- The XRP integrates the triangle inside, with help of $2.85 and resistance of almost $3.20.

- Trump’s pro-crypto commented on gasoline hypothesis about Ripple’s function within the US’s monetary modernization.

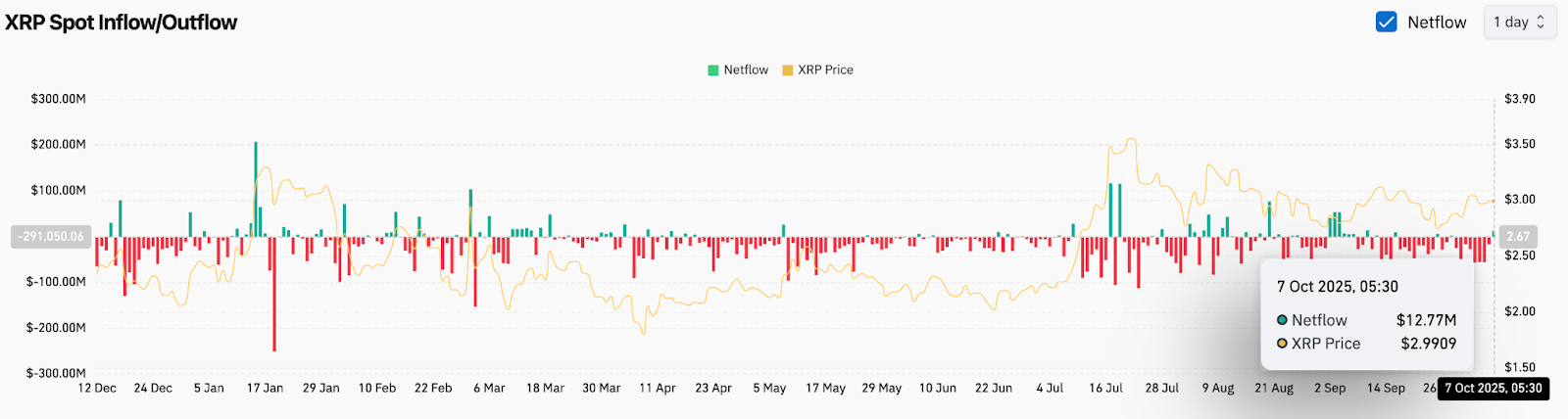

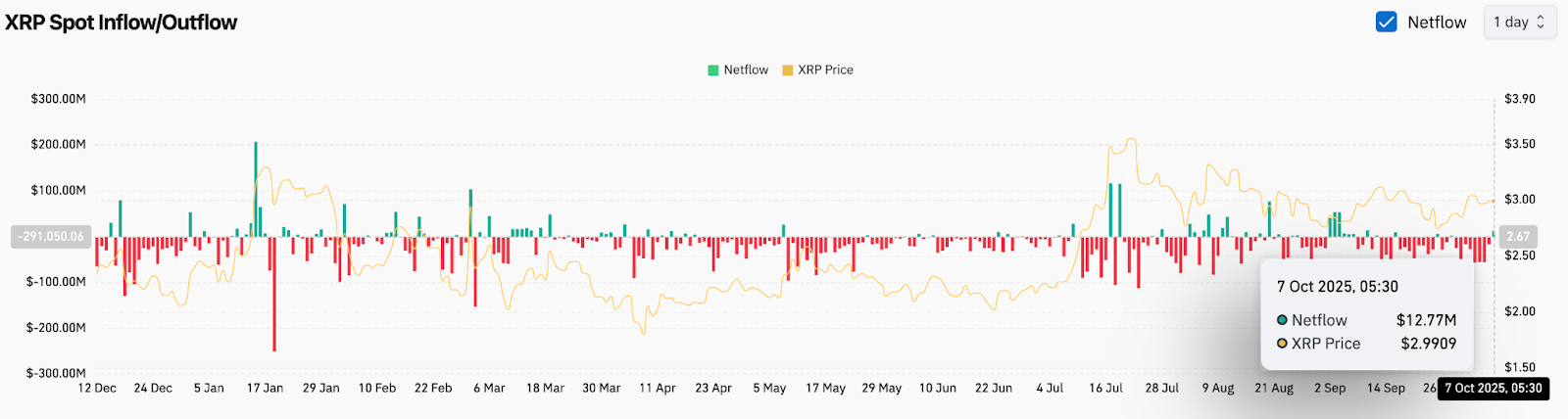

- On-chain knowledge exhibits an influx of $12.7 million, marking the preliminary accumulation after per week of outflow.

