- XRP Whale Alert Exhibits $50 Million Per Day Drop As Costs Come Beneath Strain Due To ETF Delays.

- Whale movement information stays unfavorable with assist round $2.72-$2.80.

- Ripple’s progress within the EU will offset US regulatory uncertainty within the brief time period.

A brand new XRP whale warning has appeared on the whale monitoring dashboard as giant holders speed up gross sales. Based on Santiment information, wallets managing between 1 million and 10 million XRP diminished their balances by about 440 million tokens in 30 days, bringing their complete holdings to about $6.51 billion.

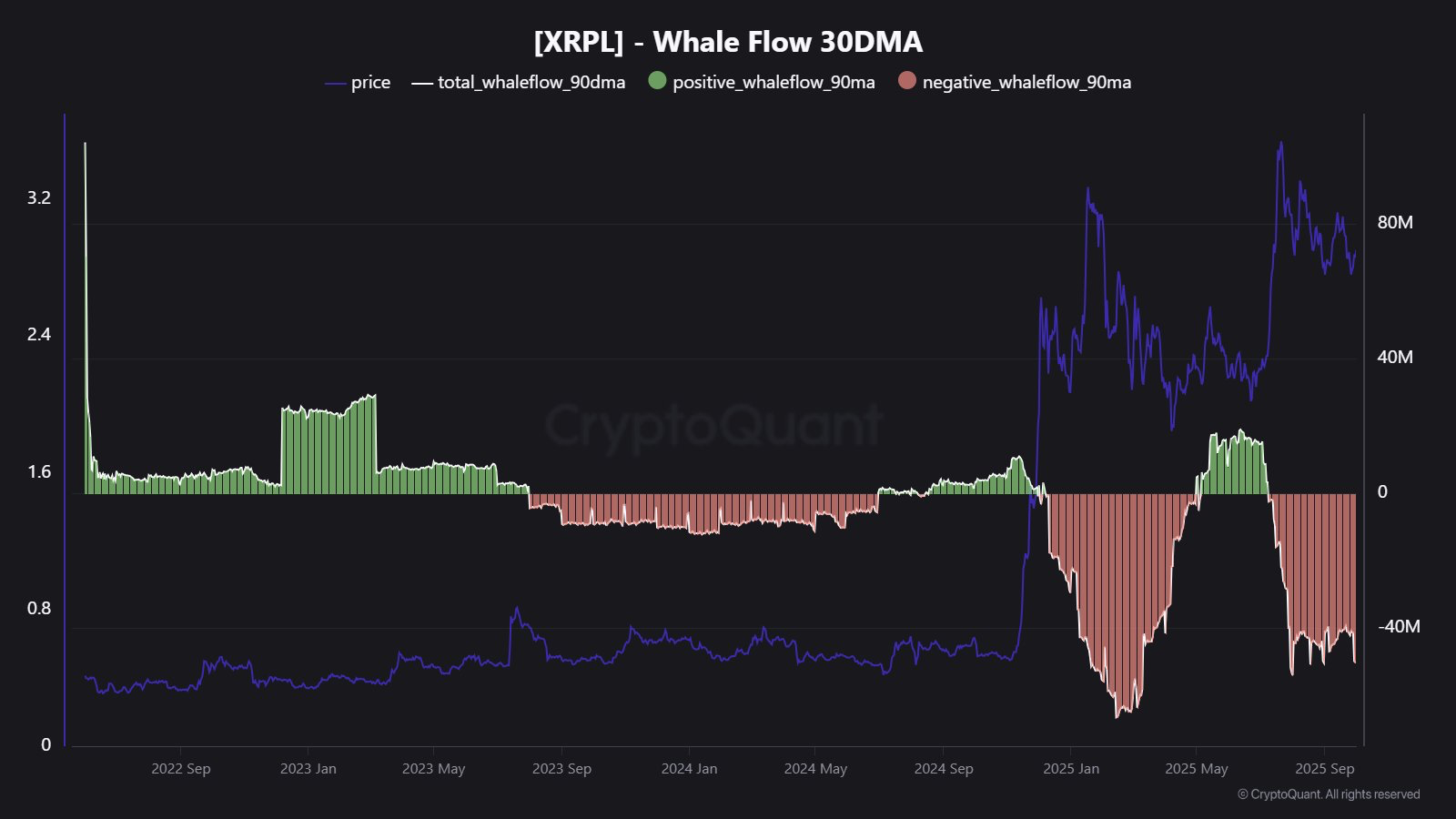

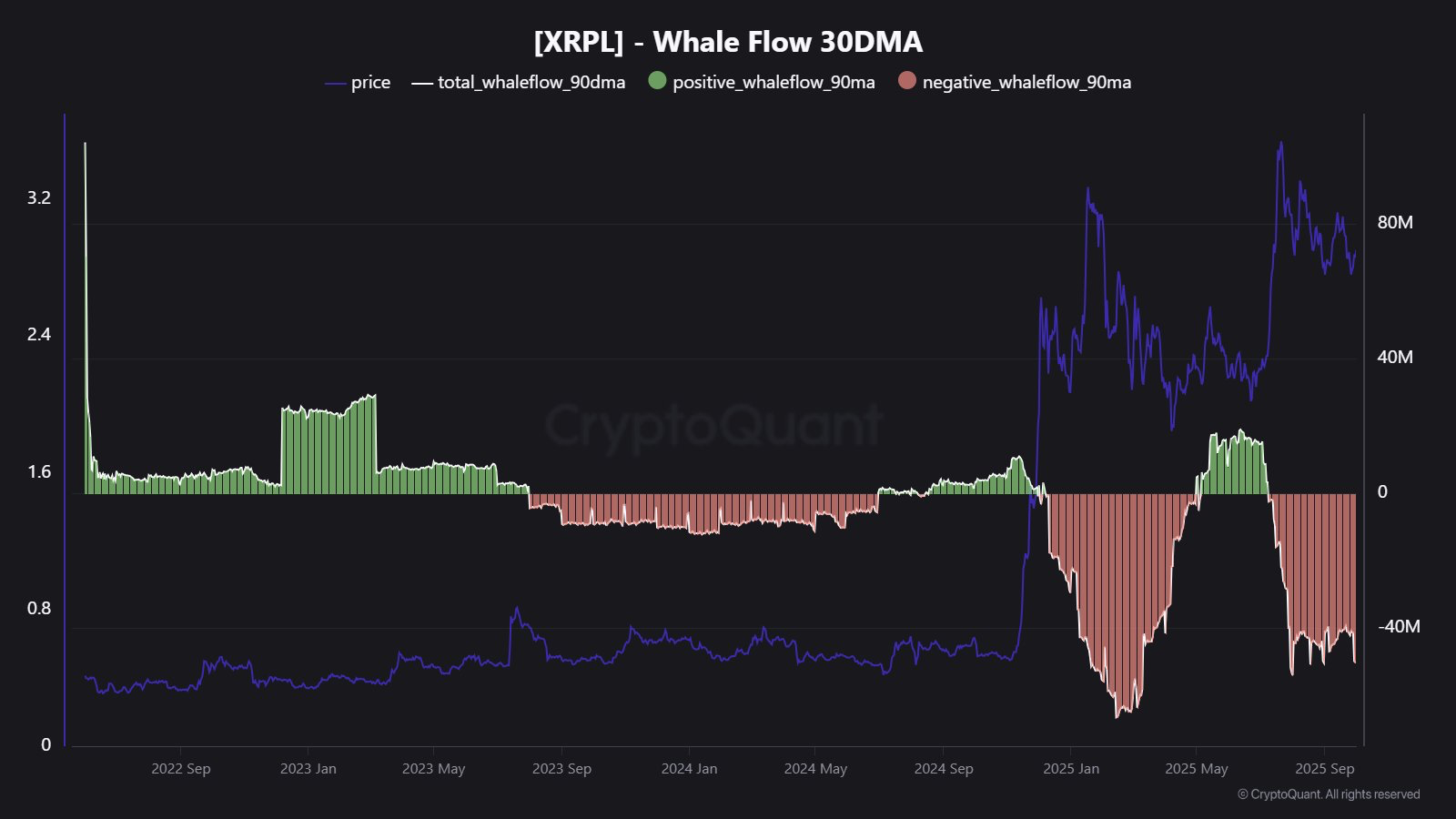

CryptoQuant studies that the 30-day common whale outflow is roughly $50 million per day, with a gentle unfavorable pattern since mid-July 2025.

