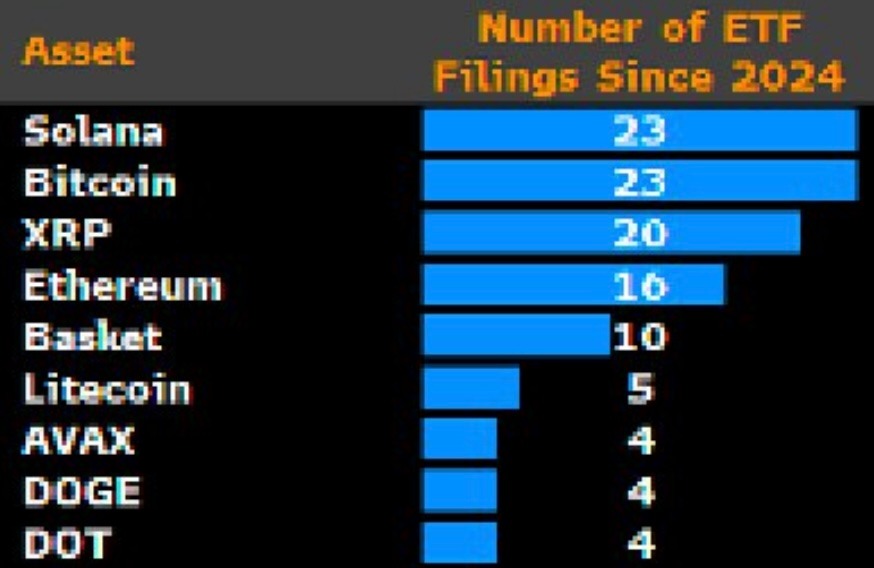

- The SEC at the moment has 155 cryptocurrency ETF filings, led by Solana, XRP, Bitcoin, and Ethereum.

- The federal government shutdown delayed choices, pushed again deadlines and created a backlog.

- Specialists say the basket wins as a result of TradFi favors index ETFs and lively crypto ETFs over single tokens.

A brand new abstract by James Seyffart exhibits that 155 crypto ETF functions are awaiting SEC motion. That pile has grown over the previous yr as issuers pursue regulated wrappers for cash past Bitcoin and Ethereum.

Now in its third week because the U.S. authorities shutdown, SEC staffing is at a minimal, which delayed choices and widened strains. This bottleneck will form the approval and denial panorama over the following 12 months.

Solana leads spot ETF utility rush

Among the many 155 crypto ETFs, varied fund managers have utilized to the US SEC to supply 23 Spot Solana (SOL) ETFs. Highlight Solana ETF functions embody:

- canary capital

- Van Eck

- 21 shares

- Bit-by-bit asset administration

- grayscale funding

- franklin templeton

- Constancy Investments

Notably, practically all Spot Solana ETF functions, apart from Franklin Templeton and Constancy Investments, had been finalized by the top of October 2025. Nevertheless, as a result of extended U.S. authorities shutdown, the SEC is working with a skeleton employees and will be unable to satisfy the ultimate deadline.

Associated: 21Shares recordsdata INJ ETF as injective, joins elite group with a number of ETF bids

Bitcoin has the identical variety of ETF functions as Solana within the US. There are 20 functions for XRP ETF and 10 functions for Ethereum.

Why Basket can beat single token funds

The U.S. crypto ETF utility checklist is prone to exceed 200 within the subsequent 12 months, in keeping with Bloomberg ETF skilled Eric Balchunas. At present, 35 completely different crypto property are included within the checklist of crypto ETF functions, together with meme cash comparable to Dogecoin (DOGE) and Pudsey Penguins (PENGU).

Nevertheless, Nate Geraci, president of NovaDius Wealth Administration and organizer of ETFPrime, identified that it’s unlikely that TradFi traders will make the most of all single-token ETFs. As such, Geraci emphasised his bullishness on actively managed index-based crypto ETFs.

“There is no such thing as a manner Tradfi traders are able to trip out all these single tokens. They’ll take a multi-pronged shotgun method to the rising asset class,” Geraci famous.

Distinguished basket-based crypto ETFs embody:

- 21Shares Crypto Basket Index ETP (HODL) plans to put money into the highest 5 digital property by market capitalization.

- CoinShares Bodily Prime 10 Crypto Market ETP (CTEN) tracks the highest 10 crypto property by market capitalization.

- CoinShares Bodily Good Contract Platform ETP (CSSC) focuses on sensible contract-oriented cryptoassets.

- HASHDEX NASDAQ Crypto Index ETF (HASH11)

- 21 Share Crypto Basket Equal Weight ETP

What’s the anticipated market affect?

The crypto ETF rush within the US marks a serious turning level for mainstream adoption of digital property. Underneath President Donald Trump, all spot crypto ETFs are prone to be permitted, particularly after the US SEC approves generic itemizing requirements for commodity-based ETFs.

Subsequently, capital inflows into the crypto market will speed up within the coming months, according to the anticipated parabolic rise within the brief time period.

Associated: XRP Worth Prediction: US Authorities Shutdown Extends ETF Delays, Analysts Warn Draw back Threat

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.