- EGRAG Crypto shares XRP charts and informs you of potential future worth actions.

- XRP has been buying and selling at $2.23, down 5.8% over the previous month at $24 hours.

- The $2 factors are the primary help degree, whereas $3.00 stays within the resistance zone.

Ripple’s XRP has not too long ago attracted renewed group curiosity regardless of the downward pressures of costs. Regardless of a large regulatory victory as a result of firing of the SEC lawsuit, XRP has not seen many anticipated sharp worth surges.

This worth motion assessments key help ranges and encourages analysts to weigh the short-term dangers in opposition to long-term bull forecasts.

XRP assessments help for necessary $2.22: What Egrag’s chart exhibits

Analyst EGRAG highlighted the significance of the XRP’s $2.22 degree. His chart evaluation identifies this worth vary as necessary instant help. That is an space that has been examined a number of occasions beforehand.

In keeping with Egrag, if patrons efficiently comply with this degree, they might doubtlessly return in direction of the primary resistance space round $3. Nevertheless, a sustained break under $2.22 might enhance short-term bearish pressures and will retest XRP’s low help zones.

Lengthy-term view: Analyst repeats $15 goal after 600% revenue

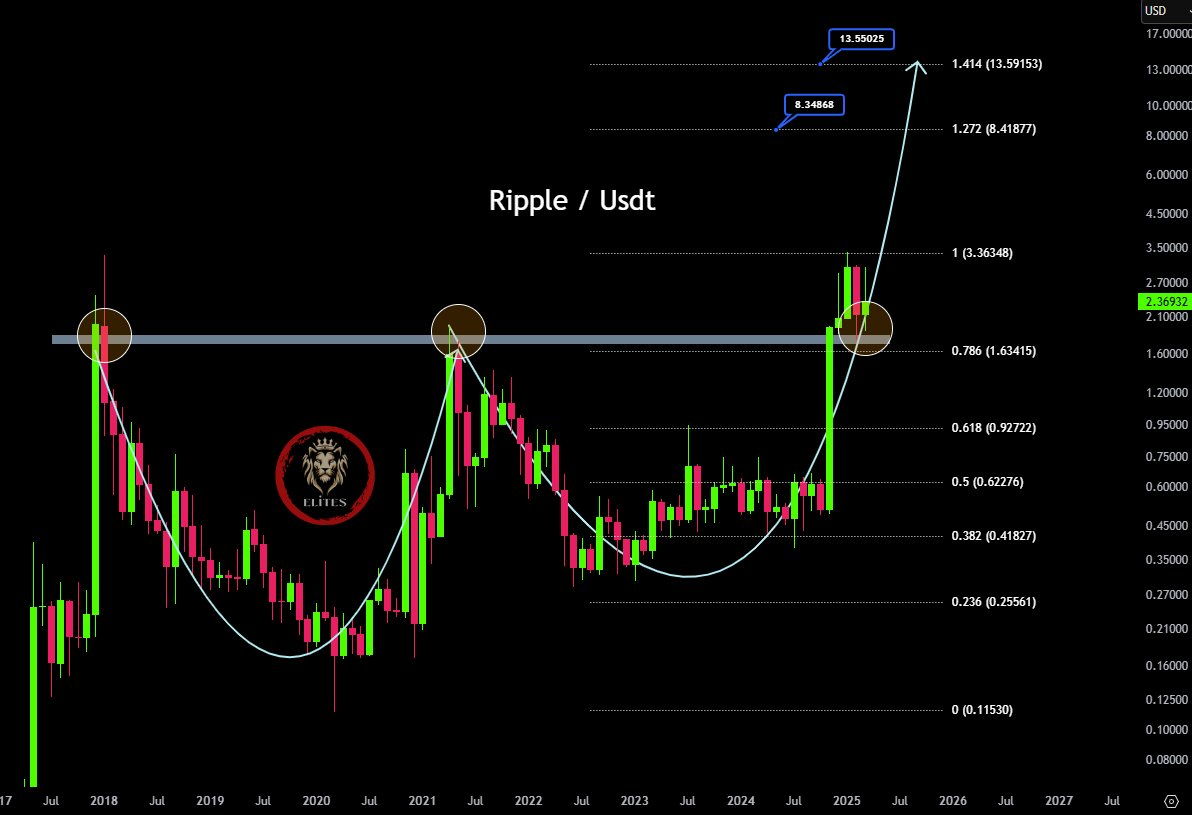

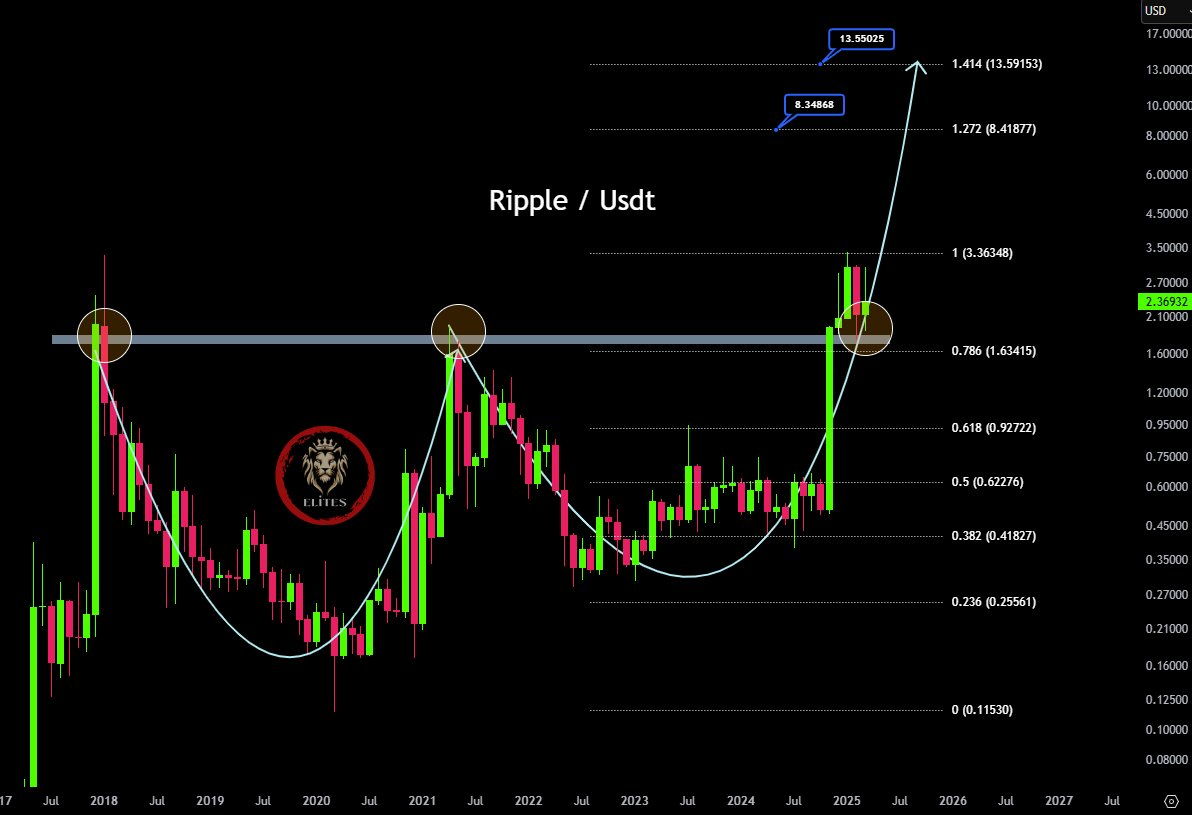

Analyst Cryptoelite, who provides a really bullish long-term perspective, not too long ago reaffirmed XRP’s daring $15 worth goal. Particularly, the analyst reportedly first shared the outlook when XRP traded almost $0.50.

