- WLD soared 9.57% in 24 hours to $9.24 throughout the launch of Private Custody.

- Worldcoin's pivot to consumer information administration elevated its market capitalization by 56.31%.

- Kenya's ban prompts WorldCoin's strategic shift to give attention to privateness.

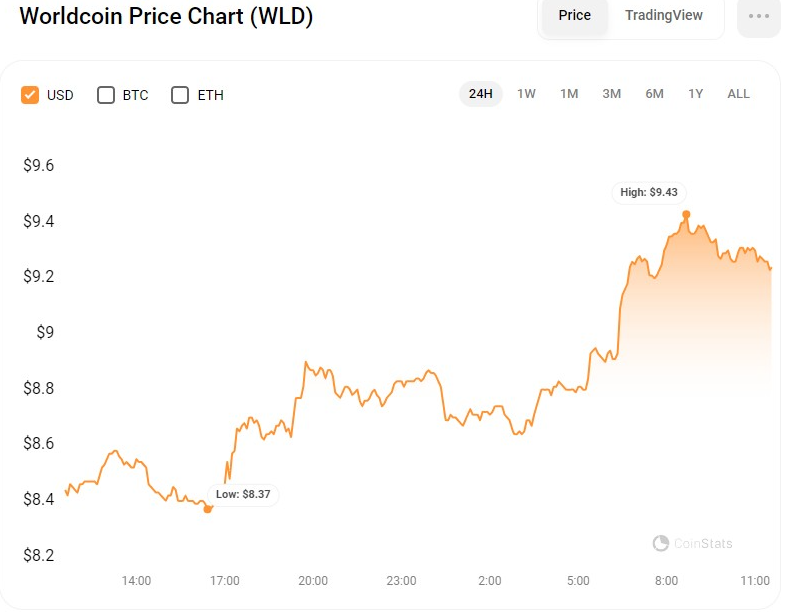

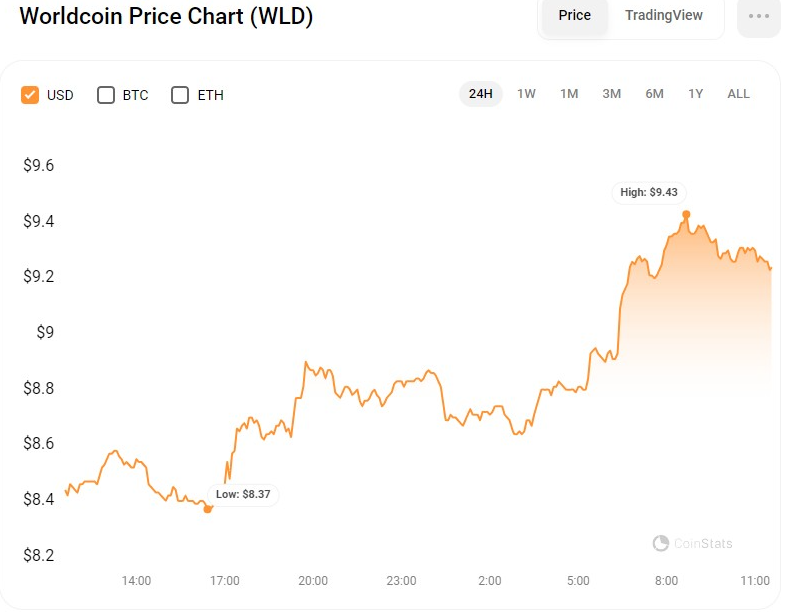

With the launch of the personal custody characteristic, the worth of World Coin (WLD) has elevated considerably, surging to a 7-day excessive prior to now 24 hours. Through the rally, the worth of WLD fluctuated between intraday highs and lows of $8.35 and $9.45, respectively. On the time of writing, bullish momentum nonetheless dominates the market, with WLD buying and selling at $9.24, up 9.57% from its intraday low.

The event comes amid rising privateness considerations and elevated regulatory scrutiny in numerous international locations, together with a distinguished ban in Kenya. This new characteristic represents a strategic pivot for the cryptocurrency undertaking, which is targeted on giving customers extra management over their private information and addressing privateness points which are shadowing its operations.

Transition to non-public administration of World Coin

Worldcoin's introduction of Private Custody marks a big shift in its strategy to consumer information administration. This characteristic permits customers to maintain private information on their machine, equivalent to photos and metadata used to generate World ID iris codes.

The transfer is in response to the rising demand for privateness and safety within the digital age, the place information breaches and unauthorized entry are a priority. Worldcoin goals to foster a safer and trust-based relationship with its consumer base by giving customers full management over their information.

Implementing Private Custody additionally permits superior options equivalent to facial recognition. This characteristic strengthens Worldcoin's safety framework by permitting customers to confirm their identification via processes on their native machine. This improvement not solely advances in defending consumer information, but additionally in constructing a user-centric expertise ecosystem that prioritizes particular person privateness and autonomy.

Addressing privateness points

The choice to cease storing private information on Worldcoin's servers was made in response to varied privateness considerations and regulatory challenges world wide. Particularly, the undertaking confronted setbacks in Kenya, the place the federal government banned WorldCoin from working, citing safety and information privateness points. This ban highlights the vital want for initiatives like WorldCoin to undertake stricter information safety measures and guarantee compliance with native laws.

In response to those challenges, Worldcoin has taken a proactive strategy by implementing private storage and discontinuing non-obligatory information storage throughout Orb visits. The transfer goals to strengthen the undertaking's dedication to privateness and safety and guarantee customers are in command of their private data.

WLD/USD Technical Evaluation

On the WLDUSD 24-hour worth chart, the vortex indicator monitoring the pattern course reveals a powerful bullish rise, with the uptrend line (blue) about to interrupt above the downtrend line (pink). This means {that a} turnaround is probably going within the close to future as shopping for strain will increase and sellers lose management. This sample signifies that optimistic momentum within the WLD market is gaining momentum and is prone to proceed within the close to time period.

The Stochastic RSI rises from the oversold stage to 34.91, supporting the notion of a bullish reversal as momentum strikes in direction of the purchase aspect. This sample can be in line with the elevated quantity noticed in latest buying and selling classes, indicating elevated investor curiosity and involvement in rising costs.

Furthermore, WLD's buying and selling quantity and market capitalization elevated by 10% and 56.31%, respectively, to $1,468,358,030 and $434,087,770 throughout the rise.

The Relative Volatility Index (RVI), which measures a safety's volatility, has additionally risen, suggesting costs might rise. An upside breakout might be close to as RVI is above the sign line and has a score of 57.68. This might appeal to extra merchants seeking to revenue from the uptrend, pushing the worth greater within the brief time period.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.