- XRP costs adopted the same fractal sample to the 2017/2018 Bull Rally over the previous 12 months.

- In accordance with technical evaluation, XRP costs are prepared for the following lift-off heading into the euphoric part of the macrobull cycle.

- Ripple’s sturdy foundations have strengthened XRP’s bullish sentiment within the close to future.

XRP (XRP) costs are prepared for parabolic gatherings within the coming months, technical analyst Egrag Crypto repeated. Crypto analysts famous that after XRP costs consolidated from the start of this 12 months, they’re able to enter the euphoria part of the 2025 Crypto Bull Market.

Egrag Crypto has set its XRP worth goal at $10 within the close to future, based mostly on previous efficiency. Moreover, XRP costs outperform necessary transferring common bands in greater time frames regardless of current integration.

Crypto analysts have expressed their opinion that the continuing Macrobull Market at XRP costs displays the 2017/2018 cycle.

Why is eGrag Crypto bullish as a result of XRP is priced first?

Technical tailwind

Following the current Crypto Bullish Rebound, led by Bitcoin (BTC), XRP costs are break up from a triangle that falls within the day by day timeframe. Giant Altcoin with a totally diluted score of round $300 billion is appropriate for rising within the close to future.

Medium bullish sentiment has been confirmed by MACD indicators, and the MACD line has just lately crossed the sign line and 0 line throughout the progress of the improved histogram.

Authorized readability of main jurisdictions

XRP’s bullish momentum was strengthened by authorized readability in main US-led jurisdictions. The US Securities and Change Fee (SEC) might additionally contribute to the rally by withdrawing the lawsuit in opposition to Ripple.

In the meantime, the crypto market is awaiting last approval of a transparent act by the Senate, particularly after President Donald Trump enacted the Genius Act. The XRP ecosystem is effectively positioned to learn from these two legal guidelines, significantly as XRPL investigates distributed monetary (DEFI) improvement.

Associated: XRP Worth Forecast: XRP Eyes $3.2 Surge in curiosity in breakout derivatives

