- After rebounding from $2.30, XRP is buying and selling close to $2.57, supported by the 200-day EMA.

- On-chain flows are displaying a moderation in outflows, suggesting stabilization after final week’s panic-induced decline.

- The ETF approval date between October 18th and twenty fifth may set off a break above the $2.80 resistance degree.

XRP value is buying and selling round $2.57 right this moment and has risen 1.6% over the previous 24 hours as consumers defend the $2.50 zone after a big drop final week. The pullback from the $2.30 space coincides with the rise of the 200-day EMA and trendline help, suggesting early indicators of a restoration as merchants shift focus to the upcoming spot ETF approval date.

XRP value regains main help zone

The day by day chart reveals XRP stabilizing after the flash crash, which briefly positioned the token under the long-term uptrend line. The rebound from $2.30 has pushed the value above $2.55, supported by the 100-day EMA of $2.63 and 50-day EMA of $2.82.

Quick resistance lies close to the intersection of the 20-day EMA and downtrend line at $2.77 to $2.82. A transparent break above this zone may result in a rally in the direction of $2.94 and $3.10. On the draw back, the $2.45-$2.30 band stays necessary help and protects XRP from bigger losses.

Associated: BNB Value Prediction: Analysts Bullish on $96M Influx Alerts Accumulate

Parabolic SAR has fallen under value for the primary time since early October, suggesting a short-term bullish shift, whereas RSI has recovered from oversold territory to impartial ranges, suggesting growing purchaser momentum.

