- In distinction to the $560 million whale accumulation with mushy retail flows, XRP has stabilized round $2.54.

- Optimism about ETFs is rising after Bitwise CIO referred to as the XRP fund a possible “billion-dollar product.”

- Forward of the SEC determination, main assist lies at $2.42 and resistance at $2.70 to $2.94.

XRP value is buying and selling round $2.54 immediately, firming beneath key transferring averages as merchants think about renewed optimism about doable ETF approval. The token stays wedged inside a symmetrical triangle for the long run, with the value transferring nearer to the apex as volatility will increase.

ETF optimism sparks debate amongst merchants

Market sentiment in the direction of XRP took a pointy flip this week after Bitwise CIO Matt Hogan predicted that the XRP exchange-traded fund might “simply turn into a $1 billion product inside months” of its launch. His feedback reignited curiosity amongst retail and enormous traders, particularly as 20 XRP ETF purposes await approval from the U.S. Securities and Change Fee.

Santiment information reveals that whale wallets have added roughly $560 million value of XRP over the previous week, a transfer that means confidence within the asset’s long-term story. This new accumulation stands in distinction to the broader decline in altcoins general as a result of Federal Reserve’s rate of interest steering and diminished liquidity for high-beta tokens.

XRP value faces slim vary as momentum cools

On the day by day chart, XRP value is beneath the 20-day EMA at $2.55 and stays constrained by the 50-day EMA close to $2.67. The 100-day EMA and 200-day EMA have converged round $2.72 and $2.61, respectively, forming a good resistance zone that coincides with the higher certain of the descending triangle sample.

Associated: Dogecoin value prediction: Doge consolidates as open curiosity rises

The decrease assist development line close to $2.42 has been held since early June and represents a key stage that defines the broader construction. A decisive shut beneath that space might set off a retest of $2.20, the place the 200-day common converges with the earlier breakout zone.

Momentum reveals a slight bearish tilt from impartial. The supertrend indicator is overhead at $2.89, confirming that sellers stay in short-term management. RSI readings are hovering close to reasonable ranges, reflecting hesitation quite than capitulation.

Transaction circulate displays blended sentiment

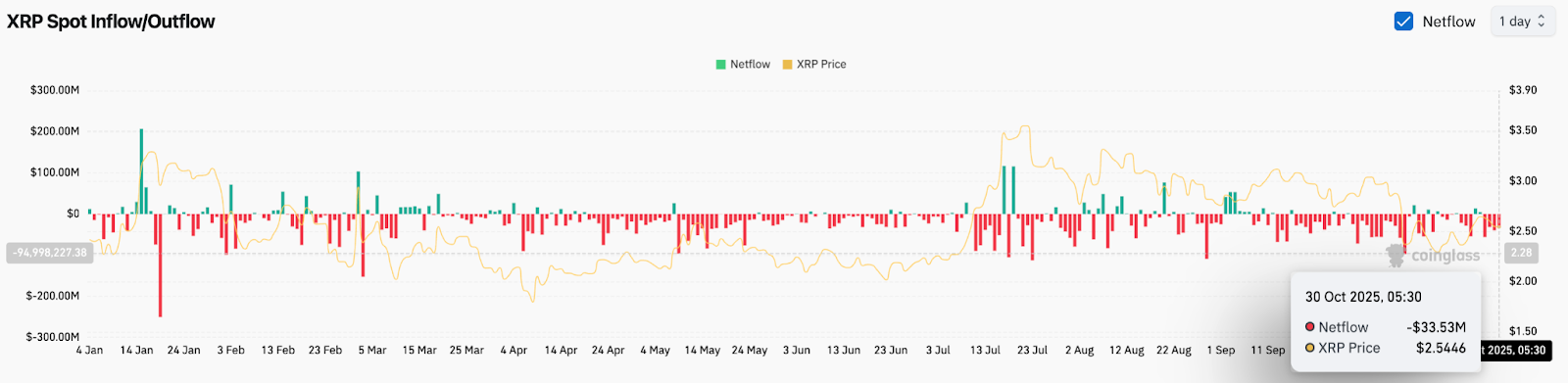

Coinglass information reveals about $33.5 million in internet outflows from centralized exchanges up to now 24 hours, indicating that though there was modest accumulation, a large-scale rotation to chilly wallets has but to happen. Traditionally, stronger inflows have been accompanied by short-term ceilings, whereas constant outflows have a tendency to point a foundation-building part.

Associated: Bitcoin value prediction: Analysts warn of additional decline as BlackRock sells $2 billion in BTC

Over the previous month, XRP spot internet flows have remained principally unfavourable, highlighting the vigilance of retail individuals regardless of the buildup of whale wallets. Merchants proceed to carefully monitor this divergence, because it usually precedes unstable adjustments in value route.

