In accordance with knowledge from buying and selling agency Webull, round 70% of Grayscale GBTC holders are prone to stay worthwhile. The typical inventory value was bought at $27.82, roughly 20% decrease than the present value on the time of writing.

Webull's knowledge reveals the state of the belief the day earlier than it was transformed right into a spot Bitcoin ETF, displaying that 70% of traders had a price vary between $18.84 and $27.24.

By way of distributions, the primary concentrated shareholder seems to be sitting between $33 and $40. On the time of writing, the worth is $34.9, and will probably be fascinating to see if the underside of this vary acts as assist for the worth because the outflow continues.

The second focus is way decrease, between $18 and $21. This group will proceed to make income till GBTC value falls by one other 39%.

If the worth falls to this degree and its belongings underneath administration endure a comparable decline, a further 230,000 BTC might be on retailer cabinets, which is equal to roughly $8.9 billion on the time of writing.

Such a decline would depart Grayscale with about 350,000 BTC, and if Bitcoin maintained its worth at about $39,000, it will have earned about $200 million even after paying the 1.5% administration charge. You may be requested to take action. This highlights the seemingly infinite potential for income for Grayscale traders, in addition to the shortage of stress on Grayscale to decrease charges. Since there may be little influx into ETFs, the proportion of traders who’re making income could be very excessive.

So there may be actually an argument that the stress on Bitcoin value attributable to revenue taking by Grayscale may very well be as extreme because the almost 40% drawdown. For the bears within the viewers, a 40% drop in Bitcoin now would ship it all the way down to a Might 2023 low of round $23,000.

Doubtlessly 100% of Grayscale traders revenue on conversion.

