- XRP > $300 million web spill commonplace from April 1-13

- Value bounce over the weekend didn’t reverse the development. Outflow controls influx

- Analyst battle: Egrag is first a possible $1.40 DIP. Steph Eyes 486percentRally

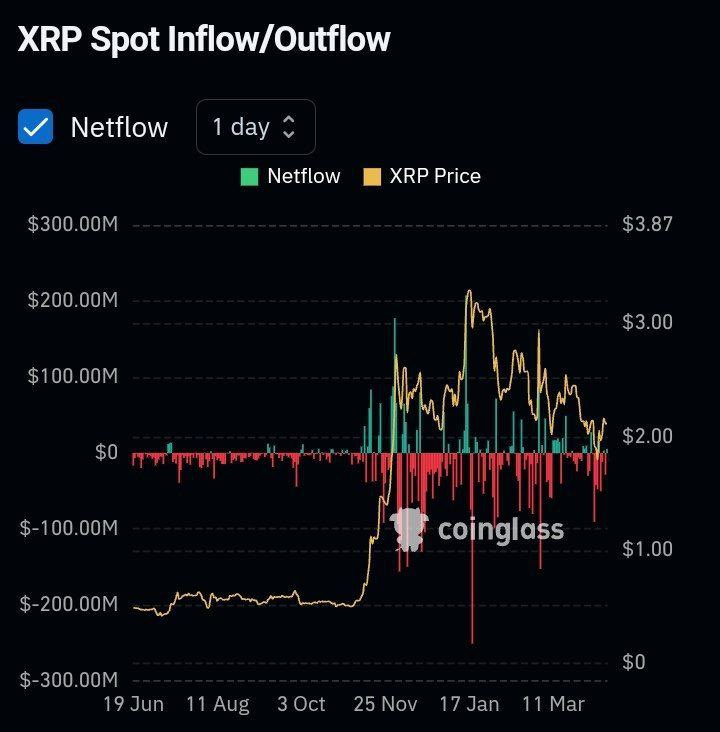

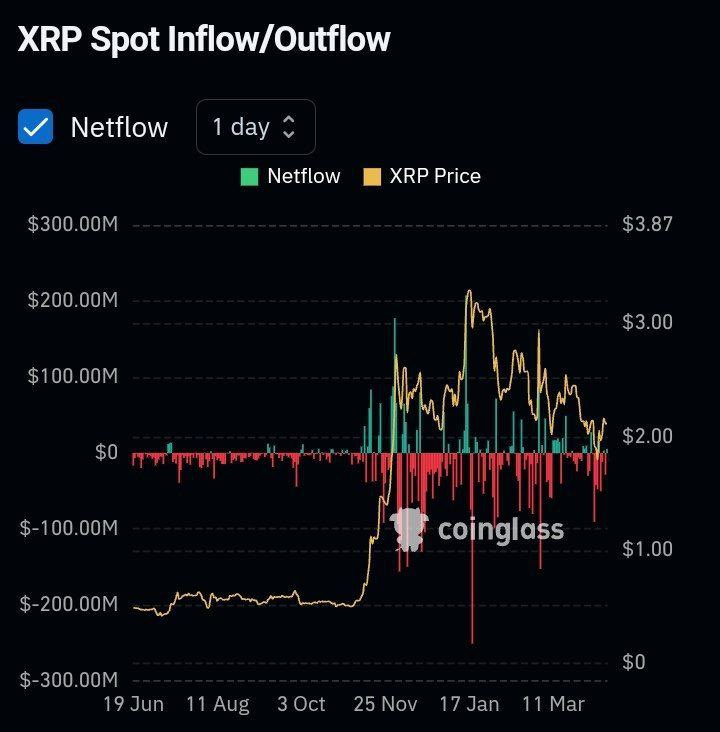

XRP recorded greater than $300 million web outflows within the first 13 days of April, in response to Coinglass information. Brief-lived worth will increase over the weekend have been unable to reverse the broader promoting development. This bearish move information is in stark distinction to bullish alerts recognized by some technical analysts.

Why does XRP concentrate regardless of the value bounce?

XRP continues to face stress this month. The online move chart reveals days redder than greener days in April. Even on inexperienced days have been delicate and couldn’t match the amount seen in the course of the spill.

Solely 4 of the 13 days ended with optimistic web move, leading to a complete of $56.08 million inflows. In distinction, the spill reached $311 million by Sunday, April thirteenth. The best every day spill on April sixth was a complete of $90 million.

Associated: Whales accumulate XRP: Are they betting on this bullish chart sign?

That is decrease than the $150 million spill date seen in January and March, however it’s nonetheless cautious out there. The tempo of the leak has slowed barely, however adverse feelings proceed to dominate.

Weekend bounce brings short-term optimism

XRP rose barely over the weekend. This precipitated a quick optimism among the many bulls. Nevertheless, many traders used worth will increase as a chance to depart the value at a greater worth.

The up to date sale already provides extra crimson to the downbeat month. Constant outflows put XRP costs beneath stress. With cash steadily leaving the XRP market, the value of belongings continues to be beneath stress.

Break up Analyst: Will XRP Dip come, or will they transfer on to the primary gatherings?

This cautious image drawn from the fund move conflicts with an evaluation that’s zeroed in a selected chart sample. Analyst EGRAG warns of the opportunity of short-term DIP as XRP is predicted to be as little as $1.40 earlier than an enormous rebound. XRP is buying and selling at $2.14, with a 1.4% DIP for the previous day, lowering weekly earnings to 26.6%.

Nonetheless, the analysts maintain his place. He sees long-term progress potential and descriptions three key worth targets: $7.50, $13 and $27. He builds on this outlook on chart patterns and long-term tendencies.

Egrag additionally highlighted the position of the market narrative. He mentioned monitoring information and feelings alongside technical evaluation is vital to understanding worth actions.

Associated: XRP worth forecast April 11: Surge assessments $2.38 after tariffs droop

In distinction, analyst Steph has recognized a bullish MACD crossover on the XRP chart, calling it a “golden MACD cross,” suggesting {that a} main gathering is ongoing.

The sign final appeared in late October 2024, when XRP surged greater than 486% inside a number of weeks, rising from beneath $0.50 to over $2.40. Steph believes the present crossover displays its historic setup and is predicting an analogous worth leap of round 486% over the subsequent 4-5 weeks.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.