They cite the important break above XRP’s multi-year resistance (previously $1.95-$2.10), and the potential formation of huge cups and deal with patterns as a significant technical affirmation.

The Cryptoelite evaluation, primarily based on Fibonacci growth, factors to a possible goal of almost $8.34 and, in the end, $13.55-$15 if sturdy bullish momentum continues, is much like earlier market cycles.

Associated: 600% Name Anatomy: Analysts clarify why XRP’s $15 goal stand

Regulation readability and ETFs hope to stay necessary catalysts

Supporting these bullish technical outlooks is a major constructive change within the US regulatory surroundings of XRP. Researcher Anders factors out SEC case termination, amongst different issues, to get rid of Ripple’s main authorized uncertainty. He additionally notes the abolition of SEC’s Employees Accounting Breaking Information 122 (SAB 122). This enables regulated US banks to offer cryptographic safety providers.

Associated: “You are not pondering”: Analyst XRP charts actually counsel a large worth surge

Additionally, hypothesis surrounding the US potential spot XRP ETF continues to develop. Nate Jelach, a widely known ETF skilled, calls such ETFs “inevitable.” The forecast market information additionally displays excessive group expectations, indicating the 82% recognition likelihood of approvals that would happen this 12 months not too long ago. ETF approval is extensively seen as a possible sport changer that may appeal to key institutional capital to XRP.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.