- XRP costs commerce at $2.78 right this moment, consolidating EMA resistance from $2.70 to $2.91 to $2.93.

- The web outflow of $10.93 million highlights the over $25 million influx wanted to vary feelings.

- Open curiosity on futures has risen to $73.6 billion, and the quantity of choices jumps by 237%, informing them of an lively however cautious place.

XRP Value Immediately is buying and selling at $2.78 past its principal assist base after going through a rejection within the $2.91-$2.93 resistance band. Sellers proceed to function close to the EMA for 20 days, whereas consumers are attempting to lock the market above the $2.70 ground. The main focus in the intervening time is whether or not XRP can regain its $2.91 degree and reestablish momentum in the direction of the next Fibonacci retracement zone.

XRP costs are approaching main assist

On the every day charts, XRP has been transferring in a wider descending construction since July, repeatedly failing for Fibonacci clusters starting from $3.09 to $3.20. Present Value Motion integrates between a $2.70 assist base and a $2.91 resistance zone.

The $2.91 20-day EMA stays a near-term barrier, whereas the $2.92 50-day EMA provides extra weight to the resistance. The $2.83 100-day EMA is being retested as short-term assist. This degree of loss will increase the decrease stress in the direction of the 200-day EMA at $2.60.

Momentum indicators point out restricted convictions. The parabolic SAR stays bearish, with the RSI hovering close to 42, reflecting weak momentum with out being oversold.

