- XRP’s efficiency is mediocre, nevertheless it has its ups and downs right here and there.

- XRP has recovered from all crashes with a spike of over 10%, suggesting additional spikes.

- Bollinger Bands might slim and market volatility might lower.

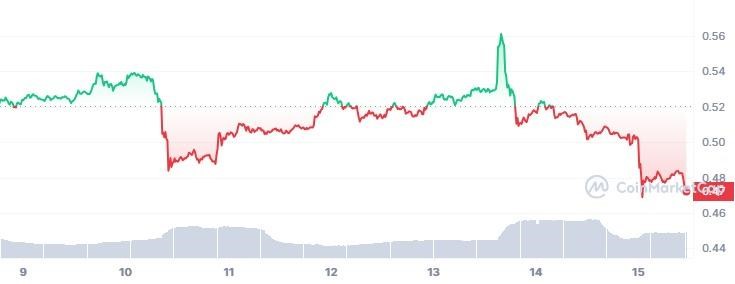

Contemplating the value volatility of the final seven days, XRP continues to carry out at mediocre ranges. There have been moments of ups and downs. However whereas the climbs had been powerful, the XRP crashes had been exhausting and generally vertical.

Wanting on the chart beneath, XRP opened on the earlier week’s open market value of $0.5203. Moreover, the token was in a position to commerce above its opening value halfway by means of June ninth and tenth. Nevertheless, it did not take lengthy for XRP to plunge from $0.5357 to $0.4869 on the identical day and enter the crimson zone.

After spending greater than a day within the crimson zone, XRP quickly accompanied the mountain into the inexperienced zone. Nevertheless, the momentum was held again by a bear. Nonetheless, the bulls had been sturdy on this event as they didn’t enable the token to sink deeper into the crimson zone. Because of this, XRP was slightly below the floor within the inexperienced zone.

On June 13, XRP rose above the crimson zone to a weekly excessive of $0.5611 from $0.5144. This rise in XRP was short-lived because the token started to crash beneath its beginning market value once more.

After declining from the $0.52 degree, XRP is at present beneath the bears’ stronghold at $0.4708 and heading in the direction of a deeper crimson zone.

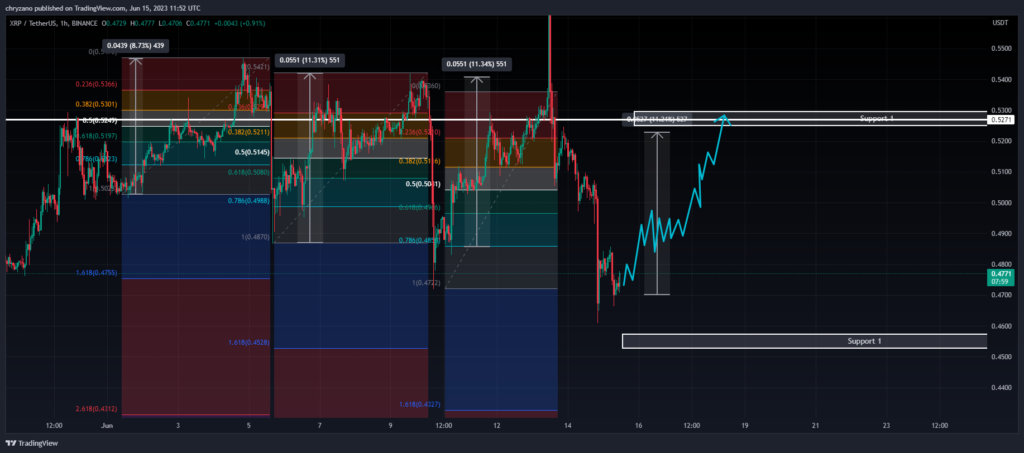

Given the above, the fib retracement exhibits how XRP rose after every crash. Moreover, in the event you examine the angle of the XRP trendline to the horizontal axis, you possibly can see that it has elevated. Every of those value will increase is accompanied by a rise of about 10% or extra. So, if XRP follows a crash-and-rise pattern, it might be time for XRP to rise once more.

If XRP follows this sample, we are able to count on it to rise by greater than 10%. Merchants trying lengthy might take into account getting into the market as situations look favorable for a rally.

For instance, XRP is at present retracing after touching the decrease aspect of the Bollinger Bands, indicating a potential rally in the direction of resistance 1 at $0.5271. In the meantime, the Bollinger Bandwidth indicator on the backside of the chart is shifting downwards. This implies that bandwidth might proceed to say no and market volatility might decline within the coming days.

Patrons may have to think about shifting the entry level nearer to the Easy Transferring Common of the Bollinger Bands. The above speculation could also be supported by the truth that XRP has risen when it has beforehand damaged out of the center band.

Disclaimer: The views, opinions and data shared on this value forecast are printed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly liable for their very own actions. Coin Version and its associates should not liable for any direct or oblique damages or losses.