- XRP is secure between $2.34 and $2.54, dealing with resistance close to the main EMA and Fib ranges.

- Rising futures open curiosity signifies elevated speculative exercise regardless of falling costs.

- Sustained spot outflows point out subdued accumulation, limiting upward worth strain.

XRP’s short-term market construction displays elevated uncertainty as merchants assess worth compression round key technical ranges. The token is buying and selling round $2.38, down barely by 1.1% after repeated makes an attempt to interrupt out of the $2.50 zone.

Costs stay beneath key exponential transferring averages and Fibonacci retracements, suggesting a cautious bias. Regardless of a short pullback in current buying and selling, momentum indicators point out subdued confidence amongst each consumers and sellers.

Technical pictures counsel lateral motion

The XRP/USD 4-hour chart exhibits the worth pattern consolidating between $2.34 and $2.54 for a number of days. The 50-EMA, at present positioned close to $2.43, serves as a right away resistance, whereas the 100-EMA and 200-EMA at $2.45 and $2.67, respectively, kind stronger obstacles.

Quick help lies on the 0.5 Fibonacci retracement stage at $2.345. A break beneath this stage might result in a fall in direction of $2.16 and even $1.94. Conversely, a break above $2.52, which coincides with the 0.618 Fib zone, might push the worth in direction of the highs of $2.77 and $3.10.

Associated: Shiba Inu Value Prediction: Holders Rise, however SHIB Struggles to Defend Help

The broader construction exhibits that XRP is recovering from the earlier retracement between $3.10 and $1.58. A current rally to the lows suggests potential accumulation, however consumers might want to reclaim the $2.52-$2.67 space to verify a pattern reversal. Till then, the worth pattern is anticipated to stay within the vary of $2.30 to $2.60.

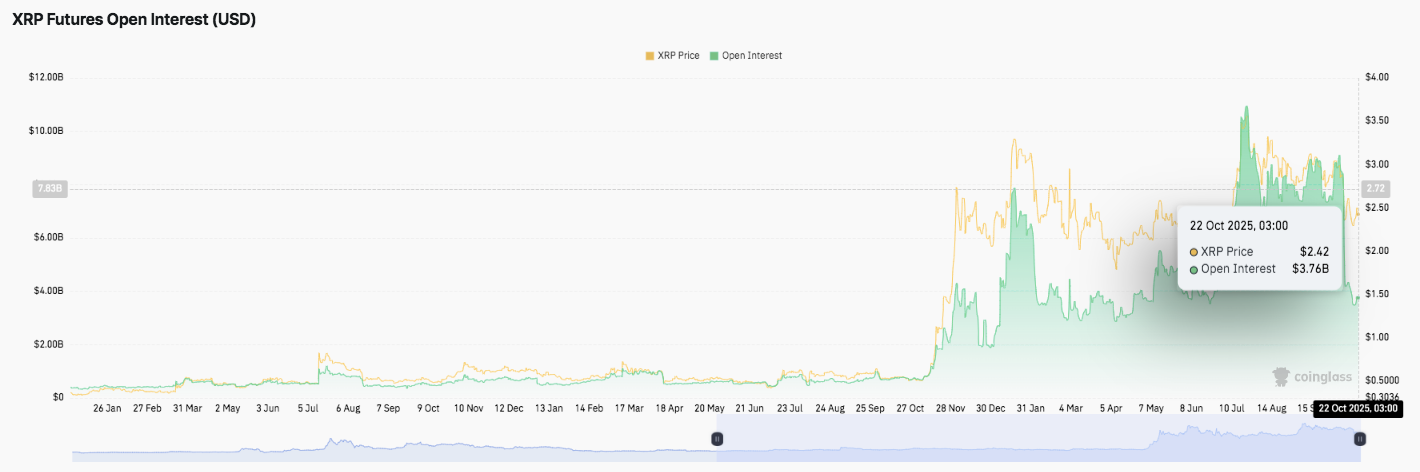

Derivatives information displays speculative exercise

Open curiosity in XRP futures has risen considerably for the reason that starting of 2025, reflecting renewed engagement from merchants. After stagnating beneath $2 billion for a number of months, open curiosity exceeded $10 billion in April, pushing the worth nearer to $3.50.