Key factors for relocating spinoff information

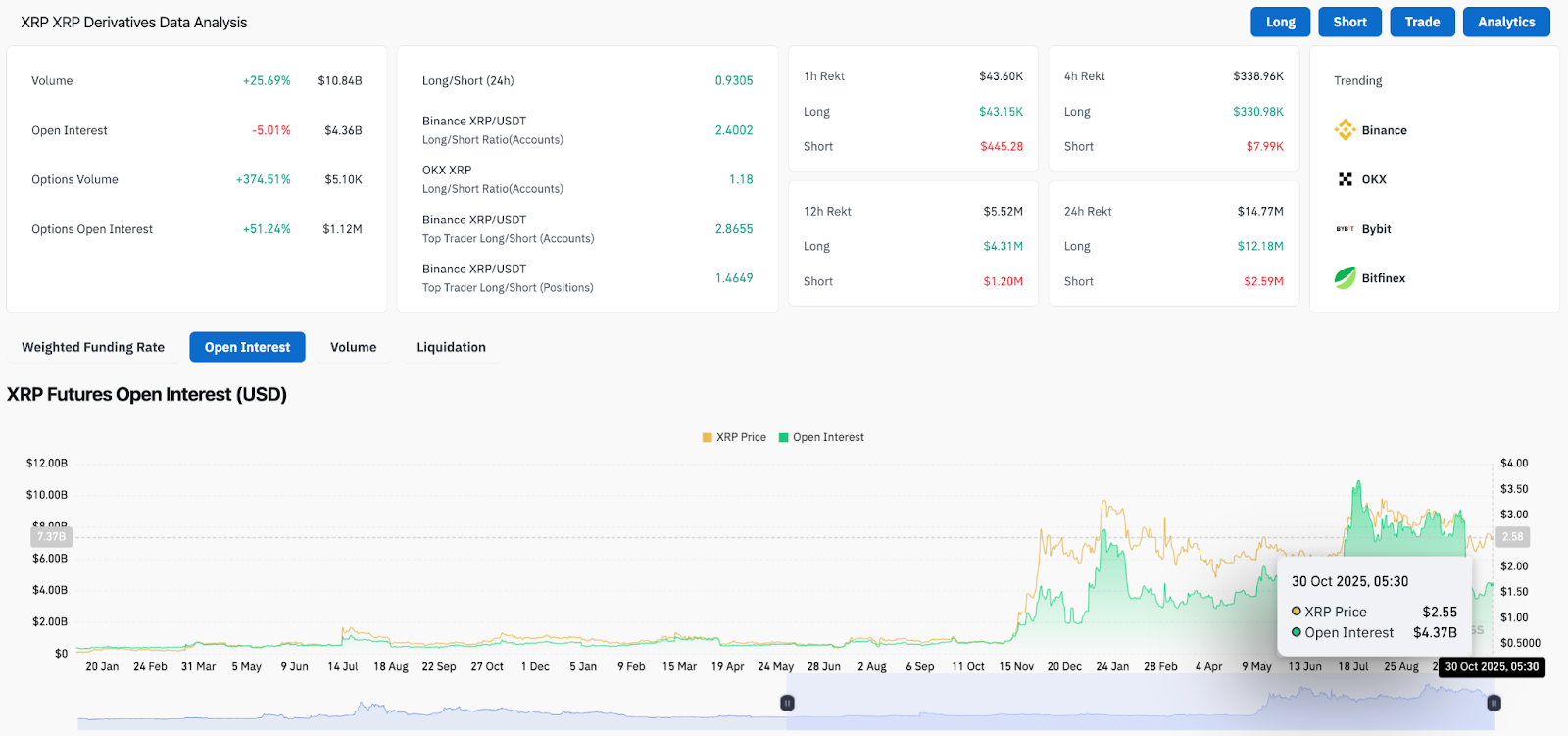

Spinoff metrics paint a extra lively image. Regardless of quantity growing 25% to $10.8 billion, open curiosity fell 5% to $4.36 billion, suggesting profit-taking amongst leveraged merchants. Choices buying and selling rose sharply, with open curiosity growing by greater than 50% in a single session, indicating hedging motion forward of potential ETF headlines.

The lengthy/quick ratio continues to rise, with Binance exhibiting 2.86 for high merchants and a couple of.4 for all accounts. This imbalance will increase the danger of a short-term flush if the value fails to regain the $2.60-$2.70 vary. Funding charges stay steady, suggesting that the market shouldn’t be but actively bullish.

Outlook: Will XRP rise?

For now, XRP value predictions stay balanced between technical compression and elevated speculative curiosity. A break above $2.70 will verify the bullish momentum as soon as once more and convey up targets close to $2.91 and $3.10. Continued quantity above these ranges might prolong in the direction of the $3.40 space the place the earlier excessive coincides with the highest of the long-term construction.

On the draw back, failure to maintain $2.42 will shift focus to $2.20, and a deeper flash might see a revisit to $1.95 earlier than a significant rebound.

Associated: Zcash Value Prediction: Zcash rally widens as open curiosity reaches yearly excessive

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.