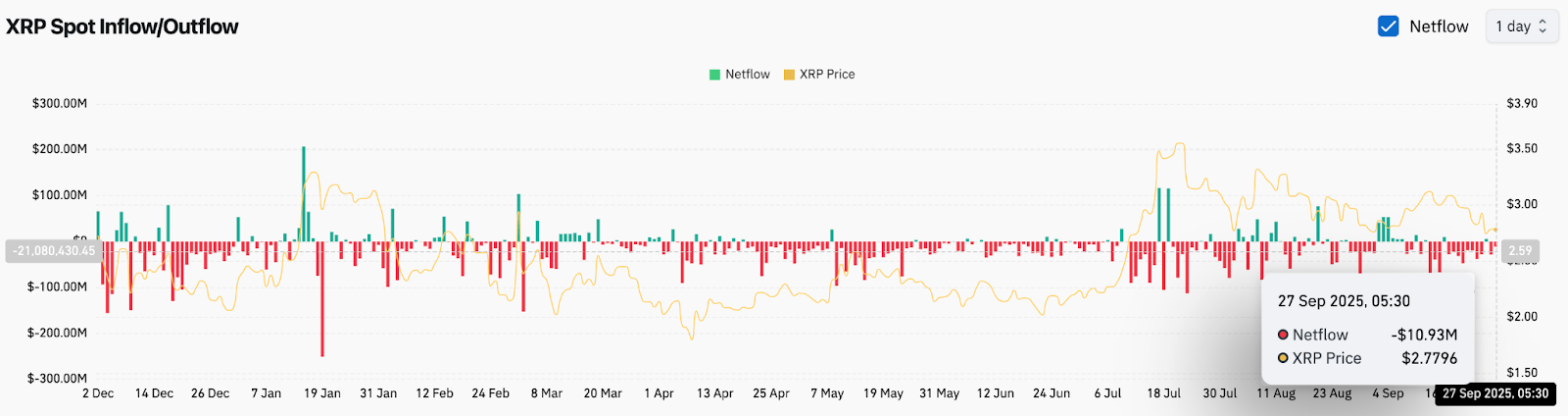

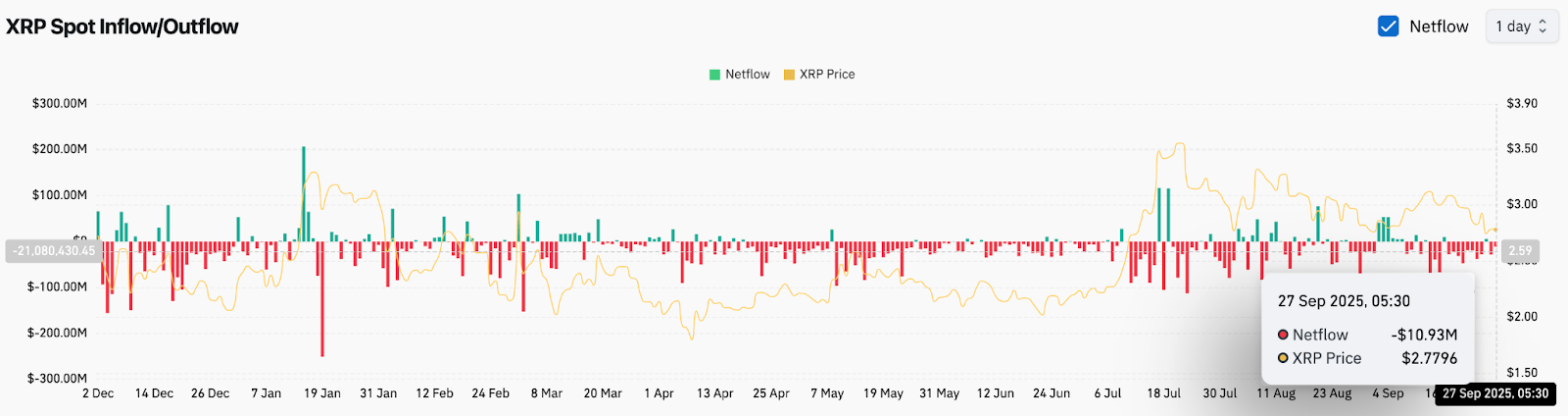

On-chain circulation signifies sustained outflow

Spot circulation highlights ongoing gross sales stress. On September twenty seventh, XRP recorded $10.93 million in internet spills, extending the damaging circulation for a number of days. These outflows consult with merchants who transfer tokens to change, and often inform sell-side positioning.

The shortage of robust inflows signifies that regardless of holding the $2.70 zone with XRP costs, the positive factors from accumulation at present ranges are restricted. Analysts level out that altering feelings requires a sustained influx of greater than $25 million to $30 million.

