- XRP value is buying and selling round $2.41 as we speak, under the important thing EMA because the bears check the $2.35 to $2.30 assist zone.

- Evernorth launched a $1 billion XRP treasury listed on the Nasdaq, sparking each long-term optimism and short-term uncertainty.

- Whereas the technical outlook sees $2.20 as a major draw back degree, bulls are eyeing a restoration between $2.75 and $3.00.

XRP value is buying and selling round $2.41 as we speak after falling greater than 3% prior to now 24 hours. The token has damaged under the ascending triangle construction, forcing merchants to give attention to the $2.35 to $2.30 assist vary as promoting momentum intensifies. The launch of a brand new $1 billion XRP treasury fund has clarified the function of Ripple executives, sparking each optimism and confusion.

Value stress will increase as breakdown widens

The most recent developments have put XRP value actions beneath stress. On the every day chart, the token rejected the resistance close to $2.76, which coincides with the 50-day EMA, after which fell sharply. Value is at the moment under all main short-term EMAs, with fast resistance on the 20-day ($2.56) and 50-day ($2.73).

Associated: Ethereum value prediction: ETH value stabilizes under $4,000 as developer rifts floor

Momentum indicators verify weak point. The RSI sits at 36, simply above oversold circumstances, highlighting the fragility of sentiment. Until XRP shortly regains the $2.62-$2.76 zone, the bears may attempt to pull the worth again into the broader uptrend line close to $2.20.

Web flows spotlight weak point in investor dedication

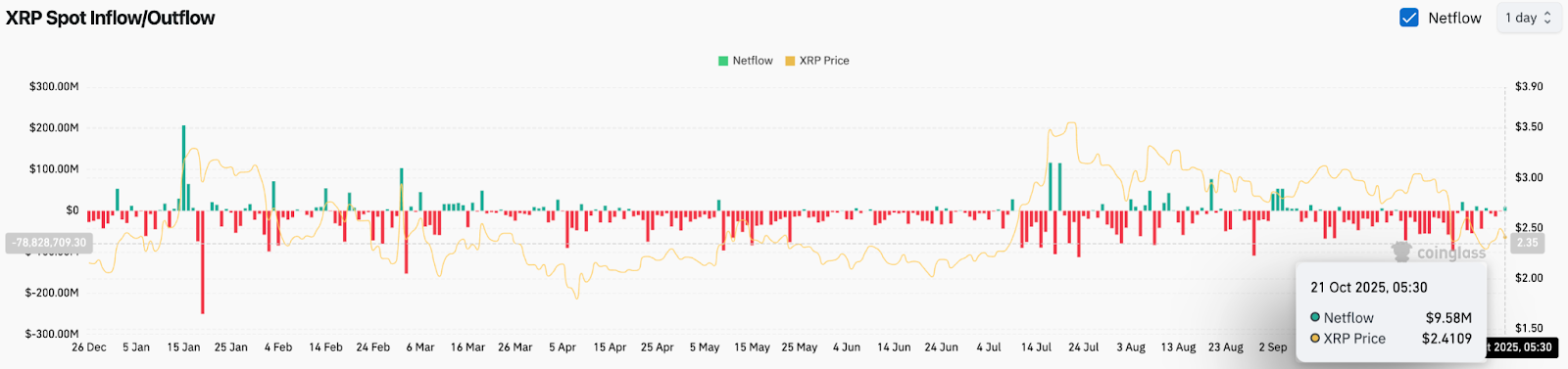

On-chain flows replicate subdued confidence. In keeping with knowledge from Coinglass, XRP spot internet flows confirmed modest inflows of $9.58 million on October twenty first, however this comes after weeks of constant outflows.

Whereas forex outflows coincided with a surge towards $3.80 in early July, latest months have seen continued inflows, which traditionally suggests potential promoting stress.

Evernorth Treasury announcement divides market

A key catalyst was the launch of Evernorth, a newly merged entity modeled after the company Bitcoin Treasury. The corporate plans to lift greater than $1 billion via the Nasdaq itemizing and function an institutional investor in XRP. Ripple’s chief expertise officer (CTO) David Schwartz has allayed hypothesis about his departure by clarifying that he’ll solely be advising on the venture, fairly than taking over a full-time function.

Associated: Bitcoin Value Prediction: BlackRock Promoting Challenges Bullish Sentiment

On the similar time, Ripple board member Asheesh Birla confirmed he’ll grow to be Evernorth’s CEO, emphasizing the corporate’s mission to construct an acquisition conflict chest.

Technical outlook suggests a spread of $2.20 to $2.75

From a technical lens, fast resistance lies at $2.56 after which $2.76, with the 50-day EMA converging on the downtrendline resistance. If the worth closes above this band for the day, a restoration in direction of $3.00 may start.

On the draw back, failure to carry $2.35 would expose XRP to a retest of $2.20. A deeper breakdown would reactivate $2.00 and supply the bottom for the broad upward channel that has guided costs since early 2025. For merchants, this slender risk-reward band makes $2.35 to $2.75 the definitive zone for the subsequent breakout.

Outlook: Will XRP rise?

XRP value prediction stays balanced. Bulls have to defend $2.35 and get better $2.62-$2.76 to regain momentum, with a possible rally in direction of $3.00 if inflows from Evernorth materialize. Bears, however, are eyeing a clear break under $2.20 that might doubtlessly thaw the broader uptrend.

For now, as we speak’s XRP value displays hesitation. The creation of a $1 billion bond has generated long-term optimism, however short-term volatility is more likely to proceed absent stronger capital inflows and a transparent technical restoration.

Associated: Cardano Value Prediction: ADA faces vary stress as momentum cools

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.