- XRP is buying and selling close to $2.31 after rejecting the downtrend line, with upside capped beneath the EMA cluster.

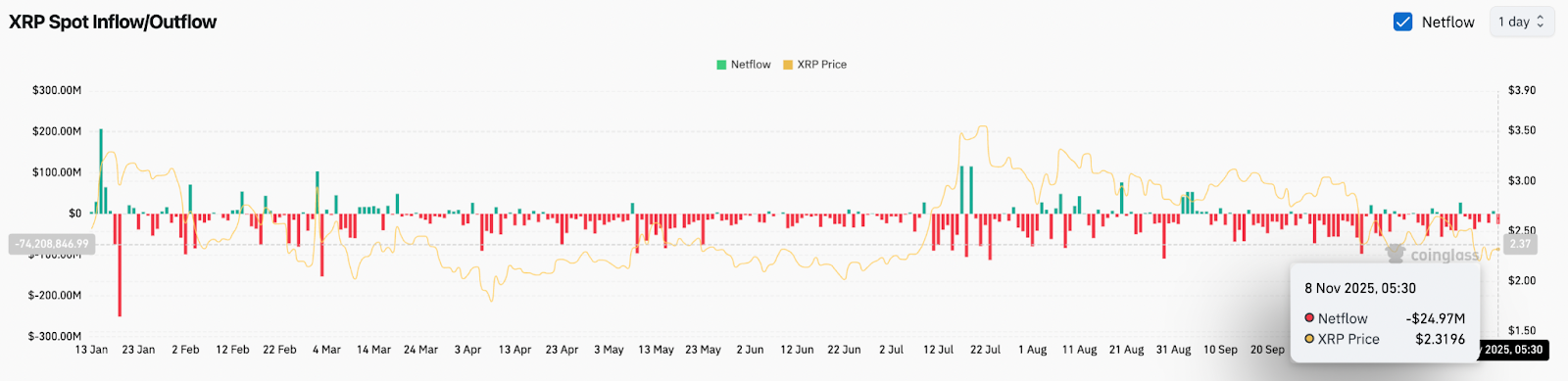

- CoinGlass information exhibits internet spot outflows of $24.97 million, indicating distribution reasonably than accumulation at help.

- An in depth beneath $2.20 would expose $2.10 and $1.95, however a bullish reversal of the construction would require a restoration between $2.42 and $2.66.

XRP is buying and selling round $2.31 on the time of writing, hovering simply above the important thing demand zone between $2.20 and $2.25. The market is reacting to continued spot outflows and sustained excessive declines on the day by day chart, reflecting purchaser hesitation as sellers defend key transferring averages.

Spot outflows present distribution as patrons retreat

In keeping with CoinGlass information, internet spot outflows had been $24.97 million. The leak signifies that tokens are being returned to exchanges reasonably than being eliminated for long-term holding. If outflows enhance whereas the worth retests a significant help space, it signifies dispersion reasonably than accumulation.