Excessive demand from institutional traders for whales

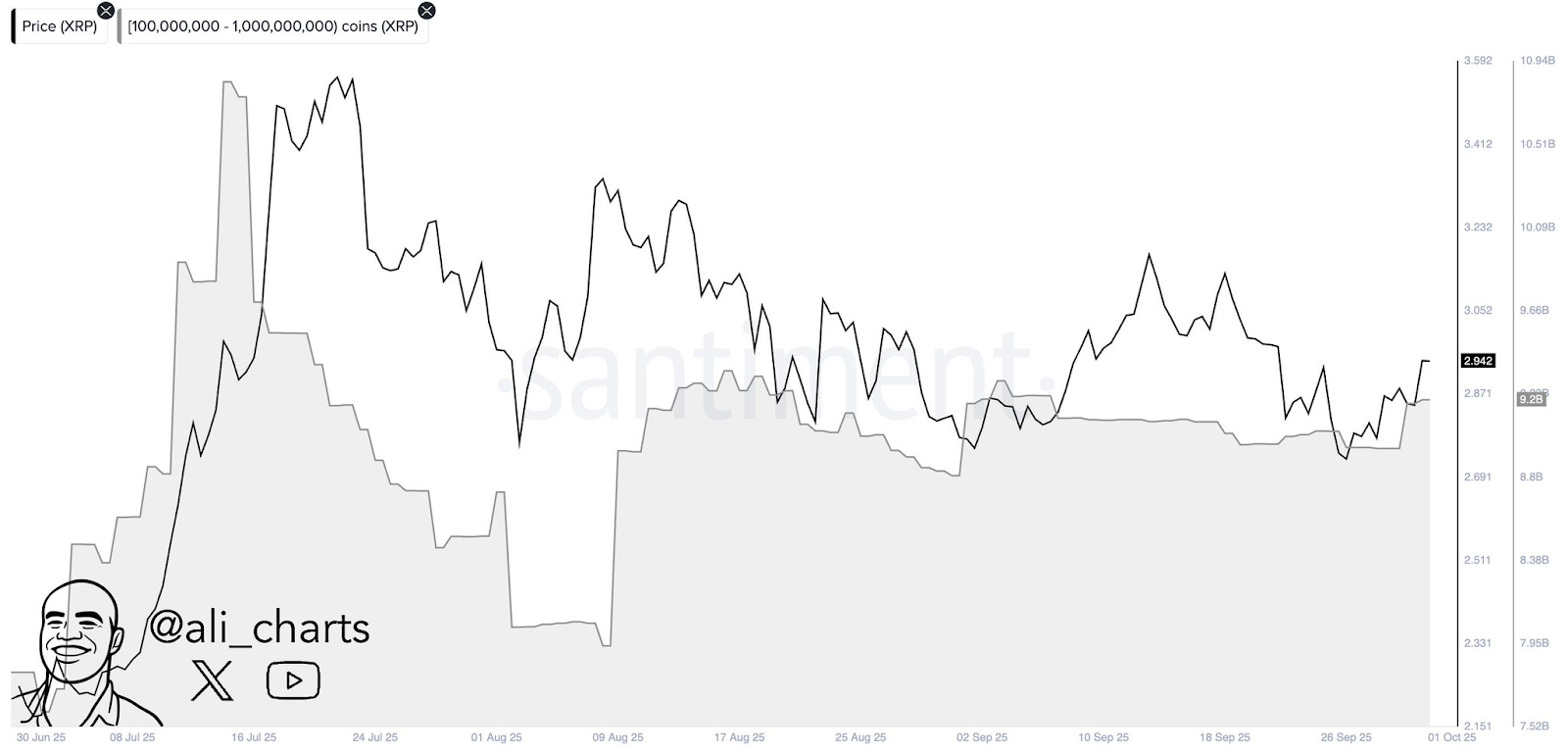

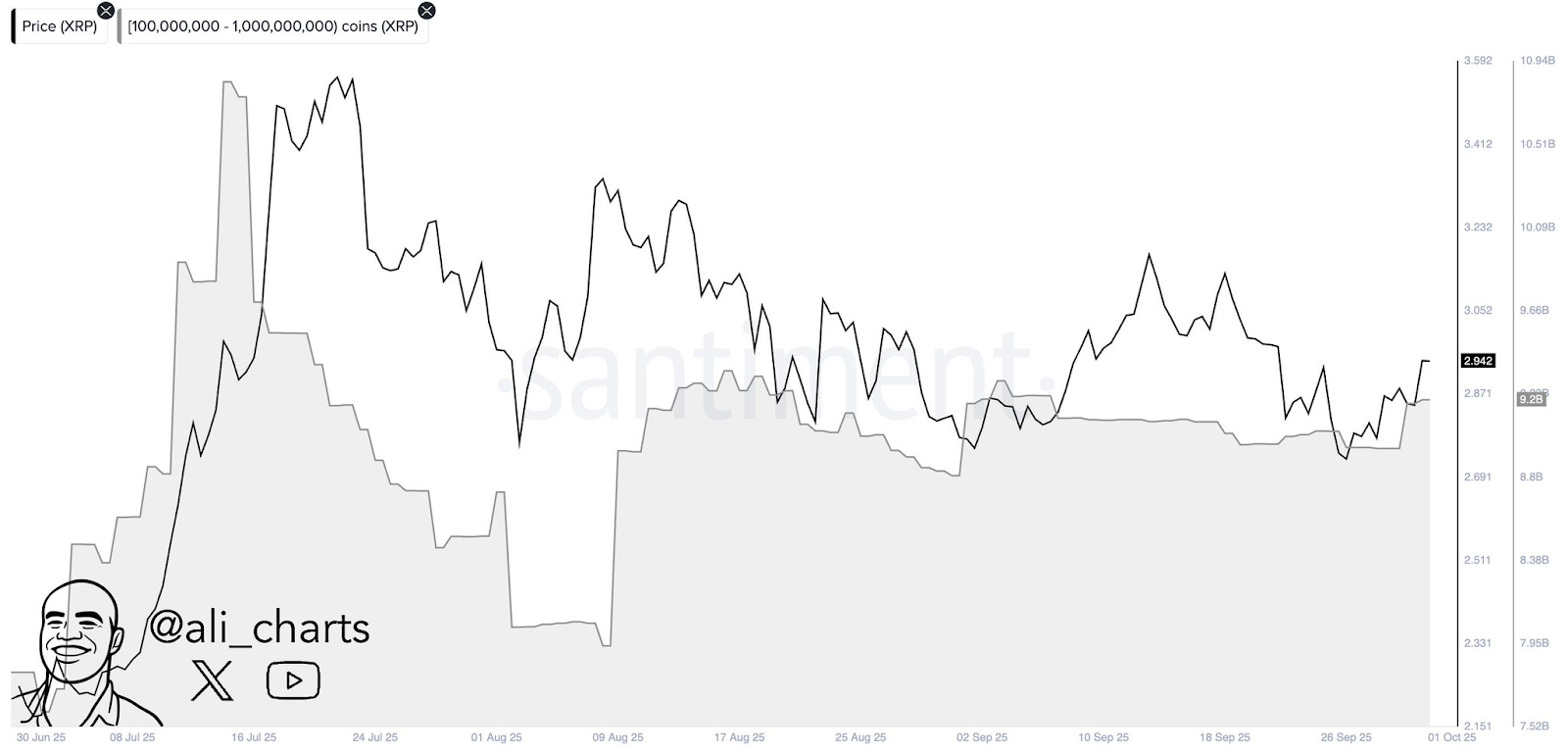

On-chain knowledge exhibits whale accumulation

Whale traders with over 250 million XRP account balances have collected greater than 250 million cash this week, based on an on-chain knowledge evaluation from Santiment. As such, the group at the moment holds a complete of 9.2 billion XRP cash.

Spot ETF hype

XRP’s natural Dana by whale traders is obvious by means of US spot ETF hype. A number of fund managers have already filed to supply Spot XRP ETFs that embrace:

- Grayscale Spot XRP ETF

- 21 share XRP ETF

- Bitwise Spot XRP ETF

- Coin Share XRP ETF

- Canary Capital XRP ETF

- WisdomTree XRP ETF

After the US authorities closure ends, the Securities and Change Fee (SEC) is predicted to approve the Spot XRP ETF transaction. Moreover, brokers have already authorised basic itemizing standards for cryptographic spurring processes.

Associated: Bitcoin breaks $121K as SUI gear for XRP, Chain Hyperlink, Solana and breakout

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.