- The XRP value has been consolidated to close $3.02, with the Bulls specializing in a $3.20 breakout on prime of the descent triangle.

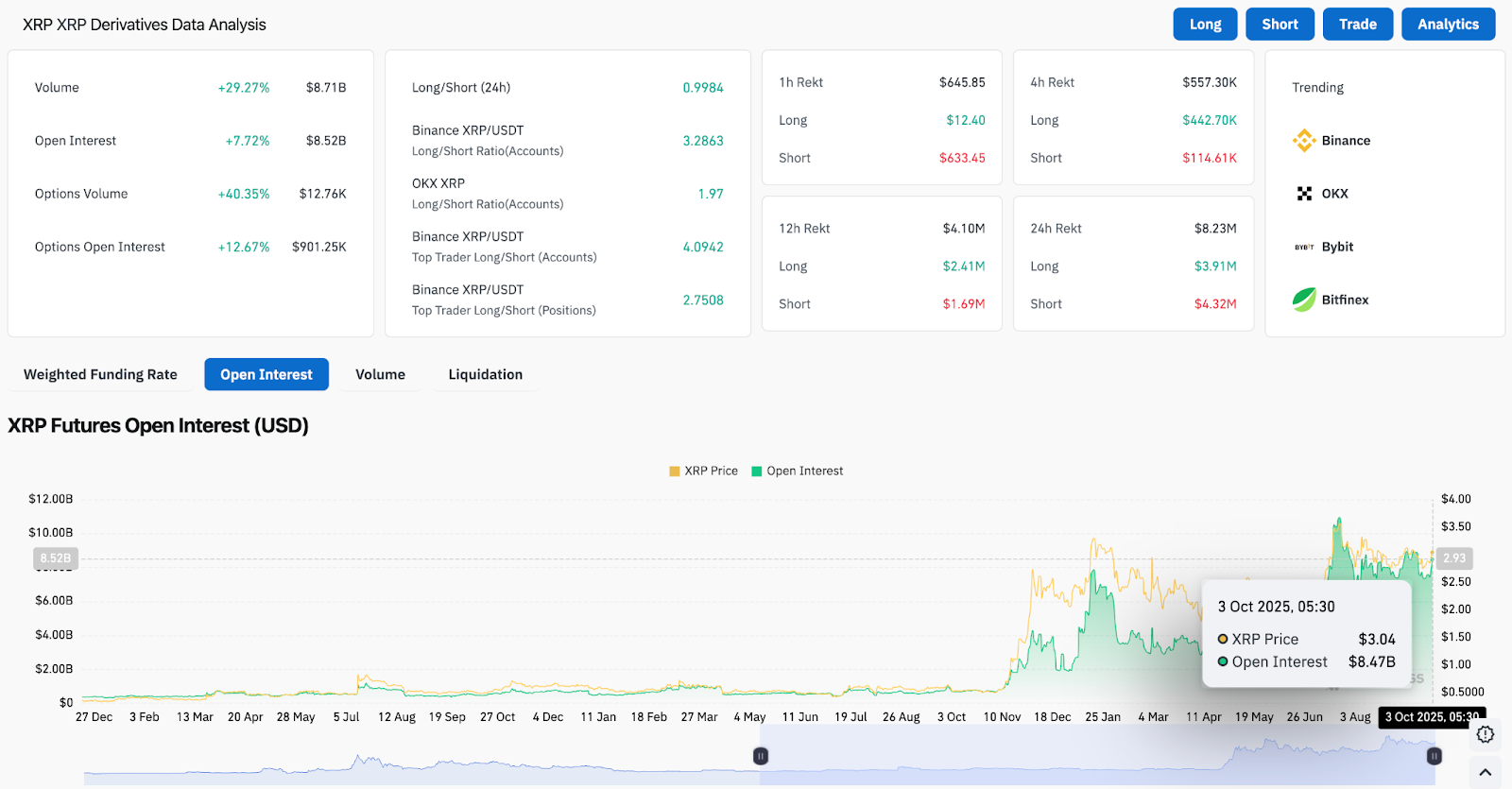

