- XRP holds key assist at $2.80 as merchants await ETF choices and market transparency.

- Rising futures open curiosity signifies robust speculative positions regardless of bodily outflows.

- The ETF dominance might change XRP sentiment and set off a breakout above the $2.94 resistance.

XRP’s latest worth actions mirror market rigidity. After a powerful rejection on the $3.08 stage, the cryptocurrency entered a correction part and located short-term assist on the $2.80 stage. This space corresponds to the 0.236 Fibonacci retracement zone and represents an space the place consumers are cautiously guarding assist.

Regardless of the stress, merchants are nonetheless keeping track of technical alerts that would reveal the subsequent decisive transfer, particularly as ETF arbitrage window looms, which is prone to affect market sentiment.

Market construction and technical indicators

The 4-hour chart reveals that XRP continues to be buying and selling beneath the necessary Exponential Transferring Common (EMA) with the 20, 50, 100, and 200 interval strains clustered throughout the $2.89 to $2.93 vary. This proximity highlights narrowly clustered ranges. Notably, the 20 EMA is beneath the 50 EMA, indicating short-term draw back bearishness.

Nonetheless, it is going to be necessary if XRP can maintain above $2.80. Losses beneath this stage might prolong to the September swing low of $2.70. However, a rebound above $2.94 would reinstate the short-term bullish development and depart a path to $2.99 and $3.08.

Associated: Shiba Inu worth prediction: Analysts concentrate on $0.000014 restoration as holders surge

