- XRP is consolidating inside a slim vary above the main resistance stage between $2.70 and $2.77.

- This technical barrier must be damaged to unlock the potential for a November rally in direction of the $3.00 stage.

- Analysts be aware that the weekly Bollinger Bands are contracting, suggesting a definitive and risky breakout is imminent.

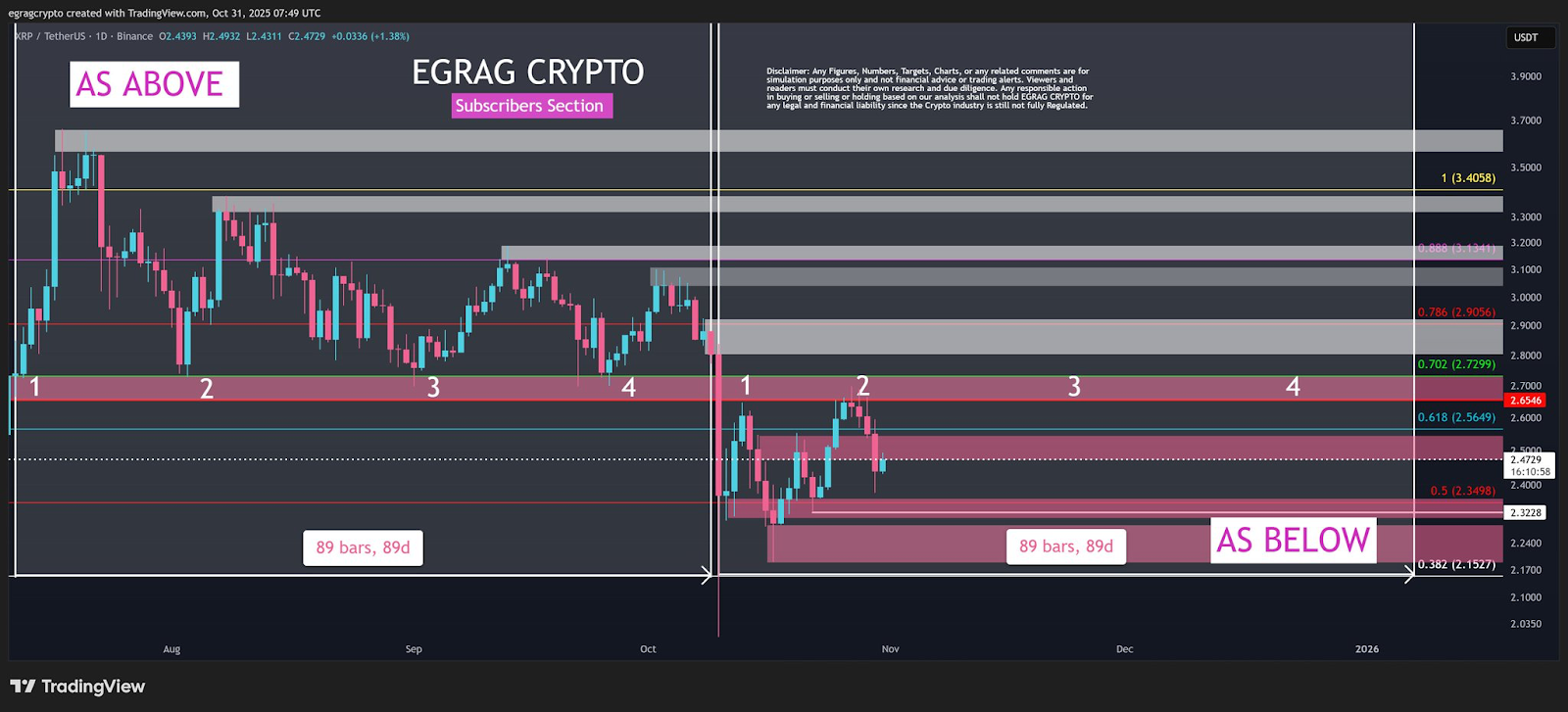

The worth of XRP has settled inside a slim vary because the market heads into November. The token’s path to a breakout above $3.00 will rely on whether or not it will possibly reclaim the essential $2.70 to $2.77 resistance zone at present. This evaluation by well-liked analyst Egrag Crypto focuses on the quick technical setup.

In keeping with the analyst, the XRP/USD pair has misplaced the important thing help stage at $2.77. This stage has now was a formidable resistance. Worth is at the moment constructing a consolidation sample primarily based on previous developments.

Associated: Ripple CTO hits again after analyst says XRP has “no actual use”

Mr. Eglag identified that:

“Traditionally, this setup builds 4 clear contact factors, and that fifth contact is the breakout second.”

Why is XRP consolidating beneath $2.77?

The present fiscal consolidation is said to the Fed’s macro-indecision. As a result of ongoing US authorities shutdown, the discharge of main financial indicators with a big impression has been postponed. Fed Chairman Jerome Powell acknowledged that this may have an effect on coverage choices in December 2025.

In consequence, the likelihood that the Fed will minimize charges by 25 foundation factors in December has fallen from 88% to 67%, in accordance with merchants at Calsi, however the likelihood that the Fed will keep coverage has elevated from 10% to 29% as of press time.

XRP Technical: $2.77 Wall and Imminent Squeeze

At present, the $2.77 stage is the primary technical barrier. The XRP/USD pair has struggled to interrupt above this value since falling beneath it in the course of the crypto crash on October eleventh. What was as soon as help has now was sturdy resistance.

This value stage had beforehand been held as help from July to early October. The weekly Bollinger Bands indicator is at the moment contracting. This technical sample signifies {that a} risky and definitive breakout is imminent.

Associated: Group insider says XRP value will ‘explode’ if IMF adopts token as E-SDR

Lastly, the market can also be contemplating the chance of a delay within the itemizing of spot XRP ETFs. Greater than a dozen purposes are pending, elevating bullish expectations. The latest listings of Solana, Litecoin, and Hedera spot ETFs recommend that XRP may very well be subsequent. On this setup, a “information promoting” occasion is more likely to happen, which might result in additional risky consolidation somewhat than a direct rally.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.