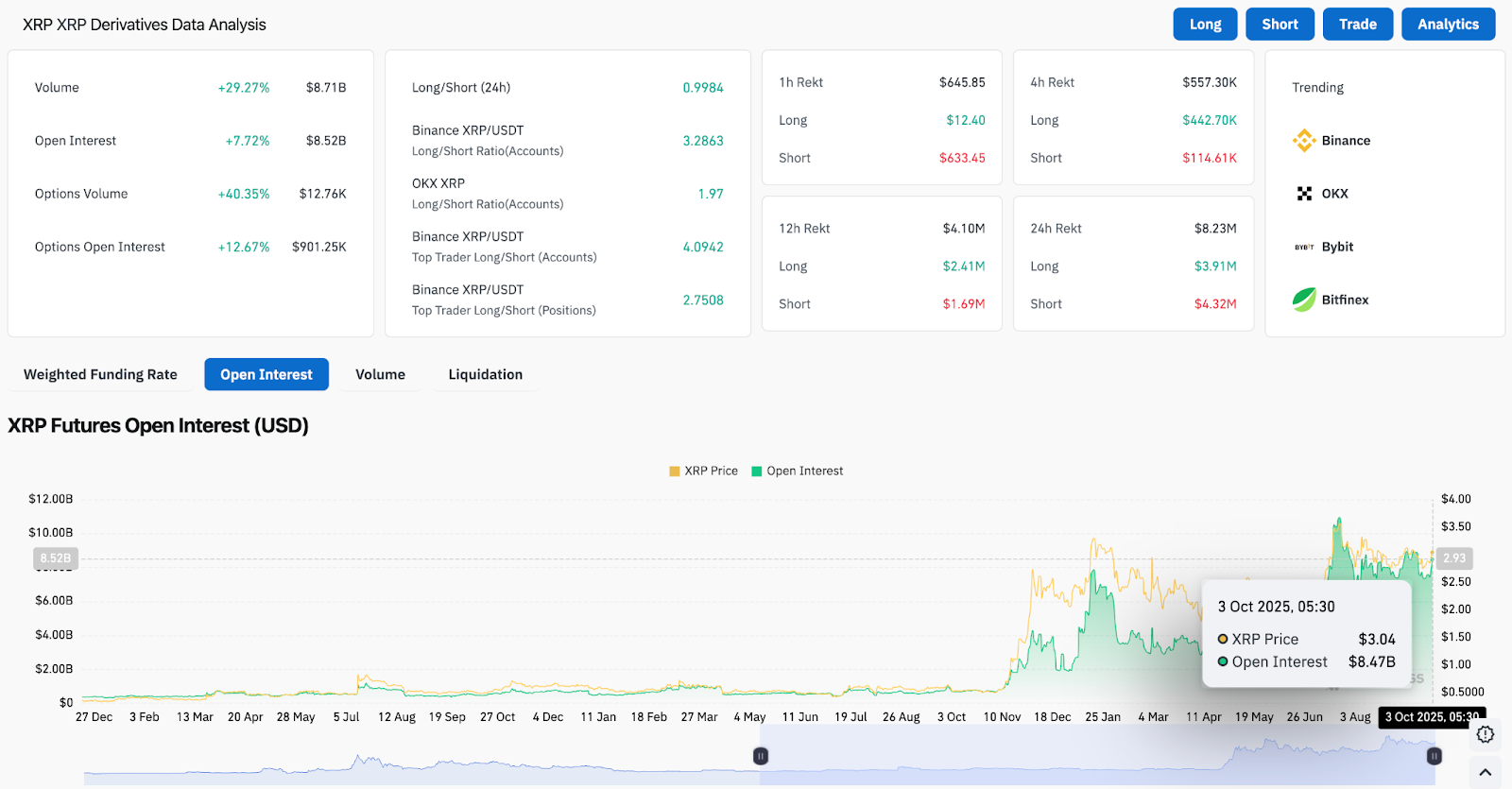

- Spinoff curiosity has risen, with XRP futures OI at $85.2 billion and choice exercise rising by over 12%.

