- The XRP value trades at $2.77 at present, reaching $2.74, and can merge after signing up for $2.60 at $2.60.

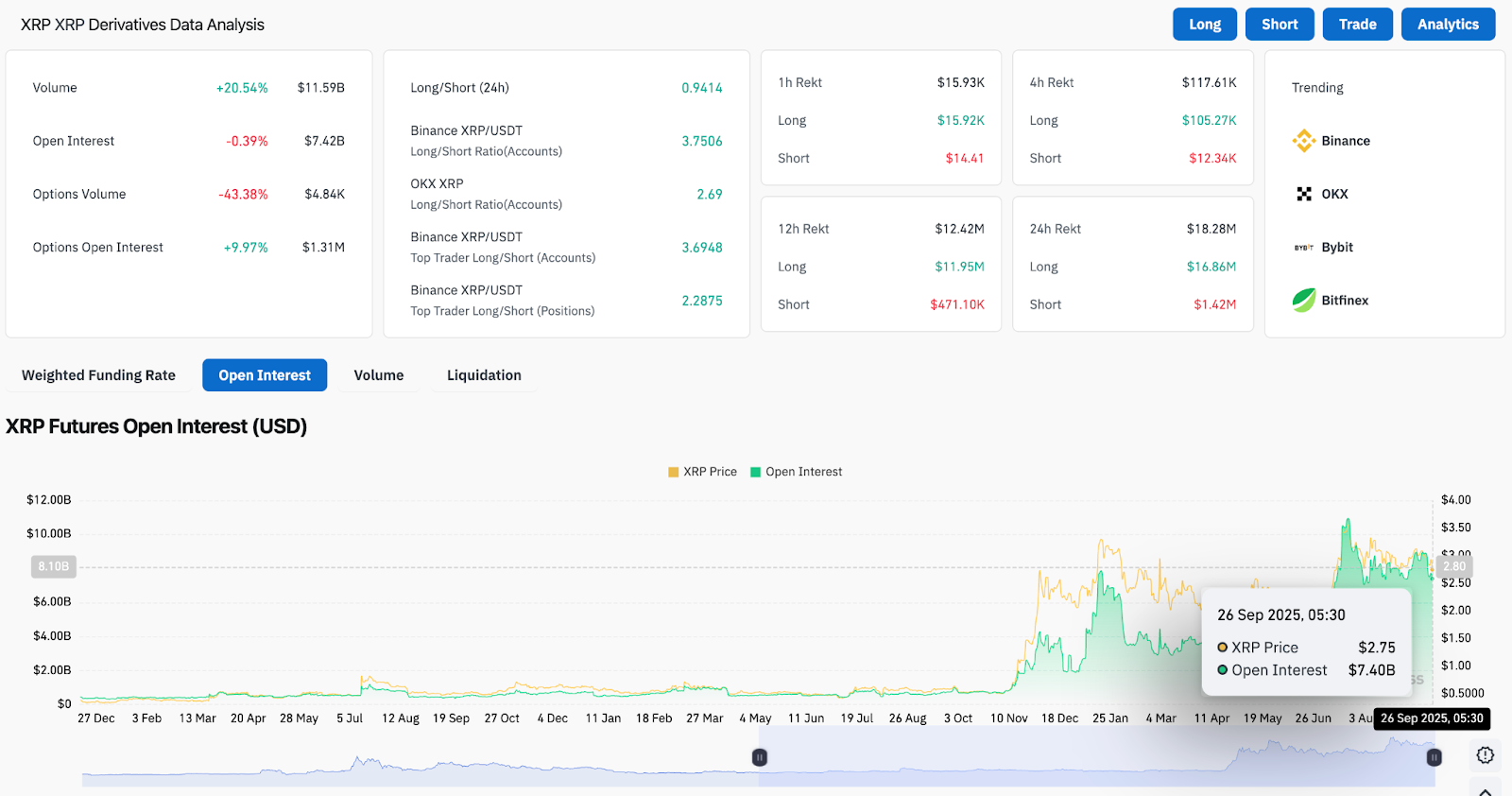

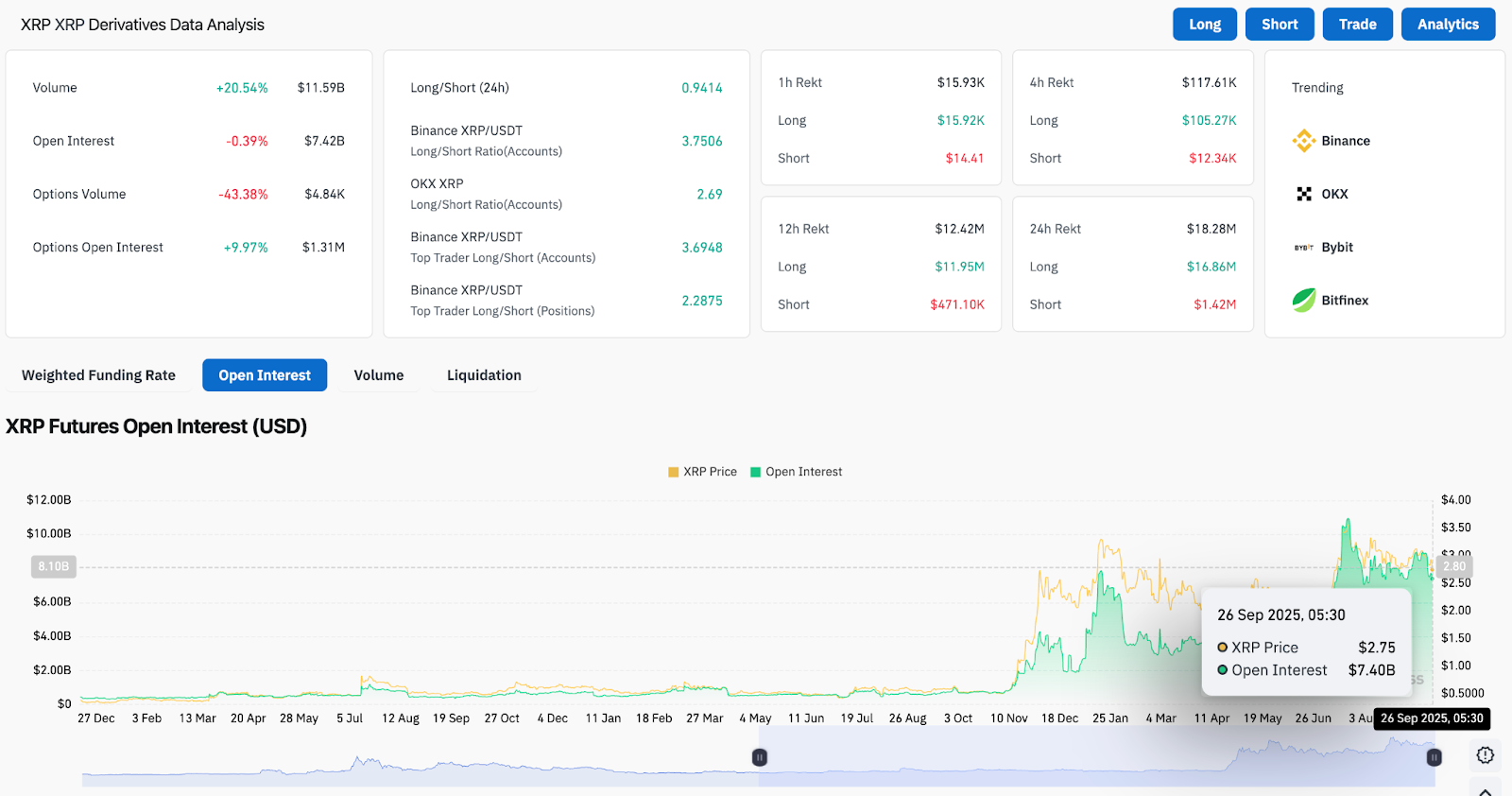

- Futures Open Curiosity slips to $7.4 billion as quantity jumps, signaling a cautious place within the derivatives market.

- The short-term chart reveals the bearish bias that sellers try and capp, attempting to regain resistance between $2.89 and $2.90.

XRP costs at present are buying and selling at practically $2.77, barely above the $2.75 zone after current strain pushed the token to a month’s low. Consumers try to stabilize costs on the predominant ranges of Fibonacci, however slide futures curiosity and bearish short-term alerts might be cautious in Outlook.

XRP costs are approaching essential assist

Each day charts present that XRP is $2.60 above its 200-day EMA after soaking it in $2.74. Fibonacci’s retracement ranges spotlight $2.95 and $3.08 as fast resistance bands, however $2.60 stays a very powerful assist ground.

A sustained closure of lower than $2.60 exposes $2.40 as the subsequent liquidity zone, marking a serious breakdown. The benefit is that regaining $2.95 will ease the strain and open the door for a retest of $3.19 and $3.30. The 39 RSI just isn’t a territory that has not but been offered, however displays weak momentum.

Associated: Solana Value Forecast: Sol struggles at $196 as futures curiosity drops

Futures information highlights cautious positioning

By-product information reveals practically $7.4 billion of favorable curiosity, slipping 0.39% over the previous day, even when buying and selling volumes rise by greater than 20% and rise by greater than $11.6 billion. This distinction signifies a rise in short-term hypothesis with none significant dedication to futures positioning.

