- Senator Lumis launched a invoice that would come with code in mortgage approvals.

- The invoice targets youthful patrons and aligns with FHFA’s latest crypto directive.

- Critics cite Crypto’s volatility because the default danger for mortgages.

Wyoming Sen. Cynthia Ramis proposed a regulation that if handed, it might require housing finance establishments to think about digital belongings when evaluating mortgage functions.

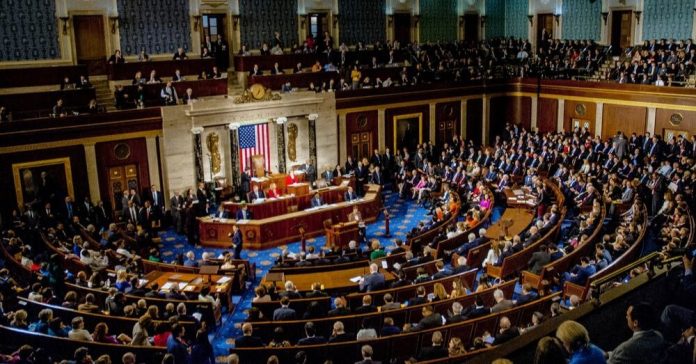

The invoice sparked debate on Capitol Hill, and supporters see it as a step in direction of critics warning of monetary modernization and potential dangers.

The invoice is linked to the latest federal housing directive

The proposed regulation, referred to as the twenty first Century Mortgage Act, is meant to codify latest orders issued by the Federal Housing Monetary Establishments (FHFA).

The order directed two main US mortgage patrons, Fannie Mae and Freddie Mac, to take cryptocurrency into consideration as a part of their single-family mortgage asset valuation.

Senator Lumis issued the invoice shortly after the FHFA directive, saying Congressional motion is important to make sure the order turns into everlasting.

In keeping with the senator, the invoice displays a contemporary strategy to wealth constructing, particularly for younger People who usually tend to personal digital belongings than conventional wealth or financial savings.

Focusing on youthful generations of patrons

Citing information from the US Census Bureau, Ramis famous that homeownership for People beneath the age of 35 stood at simply 36% within the first quarter of 2025.

For a lot of of this demographic, crypto represents a good portion of web value.

Due to this fact, the invoice seeks to handle the rising want to think about not solely fiat and conventional belongings, but additionally all types of private wealth throughout the mortgage approval course of.

The invoice permits debtors to retain their cryptocurrency holdings with out being pressured to liquidate them in US {dollars} for mortgage concerns.

This strategy corresponds to how wealth is evolving, and acknowledges the financial realities of recent youth, Ramis argues.

Pushback from democratic lawmakers

Regardless of the potential to broaden monetary inclusion, the invoice faces early resistance.

A number of Senate Democrats have expressed concern over the FHFA order and, in flip, proposed regulation.

In a letter despatched to FHFA Director William Pulte on July twenty fourth, they urged the establishment to totally assess the dangers and advantages of integrating cryptography into mortgage assessments.

In keeping with the letter, debtors who depend on unstable digital belongings could have a tough time changing their holdings into money throughout recessions.

This might improve the chance of defaulting your mortgage. This impacts not solely particular person debtors, but additionally the broader monetary system.

Wider cryptography on the horizon

The twenty first century mortgage regulation is only one of a number of crypto-related payments that can move by means of Congress.

Senator Ramis is main one other effort to ascertain a complete framework for the digital asset market.

In the meantime, the Senate is reviewing one other invoice that bans the Federal Reserve from launching central financial institution digital foreign money (CBDC) after receiving approval from the Home earlier this month.

An analogous invoice has already been launched by Consultant Nancy Mace on the Home facet.

The MACE invoice, referred to as the Crypto Modernization Act, requires mortgage lenders to think about the worth of digital belongings held in securities buying and selling accounts associated to crypto exchanges throughout the credit score valuation course of.

(TagStoTRASSLATE) Market (T) Coverage and Regulation (T) Cryptocurrency Information