Capital flows and derivatives sentiment

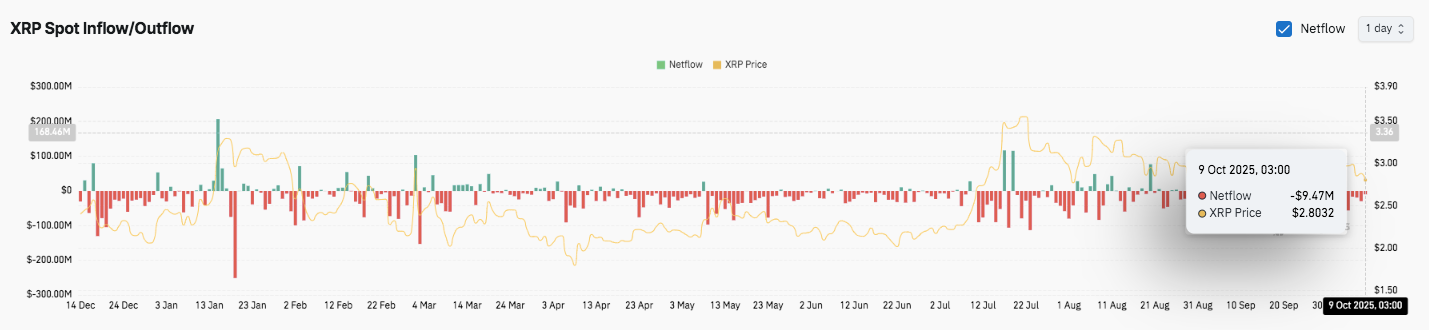

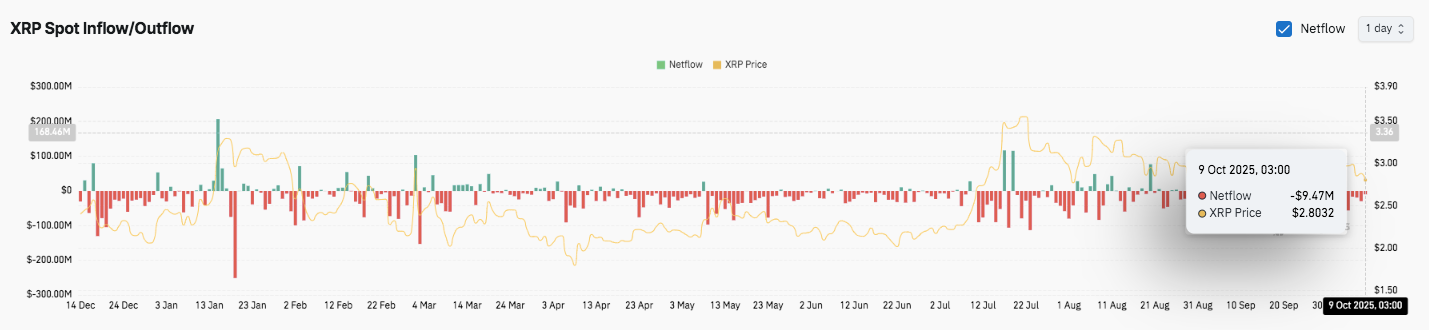

Past the technicals, capital movement information paints a cautious image. On October 9, XRP recorded web outflows of $9.47 million, persevering with a multi-month development of buyers decreasing their publicity since mid-July.

Enthusiasm has waned since earlier this 12 months, when inflows exceeded $200 million throughout upswings in January and July. This sustained outflow signifies profit-taking by short-term merchants, whereas long-term holders seem content material to attend for the value to fall.