Non-compulsory exercise was significantly weak, with quantity down 43%. The highest dealer ratios throughout Binance and OKX stay skewed in the direction of the lengthy, however the lack of contemporary open curiosity suggests a cautious perspective. Till the conviction returns, XRP pricing measures may proceed to commerce with weak assist.

Brief-term charts present bearish bias

The 1-hour chart highlights a sustained bearish construction. The XRP stays capped beneath the $2.85 supertrend resistance, with parabolic SAR alerts additionally lined up on the draw back. Makes an attempt to recuperate between $2.89 and $2.90 have repeatedly failed, confirming that the vendor is in management.

The momentum all through the daytime window stays sluggish, with value motion locked with a decrease resistance degree. Solely crucial breaks above $2.90 shift bias, suggesting that short-term rebounds are ongoing.

Technical outlook for XRP value

XRP short-term value forecasts revolve across the $2.60-$2.95 vary.

- Upside Stage: Rapid targets: $2.95, $3.08, $3.19.

- Drawback degree: $2.74 for minor assist, $2.60 for critical protection, $2.40 if it breaks.

- Development Markers: A $2.60 200-day EMA locks within the cycle.

Associated: Dogecoin Value Forecast: Analysts Goal $0.30 in Help Assessments

Outlook: Will XRP go up?

The direct XRP go will depend on whether or not the client is ready to defend the $2.60-$2.74 area. Holding on prime of this band can rebound to $2.95 and $3.08, however the obstacles danger inflicting deeper corrections.

Analysts are cautious as futures positioning turns into weaker and short-term charts are bearish. Over $2.95 will enhance sentiment, however up till then, XRP’s outlook stays weak at $2.60 as a sand keyline.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.