XRP (Crypto:XRP) Costs are buying and selling almost $2.98 right now, and as proven on the day by day charts, the tightening is built-in inside a symmetrical triangle sample. Tokens proceed to outweigh main help, round $2.85-$2.88, however resistance stays on the higher restrict of almost $3.10-$3.20. Merchants are carefully watching the technological compression coincides with up to date on-chain inflow and political indicators which have injected new optimism into the market.

XRP worth integrates with symmetrical triangles

The XRP chart construction highlights a slender vary between the $2.85 base and the highest development line close to $3.20, indicating a possible breakout part. The 20-day EMA is round $2.94, the 50-day EMA is $2.93 and the 100-day EMA is $2.85, and every thing is tightly converging.

So long as XRP exceeds the trendline from its June low to ascending, the broader upward development stays. A breakout over $3.20 might open the doorways heading in direction of $3.35 and $3.60, however dropping $2.85 might reveal a deeper draw back in direction of a 200-day EMA of almost $2.63.

Associated: Bitcoin Value Prediction: Technique’s $3.9 billion achieve boosts feelings

The momentum is impartial, however stays constructive, with a better OBV (stability quantity) indicating that accumulation persists regardless of short-term worth stagnation.

Social media actions spiked on October sixth after a speech by Donald Trump referenced plans to “Improve the traditional US monetary system utilizing cutting-edge cryptographic expertise.” Clips shared by neighborhood members Jack Teliplerelicited over 180,000 views in a matter of hours, inflicting a surge in XRP-related debate.

The timing of Trump’s remarks shortly after the assembly, which reportedly concerned Ripple executives, amplified hypothesis that Ripple (XRP) might play a task in a broader US monetary modernization effort. Though no official partnerships have been confirmed, merchants view rhetoric as a sign of momentum in procrypt coverage, a theme that may strengthen institutional curiosity in XRP.

On-chain knowledge exhibits optimistic stream returns

Coinglass’ on-chain metrics confirmed a web influx of $12.77 million into the XRP market on October 7, displaying its first optimistic studying after almost per week’s outflow exceeded $22 million. To be modest, this reversal displays early indicators of a brand new accumulation following Trump’s feedback.

Associated: PI Value Prediction: Bearish Channels final when PI is fighting close to $0.26

Traditionally, the sustained inflow of this scale has preceded the short-term bullish reversal of XRP, particularly when mixed with volatility band tightening. Nonetheless, analysts ought to be aware that the market nonetheless wants a constant influx of over $25 million per day to verify convictions from massive members.

Technical outlook for XRP worth

| path | Key stage |

| Upside Goal | $3.20, $3.35, $3.60 |

| Disadvantages help | $2.85, $2.63, $2.40 |

| Pattern bias | From impartial inside a triangle to fierce |

| Momentum sign | Accumulation continues and breakouts for a close to time period |

Outlook: Will XRP go up?

XRP’s short-term trajectory is dependent upon whether or not the Bulls can make the most of bettering sentiment and regaining a $3.20 resistance line. The alignment of political curiosity, technical compression and gentle on-chain inflow creates a balanced however constructive background.

So long as XRP costs exceed $2.85 right now, analysts will stay cautiously optimistic that the subsequent transfer can help the advantages. By confirming that it exceeds $3.20, we confirm that the bullish continuation will probably be between $3.35-$3.60, but when we do not sustain with present help, the momentum could possibly be delayed and the value might return to $2.63.

Associated: Litecoin Value Forecast: Regardless of ETF delays, the Bulls maintain floor above $118

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.