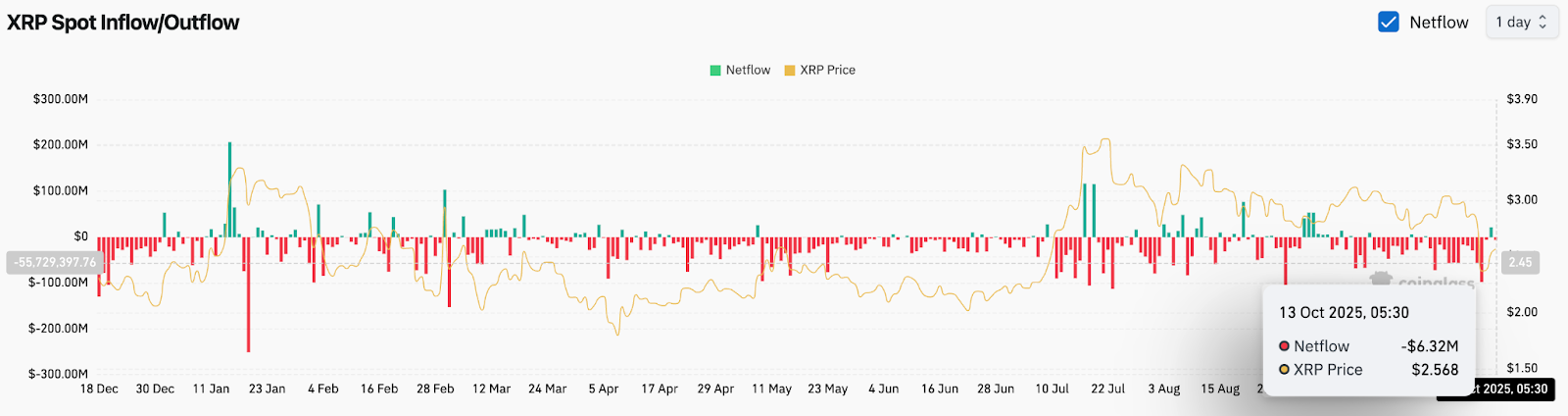

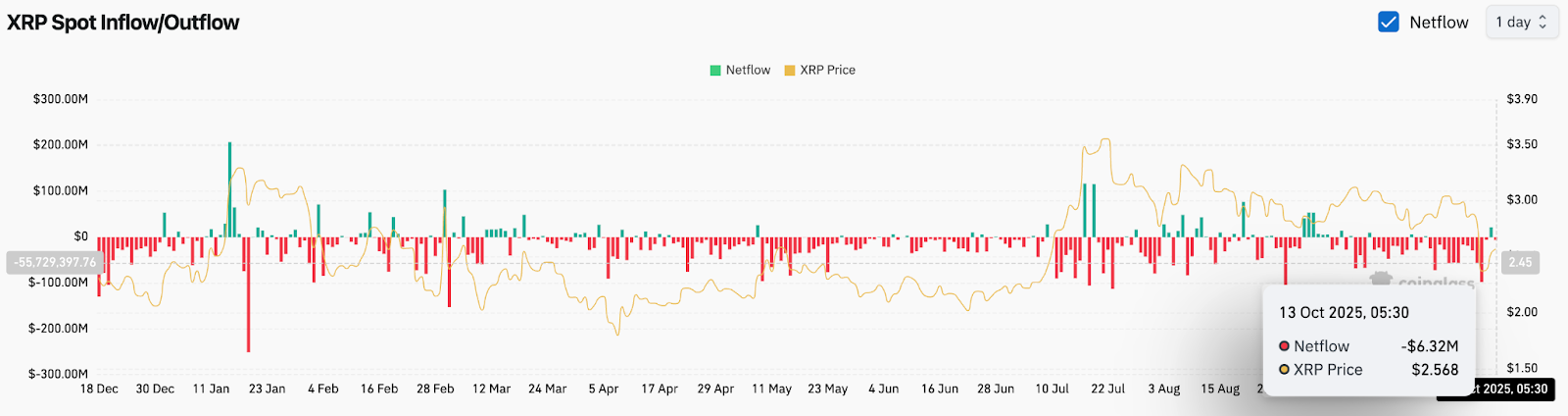

On-chain stream displays stabilization after panic outflow

In line with Coinglass change knowledge, internet outflows on October 13 had been $6.32 million, a notable enchancment from final week’s excessive promoting stress. Regardless of the gradual withdrawal, the broader stream construction suggests stabilization, with fewer massive spikes in comparison with the liquidation-driven dump seen earlier this month.

Analysts see this as a wholesome signal of market normalization. A sustained return to inflows above $25 million per day may display recent accumulation forward of a significant ETF choice, whereas continued low outflows recommend individuals are ready for affirmation earlier than re-entering aggressively.

Expectations for ETFs enhance market pleasure

Investor consideration has shifted sharply to the October 18-25 interval when closing choices are anticipated on eight proposed XRP spot ETFs, together with filings from Grayscale, Bitwise, Franklin Templeton and WisdomTree.

Cryptocurrency influencer JackTheRippler emphasised that the approval can be “enormous information,” fueling hypothesis that XRP may mirror the ETF-led momentum of Bitcoin earlier this yr. Though the SEC has not issued any formal directions, the focus of choice dates has elevated market optimism, and speculative bidding has returned to XRP after weeks of decline.

Broad market restoration helps sentiment

The broader crypto market is stabilizing following the $20 billion liquidation occasion triggered by final week’s US tariff information. Each Bitcoin and Ethereum have rebounded sharply, with main analysts calling them “purchase zones” somewhat than crashes. This restoration contributed to improved sentiment throughout massive altcoins, together with XRP, which was hit hardest by the flash crash.

Associated: Cardano Value Prediction: Outflows ease, consumers shield help

If ETF headlines attain expectations, bettering macro sentiment and danger urge for food may additional help a near-term restoration for XRP.

Technical outlook for XRP value

XRP’s construction stays cautiously bullish so long as the value stays above the $2.45 pivot.

- Prime degree: If the breakout power continues, it is going to transfer to $2.77, $2.94, after which $3.10.

- Lower cost degree: If the vendor regains management, it is going to be $2.45, $2.30, and $2.10.

- Development anchor: The 100-day EMA of $2.63 and 200-day EMA of $2.63 stay necessary to keep up the medium-term uptrend.

Outlook: Will XRP rise?

XRP’s near-term path will depend upon whether or not the ETF’s optimism interprets into precise inflows and technical follow-through above $2.77. A gradual easing in capital outflows and a parabolic reversal in SAR point out that momentum is shifting in favor of consumers.

If XRP can shut above $2.82 within the subsequent few periods, analysts predict that it may head towards $2.94-$3.10 on a break of the downtrend line. Nonetheless, a lack of $2.45 would enhance the danger once more in the direction of $2.30 and delay the restoration part.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.