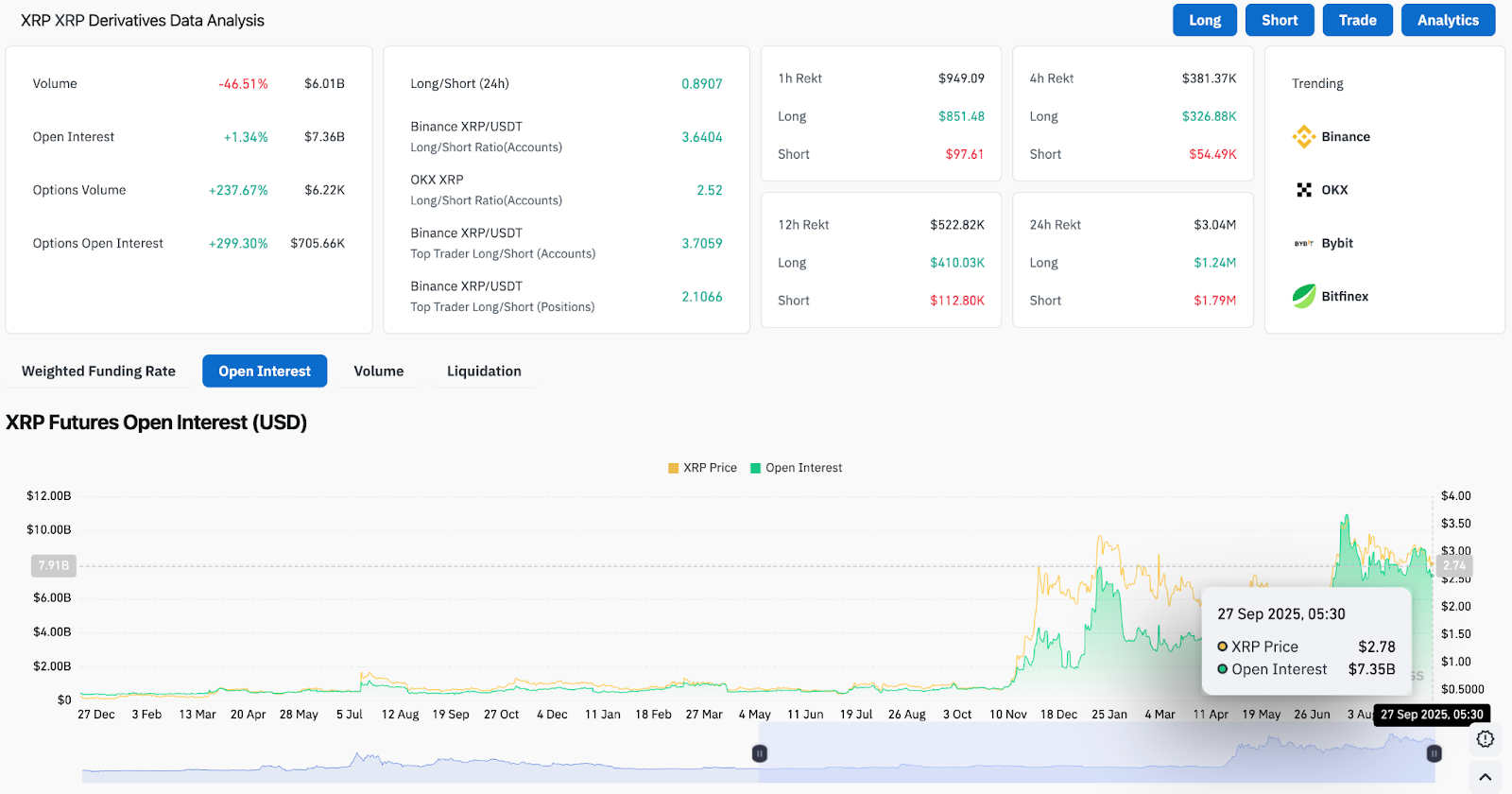

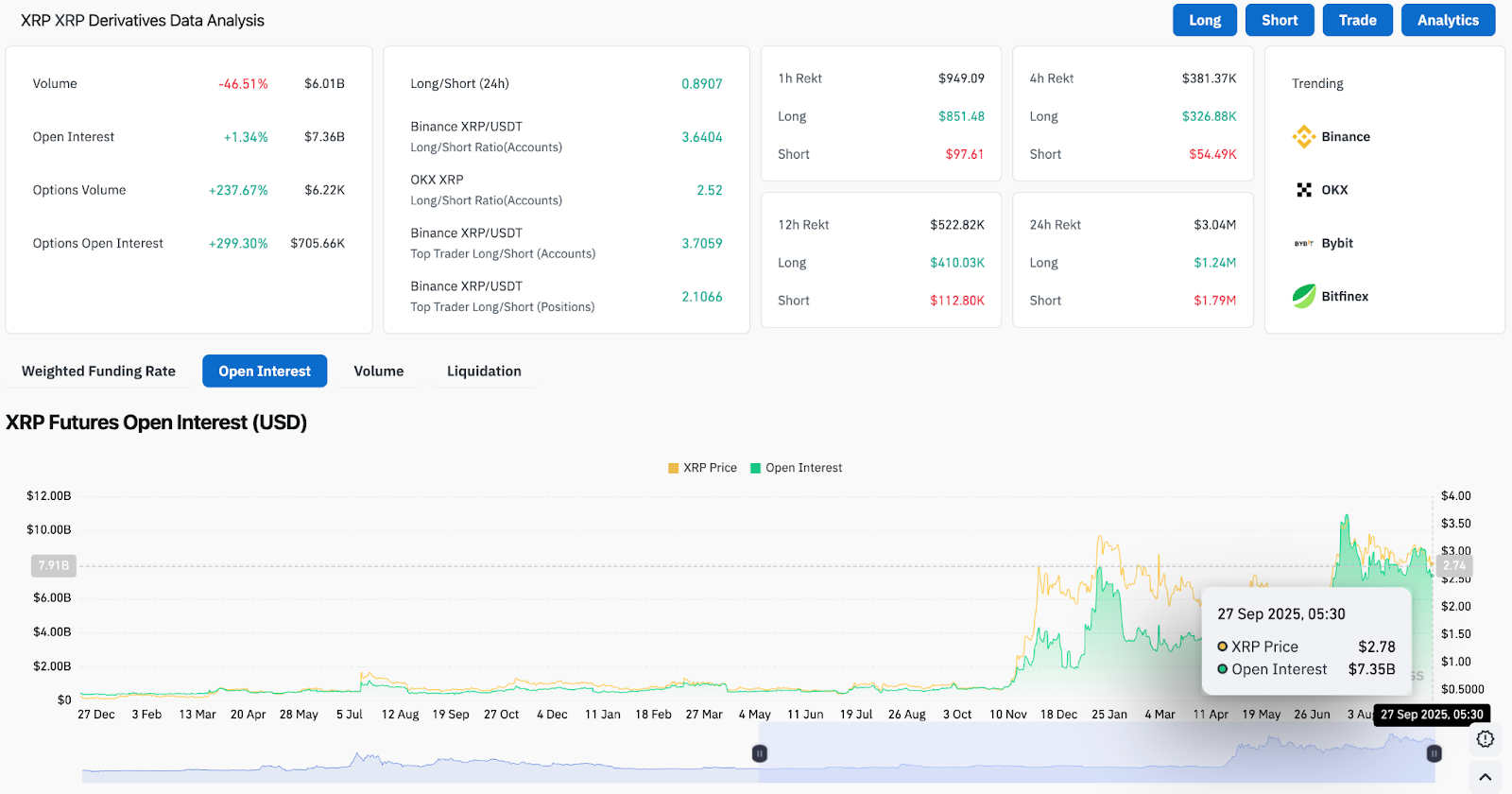

The derivatives market reveals cautious positioning

Futures information reveals the blending setup. XRP’s open curiosity elevated by 1.34% to $7.36 billion, indicating that merchants stay in place, at the same time as spot quantity drops sharply by 46%. Choices exercise has skyrocketed, with choices quantity rising by 237%, and choices volumes have elevated by almost 300%, reflecting present ranges of hedging demand.

The lengthy/quick ratio of main exchanges is above 2.0, with the Binance account exhibiting a stronger bullish bias. Nevertheless, liquidation information reveals that the shorts nonetheless put stress on throughout daytime periods, with costs beneath the $2.91 resistance.

Technical outlook for XRP worth

The technical roadmap for XRP pricing reveals a transparent degree.

- Upward goal: Recovering $2.91 will pave the way in which for $3.09 (Fibonacci 0.382) and $3.19 (Fibonacci 0.5). Breakouts above $3.20 will shift focus to $3.30 and $3.46.

- Disadvantages: Failure to stay to $2.70 may probably expose $2.60 in a 200-day EMA. Deeper failures will revive $2.50 and $2.36.

Outlook: Will XRP go up?

XRP stays at a key level. On-chain flows present sustained gross sales stress, however the place of derivatives displays cautious however lively participation. The technical chart highlights $2.70 for key assist flooring and $2.91 for breakout limitations.

Analysts counsel that market bias will stay impartial to barely bullish so long as XRP is above $2.70. A crucial close to vary above $2.91 may appeal to momentum consumers and probably pull the worth again to $3.19-3.30. Conversely, dropping $2.70 places a deeper retrace in the direction of a 200-day EMA in peril.

For now, XRP’s worth forecasts rely on whether or not inflows will return to assist strikes above $2.91, or whether or not sustained outflows will push to a brand new integration vary of almost $2.60.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version will not be chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.