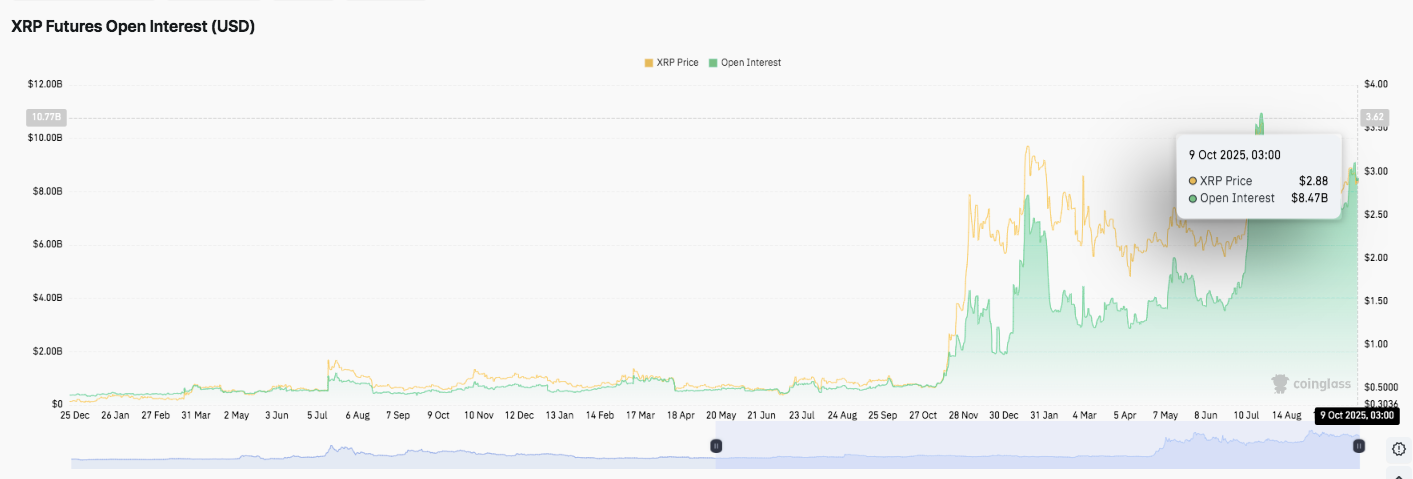

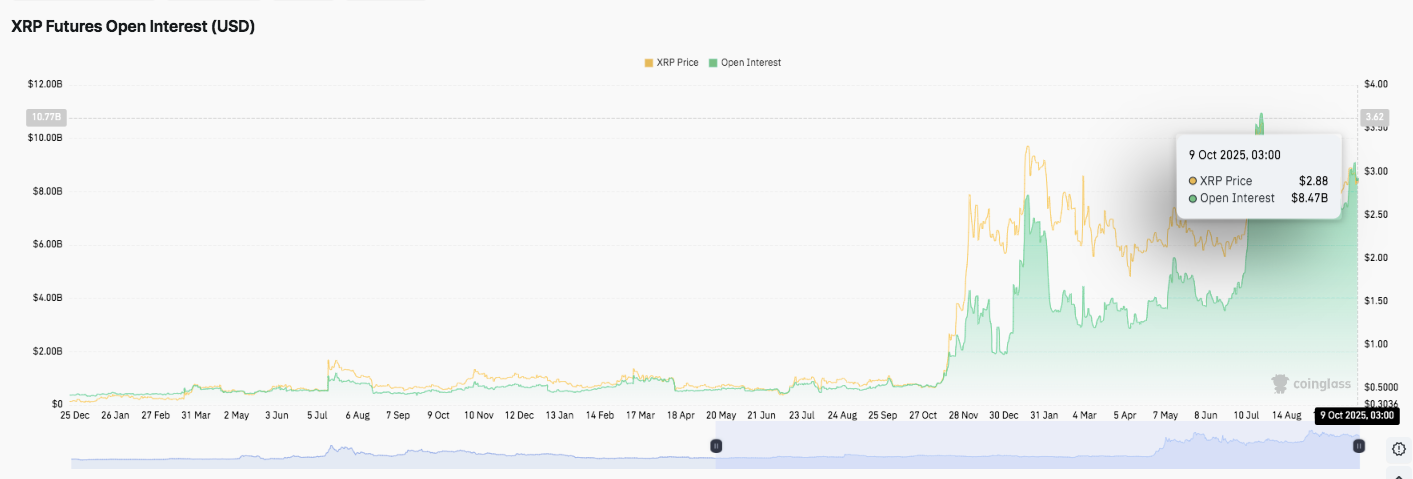

The futures market, however, tells a special story. Open curiosity soared to $8.47 billion, the best in latest months. The regular improve from lower than $2 billion earlier this 12 months suggests speculative curiosity stays robust. This mix of cautious spot flows and aggressive derivatives positioning alerts heightened expectations for volatility.

ETF choices might decide the subsequent development

All eyes at the moment are on the interval from October 18th to October twenty fifth, when regulators will determine on six spot XRP ETF purposes. The checklist contains main firms reminiscent of Grayscale, Bitwise, and WisdomTree.

Even partial approval might mirror the rise in Bitcoin costs because the ETF’s launch, permitting for brand new institutional inflows. Nonetheless, although XRP’s short-term bias stays bearish, a constructive name might rapidly reverse sentiment and push the asset again towards the $3.18 resistance zone.

Associated: Solana Value Prediction: ETF Staking Twist and 95% Fairness Quantity Lead Momentum

Technical outlook for XRP worth

Key ranges stay effectively outlined heading into mid-October.

- Prime stage: Fast hurdles are $2.88 (0.382 fib), $2.94 (EMA cluster), and $2.99. A transfer above $2.99 might pave the best way for a retest of the $3.08 resistance zone, and probably $3.18 if momentum picks up.

- Lower cost stage: $2.81 (0.236 Fib) serves as instant assist, adopted by September swing lows at $2.70 and $2.69. A sustained shut beneath $2.80 might put XRP beneath deeper retracement stress in direction of $2.60.

- Higher restrict of resistance: The $2.94-$2.96 space is in keeping with the 200-period EMA and stays a key stage to show for medium-term bullish continuation.

The technical framework signifies that XRP is steady in a variety of $2.69 to $3.18, with a slight bearish bias so long as it stays beneath the 200 EMA line. Nonetheless, rising worth compression across the $2.80 base signifies elevated volatility.

Will XRP rise once more?

XRP’s October path will depend upon whether or not consumers can preserve the $2.80-$2.81 zone within the face of regular revenue taking. Above $2.94, a brand new wave of shopping for might happen, spurred by elevated futures open curiosity and expectations for future ETF choices. Conversely, if it breaks above $2.80, the wave of correction will strengthen and XRP might fall to $2.70 earlier than a restoration is tried.

Associated: Ethereum worth prediction: ETH holds key Fibonacci ranges forward of Fusaka improve

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.