- Bitcoin is rallying in direction of the $90,000 degree, supported by $221 million in whale purchases.

- Citi’s bullish forecast for Bitcoin requires it to rise to $180,000 inside a yr.

- The cryptocurrency market rose by 1.98%, with altcoins reminiscent of Ethereum and XRP additionally displaying important features.

Cryptocurrency markets are displaying indicators of restoration right now, rebounding from per week of weak spot as Bitcoin leads an enormous rally. Enhancing sentiment round institutional shopping for, ETF flows, and regulatory developments within the U.S. are serving to to maintain costs steady and rising.

Bitcoin market rebounds after weekly decline

The general cryptocurrency market rose 1.98% prior to now 24 hours, reversing a 7-day decline of two.64%. The rally got here after a number of days of cautious buying and selling pushed by macro uncertainty and profit-taking after the October excessive.

Bitcoin is setting the tone for a restoration as consumers entered the market aggressively following yesterday’s selloff. Particularly, Bitcoin is up 1.59% prior to now 24 hours and is buying and selling at round $88,346 on the time of writing. The asset briefly reached $89,339 right now after falling to $84,500 yesterday.

This rebound means that consumers are defending key ranges after per week of regular decline.

Whale exercise accelerates Bitcoin value surge

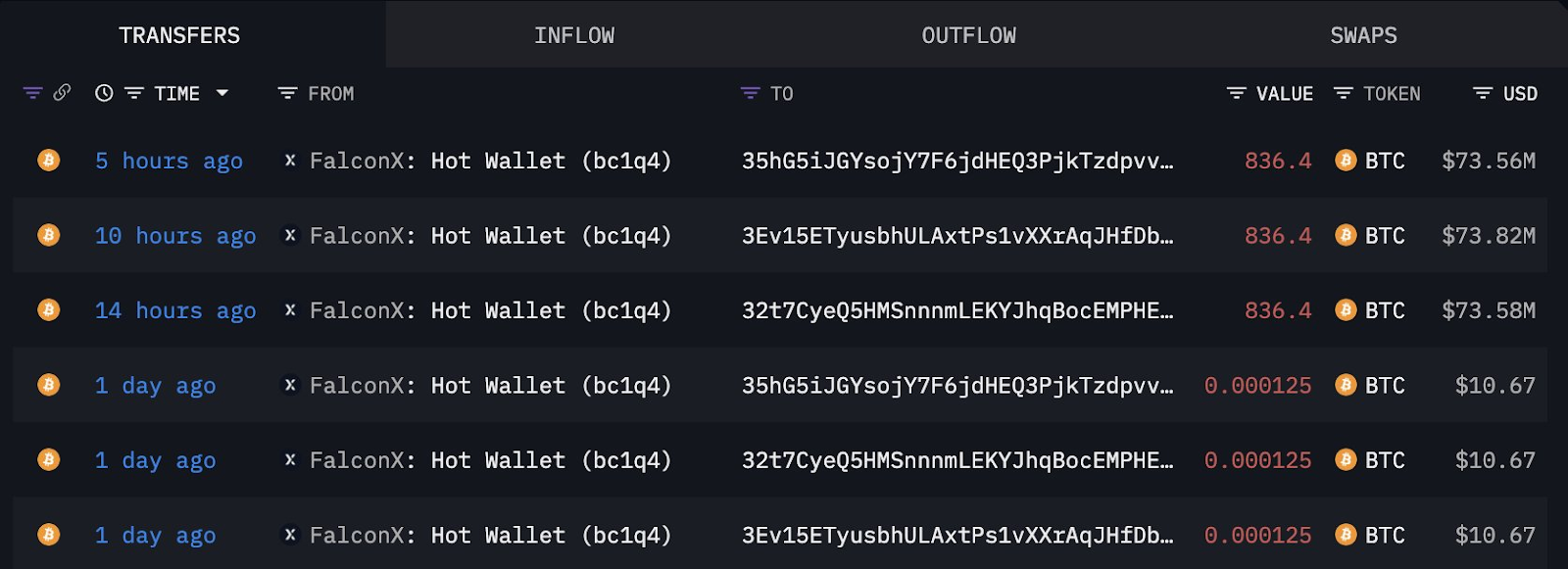

On-chain information shared by Lookonchain reveals that whale exercise has resumed. In line with the tracker, one group amassed 2,509 BTC value roughly $221 million in 14 hours.

Bitcoin was transferred from the FalconX-linked pockets to 3 newly created wallets, which Lookonchain believes belong to the identical whale. This accumulation is a bullish sign, particularly throughout instances of market downturn.

Metropolis and Bernstein regain momentum

Including to the optimistic sentiment, Citigroup on Friday outlined its optimistic 12-month forecast for Bitcoin and Ethereum. Citi set a baseline goal for Bitcoin at $143,000, noting that easing regulatory pressures may enable new institutional capital to movement in.

Below a bullish situation, Citi expects Bitcoin to rise to $189,000. Alternatively, within the bearish case, there’s nonetheless a draw back close to $78,000.

Beforehand, brokerage agency Bernstein claimed that Bitcoin is transferring past conventional four-year cycles. The agency famous that regardless of latest declines, ETF outflows accounted for lower than 5% of complete holdings, indicating sturdy investor conviction.

Bernstein subsequently raised his 2026 Bitcoin goal to $150,000 and expects the present cycle to peak close to $200,000 in 2027.

Regulatory momentum will increase market confidence

Regulatory developments within the US are additionally supporting right now’s rally. White Home Counsel for AI and Digital Property David Sachs confirmed that the Senate will start marking up the Digital Asset Market Transparency Act in January 2026.

The invoice, which has already handed the Home with bipartisan assist, goals to obviously outline the oversight position between the SEC and CFTC.