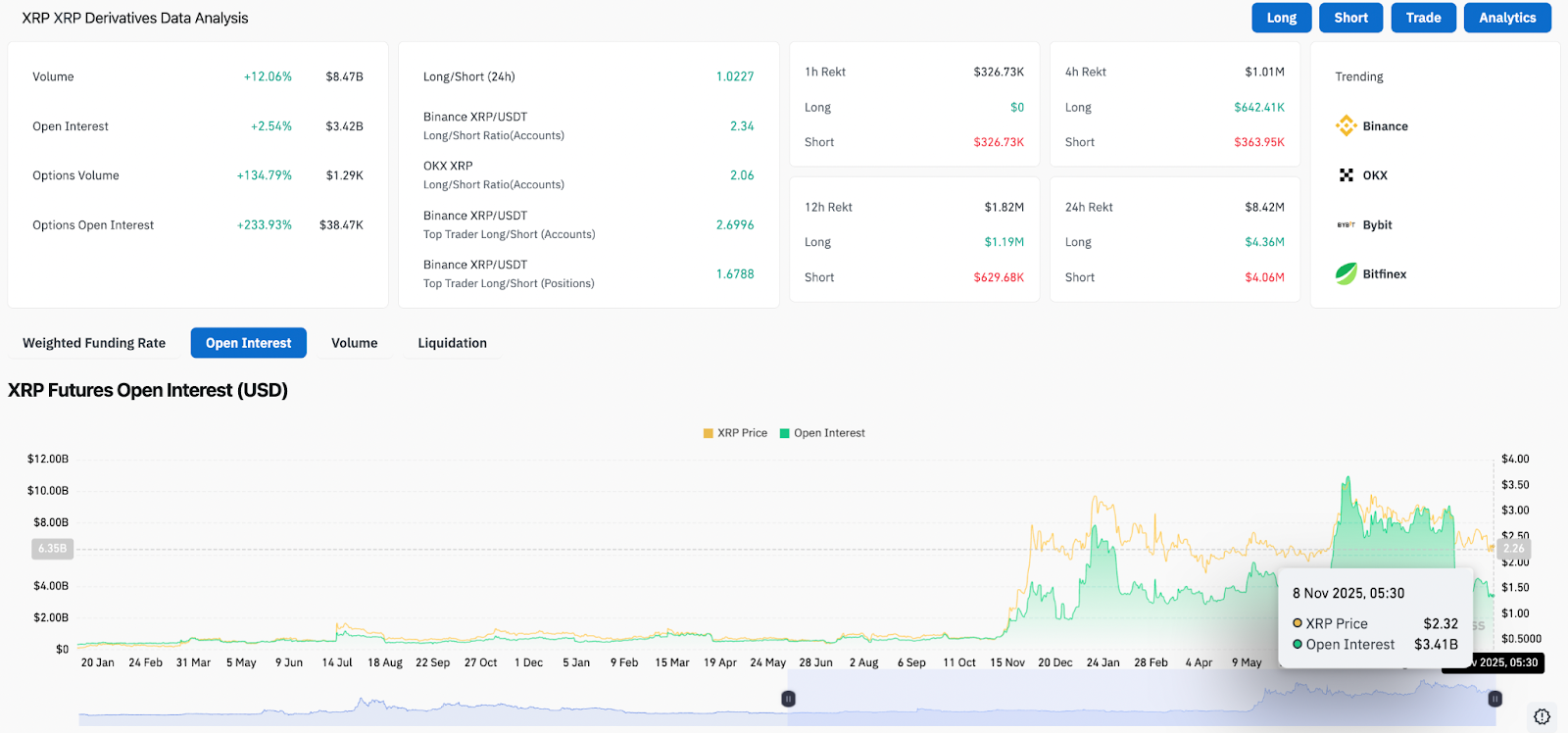

Spinoff buying and selling will increase, however bias stays combined

Futures open curiosity elevated by 2.54% to $3.42 billion. Buying and selling quantity additionally elevated by greater than 12%. A rise in open curiosity signifies that new positions are being constructed reasonably than previous positions being unwound.

Choices buying and selling soared. Choices quantity elevated by practically 135% over the past session, and choices open curiosity elevated by 233%. The rise in choices positioning displays merchants constructing publicity to approaching volatility. Nonetheless, no stable directional bias is noticed.

Lengthy positions are nonetheless greater than quick positions throughout Binance and OKX in high dealer accounts. Binance XRP USDT has an extended/quick ratio of two.34, indicating that some merchants are attempting to seize a reversal from help. Regardless of this, costs proceed to battle to beat resistance, suggesting that patrons are utilizing leverage however not profiting from spot demand.

Rejection of pattern line leaves construction weak

On the day by day chart, we are able to see that XRP stays confined to the downtrend line. A number of rejection factors affirm this trendline as an energetic resistance line.

Major observations concerning the present construction:

- XRP trades beneath 20-day, 50-day, 100-day, and 200-day EMAs

- EMA cluster between $2.42 and $2.66 varieties a ceiling

- MACD continues to fall beneath the sign line, momentum weakens

Consumers tried a rebound earlier this week however had been unable to regain the 20-day EMA of $2.42. This rejection pushed the worth again in the direction of the $2.20 and $2.25 demand zones. Shedding this shelf would expose a deeper liquidity zone round $2.10, adopted by the origin of the July breakout at $2.01.

Momentum stays restricted till XRP clears $2.48 on robust quantity. Rejection on the EMA suggests the trail of least resistance is even decrease.

Will XRP go up?

XRP buying and selling is at a crossroads. Rejection of the pattern line and continued spot outflows point out that sellers stay in management. Nonetheless, derivatives positioning exhibits curiosity from merchants seeking to seize reversals.

- Bullish case: XRP rebounded from $2.20 to clear $2.42 after which $2.66. As soon as we get better the EMA cluster, we are going to see the primary structural change. The goal for this breakout is $2.85 after which $3.10.

- Bearish case: If the day by day closing worth is lower than $2.20, the demand block loss is confirmed and $2.10 is uncovered. If this stage fails, the construction will open up a deeper draw back in the direction of $1.95.

Associated: https://currencyjournals.com/xrp-price-faces-deeper-correction-analyst-warns-of-1-9-retest-ahead/

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.