This sustained outflow suggests deliberate distribution reasonably than short-term profit-taking, and sentiment across the altcoin sector stays subdued.

Historic information on CryptoQuant’s 90DMA Whale Movement exhibits that unfavorable readings typically widen earlier than delicate worth motion inside two weeks. Depth evaluation of the order e-book on TradingView’s XRP/USDT chart confirms skinny liquidity across the $3.30 resistance zone, leaving the worth weak to spikes in volatility if promoting strain continues.

Why are Whale traders offloading XRP?

Regulatory uncertainty retains U.S. whales on alert

The U.S. authorities shutdown and stalled bipartisan crypto invoice have made betting on XRP troublesome for establishments on the lookout for readability.

The bipartisan market construction deadlock within the US Senate has made XRP much less fascinating in comparison with different crypto belongings, particularly within the BNB ecosystem. In the meantime, Ripple is progressing with regulatory compliance within the European market in accordance with the Marketplace for Crypto Belongings (MiCA) Rules.

Crypto asset rotation to happen forward of anticipated ETF approval

Total demand for XRP by whale traders has decreased considerably over the previous few months. The spectacular efficiency of BNB Chain, Bitcoin (BTC), and Gold has weighed on XRP not too long ago.

Moreover, the anticipated approval of a spot XRP ETF within the US, maybe by the tip of this yr, is more likely to be a promoting occasion. Moreover, the XRP worth has fallen under the resistance degree round $3.3 for the reason that starting of the yr, coming into right into a multi-month decline.