- Rumors of a speedy trade strengthen XRP’s long-term liquidity papers and improve the momentum of the story.

At present’s XRP value is buying and selling at $3.02 and faces resistance of almost $3.04 after testing the higher restrict of the falling triangle. The token recovered the 20-day EMA for $2.92, surpassing the 50-day EMA for $2.93. Merchants are whether or not XRP can break previous $3.20 or if there’s a threat of coming again in direction of the help base.

XRP Costs Face Compression Testing

Day by day charts present that XRP is locked into the compression part, decrease highs which can be pushing the development of July’s downward resistance. Costs at the moment combine between clusters between $2.92-$3.04 and a $2.84 help zone that overlaps with 100-day EMA.

So long as XRP surpasses the 200-day EMA rise at $2.62, the broader development stays constructive. The momentum indicator reveals preliminary indicators of enchancment with RSI near 54 after rebounding from the impartial area. Analysts may retreat to $2.62 in the event that they fail to carry $2.84 in the event that they open the doorways for $3.40 and $3.60, with a vital break above $3.20.

Associated: Bitcoin Worth Prediction: MicroStrategy’s BTC Holdings attain 77.4B, so you’ll be able to see $125K

Spinoff actions present a rise in demand

The XRP derivatives market is displaying new participation. Futures Open Inters rose to $8.52 billion, up 7.7% in 24 hours, however buying and selling quantity rose 29% to $8.7 billion. Moreover, non-compulsory actions have expanded quickly, with open curiosity rising by over 12% to $901,000.

The lengthy/quick ratio throughout main exchanges displays the rising optimism. At Binance, the highest merchants’ lengthy publicity outweighs shorts which can be greater than 4-1, highlighting a powerful bullish confidence. Analysts warn that such positioning makes XRP weak to short-term volatility, however the improve basically curiosity is normally in favor of value motion.

The momentum of the story is constructed with fast rumors

This week, speculations concerning the potential function of XRP within the US Swift system change are extensively distributed and are attracting market consideration. Though no official affirmation has been made, the unlocking story of XRP’s unlocking entry strengthens retail traders’ optimism by unlocking entry to trillions of {dollars}’ fee flows.

Ripple CEO Brad Garlinghouse continues to focus on precise adoption use circumstances, with the community positioned as an company’s liquidity bridge. The broader story coincides with XRP long-term papers as cross-border settlement tokens, including momentum at a time when costs are close to vital breakout ranges.

Technical outlook for XRP value

The short-term XRP value forecast is determined by whether or not patrons can regain the $3.20 zone.

- Upside degree: $3.20, $3.40, $3.60

- Disadvantages help: $2.92, $2.84, $2.62

- Pattern primarily based: $2.62 because the final main line of protection

The broader development will favor patrons so long as XRP maintains costs above $2.92. The method above $3.20 is a check of bullish continuity, focusing on $3.60 over the subsequent few weeks.

Associated: Ethereum Worth Forecast: Analysts Predict Breakouts as U.S. Tax-Free Improves Belief

Outlook: Will XRP go up?

XRP enters October and momentum shifts in direction of patrons. Spinoff positioning has risen sharply, and speculative narratives are attracting consideration, however expertise highlights a $3.20 breakout level.

If XRP maintains value motion above $3.04 and pushes $3.20 on quantity, analysts count on an upward goal of $3.40 and $3.60. Nonetheless, if you cannot maintain $2.84, you possibly can reset your bullish case and shift the main focus again to $2.62 help. For now, the stability between stream and positioning helps potential breakouts within the coming days.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version isn’t accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.