Market contributors see this as a serious step in direction of long-awaited regulatory readability and will encourage deeper institutional participation throughout crypto markets.

Associated: Cryptocurrency czar David Sachs confirms Readability Act value hike in January 2026

Altcoins be part of the restoration as XRP and ETH rise

Altcoins are on the rise following Bitcoin. Ethereum has been buying and selling effectively, briefly reaching the $3,000 threshold right now after falling under $2,900 yesterday. This restoration suggests institutional optimism is mirrored in Citi’s outlook.

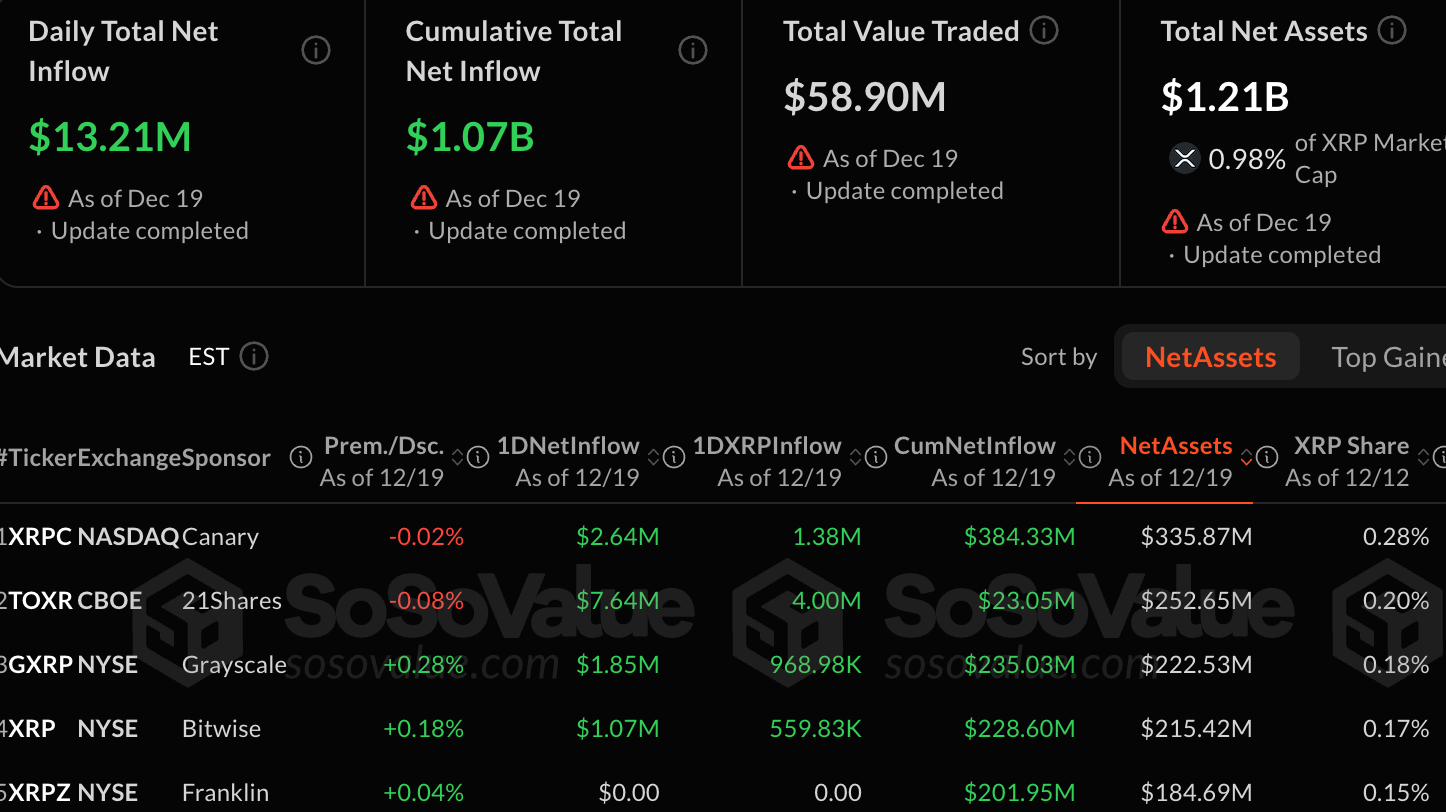

XRP additionally rebounded strongly from its latest low of $1.77 to $1.91. That restoration is fueled by the continued momentum of the XRP ETF. The XRP ETF recorded $13 million in inflows as of yesterday’s shut.

This newest funding brings complete inflows to $1.07 billion and complete property beneath administration to $1.21 billion.

Massive image: BTC to $200,000 in 3 months?

In the end, right now’s market rebound displays a mix of bullish shopping for, enhancing expectations from regulators, and confidence from massive traders. Whereas macro uncertainties persist, Bitcoin’s try and regain the $90,000 degree means that the crypto market could also be regaining some bullish momentum after a unstable week.

On this context, Arthur Hayes mentioned Bitcoin may attain $200,000 inside three months as traders get up to what he sees as stealth cash printing by the Federal Reserve.

In a brand new essay, CIO Maelstrom argues that the Fed’s “reserve administration purchases” ($40 billion per thirty days in authorities bond purchases) are successfully quantitative easing beneath a brand new title. As soon as the market realizes that RMP creates new cash in the identical means as QE, Hayes expects Bitcoin to skyrocket.

He believes BTC will keep within the $80,000 to $100,000 vary till traders notice that, after which regain $124,000 and transfer towards $200,000 by March, when Fed liquidity expectations peak. We count on it to say no after that, however the value stays effectively above $124,000.

Associated: Bitcoin soars to $88,000 as Hayes says weak yen will promote the unfold of digital forex

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.