Skilled insights on medium-term targets for XRP worth

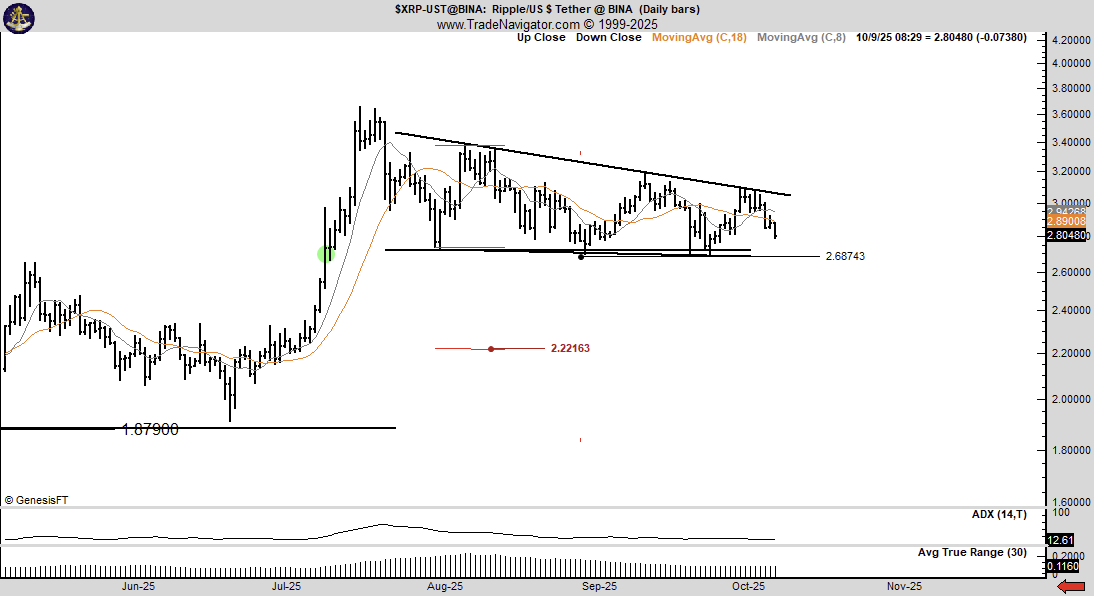

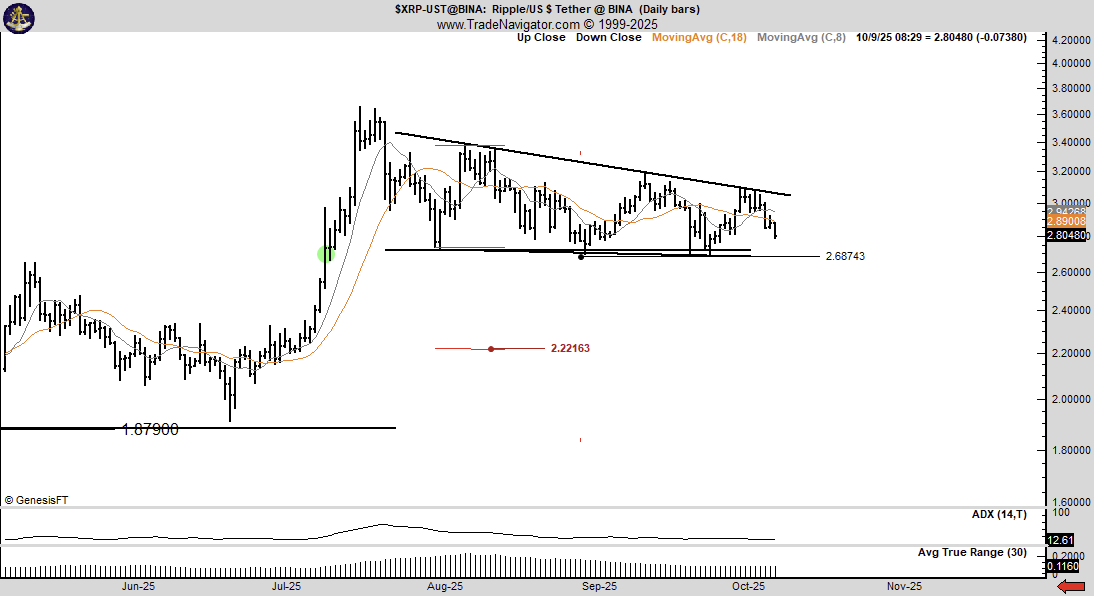

The continuing sell-off of XRP by whale traders is weighing on the corporate’s bullish macro outlook. Based on crypto analyst Ali Martinez, XRP worth must rebound from assist ranges round $2.73 to verify medium-term bullish sentiment.

Peter Brandt, knowledgeable market dealer, identified that the XRP worth is approaching the highest of a descending triangle sample on the day by day timeframe. Subsequently, Brandt emphasised that the XRP worth mustn’t fall under $2.68, as the autumn to $2.22 is inevitable.

large image

This massive altcoin has a totally diluted valuation of roughly $280 billion and has benefited enormously from Ripple Labs’ enterprise improvement. With the formal conclusion of the Ripple vs. SEC case, a number of fund managers will file functions for spot XRP ETFs within the US.

In the meantime, some firms have launched XRP treasury as a hedge in opposition to inflation. Earlier this week, Nasdaq-listed insurance coverage dealer Reliance Group International reportedly added $17 million value of XRP to its treasury administration.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.