- Ethereum (ETH) costs present restoration after falling to a low of $1,415.

- Bullish patterns and dex depth point out potential ETH costs rebounds.

- Future Pectra updates may drive ETH to $2,140.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, not too long ago fell to $1,415, reflecting a pointy 61% drop from its December peak.

This huge decline has led to Ethereum being forged as a outstanding unhealthy man within the crypto market, inflicting unease amongst traders and analysts.

Nonetheless, after hitting a low of $1,415, the worth confirmed indicators of a restoration, rising to round $1,623.42, suggesting a possible change in momentum.

What triggered ETH costs to trigger this drop?

The worth hunch for Ethereum is partly because of inside points as Bankles co-founder David Hoffman requires neighborhood management to alienate customers and builders.

Hoffman factors out antagonistic perspective. This contains shameful funds on hostile platforms and criticizing sure merchants who might have shaken their confidence within the ecosystem.

The explanation ETH value efficiency was sucked in is everybody’s bored within the center

Ethereum’s management and tradition alienates customers and builders by being hostile to their very own app layers.

We publicly eliminated @lidofinance. I averted my dealer and diploma.

On a series that was not permitted, we tried…

– David Hoffman (@trustlessState) April 12, 2025

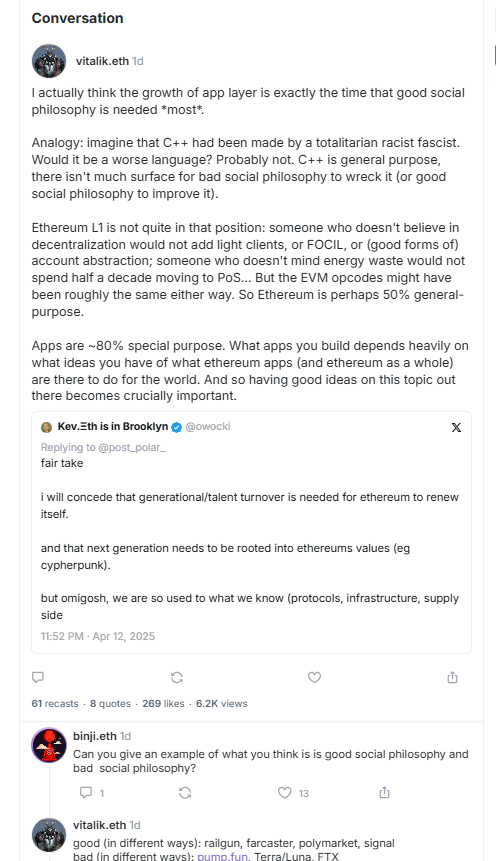

In a Warpcast put up on April twelfth, Vitalik Buterin, co-founder of Ethereum, cited initiatives like Railgun and Farcaster as optimistic examples, highlighting the necessity for a powerful social philosophy within the Ethereum software layer that guides builders to tailor their core values.

Past inside battle, Ethereum’s Layer 1 infrastructure is struggling to accommodate new blockchains and put strain on evaluations.

Exterior forces equivalent to market volatility brought on by President Trump’s tariff announcement have additionally inspired the sale of your complete cryptocurrency, additional decreasing Ethereum.

Technical evaluation exhibits value rebound for Ethereum (ETH)

Regardless of the rocky begin of 2025, a number of components counsel that Ethereum could also be getting ready for a rebound, providing hope for these its trajectory.

Nonetheless, technical evaluation attracts a extra optimistic image, because the chart sample exhibits the opportunity of a reversal of Ethereum’s destiny.

Each each day and weekly charts have seen calm wedge patterns seem, approaching confluence ranges that usually precede bullish breakouts.

If this sample happens, Ethereum (ETH) can rise to $2,140, with a 35% bounce from the present value.

One other bull metric, a reverse head and shoulder sample, can also be formed into the each day chart, reinforcing instances of upward motion within the quick time period.

The RSI indicator has additionally not too long ago rebounded from the world the place it was offered, indicating that the token could also be on bullish rebounds.

The market worth from realized worth (MVRV) was soaked in -0.832 earlier than rebounding to about 0.98 at press, indicating that Ethereum is nicely beneath historic common.

This metric signifies that cryptocurrency might be a cut price for traders and will trigger buy rights that might elevate costs.

Traditionally, such undervaluations typically precede durations of value rises, including weight to bullish outlook.

Ethereum-based Dexs outweigh rivals

Ethereum’s distributed Change (DEX) community continues to display resilience and presents another excuse for optimism.

Defilama knowledge exhibits that regardless of competitors with blockchains like Solana and Arbitrum, Ethereum’s Dexs has processed greater than $17 billion previously week, surpassing its rivals.

This sustainable exercise highlights Ethereum’s means to keep up customers and liquidity to boost its primary energy, even at increased charges.

Such sturdy efficiency means that networks are the idea of a decentralized monetary house and may climate competitiveness.

The metrics additional strengthen the argument that Ethereum is being ready for restoration, as present costs seem like undervalued.

Future Ethereum Pectra updates

The Pectra replace, scheduled for Might 7, 2025, guarantees to strengthen Ethereum’s community and will reverse among the current set-offs.

This improve is meant to deal with Layer 1 challenges and enhance scalability and effectivity.

A profitable deployment may function a catalyst, rising the worth of Ethereum because the market predicts a extra aggressive blockchain.

Scheduled enhancements, equivalent to these commitments to the evolution of Sign Ethereum, are components that may rekindle enthusiasm.

A mix of bullish know-how patterns, a strong DEX ecosystem, underestimation, and guarantees from the Pectra Replace will create stable instances for restoration.

Traders might be making an attempt to control adjustments in resistance ranges and feelings, however proof factors to Ethereum, which is probably rising from the unlucky quarter.

Put up on why Ethereum costs are rising after it first appeared in Coinjournal.