- Ripple goals to increase RLUSD Stablecoin via its community on Hidden Highway.

- XRP will likely be buying and selling above the 50-day transferring common for the primary time in months.

- Ripple’s cross-border funds community spans over 70 monetary establishments.

Ripple’s authorized battle with the US Securities and Alternate Fee (SEC) could lastly be approaching that conclusion.

On Wednesday, Ripple and the SEC filed a joint grievance to droop their pending enchantment, indicating {that a} much-anticipated settlement could also be imminent.

That is when Ripple introduced a $1.25 billion acquisition of main crypto brokerage firm Hidden Highway.

The event of the dual has introduced XRP costs to surge by 30% resulting from current lows, bringing again investor belief.

The XRP’s standing as a cross-border fee as tensions eased in world commerce and the US takes on a extra custody place underneath President Trump seems to be strengthening its place as a cross-border fee asset.

The SEC case for Ripple will enter the ultimate stage

The authorized battle between Ripple and the US SEC, which has been underway since December 2020, has undergone a crucial shift because the events filed a joint grievance to droop the enchantment.

The movement, confirmed Wednesday by authorized analyst James Phillan, paves the best way for a negotiated settlement.

XRP is reportedly labeled as a fee asset somewhat than safety, particularly underneath Sec Chair Paul Atkins, who has adopted a mushy regulatory strategy.

This reclassification reduces the regulatory danger of XRP and is in keeping with Ripple’s technique of driving world adoption of blockchain-based fee methods.

Though the complete phrases of the potential settlement haven’t been revealed, the suspension of authorized proceedings marks an vital step in Ripple’s growth efforts.

Ripple’s $1.25 billion Hidden Highway Deal goals for institutional progress

To deliver authorized readability into sight, Ripple has introduced the acquisition of Hidden Highway, a number one London-based brokerage firm recognized for its crypto liquidity options.

The $1.25 billion transaction is meant to strengthen XRP’s market infrastructure and speed up recruitment between banks and monetary establishments.

Ripple can also be anticipated to increase its new Stablecoin, RLUSD, past hidden street platforms. With this settlement, Ripple will enhance entry to liquidity and buying and selling effectivity within the establishment’s shopper chain.

The acquisition follows a number of strategic adoptions by Ripple in Europe and Asia, and focuses on constructing corporate-grade merchandise for cross-border settlements.

Hidden Highway’s present shopper base and multi-jurisdictional regulatory licenses present a springboard for a bigger worldwide attain, notably within the Asia-Pacific area.

XRP costs beat main expertise ranges

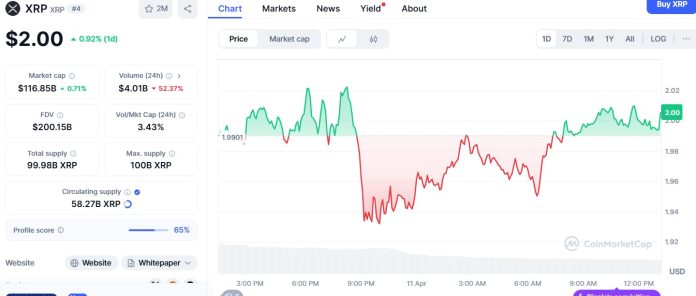

XRP costs have risen strongly, rising nearly 30% over the previous week. The token just lately surpassed its 50-day transferring common, buying and selling at $2.00 for the primary time since early 2024.

Supply: CoinMarketCap

Market analysts have recognized $2.50 as the subsequent zone of resistance that would probably profit additional if XRP enters value discovery mode.

On the draw back, XRP is supported at $1.50 and has clustered buy orders.

Presently, the relative power index (RSI) is positioned at 65, approaching an extra stage, indicating the opportunity of a short-term pullback.

Ripple’s current strikes have opened the door to rising volumes and renewing institutional curiosity, together with authorized progress and strategic acquisitions.

With a clearer regulatory course, XRP may probably see sooner integration into world finance by utilizing it as a bridge foreign money for real-time settlements.

World backgrounds are most popular by Ripple and XRP

The broader macro surroundings has additionally turn into extra supportive.

The US is engaged in new tariff negotiations between the European Union and China, reportedly easing fears of one other commerce conflict.

These developments have contributed to stabilizing the worldwide market, fostering dangerous sentiments and enhancing crypto belongings phrases.

Digital belongings like XRP may possible be much less regulatory obstacles within the coming months as President Donald Trump shifts in the direction of a pro-business stance again to workplace and SEC management.

If the Ripple-SEC settlement proceeds as anticipated, this marks some of the vital authorized options within the US crypto trade so far.

Ripple’s cross-border fee options already serve greater than 70 monetary establishments.

If confidence continues, extra banks could begin utilizing XRP as an asset for the bridge, additional rising demand and liquidity.

PostXRP jumped 30% as Ripple approached SEC funds, first planning a $1.25 billion acquisition with Coinjournal.