- XRP is buying and selling under the key EMA and downtrend line, with sellers rejecting any features since July.

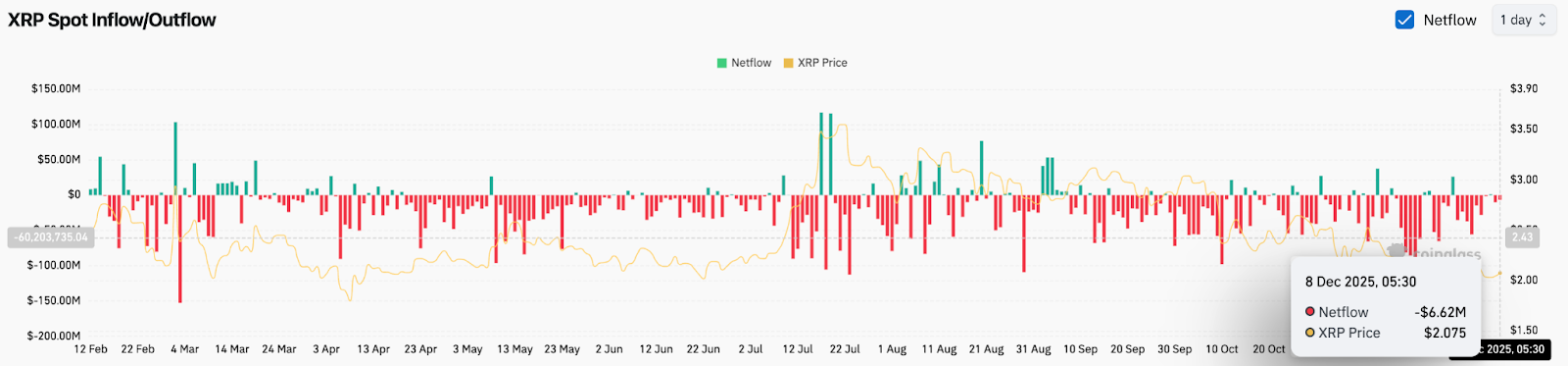

- Web outflows of greater than $6.6 million point out continued distribution, limiting the depth of restoration makes an attempt.

- Derivatives positioning is closely tilted towards resistance, growing the danger of accelerated declines if help fails.

XRP value is buying and selling round $2.07 right this moment, stabilizing after a unstable week that prolonged a widespread downtrend. Value stays under the long-term downtrend line whereas situated inside the descending channel that characterizes the latest construction. Sellers proceed to press for a restoration as spot flows stay detrimental and key transferring averages flip into resistance.

Sellers defend long-term development strains

On the each day chart, XRP continues to carry a downtrend line that has rejected each try to maneuver increased since July. The pullback to this line rapidly dissipated and was changed by a structural ceiling that bolstered bearish sentiment.

The value can be buying and selling under the 20-day, 50-day, and 100-day EMAs close to $2.27, $2.43, and $2.47. These ranges now act as layered resistance quite than help. Patrons stay reactive quite than dominant till XRP closes above this cluster.

The decrease restrict of the descending channel is situated round $1.95 to $1.85, the zone the place the worth defended throughout the earlier capitulation occasion. Though a retest shouldn’t be assured, it’s technically legitimate whereas the worth stays under the development line.

The parabolic SAR dot sits above the worth, confirming that momentum continues to be tilted to the draw back on the upper time frames.

Spot leaked spotlight distribution

In accordance with the most recent knowledge, XRP recorded web outflows of over $6.6 million on December 8, extending a collection of detrimental periods spanning a number of weeks.

This follows a constant distribution over time, as proven by the deep pink bars throughout the chart. Regardless of a small surge in inflows, sellers have been within the ascendancy for the reason that starting of the autumn.

Day-to-day construction signifies rescue try however lacks affirmation

Decrease time frames point out that it’s attempting to stabilize after the latest decline. On the 30-minute chart, XRP rebounded from $2 and returned to the $2.07 to $2.1 vary, forming a short-term uptrend line.

The supertrend turned pink early within the session and continues to restrict upside strain. Till the worth closes above $2.09 to $2.11, a pullback shouldn’t be confirmed.

The RSI is close to 55, indicating that momentum is bettering after the oversold interval, however not sturdy sufficient to counsel a development reversal.

If the intraday uptrend holds, the worth might retest the higher resistance band. If rejected, it can transfer again in the direction of $1.98 from $2.02.

