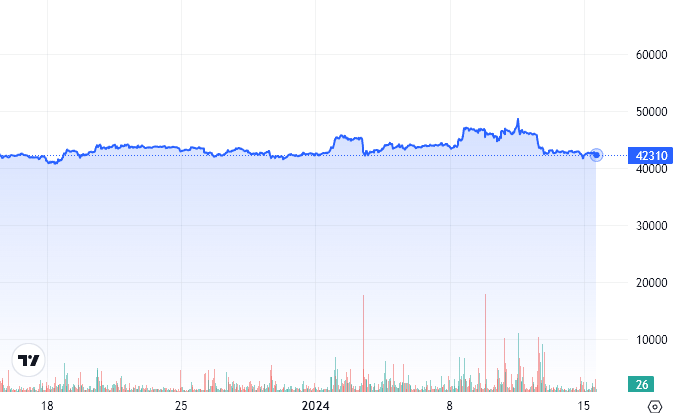

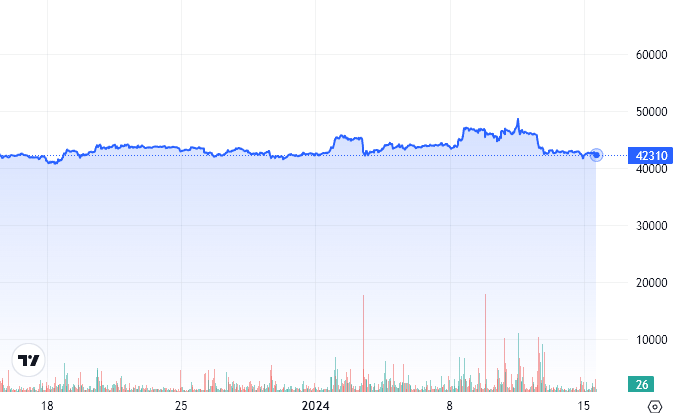

First, let's be certain we perceive the state of affairs accurately. The latest worth rally gained momentum when BlackRock introduced the submitting of a Spot Bitcoin ETF on June 15, 2023. On the time, the worth of Bitcoin was about $25,000. Since then, it has risen 70% to about $42,000 and remained primarily flat.

Following the launch of the ETF, Bitcoin soared to $49,000, however shortly fell to round $42,000. Wanting on the chart, it’s cheap to recommend that maybe Bitcoin was overbought above $44,000 at this level within the cycle.

With that in thoughts, let's check out how Bitcoin purchases work in relation to the not too long ago sanctioned Spot Bitcoin ETF.

How Bitcoin is valued for ETF functions.

Working a Spot Bitcoin ETF is extra difficult than it seems. When people purchase and promote shares in ETFs like these provided by BlackRock, Bitcoin is just not purchased or offered in actual time. As a substitute, Bitcoins representing shares are bought at the least someday upfront.

ETF issuers create shares with money after which use that money to purchase Bitcoin. This oblique mechanism implies that no direct switch of Bitcoin between ETFs happens. Due to this fact, the influence on Bitcoin worth is delayed and doesn’t mirror real-time buying and selling exercise.

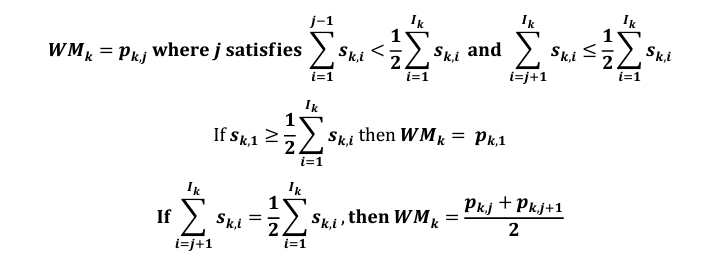

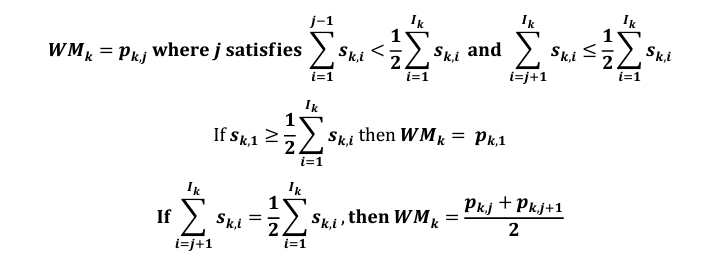

Primarily, for an ETF like BlackRock, the inventory worth on a given day is supposed to signify the common worth of Bitcoin throughout customary buying and selling hours, fairly than the reside worth of Bitcoin at a particular cut-off date. Most ETFs use a “CF Benchmark Index” to calculate the worth of Bitcoin on a given day. As described on the CF Benchmarks web site:

“The CME CF Bitcoin Reference Fee (BRR) is a once-daily Bitcoin benchmark index worth that aggregates buying and selling knowledge from a number of Bitcoin-USD markets operated by main crypto exchanges.”

