- Tokenized shares are hovering as crypto buyers transfer away from unstable altcoins.

- Analysts are evaluating at the moment’s market to stablecoins earlier than the large enlargement.

- The speedy progress of RWA and tokenized authorities bonds have paved the way in which for fairness tokens.

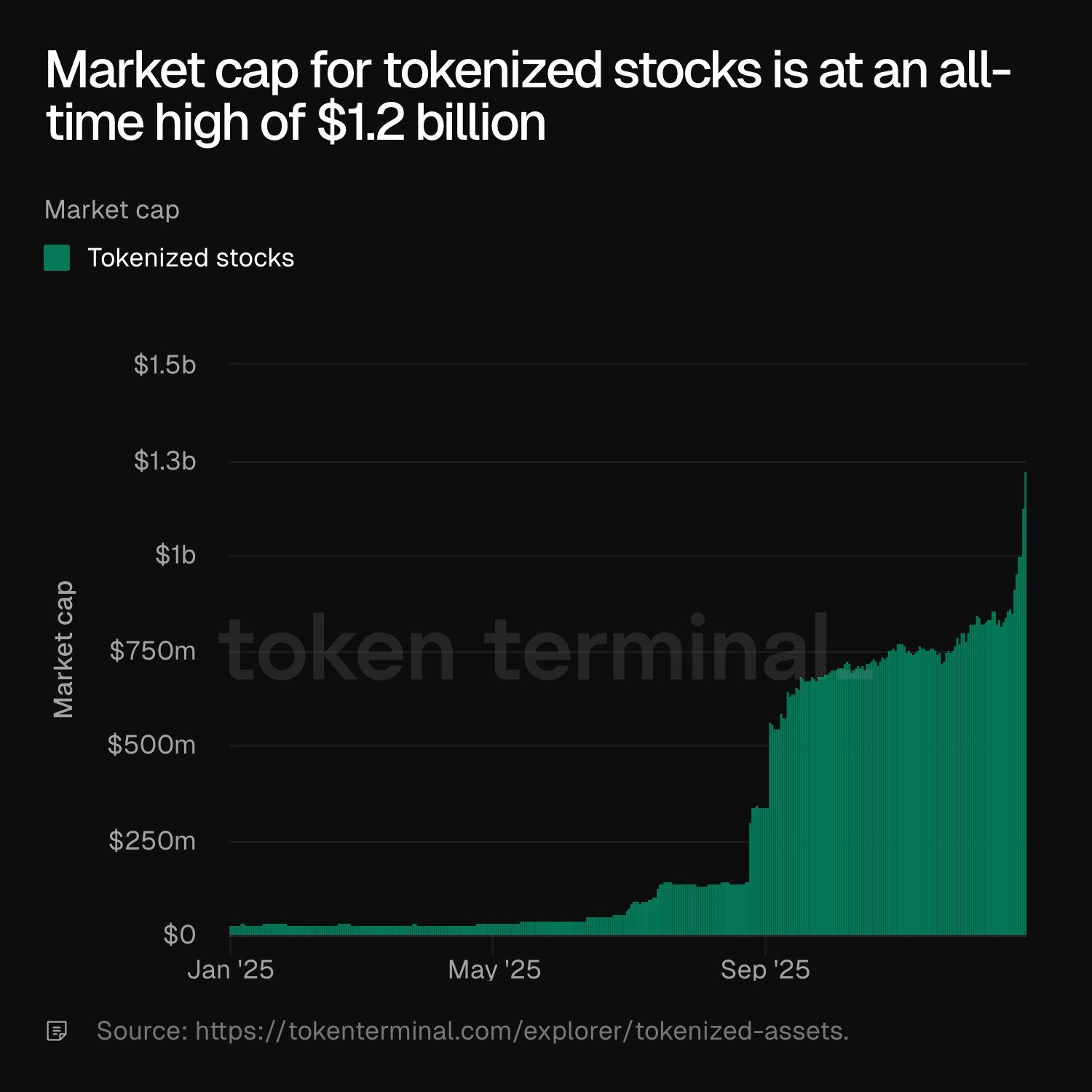

As volatility hits the crypto market, buyers are shifting their bets. Tokenized shares, which deliver actual shares onto the blockchain, are at the moment skyrocketing to new all-time highs. Analysts say the market continues to be in its infancy.

Supply: Token Terminal

Token Terminal in contrast present tokenized shares to stablecoins in 2020, however this was earlier than stablecoins exploded right into a market that’s now price lots of of billions of {dollars}.

What are tokenized shares?

Tokenized shares are digital tokens that signify real-world shares like Apple, Tesla, and ETFs. These belongings can be introduced on-chain utilizing blockchain know-how, permitting buyers to commerce conventional shares inside the cryptocurrency ecosystem.

These fall into the broader class of Actual World Property (RWA), which goals to attach conventional and decentralized finance.

RWA progress units the stage

The RWA sector has additional expanded over the previous three years. The entire quantity locked in RWA has jumped from about $750 million in 2023 to greater than $17 billion at the moment, largely on account of tokenized U.S. authorities debt.

As yields on conventional DeFi merchandise declined, buyers started on the lookout for new sources of steady returns. Tokenized shares are rising as the subsequent step on this development.

Regulatory surroundings turns supportive

Earlier makes an attempt to tokenize shares thus far, together with an providing by a serious alternate in 2021, have failed largely on account of regulatory strain. The surroundings seems completely different this time.

Modifications in US political management and elevated regulatory readability are encouraging each monetary establishments and crypto-native corporations to return to the area. Nasdaq’s proposal for tokenized securities and the US SEC’s approval for DTCC to check tokenized companies added confidence to the market.

Associated: Cryptocurrencies proceed to consolidate: Listed here are the important thing occasions to observe this week

Market progress is pushed by a small variety of giant gamers

In 2025, tokenized shares skilled sturdy progress, particularly within the second half of the yr. Based on DeFiLlama, the sector at the moment has round $635 million in whole worth locked in, making it one of many largest RWA classes.

Most of this progress got here from Ondo Finance and Backed Finance xStocks, which collectively account for almost 90% of the market. Standard tokenized belongings embrace ETFs like SPY and QQQ, in addition to shares like Tesla and Google.

Additional progress is predicted sooner or later

Seeking to the longer term, analysts count on tokenized shares to develop even quicker. Leon Wideman, Head of Onchain Analysis, mentioned tokenized shares and merchandise might grow to be the quickest rising asset class in 2026.

Whole tokenized belongings have already reached almost $330 billion, a virtually three-fold improve from their 2023 lows, suggesting this development is barely simply starting.

Associated: Bitfinex eyes multi-trillion greenback market, RWA tops crypto returns in 2025

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.