- XRP value right now is buying and selling round $2.44 and maintains the $2.30 trendline help zone.

- Hypothesis about ETFs has emerged following stories that 13 XRP transactions have been filed with the SEC.

- Resistance lies between $2.58 and $2.69, and a break goal might be between $2.95 and $3.10.

XRP value is buying and selling round $2.44 right now and stays stable after holding trendline help close to $2.30. Regardless of weeks of strain, renewed pleasure over a number of XRP ETF filings pending with the U.S. Securities and Change Fee (SEC) has reignited curiosity within the asset’s near-term prospects.

XRP value features help amid intense promoting

The 4-hour chart reveals that XRP maintains its broader uptrend construction regardless of current volatility. The token stays above the important thing uptrend line that has guided the worth since June, whereas going through overhead resistance between $2.58 and $2.69, the place the 20-day and 50-day EMAs are concentrated.

Repeated protection of the $2.30 to $2.35 zone confirms robust shopping for exercise close to the trendline base. The parabolic SAR dot is beginning to flatten round $2.60, indicating a attainable reversal try. For bulls, a clear break above $2.70 may lengthen the upside in the direction of $2.95-$3.10, whereas failure to maintain $2.30 may expose the $2.10 flooring.

Associated: Chainlink Worth Prediction: Hyperlink eyes restoration as bulls defend key help

Momentum indicators are displaying early indicators of restoration. The RSI studying is rising once more above 45 and the MACD sign is flattening out after a number of weeks of bearish divergence. This setup means that XRP could also be coming into a compression part earlier than a directional breakout.

ETF functions set off hypothesis amongst institutional buyers

In a chart shared by analyst @amonbuy, market sentiment modified sharply after the SEC revealed 13 XRP ETF filings, together with filings from Bitwise, 21Shares, WisdomTree, Grayscale, Franklin Templeton, and CoinShares. Many of the functions are for spot XRP ETFs, and the ultimate assessment deadline is October 18, 2025 to November 14, 2025.

Though the authenticity of those filings has not but been confirmed via the SEC’s official database, the wave of controversy has reignited hypothesis throughout the company relating to XRP’s regulatory readability. Merchants observe that the approval of even one spot product may dramatically improve liquidity and accessibility, just like the inflows noticed when Bitcoin ETFs debuted.

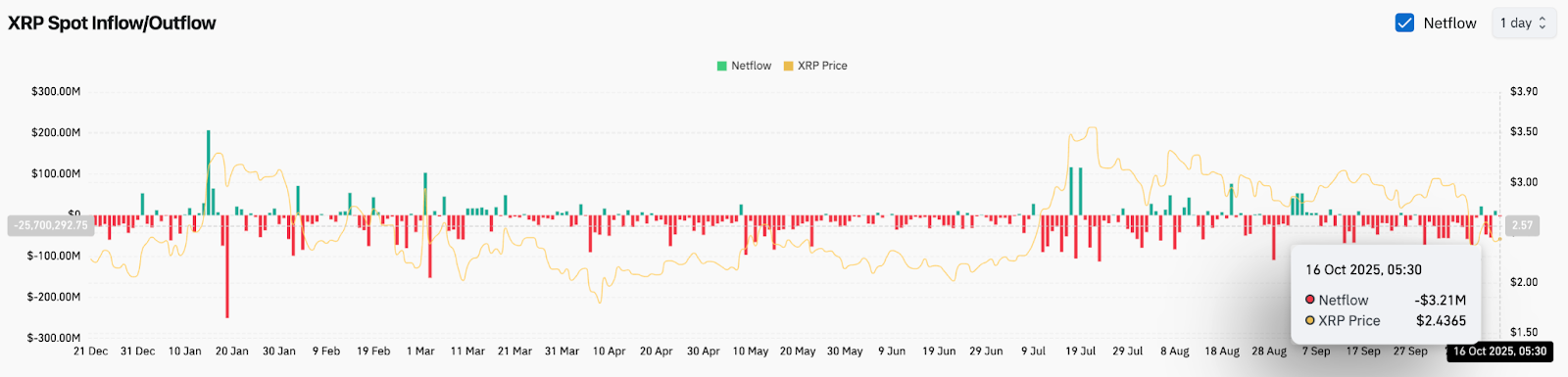

On-chain information reveals blended flows

Coinglass foreign money move information confirmed web outflows of $3.21 million on October 16, reflecting modest accumulation at present ranges. Nevertheless, the broader move pattern is inconsistent, with alternating purple and inexperienced bars indicating that the market remains to be trying to find course.

Associated: Tron Worth Prediction: TRX tries to get well as merchants deal with main resistance

All through the primary half of October, capital outflows continued after XRP plummeted round $3.10. This week’s stabilization of web flows could sign early re-entry by long-term holders in preparation for potential ETF-related developments. Analysts stress that stronger inflows, notably in extra of $25 million per day, shall be wanted to substantiate the brand new bullish conviction.

Technical ranges that merchants are being attentive to

Speedy resistance is about at $2.58, the place the short-term EMA converges. If the worth continues to shut above this mark, it may result in robust shopping for in the direction of $2.69, with the subsequent high probably round $2.95. A breakout of this vary would sign a bullish breakout from the descending channel seen on the medium-term chart.

Assist stays at $2.30, however deeper demand is anticipated at $2.10 and $1.95 if promoting strain resumes. The Bollinger Bands have tightened considerably, suggesting {that a} robust directional transfer may emerge as volatility expands.

The general construction favors a rebound state of affairs so long as XRP maintains its upward base and stays above the $2.30 threshold.

Outlook: Will XRP rise?

XRP’s subsequent transfer will largely rely on affirmation of the rumored ETF submitting and broader market sentiment. The asset continues to commerce inside a compressed vary, with technical indicators pointing to a attainable upside breakout if the bulls regain the $2.70 zone.

Associated: Cardano Worth Prediction: ISO 20022 Hype Good points Consideration

Analysts stay cautiously optimistic. So long as XRP stays above $2.30, the bias is towards restoration and targets $2.95 to $3.10 within the quick time period. Nevertheless, a decisive break under $2.30 would invalidate the bullish construction and expose $2.10.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.