In keeping with the most recent information, the open curiosity is $3.76 billion and the worth is round $2.42. This means continued participation even throughout worth declines. The robust correlation between rising open curiosity and worth volatility highlights the expansion of speculative positions in derivatives markets.

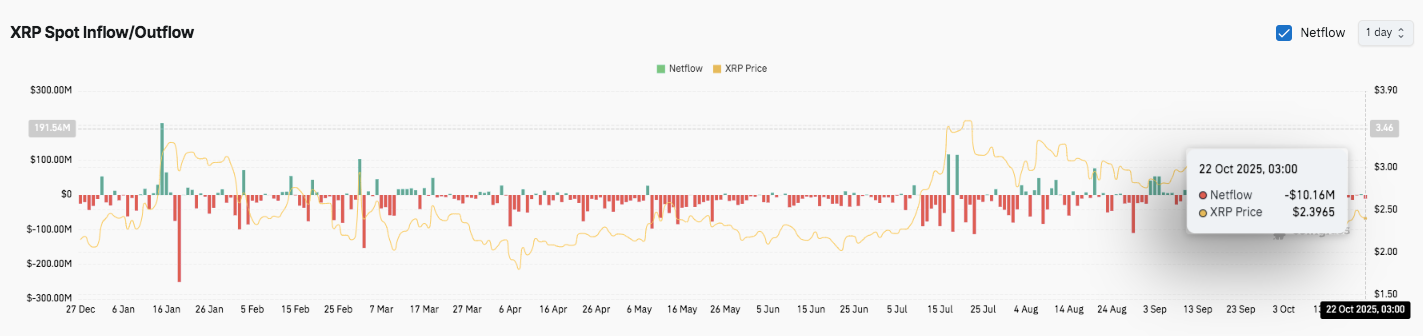

Spot move signifies sustained runoff

Spot web flows proceed to indicate dominant outflows by means of most of 2025. The newest information exhibits an outflow of $10.16 million on October twenty second, indicating constant profit-taking. Though there was a short interval of capital inflows in mid-year, general capital flows remained unfavorable, suggesting lowered accumulation and weak upward strain.

Associated: Ethereum Value Prediction: ETF Flows Help ETH, however CPI Threat Makes Merchants Cautious

Ripple’s increasing organizational position

Past market strikes, Ripple has secured a place on the Federal Reserve’s Immediate Funds Job Drive Steering Committee. This improvement will improve our affect in shaping the long run U.S. funds infrastructure.

This transfer confirms Ripple’s rising recognition as a key participant bridging conventional finance and blockchain-based cost programs.

Technical outlook for XRP worth

Key ranges stay well-defined as XRP enters a strong section close to $2.38. Quick-term bias stays impartial, and merchants are intently monitoring whether or not the bulls can regain momentum above a key resistance zone.

- Prime stage: Quick hurdles are $2.43 (50-EMA) and $2.52 (Fib 0.618), adopted by $2.67 (200-EMA). A break above $2.67 might pave the best way to $2.77 (Fib 0.786) and the earlier swing excessive of $3.10.

- Cheaper price stage: The key helps are at $2.34 (Fib 0.5), adopted by $2.16 (Fib 0.382), and $1.94 (Fib 0.236). A definitive shut beneath $2.30 might point out renewed promoting strain on these decrease ranges.

- Higher restrict of resistance: The $2.52-$2.67 space stays a key reversal zone. Clearing this cluster would affirm bullish momentum and might be the beginning of a brand new uptrend.

The technical construction exhibits that XRP stays agency inside a decent vary between $2.30 and $2.60, with volatility prone to improve if a breakout happens. Momentum indicators resembling flattening EMAs and secure open curiosity counsel indecision amongst merchants.

Will XRP breakout or collapse?

XRP’s near-term course hinges on its capacity to defend the $2.34 to $2.30 help space. If the shopping for continues round this zone, a rescue rebound in direction of $2.77 and $3.10 might happen. Nonetheless, if the worth can not maintain above $2.30, the worth might fall additional in direction of $2.16.

Associated: Bitcoin Value Prediction: BTC Consolidates as Merchants Await Breakout Sign

For now, XRP stays rangebound, with the $2.52 stage serving as the important thing line between a possible bullish breakout and a long-term consolidation. Enhanced inflows and Ripple’s rising regulatory presence might act as a catalyst for the subsequent large transfer.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.