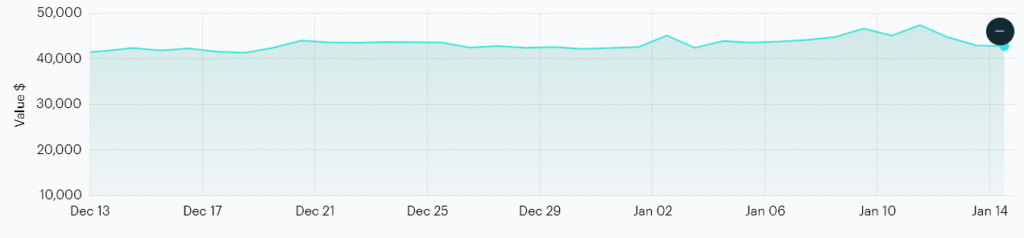

We use common costs from Bitstamp, Coinbase, Gemini, Itbit, Kraken, and LMAX Digital. In line with CF Benchmarks, the worth of Bitcoin is: Observe that the newest excessive was $47,525 on January eleventh.

This is identical time interval and Y-axis scale utilizing currencyjournals knowledge on a 1-hour timeframe. In line with CF Benchmarks, Bitcoin is price $42,594.27 on the time of writing. crypto slate In actual time, it’s $42,332.35. This means that spot ETFs are buying and selling at a reduction to Bitcoin ETFs, although spot ETFs usually are not obtainable at the moment as a result of a US vacation.

To be trustworthy, I by no means anticipated one thing like this to occur when ETFs had been launched. I humbly believed that the ETF would truly monitor the worth of Bitcoin and that the monetary establishment would purchase and promote BTC relative to his ETF shares being traded. How flawed and naive I used to be!

I learn the S1 submitting totally and didn’t think about that the underlying Bitcoin might be bought at a median worth in a personal transaction just a few days later. I took it without any consideration that the CF Benchmark Index worth was a reside mixture worth. Remarkably, it exists and known as BRTI. Nevertheless, that is solely used for “reference” functions and isn’t used to calculate the transaction worth.

How Bitcoin enters an ETF.

That is how Bitcoin is usually traded between varied Spot Bitcoin ETFs.

Approved contributors akin to Goldman Sachs, Jane Road, and J.P. Morgan Securities would require a “switch agent, money custodian, or prime execution agent” to create a basket of shares by a set time on a normal enterprise day. Place your order. That is 2pm in Grayscale, however BlackRock's closing time is 6pm.

Following this, the sponsor (ETF) is liable for figuring out the overall basket web asset worth (NAV) and calculating charges. This course of is often accomplished as shortly as potential. For instance, 4pm for grayscale. For BlackRock, it's 8pm New York time. Correct timing right here is crucial to make sure correct valuation of the basket primarily based on the day's closing market knowledge.

You could have seen phrases like T+1 and T+2 thrown round in terms of ETFs. The time period “T+1” or “T+2” refers back to the settlement date of those transactions. “T” represents the buying and selling date, i.e. the day the order was positioned. “T+1” implies that the order can be settled on the subsequent enterprise day, and “T+2” implies that the order can be settled on the second enterprise day after the order is positioned.

In a Spot Bitcoin ETF, a liquidity supplier transfers the overall basket of Bitcoins to the belief's custodial steadiness on both T+1 or T+2, relying on the precise prospectus. It will reportedly be certain that transactions adjust to customary monetary market practices for settling trades.

Execution and settlement of Bitcoin purchases and transfers to the Belief's buying and selling pockets sometimes happen at time T+1, fairly than on the time of buy of ETF shares.

OTC buying and selling and its influence

An essential facet of this mechanism is that it entails over-the-counter (OTC) buying and selling. Buying and selling takes place between institutional traders in a personal surroundings away from public exchanges. Though they don’t instantly have an effect on market costs, these transactions set a precedent for alternate costs.

Suppose a monetary establishment akin to BlackRock agrees to decrease the worth of Bitcoin throughout these over-the-counter transactions. In that case, if that info is disclosed to the general public or market makers, it might not directly have an effect on market costs. Nevertheless, these trades usually are not added to the worldwide composite order ebook and subsequently don’t have an effect on the reside worth of Bitcoin. These are primarily peer-to-peer non-public transactions.

Moreover, primarily based on the CF Benchmark Index's pricing methodology, if Bitcoin trades at, say, $42,000 all through the day after which rises to almost $50,000 on the finish of the day, the worth of the CF Index can be considerably beneath the present spot worth. Extra possible. Value by quantity (and different advanced calculations accomplished by CF Benchmarks)

Which means NAV is calculated primarily based on a worth decrease than the spot worth, and subsequent day creation or redemption happens over-the-counter, aiming to be as near NAV as potential.

Market makers with entry to those OTC desk trades are unlikely to wish to commerce Bitcoin on the present spot worth of $50,000, resulting in illiquidity at these excessive costs and the spot worth falling beneath the ETF's NAV. might develop into in line with. Within the quick time period, ETF NAV might play a extra essential position in defining Bitcoin's spot worth, leading to decrease volatility in direction of a smoother common worth.

Nevertheless, these transactions nonetheless have to happen on the blockchain and require the switch of Bitcoin between wallets. This transfer will develop into more and more essential for market evaluation, particularly amongst institutional wallets.

For instance, Coinbase Prime's scorching pockets facilitates buying and selling, whereas institutional chilly storage wallets are used for long-term holdings and may be analyzed on platforms akin to Arkham Intelligence.

I imagine the extra clear these over-the-counter transactions may be, the higher it will likely be for all market contributors. Nevertheless, the visibility of those actions is considerably opaque for the time being, and the SEC seems to imagine it’s “in one of the best curiosity” of traders.

(Tag translation) Bitcoin