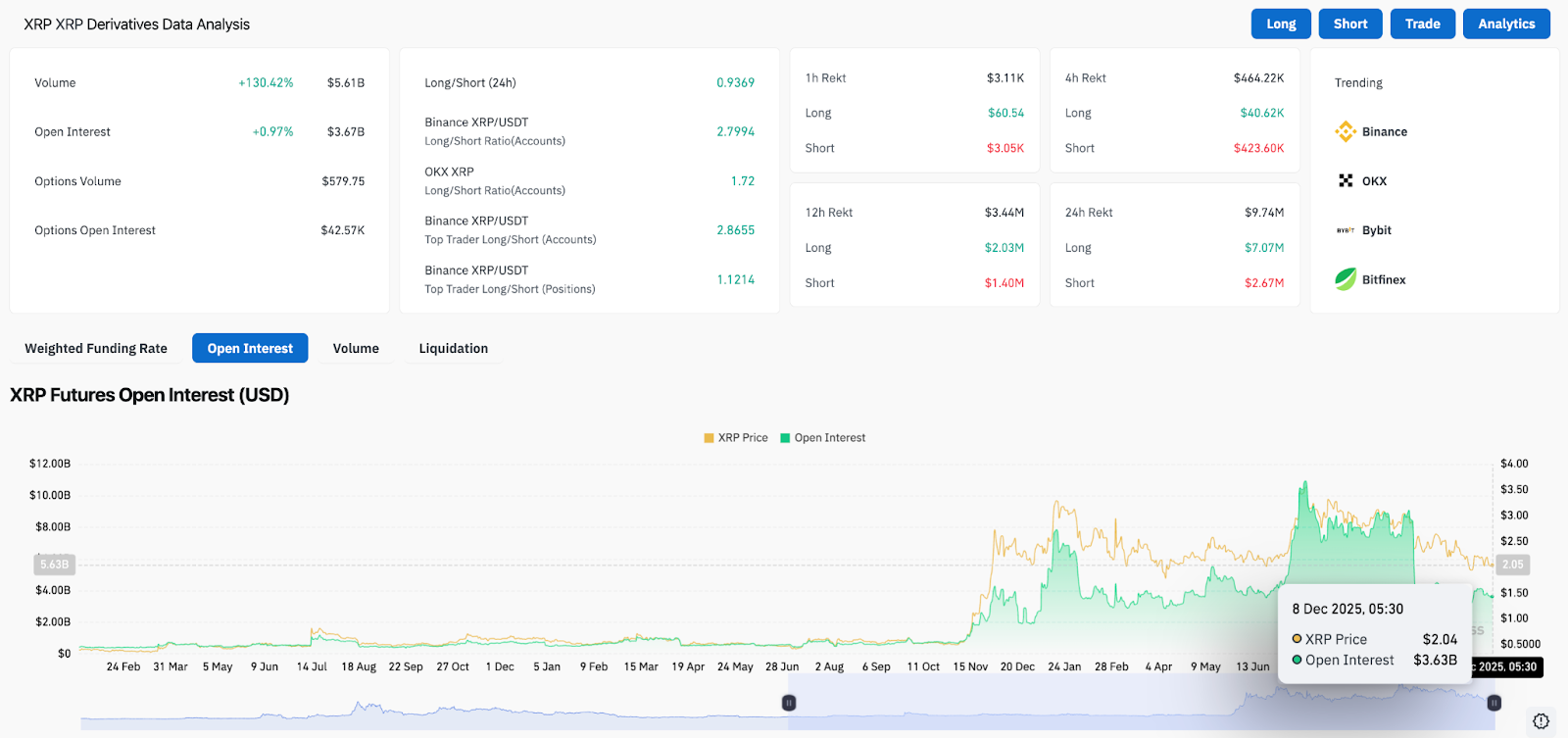

Derivatives positioning turns into longer and riskier

Derivatives exercise elevated sharply. Quantity elevated 130% to $5.6 billion, and open curiosity expanded barely to $3.67 billion.

High merchants on main exchanges keep a protracted bias, with the ratio for the Binance USDT pair above 2.7. This positioning is vital as a result of failures are inclined to speed up when leverage leans into resistance for too lengthy.

The liquidation knowledge exhibits a comparatively small wipe, suggesting that the place continues to be intact and stays in danger if volatility spikes.

This implies derivatives merchants are taking positions for upside, however the value construction does not help it, creating vulnerability if the present rally stalls.

outlook. Will XRP go up?

The subsequent transfer will rely upon whether or not patrons can take in provide at increased ranges and overcome the compression zone shaped by the trendline.

- Bullish case: A clear break above $2.27 on sturdy quantity opens the door to $2.43 and $2.55. Clearing the development line signifies a change in momentum and begins a bigger restoration part.

- Bearish case: Failure to carry between $2.00 and $1.95 exposes the decrease channel round $1.85 with deeper liquidity under. This transfer confirms the continuation of capital outflows and can seemingly prolong the correction development.

Sentiment will enhance if XRP regains $2.27. The $1.95 drop indicators a broader continuation of the downtrend into the top of the yr.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.