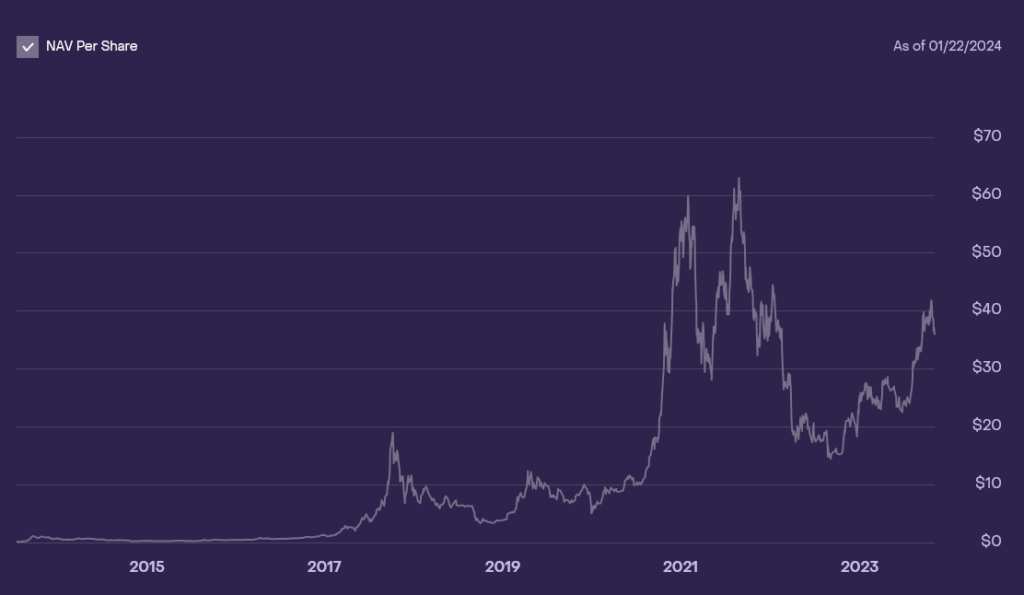

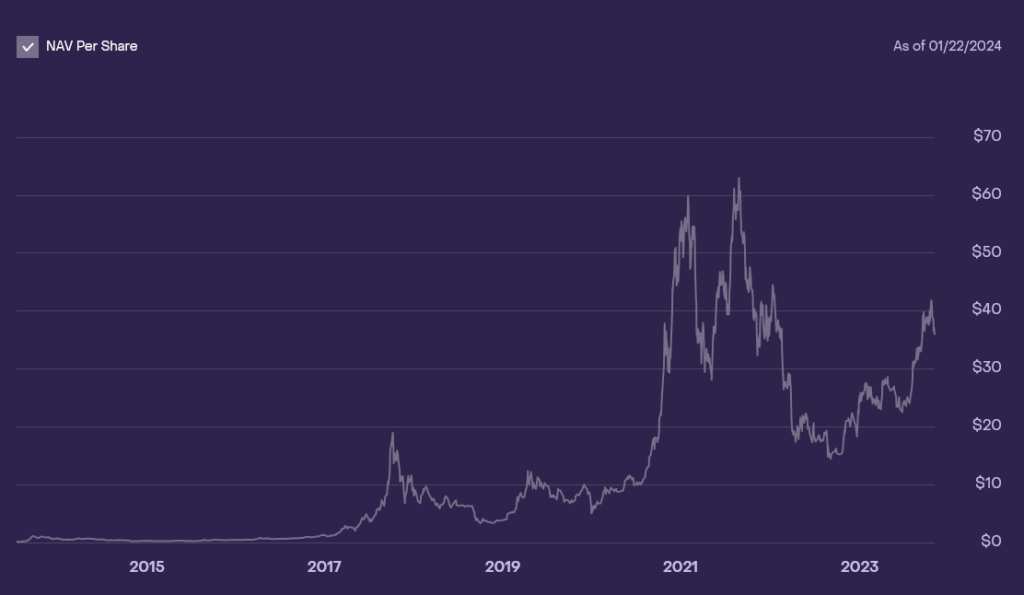

Because the conversion, the ETF has seen important outflows totaling roughly $3.5 billion. The corporate's belongings underneath administration additionally fell from a year-to-date excessive of $29 billion (623,390 BTC) on January 10 to $22.1 billion (552,681 BTC). In greenback phrases, the corporate's all-time excessive in belongings underneath administration really goes again even additional. The 2021 bull market peak is a staggering $44 billion (651,000 BTC).

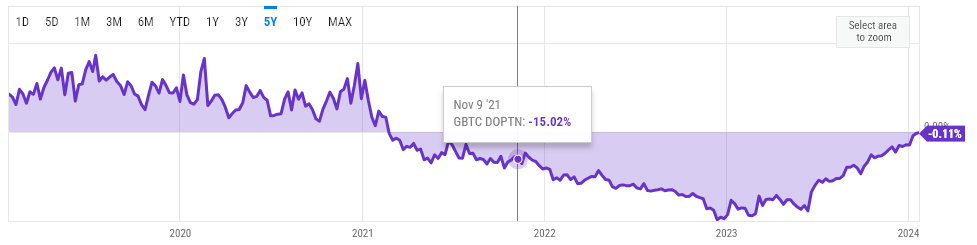

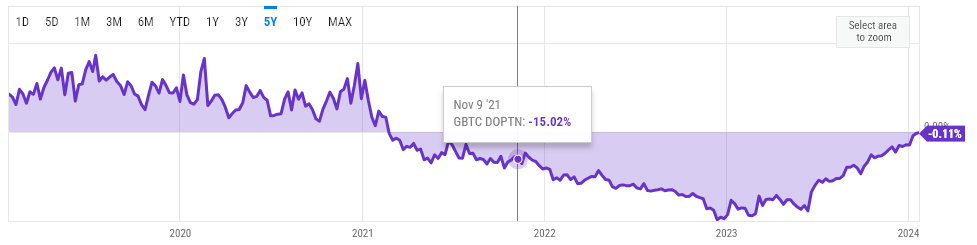

Apparently, even on the high of the market, issues over the construction of the belief resulted in it buying and selling at a 15% low cost to its internet asset worth (NAV), relatively than the spot value of $69,000. The best value was roughly $58,000. This low cost fee continued to extend till the start of his 2023, reaching -47% at its lowest level.

As a result of profitable software and eventual conversion to the Spot Bitcoin ETF, the low cost disappeared to only -0.11% as of January twenty third.

Apparently, Webull's place price distribution diagram above reveals that every one traders who purchased roughly $40.53 exited the belief earlier than the conversion. Evaluating to the historic NAV value chart beneath, GBTC largely traded above $40.53 for about 12 months from Might 2021 to January 2022. Nevertheless, in keeping with Webull knowledge, the belief's closing value on January 10 was the final day earlier than conversion to NAV. Within the case of ETFs, 100% of the shares delivered beneficial properties.

The TradingView chart beneath helps this declare, because it closed at a 17-month excessive. Much more stunning is the variety of traders who’ve already exited the fund after getting into at excessive costs all through 2021.

After it was revealed that a lot of the outflows from GBTC had been the results of FTX liquidation, many within the Bitcoin neighborhood had been inspired by the prospect of ETF outflows slowing. Nevertheless, at this time, January twenty third, a further 17,000 BTC was transferred to Coinbase Prime, leading to a internet outflow of roughly 15,000 BTC, equal to roughly $600 million.

The big variety of traders in worthwhile positions places ETFs susceptible to additional outflows. Nevertheless, the influence this may have on Bitcoin’s spot value will change into clearer over time. Trades between the ETF issuer and its counterparty Coinbase are carried out over-the-counter (OTC) and subsequently have restricted direct influence on the underlying Bitcoin value.

Nevertheless, that is solely true if there’s a purchaser who is able to purchase the Bitcoin. If over-the-counter liquidity dries up, the influence on costs might be important. However given the institutional demand for Bitcoin, it's onerous to think about traders like Michael Saylor turning down the possibility to accumulate low-cost Bitcoin.

Bloomberg analysts together with James Seifert estimated that solely about 33% of GBTC outflows went to different ETFs. But when FTX liquidation ends, we'll see if flows ultimately change into shallower and the bulk merely swap to lower-fee funds corresponding to Constancy and BlackRock, which at present lead the New child 9. could be fascinating.

(Tag translation) Bitcoin