- XRP costs commerce practically $2.84 in the present day after rejecting them in EMA clusters starting from $2.94 to $2.95.

- The broader SEC approval of cryptographic ETFs contains XRP and extends institutional publicity past BTC and ETH.

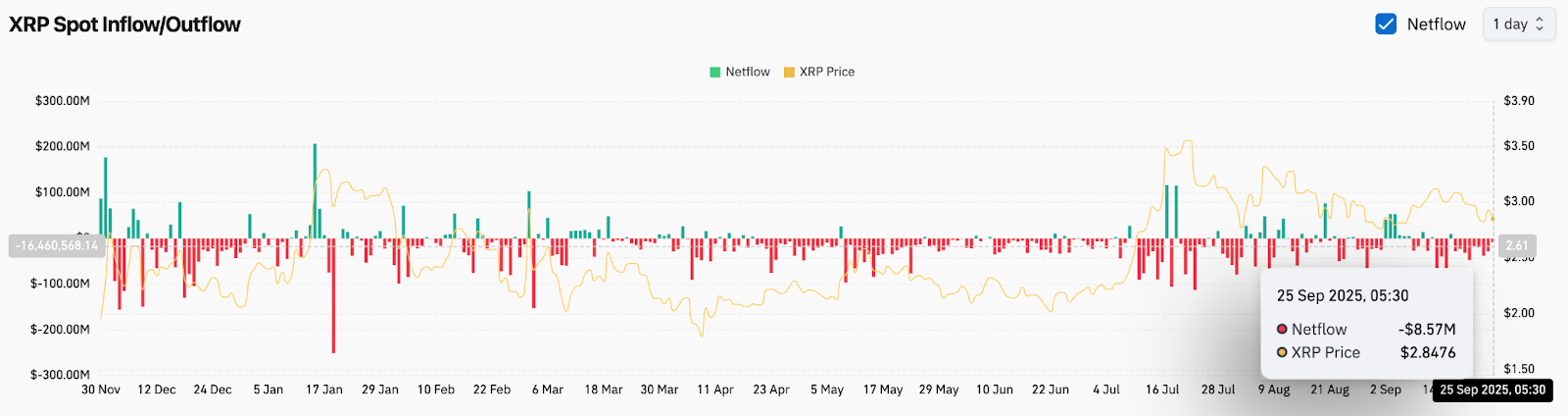

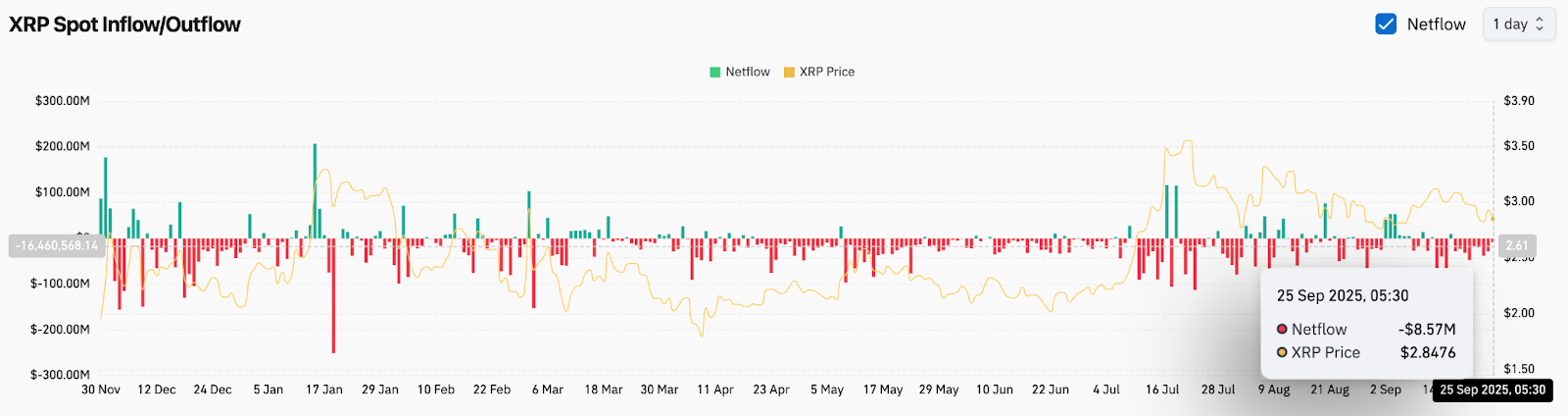

- The $8.57 million web movement reveals cautious sentiment, limiting makes an attempt to rise to $3.08 and $3.19.

At this time’s XRP costs are buying and selling at practically $2.84 and ski after rejecting on EMA clusters between $2.94 and $2.95. Quick assist is near $2.79-$2.83, however resistance stays at $3.08 and $3.19, with Fibonacci ranges. The present query is whether or not contemporary ETF headings can offset weak flows and revive momentum.

XRP Costs Take a look at Main Assist Ranges

The each day chart reveals XRP transactions inside a large integration vary of $2.72 to $3.30. The worth was under the 20- and 50-day Emma at $2.94, giving it momentum within the quick time period.

The Bollinger band expanded following final week’s decline, with the decrease band providing rapid protection of practically $2.79. The $2.83 100-day EMA has additionally turn out to be a key pivot. Conversely, the $3.08 Fibonacci Zone and $3.19 half-lacement ranges stay the following resistance checkpoint.

SEC approval provides optimistic catalyst

Emotions have improved after the US SEC accepted the Hashdex Nasdaq Crypto Index US ETF to work with the brand new generic checklist normal. Not like earlier approvals restricted to Bitcoin and Ethereum, the brand new framework permits funds to carry further property reminiscent of XRP, SOL, and XLM.

This transfer broadens institutional publicity to XRP and indicators modulation recognition past the utmost token. Market members see it as an vital step in mainstream integration regardless of widespread market debilitating short-term responses.

On-chain knowledge reveals ongoing leaks

Steady consideration to the alternate movement knowledge highlighting. On September twenty fifth, XRP recorded a web spill of $8.57 million, marking one other distribution date. Whereas the customarily sustained spill typically displays gross sales stress, the size was lighter in comparison with August, when the spill exceeded $50 million in a number of days.

Associated: Bitcoin Value Forecast: BTC holds $111K as ETF Demand and Company Buy Absorbed Provide

The optimistic accumulation is constant, suggesting that traders are hesitant to commit aggressively regardless of optimistic regulatory headlines. Except the movement transitions to sustained inflow, upward makes an attempt might fall under the $3.08-$3.19 resistance zone.

Technical outlook for XRP worth

Within the quick time period, XRP worth forecasts stay outlined at a transparent stage.

- Upside Stage: $3.08, $3.19, $3.30.

- Drawback stage: $2.83, $2.79, $2.72.

- Pattern Pivot: 20/50 EMA cluster $2.94, 200 EMA deep $2.60.

Approaching over $2.95 adjustments momentum in favor of patrons, however collapse under $2.79 dangers driving losses to $2.72.

Outlook: Will XRP go up?

The XRP path is determined by whether or not ETF-driven optimism outweighs the cautious movement. So long as XRP is above $2.79-$2.83, analysts imagine there may be room for restoration heading in direction of $3.08 and $3.19.

Dropping a $2.72 base weakens the bullish paper and will increase the danger of a deeper retrace in direction of the $2.60 zone. For now, XRP stays a retention sample, with ETF headings offering a long-term tailwind, however informing you of reluctance because of movement and technicality.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.